The Shoe Packaging Market size was USD 6.44 billion in 2023 and is expected to Reach USD 8.49 billion by 2031 and grow at a CAGR of 3.51 % over the forecast period of 2024-2031.

The Shoe packaging market forms an important segment in the broader packaging industry, playing a vital role in protecting Shoe products throughout their journey from producer to consumer.

Get More Information on Shoe Packaging Market - Request Sample Report

With the continued expansion of the global Shoe market and the growing popularity of e-commerce, the demand for packaging solutions that are efficient, protective and visually appealing has increased dramatically. Shoe packaging is not only used to protect shoes from damage during transportation, but also serves as a marketing and branding tool to influence consumers' purchasing decisions. As brands strive to create unique unboxing experiences and establish distinctive brand identities, innovative packaging designs are becoming increasingly important. Additionally, sustainability concerns are driving the industry towards environmentally friendly packaging materials and practices. The challenge is to balance these eco-friendly options with the need to maintain product integrity and reduce costs. To succeed in this competitive landscape, packaging manufacturers and Shoe brands must tackle complex issues such as customization needs, logistics optimization and regulatory compliance, while keeping up ever-changing consumer preferences and technological advancements.

KEY DRIVERS:

Global Shoe Industry Growth

The Shoe packaging market is strongly driven by the worldwide expansion of the Shoe sector. The demand for appropriate packaging solutions to secure and display Shoe during transit or store visits is also growing, due to the increased consumption of Shoe throughout the world.

Growing number of sports enthusiasts is also driving the market.

RESTRAIN:

Counterfeit and Piracy

Sophisticated packaging solutions, which can increase costs and complexity, are needed to protect against counterfeit products.

OPPORTUNITY:

Efficient Logistics Packaging

Manufacturers and retailers can benefit from savings in costs by reducing packing to optimize utilization of space and lower shipping costs.

Integrating the technology into Shoe packaging

CHALLENGES:

Waste Management can be a challenging task to handle

Waste streams are generated by the discarding of Shoe packaging. It is difficult to design packaging that has a balance of appeal and waste reduction.

The war has caused a number of disruptions in global supply chains, including those of raw materials, components and finished products. This can lead to higher prices for Shoe and other goods, making it harder for businesses to access traditional packaging materials. In addition, the war raised concerns about the environmental impact of transporting goods over long distances. This could lead companies to look for more sustainable packaging solutions, such as recycled materials or reusable containers.

Finally, war also creates uncertainty about the future of the global economy. This can make companies hesitant to make long-term commitments, such as investing in new packaging technology.

Overall, the impact of the Russia-Ukrainian war on shoe packaging remains unclear. However, it is likely that war will have a certain impact on the industry, as companies seek to mitigate the risks and challenges created by conflict.

Cardboard boxes are the most common type of shoe packaging. They are relatively inexpensive and can be easily recycled. However, they are also bulky and take up a lot of space. As a result, they may become less popular during a recession, when companies are looking for ways to save money on shipping costs. A study from the University of California, Berkeley found that the average shipping cost of a cardboard box increased by 10% in the first quarter of 2023. This will likely lead to a reduction in the use of cardboard boxes for shoe packaging as companies are looking to save on shipping costs. Plastic bags are also a popular type of shoe packaging. They are lightweight and can be easily sealed, making them perfect for transporting shoes. However, they are not recyclable and can pollute the environment. As a result, they are becoming less and less common, especially in countries with strict environmental regulations. A study by the World Wildlife Fund found that the production of plastic bags generates 12 million tons of greenhouse gases each year. This is a major concern during recessions, when businesses seek to reduce their environmental impact. As a result, the use of plastic bags for shoe packaging is likely to be reduced. Shoe boxes are a more expensive type of shoe packaging, but they are also more durable and can protect shoes from damage. They are also commonly used as a marketing tool as they can be used to showcase the brand and style of the shoe. As a result, they are likely to remain popular even during recessions. A study by the National Retail Federation found that the average price of a shoebox increased by 5% in the first quarter of 2023. This will likely lead to a reduction in the use of shoeboxes for shoe packaging. , companies are looking to save money. packaging costs. A study by the International Foam Packaging Association found that the average price of foam inserts increased by 7% in the first quarter of 2023. This will likely lead to a reduction in the use of foam inserts for shoe and business packaging.

