Silanes Market Report Scope & Overview

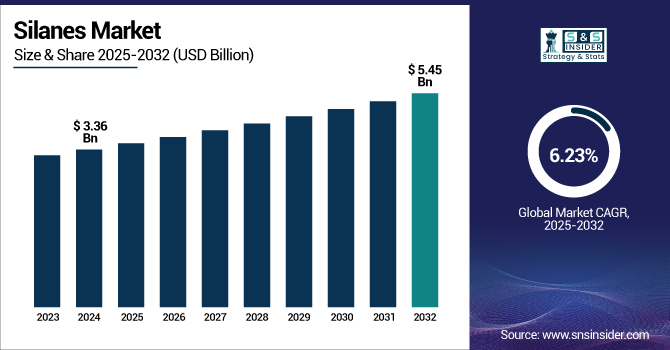

The Silanes Market size was valued at USD 3.36 billion in 2024 and is expected to reach USD 5.45 billion by 2032, growing at a CAGR of 6.23% over the forecast period of 2025-2032.

To Get more information on Silanes Market - Request Free Sample Report

Increasing usage of the automotive sector drives market growth. The growing use of lightweight, high-performance composite materials in the quest for better fuel economy and lower emissions can be attributed to the automotive industry, where components are often bonded and reinforced using silanes. For advancing automotive components' ability, improved adhesion between dissimilar materials such as plastics, metals, and glass is critical, and silanes play a pivotal role in achieving this.

The government's Production Linked Incentive (PLI) scheme for the automobile and auto components sector has garnered ₹67,690 crores in investment proposals, out of which ₹14,043 crore investment has already been made till March 2024. The effort will also help in boosting manufacturing capacity, so employment is expected to grow and will ultimately help industries providing supply inputs like silanes.

Moreover, the use of silicone in protective coatings, sealants, and tires also contributes to vehicle durability and safety. In addition, the increasing electrification of automotive production around the world, which requires high thermal stability and durable bonding solutions, is also driving demand for silane technologies in the automotive industry.

Silanes Market Dynamics

Drivers

-

Growth in the construction & infrastructure development sectors drives the market growth.

The rising demand for construction and infrastructure development. With urbanization and industrialization on the rise all over the world, especially in emerging markets, the need for good quality building materials is ever-increasing. Silanes play an essential role in construction, as they help improve the durability and performance of building materials such as concrete, adhesives, and coatings, and their increasing popularity in construction applications can be attributed to their unique properties. It improves the anchoring, repellent, and weather resistance of these materials to make them weather-resistant in harsh environmental conditions.

The U.S. Environmental Protection Agency offered more than USD 11.5 billion in funding for water infrastructure projects through the FY24 State Revolving Fund programs in May 2024. It will be used to help replace deteriorating water mains and boilers, replace hazardous lead pipelines, and improve community resistance to climate change effects such as flooding.

Restrain

-

Fluctuating raw material prices may hamper the market growth.

Silanes are mostly derived from raw materials such as silicon, hydrogen, and different chemicals that are prone to fluctuating prices owing to disruptions within the provide chain, geopolitical tensions, and modifications in international demand around the world. A sudden increase in the price of these raw materials leads to increased production costs for manufacturers, which could result in higher prices passed on to consumers or reduced profit margins for producers. Such price volatility brings uncertainty in the market and makes it hard for businesses to plan and budget. Moreover, regular changes in raw material costs can prevent more investment in the industry since firms are reluctant to engage in long-run production patterns without a set cost structure.

Opportunity

-

Technological advancements in silane chemistry are creating opportunities for market growth.

Emerging technological advances in silane chemistry to enhance the penetration and utilization of silanes in different industries are a specific area that is anticipated to generate sustainable and improved growth opportunities for the global silanes market. Emerging synthetic methods, including cost-effective and sustainable production methods, are further decreasing manufacturing costs and enhancing product performance. Such innovations have also facilitated the creation of specialized silane compounds designed for use in high-performance applications within the electronics, automotive, aerospace, and renewable energy industries. Silane coupling agents have applications in emerging technologies such as nanomaterials and advance composites where lower adhesion, durability, and chemical resistance are required, therefore, better formulations are further extending their usage.