By Material

Plastic

Paper

Others

By Market Type

Rigid

Flexible

By Distribution Channel

Online

Offline

By Shoes Type

Leather Shoes

Short Shoes

Loafers

Casual Shoes

Long Boots

Running Shoes

By Shoe Packaging Type

Tubular Packaging

Sustainably Reduced Shoe Boxes

Reusable Shoe Packaging

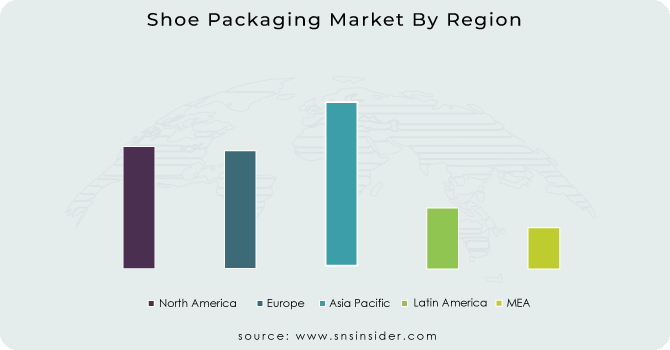

Asia Pacific is dominating the Shoe Packaging Market with the market share of 45.5% in 2022. The growing urban population, followed by rapid industrialization is driving the market in the region. The consumption and manufacturing in the region will give boost to the market growth in this region. China is dominating the market in this region with largest market share, followed by India with the fastest growth rate.

North America shoe packaging market is showing fastest growth. The frequent use of shoe and consumers lifestyle. The market in this region is majorly driven by the expansion the US and Canada.

European Shoe Packaging market will show significant growth overt the forecast period. The consumers busy lifestyles which are increasing market for the shoe sales throughout the region. There is demand for various types of shoes, which is increasing the market for shoe packaging. Germany is holding the largest market share.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Shoe Packaging market are Sneakerbox Co, Packqueen, Cross Country Box Company, Royal Packers, Elevated Packaging, Precious Packaging, Samrat Box Mfg Co Pvt Ltd, Packman Packaging Pvt Ltd, Packaging of the World, Zhuhai Zhuoya Packing Product Ltd and other players.

In its global sustainability efforts, Skechers will continue to leave a green footprint. The Manhattan Beach, California based company reported that since 2016, it has reduced the use of plastics in its Shoe packaging by 85%.

Nike introduces One Box, which can be converted into shipping box and shoe box.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.44 Bn |

| Market Size by 2031 | US$ 8.49 Bn |

| CAGR | CAGR of 3.51 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Paper, Others) • by Market Type (Rigid, Flexible) • by Distribution Channel (Online, Offline) • by Shoes Type (Leather Shoes, Short Shoes, Loafers, Casual Shoes, Long Boots, Running Shoes) • by Shoe Packaging Type (Tubular Packaging, Sustainably Reduced Shoe Boxes, Corrugates Boxes, Reusable Shoe Packaging) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sneakerbox Co, Packqueen, Cross Country Box Company, Royal Packers, Elevated Packaging, Precious Packaging, Samrat Box Mfg Co Pvt Ltd, Packman Packaging Pvt Ltd, Packaging of the World, Zhuhai Zhuoya Packing Product Ltd |

| Key Drivers | • Global Shoe Industry Growth • Growing number of sports enthusiasts is also driving the market |

| Market Opportunities | • Efficient Logistics Packaging • Integrating the technology into Shoe packaging |

Ans: The Shoe Packaging Market is expected to grow at a CAGR of 3.45 %.

The Shoe Packaging Market size was USD 6.23 billion in 2022 and is expected to Reach USD 8.17 billion by 2030.

Ans: Global Shoe Industry Growth.

Ans: Counterfeit and Piracy are major concern for the business.

The Asia Pacific region held the largest market share of 45.5 % in 2022 and will continue to dominate the market.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact Of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Shoe Packaging Market Segmentation, By Material

8.1 Plastic

8.2 Paper

8.3 Others

9. Shoe Packaging Market Segmentation, By Market Type

9.1 Rigid

9.2 Flexible

10. Shoe Packaging Market Segmentation, By Distribution Channel

10.1 Online

10.2 Offline

11. Shoe Packaging Market Segmentation, By Shoes Type

11.1 Leather Shoes

11.2 Short Shoes

11.3 Loafers

11.4 Casual Shoes

11.5 Long Boots

11.6 Running Shoes

12. Shoe Packaging Market Segmentation, By Shoe Packaging Type

12.1 Tubular Packaging

12.2 Sustainably Reduced Shoe Boxes

12.3 Corrugates Boxes

12.4 Reusable Shoe Packaging

13.1 Introduction

13.2 North America

13.2.1 North America Shoe Packaging Market By Country

13.2.2 North America Shoe Packaging Market By Material

13.2.3 North America Shoe Packaging Market By Market Type

13.2.4 North America Shoe Packaging Market By Distribution Channel

13.2.5 North America Shoe Packaging Market By Shoes Type

13.2.6 North America Shoe Packaging Market By Shoe Packaging Type

13.2.7 USA

13.2.7.1 USA Shoe Packaging Market By Material

13.2.7.2 USA Shoe Packaging Market By Market Type

13.2.7.3 USA Shoe Packaging Market By Distribution Channel

13.2.7.4 USA Shoe Packaging Market By Shoes Type

13.2.7.5 USA Shoe Packaging Market By Shoe Packaging Type

13.2.8 Canada

13.2.8.1 Canada Shoe Packaging Market By Material

13.2.8.2 Canada Shoe Packaging Market By Market Type

13.2.8.3 Canada Shoe Packaging Market By Distribution Channel

13.2.8.4 Canada Shoe Packaging Market By Shoes Type

13.2.8.5 Canada Shoe Packaging Market By Shoe Packaging Type

13.2.9 Mexico

13.2.9.1 Mexico Shoe Packaging Market By Material

13.2.9.2 Mexico Shoe Packaging Market By Market Type

13.2.9.3 Mexico Shoe Packaging Market By Distribution Channel

13.2.9.4 Mexico Shoe Packaging Market By Shoes Type

13.2.9.5 Mexico Shoe Packaging Market By Shoe Packaging Type

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Eastern Europe Shoe Packaging Market By Country