The silanes market companies try to adopt and provide the new solutions.

For instance, in March 2024, BRB launched a water-based epoxy functional silane oligomer, Silanil 533 ESO, at a conference focusing on a more stable and sustainable solution. This commodity, compared with monomeric epoxy silanes, gives off less methyl liquor during hydrolysis.

Silanes Market Segmentation Analysis

By Type

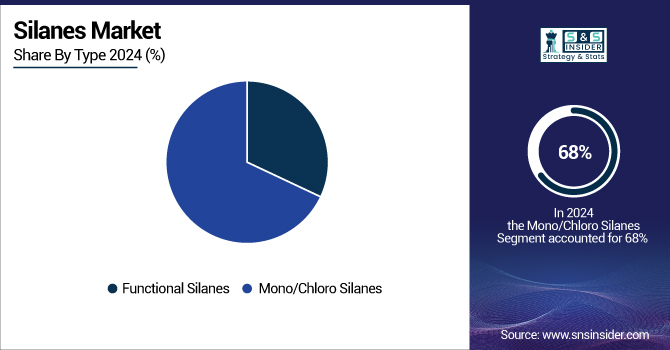

Mono/Chloro Silanes held the largest in silanes market share, around 68%, in 2024. It is due to their extensive application in various high-growth end-use industries, including semiconductors, electronics, and solar PV cells. Mono/Chloro silanes are key intermediates towards ultra-pure silicon, a material required for integrated circuits and solar panels. The increasing demand for renewable energy, mainly solar and progressive in microelectronics, has been a significant factor behind their consumption.

Functional Silanes held the significant market share and fastest growing segment in the forecast period. It is owing to their diverse functions for general-purpose performance improvements across specialty products in several industries. These silanes are coupling agents, adhesion promoters, and surface modifiers, which are key to various applications such as paints & coatings, adhesives & sealants, rubber & plastics, and fiber treatment.

By Application

The paint & coatings segment held the largest market share, around 32%, in 2024. It is owing to the vital contribution of silanes in improving adhesion, water repellency, and durability of coatings on glass, metal, and concrete substrates. Silanes are good adhesion promoters and crosslinkers that enhance chemical-resistant properties and surface bonding in protective and industrial coatings. Moreover, rising global efforts towards eco-friendly, low-VOC coatings are increasing the utilization of silane technologies in formulations.

The rubber & plastic segment held a significant market share and was the fastest-growing segment in the forecast period. It is owing to the wide usage of silane-based coupling agents, which improve the mechanical properties as well as enhance the durability of rubber and plastic compounds significantly, and focuses on the silanes market trends. Silanes are irreplaceable with their capability to improve filler dispersion, additional strengthening of tensile strength, and provide a high degree of resistance to heat, moisture, and abrasion, to is necessary in the manufacture of tires, automotive components, and industrial rubber products.

By End-User Industry

The building & construction sector segment held the largest market share, around 28%, in 2024, as silanes enhance the performance, durability, and adhesion of construction materials. Due to their increasing role as coupling agents, adhesion promoters, and surface modifiers for use in sealants, adhesives, coatings, and concrete admixtures, silanes are critical for infrastructure and commercial construction applications. They are a necessity and play an important role in ensuring long-term structural integrity due to their ability to enhance moisture resistance and improve bonding between organic and inorganic materials.

The automotive segment held a significant market share. It is owing to the high application of silanes to improve the functional performance of automotive components well as durability. It is increasing the consumption of lightweight, durable, and high-performance raw materials in the manufacture of vehicles. Used as adhesion promoters, coupling agents, and surface modifiers in tires, coatings, plastics, and composites in automotive components, silanes have a well-established technology toolbox. They aid in lowering vehicle mass, which will enhance fuel economy and also supply higher mechanical properties for parts. As the world moves to electric vehicles (EV) and has more stringent emission regulations, automakers are turning to silane-based solutions to help ensure the performance, durability, and sustainability of vehicle parts which drive the silanes market growth.