13.3.1.2 Eastern Europe Shoe Packaging Market By Material

13.3.1.3 Eastern Europe Shoe Packaging Market By Market Type

13.3.1.4 Eastern Europe Shoe Packaging Market By Distribution Channel

13.3.1.5 Eastern Europe Shoe Packaging Market By Shoes Type

13.3.1.6 Eastern Europe Shoe Packaging Market By Shoe Packaging Type

13.3.1.7 Poland

13.3.1.7.1 Poland Shoe Packaging Market By Material

13.3.1.7.2 Poland Shoe Packaging Market By Market Type

13.3.1.7.3 Poland Shoe Packaging Market By Distribution Channel

13.3.1.7.4 Poland Shoe Packaging Market By Shoes Type

13.3.1.7.5 Poland Shoe Packaging Market By Shoe Packaging Type

13.3.1.8 Romania

13.3.1.8.1 Romania Shoe Packaging Market By Material

13.3.1.8.2 Romania Shoe Packaging Market By Market Type

13.3.1.8.3 Romania Shoe Packaging Market By Distribution Channel

13.3.1.8.4 Romania Shoe Packaging Market By Shoes Type

13.3.1.8.5 Romania Shoe Packaging Market By Shoe Packaging Type

13.3.1.9 Hungary

13.3.1.9.1 Hungary Shoe Packaging Market By Material

13.3.1.9.2 Hungary Shoe Packaging Market By Market Type

13.3.1.9.3 Hungary Shoe Packaging Market By Distribution Channel

13.3.1.9.4 Hungary Shoe Packaging Market By Shoes Type

13.3.1.9.5 Hungary Shoe Packaging Market By Shoe Packaging Type

13.3.1.10 Turkey

13.3.1.10.1 Turkey Shoe Packaging Market By Material

13.3.1.10.2 Turkey Shoe Packaging Market By Market Type

13.3.1.10.3 Turkey Shoe Packaging Market By Distribution Channel

13.3.1.10.4 Turkey Shoe Packaging Market By Shoes Type

13.3.1.10.5 Turkey Shoe Packaging Market By Shoe Packaging Type

13.3.1.11 Rest of Eastern Europe

13.3.1.11.1 Rest of Eastern Europe Shoe Packaging Market By Material

13.3.1.11.2 Rest of Eastern Europe Shoe Packaging Market By Market Type

13.3.1.11.3 Rest of Eastern Europe Shoe Packaging Market By Distribution Channel

13.3.1.11.4 Rest of Eastern Europe Shoe Packaging Market By Shoes Type

13.3.1.11.5 Rest of Eastern Europe Shoe Packaging Market By Shoe Packaging Type

13.3.2 Western Europe

13.3.2.1 Western Europe Shoe Packaging Market By Country

13.3.2.2 Western Europe Shoe Packaging Market By Material

13.3.2.3 Western Europe Shoe Packaging Market By Market Type

13.3.2.4 Western Europe Shoe Packaging Market By Distribution Channel

13.3.2.5 Western Europe Shoe Packaging Market By Shoes Type

13.3.2.6 Western Europe Shoe Packaging Market By Shoe Packaging Type

13.3.2.7 Germany

13.3.2.7.1 Germany Shoe Packaging Market By Material

13.3.2.7.2 Germany Shoe Packaging Market By Market Type

13.3.2.7.3 Germany Shoe Packaging Market By Distribution Channel

13.3.2.7.4 Germany Shoe Packaging Market By Shoes Type

13.3.2.7.5 Germany Shoe Packaging Market By Shoe Packaging Type

13.3.2.8 France

13.3.2.8.1 France Shoe Packaging Market By Material

13.3.2.8.2 France Shoe Packaging Market By Market Type

13.3.2.8.3 France Shoe Packaging Market By Distribution Channel

13.3.2.8.4 France Shoe Packaging Market By Shoes Type

13.3.2.8.5 France Shoe Packaging Market By Shoe Packaging Type

13.3.2.9 UK

13.3.2.9.1 UK Shoe Packaging Market By Material

13.3.2.9.2 UK Shoe Packaging Market By Market Type

13.3.2.9.3 UK Shoe Packaging Market By Distribution Channel

13.3.2.9.4 UK Shoe Packaging Market By Shoes Type

13.3.2.9.5 UK Shoe Packaging Market By Shoe Packaging Type

13.3.2.10 Italy

13.3.2.10.1 Italy Shoe Packaging Market By Material

13.3.2.10.2 Italy Shoe Packaging Market By Market Type

13.3.2.10.3 Italy Shoe Packaging Market By Distribution Channel

13.3.2.10.4 Italy Shoe Packaging Market By Shoes Type

13.3.2.10.5 Italy Shoe Packaging Market By Shoe Packaging Type

13.3.2.11 Spain

13.3.2.11.1 Spain Shoe Packaging Market By Material

13.3.2.11.2 Spain Shoe Packaging Market By Market Type

13.3.2.11.3 Spain Shoe Packaging Market By Distribution Channel

13.3.2.11.4 Spain Shoe Packaging Market By Shoes Type

13.3.2.11.5 Spain Shoe Packaging Market By Shoe Packaging Type

13.3.2.12 The Netherlands

13.3.2.12.1 Netherlands Shoe Packaging Market By Material

13.3.2.12.2 Netherlands Shoe Packaging Market By Market Type

13.3.2.12.3 Netherlands Shoe Packaging Market By Distribution Channel

13.3.2.12.4 Netherlands Shoe Packaging Market By Shoes Type

13.3.2.12.5 Netherlands Shoe Packaging Market By Shoe Packaging Type

13.3.2.13 Switzerland

13.3.2.13.1 Switzerland Shoe Packaging Market By Material

13.3.2.13.2 Switzerland Shoe Packaging Market By Market Type

13.3.2.13.3 Switzerland Shoe Packaging Market By Distribution Channel

13.3.2.13.4 Switzerland Shoe Packaging Market By Shoes Type

13.3.2.13.5 Switzerland Shoe Packaging Market By Shoe Packaging Type

13.3.2.14 Austria

13.3.2.14.1 Austria Shoe Packaging Market By Material

13.3.2.14.2 Austria Shoe Packaging Market By Market Type

13.3.2.14.3 Austria Shoe Packaging Market By Distribution Channel

13.3.2.14.4 Austria Shoe Packaging Market By Shoes Type

13.3.2.14.5 Austria Shoe Packaging Market By Shoe Packaging Type

13.3.2.15 Rest of Western Europe

13.3.2.15.1 Rest of Western Europe Shoe Packaging Market By Material

13.3.2.15.2 Rest of Western Europe Shoe Packaging Market By Market Type

13.3.2.15.3 Rest of Western Europe Shoe Packaging Market By Distribution Channel

13.3.2.15.4 Rest of Western Europe Shoe Packaging Market By Shoes Type

13.3.2.15.5 Rest of Western Europe Shoe Packaging Market By Shoe Packaging Type

13.4 Asia-Pacific

13.4.1 Asia Pacific Shoe Packaging Market By Country

13.4.2 Asia Pacific Shoe Packaging Market By Material

13.4.3 Asia Pacific Shoe Packaging Market By Market Type

13.4.4 Asia Pacific Shoe Packaging Market By Distribution Channel

13.4.5 Asia Pacific Shoe Packaging Market By Shoes Type

13.4.6 Asia Pacific Shoe Packaging Market By Shoe Packaging Type

13.4.7 China

13.4.7.1 China Shoe Packaging Market By Material

13.4.7.2 China Shoe Packaging Market By Market Type

13.4.7.3 China Shoe Packaging Market By Distribution Channel

13.4.7.4 China Shoe Packaging Market By Shoes Type

13.4.7.5 China Shoe Packaging Market By Shoe Packaging Type

13.4.8 India

13.4.8.1 India Shoe Packaging Market By Material

13.4.8.2 India Shoe Packaging Market By Market Type

13.4.8.3 India Shoe Packaging Market By Distribution Channel

13.4.8.4 India Shoe Packaging Market By Shoes Type

13.4.8.5 India Shoe Packaging Market By Shoe Packaging Type

13.4.9 Japan

13.4.9.1 Japan Shoe Packaging Market By Material

13.4.9.2 Japan Shoe Packaging Market By Market Type

13.4.9.3 Japan Shoe Packaging Market By Distribution Channel

13.4.9.4 Japan Shoe Packaging Market By Shoes Type

13.4.9.5 Japan Shoe Packaging Market By Shoe Packaging Type

13.4.10 South Korea

13.4.10.1 South Korea Shoe Packaging Market By Material

13.4.10.2 South Korea Shoe Packaging Market By Market Type

13.4.10.3 South Korea Shoe Packaging Market By Distribution Channel

13.4.10.4 South Korea Shoe Packaging Market By Shoes Type

13.4.10.5 South Korea Shoe Packaging Market By Shoe Packaging Type

13.4.11 Vietnam

13.4.11.1 Vietnam Shoe Packaging Market By Material

13.4.11.2 Vietnam Shoe Packaging Market By Market Type

13.4.11.3 Vietnam Shoe Packaging Market By Distribution Channel

13.4.11.4 Vietnam Shoe Packaging Market By Shoes Type

13.4.11.5 Vietnam Shoe Packaging Market By Shoe Packaging Type

13.4.12 Singapore

13.4.12.1 Singapore Shoe Packaging Market By Material

13.4.12.2 Singapore Shoe Packaging Market By Market Type

13.4.12.3 Singapore Shoe Packaging Market By Distribution Channel

13.4.12.4 Singapore Shoe Packaging Market By Shoes Type

13.4.12.5 Singapore Shoe Packaging Market By Shoe Packaging Type

13.4.13 Australia

13.4.13.1 Australia Shoe Packaging Market By Material

13.4.13.2 Australia Shoe Packaging Market By Market Type

13.4.13.3 Australia Shoe Packaging Market By Distribution Channel

13.4.13.4 Australia Shoe Packaging Market By Shoes Type

13.4.13.5 Australia Shoe Packaging Market By Shoe Packaging Type

13.4.14 Rest of Asia-Pacific

13.4.14.1 APAC Shoe Packaging Market By Material

13.4.14.2 APAC Shoe Packaging Market By Market Type

13.4.14.3 APAC Shoe Packaging Market By Distribution Channel

13.4.14.4 APAC Shoe Packaging Market By Shoes Type

13.4.14.5 APAC Shoe Packaging Market By Shoe Packaging Type

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 Middle East Shoe Packaging Market By country