Silanes Market Regional Outlook

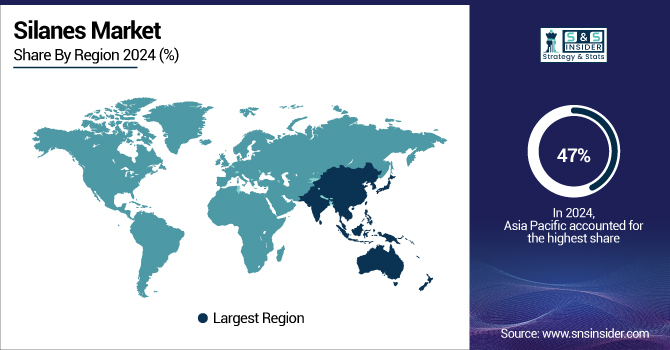

Asia Pacific held the largest market share, around 47%, in 2023. Asia Pacific accounted for the largest market share in the overall silanes market, owing to supportive industrialization, large-scale infrastructure development, and a growing manufacturing industry. China, India, Japan, South Korea, and Vietnam are experiencing rapid development in construction, automotive, and electronics & electrical industries, which forms a large consumer base for silanes-based products.

This growth has been supported by numerous initiatives taken by the government. An ambitious USD 4.2 trillion to be spent on infrastructure projects within China's 14th Five-Year Plan (2021–2025) will target transportation, power, water systems, and urban development. Likewise, the National Infrastructure Pipeline (NIP) in India proposes nearly USD 1.4 trillion for infrastructure upgradation with a strong focus on areas like renewables, roads, urban infrastructure, and railways 38.

North America held the second-largest share in 2023. Rapid-growth-inducing demand for silanes as building materials, consolidation in residential and commercial construction, owing to their ability to improve durability and adhesion properties. Furthermore, the automotive sector's transition for lighter, stronger components has resulted in increasing consumption of silane-based materials in automobile development. Silanes provide key attributes in semiconductor and solar panel manufacturing, supporting growth in the electronics sector as well.

Major market players are continually investing in research and development to develop innovations to meet the changing needs in these industries. For instance, in North America, where companies are launching new generation silane formulations for the local market, such as Dow, Eastman Chemical Co., and Air Products & Chemicals Inc.

Europe held a significant market share and growing region in the forecast period. It is due to the strong commitment to sustainable development and strict environmental regulations in the region (especially those promulgated by European Chemicals Agency (ECHA)) that are propelling growth for eco-friendly and low-VOC silane products. Moreover, there are various leading manufacturers and research institutions in Europe focusing on innovative silane formulations for advanced applications. The high usage of silanes in energy-efficient buildings, high-performance automotive applications, and green electronics also solidifies the role of Europe as a strong pillar of the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

In the report, the silanes companies such as, Evonik Industries AG, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Dow Inc., Momentive Performance Materials Inc., Gelest, Inc., China Bluestar International Chemical Co., Ltd., Nanjing Shuguang Chemical Group Co., Ltd., Tokuyama Corporation, BRB International B.V. These key players help to understand the silanes market analysis, silanes industry trends.

Recent Development:

-

In 2024, Shin-Etsu Chemical Co., Lt launched the first non-emulsified waterborne fast-curing silicone resin (KRW-6000 Series) in the industry. This solution provides excellent film properties with fast cured by heating and adds value to VOC-free products, and hence fits sustainability.

-

In 2024, Wacker Chemie AG created a unique specialty silane for next-generation, high-value microchips that enable artificial intelligence and cloud computing. This silane is used in CVD to form ultrathin low κ dielectric layers to promote the reliable operation of microchips with high integration density.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.36 Billion |

| Market Size by 2032 | USD 5.45 Billion |

| CAGR | CAGR of6.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Functional Silanes, Mono/Chloro Silanes) • By Application (Rubber & Plastic, Fiber Treatment, Adhesive & Sealants, Paints & Coatings) • By End User (Building & Constructions, Electrical & Electronics, Automotive |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Evonik Industries AG, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Dow Inc., Momentive Performance Materials Inc., Gelest, Inc., China Bluestar International Chemical Co., Ltd., Nanjing Shuguang Chemical Group Co., Ltd., Tokuyama Corporation, BRB International B.V. |