13.5.1.2 Middle East Shoe Packaging Market By Material

13.5.1.3 Middle East Shoe Packaging Market By Market Type

13.5.1.4 Middle East Shoe Packaging Market By Distribution Channel

13.5.1.5 Middle East Shoe Packaging Market By Shoes Type

13.5.1.6 Middle East Shoe Packaging Market By Shoe Packaging Type

13.5.1.7 UAE

13.5.1.7.1 UAE Shoe Packaging Market By Material

13.5.1.7.2 UAE Shoe Packaging Market By Market Type

13.5.1.7.3 UAE Shoe Packaging Market By Distribution Channel

13.5.1.7.4 UAE Shoe Packaging Market By Shoes Type

13.5.1.7.5 UAE Shoe Packaging Market By Shoe Packaging Type

13.5.1.8 Egypt

13.5.1.8.1 Egypt Shoe Packaging Market By Material

13.5.1.8.2 Egypt Shoe Packaging Market By Market Type

13.5.1.8.3 Egypt Shoe Packaging Market By Distribution Channel

13.5.1.8.4 Egypt Shoe Packaging Market By Shoes Type

13.5.1.8.5 Egypt Shoe Packaging Market By Shoe Packaging Type

13.5.1.9 Saudi Arabia

13.5.1.9.1 Saudi Arabia Shoe Packaging Market By Material

13.5.1.9.2 Saudi Arabia Shoe Packaging Market By Market Type

13.5.1.9.3 Saudi Arabia Shoe Packaging Market By Distribution Channel

13.5.1.9.4 Saudi Arabia Shoe Packaging Market By Shoes Type

13.5.1.9.5 Saudi Arabia Shoe Packaging Market By Shoe Packaging Type

13.5.1.10 Qatar

13.5.1.10.1 Qatar Shoe Packaging Market By Material

13.5.1.10.2 Qatar Shoe Packaging Market By Market Type

13.5.1.10.3 Qatar Shoe Packaging Market By Distribution Channel

13.5.1.10.4 Qatar Shoe Packaging Market By Shoes Type

13.5.1.10.5 Qatar Shoe Packaging Market By Shoe Packaging Type

13.5.1.11 Rest of Middle East

13.5.1.11.1 Rest of Middle East Shoe Packaging Market By Material

13.5.1.11.2 Rest of Middle East Shoe Packaging Market By Market Type

13.5.1.11.3 Rest of Middle East Shoe Packaging Market By Distribution Channel

13.5.1.11.4 Rest of Middle East Shoe Packaging Market By Shoes Type

13.5.1.11.5 Rest of Middle East Shoe Packaging Market By Shoe Packaging Type

13.5.2 Africa

13.5.2.1 Africa Shoe Packaging Market By Country

13.5.2.2 Africa Shoe Packaging Market By Material

13.5.2.3 Africa Shoe Packaging Market By Market Type

13.5.2.4 Africa Shoe Packaging Market By Distribution Channel

13.5.2.5 Africa Shoe Packaging Market By Shoes Type

13.5.2.6 Africa Shoe Packaging Market By Shoe Packaging Type

13.5.2.7 Nigeria

13.5.2.7.1 Nigeria Shoe Packaging Market By Material

13.5.2.7.2 Nigeria Shoe Packaging Market By Market Type

13.5.2.7.3 Nigeria Shoe Packaging Market By Distribution Channel

13.5.2.7.4 Nigeria Shoe Packaging Market By Shoes Type

13.5.2.7.5 Nigeria Shoe Packaging Market By Shoe Packaging Type

13.5.2.8 South Africa

13.5.2.8.1 South Africa Shoe Packaging Market By Material

13.5.2.8.2 South Africa Shoe Packaging Market By Market Type

13.5.2.8.3 South Africa Shoe Packaging Market By Distribution Channel

13.5.2.8.4 South Africa Shoe Packaging Market By Shoes Type

13.5.2.8.5 South Africa Shoe Packaging Market By Shoe Packaging Type

13.5.2.9 Rest of Africa

13.5.2.9.1 Rest of Africa Shoe Packaging Market By Material

13.5.2.9.2 Rest of Africa Shoe Packaging Market By Market Type

13.5.2.9.3 Rest of Africa Shoe Packaging Market By Distribution Channel

13.5.2.9.4 Rest of Africa Shoe Packaging Market By Shoes Type

13.5.2.9.5 Rest of Africa Shoe Packaging Market By Shoe Packaging Type

13.6 Latin America

13.6.1 Latin America Shoe Packaging Market By Country

13.6.2 Latin America Shoe Packaging Market By Material

13.6.3 Latin America Shoe Packaging Market By Market Type

13.6.4 Latin America Shoe Packaging Market By Distribution Channel

13.6.5 Latin America Shoe Packaging Market By Shoes Type

13.6.6 Latin America Shoe Packaging Market By Shoe Packaging Type

13.6.7 Brazil

13.6.7.1 Brazil Shoe Packaging Market By Material

13.6.7.2 Brazil Shoe Packaging Market By Market Type

13.6.7.3Brazil Shoe Packaging Market By Distribution Channel

13.6.7.4 Brazil Shoe Packaging Market By Shoes Type

13.6.7.5 Brazil Shoe Packaging Market By Shoe Packaging Type

13.6.8 Argentina

13.6.8.1 Argentina Shoe Packaging Market By Material

13.6.8.2 Argentina Shoe Packaging Market By Market Type

13.6.8.3 Argentina Shoe Packaging Market By Distribution Channel

13.6.8.4 Argentina Shoe Packaging Market By Shoes Type

13.6.8.5 Argentina Shoe Packaging Market By Shoe Packaging Type

13.6.9 Colombia

13.6.9.1 Colombia Shoe Packaging Market By Material

13.6.9.2 Colombia Shoe Packaging Market By Market Type

13.6.9.3 Colombia Shoe Packaging Market By Distribution Channel

13.6.9.4 Colombia Shoe Packaging Market By Shoes Type

13.6.9.5 Colombia Shoe Packaging Market By Shoe Packaging Type

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Shoe Packaging Market By Material

13.6.10.2 Rest of Latin America Shoe Packaging Market By Market Type

13.6.10.3 Rest of Latin America Shoe Packaging Market By Distribution Channel

13.6.10.4 Rest of Latin America Shoe Packaging Market By Shoes Type

13.6.10.5 Rest of Latin America Shoe Packaging Market By Shoe Packaging Type

14 Company Profile

14.1 Sneakerbox Co

14.1.1 Company Overview

14.1.2 Financials

14.1.3 Product/Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Packqueen

14.2.1 Company Overview

14.2.2 Financials

14.2.3 Product/Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Cross Country Box Company

14.3.1 Company Overview

14.3.2 Financials

14.3.3 Product/Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 Royal Packers

14.4.1 Company Overview

14.4.2 Financials

14.4.3 Product/Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Elevated Packaging

14.5.1 Company Overview

14.5.2 Financials

14.5.3 Product/Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Precious Packaging

14.6.1 Company Overview

14.6.2 Financials

14.6.3 Product/Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Samrat Box Mfg Co Pvt Ltd

14.7.1 Company Overview

14.7.2 Financials

14.7.3 Product/Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Packman Packaging Pvt Ltd

14.8.1 Company Overview

14.8.2 Financials

14.8.3 Product/Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Packaging of the World

14.9.1 Company Overview

14.9.2 Financials

14.9.3 Product/Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Zhuhai Zhuoya Packing Product Ltd

14.10.1 Company Overview

14.10.2 Financials

14.10.3 Product/Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Bench marking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. USE Cases and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Eco-Friendly Labels Market size was estimated at USD 1.46 billion in 2023 and is expected to reach USD 2.50 billion by 2032 at a CAGR of 6.14% during the forecast period of 2024-2032.

The Insulated Packaging Market Size was $16.2 billion in 2023 and is expected to reach USD 28.5 billion by 2031 and grow at a CAGR of 6.5% by 2024-2031.

The Anti-counterfeit Packaging Market size was USD 161 billion in 2023 and is expected to reach USD 237.87 billion by 2031 and grow at a CAGR of 5 % over the forecast period of 2024-2031.

The Inorganic Chemical Packaging Market Size was valued at USD 3.12 billion in 2023 and is expected to reach USD 4.30 billion by 2031 and grow at a CAGR of 4.1 % over the forecast period 2024-2031.

The Thermoformed Healthcare Packaging Market Size was valued at $48.41 billion in 2023 & will reach $94.53 billion by 2032 growing at a CAGR of 7.72% from 2024-2032

The Corrugated Bulk Bins Market size was USD 12.43 billion in 2023 and is expected to Reach USD 17.68 billion by 2031 and grow at a CAGR of 4.5 % over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone