Shock Sensor Market Size & Trends:

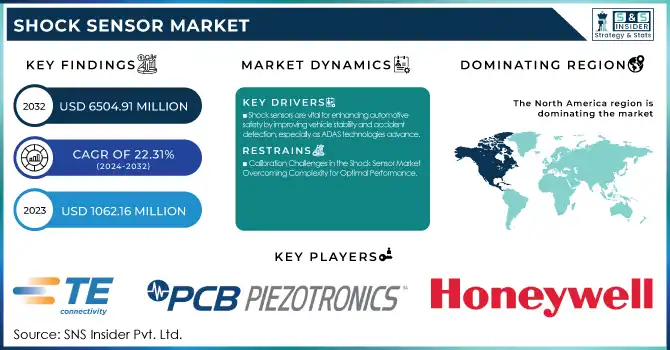

The Shock Sensor Market Size was valued at USD 1062.16 Million in 2023 and is expected to reach USD 6504.91 Million by 2032 and grow at a CAGR of 22.31% over the forecast period 2024-2032.

The shock sensor market is experiencing rapid growth within the automotive sector, primarily driven by increasing demands for safety, enhanced performance, and advancements in autonomous driving technologies. These sensors are crucial for applications like vehicle stability control, crash detection, and suspension monitoring, providing real-time optimization of vehicle performance.

Get more information on Shock Sensor Market - Request Free Sample Report

As embedded systems and ADAS technologies integrate, the demand for shock sensors grows, especially with the surge in electric vehicles and smart mobility. These sensors improve vehicle safety and response in high-impact scenarios, promoting safer and more efficient automotive systems. Additionally, across industries like construction and manufacturing, sensors have proven effective in boosting productivity, reducing energy consumption, and advancing environmental sustainability. For example, sensors have helped optimize energy consumption in lighting and HVAC systems, leading to savings of up to 47% in lighting and 30% in HVAC, while supporting waste reduction and environmental monitoring. As industries adopt smart technology and automation, sensors play a crucial role in driving innovation, enhancing data acquisition, optimizing processes, and improving operational efficiency, ultimately revolutionizing various sectors.

Shock Sensor Market Dynamics

Drivers

-

Shock sensors are vital for enhancing automotive safety by improving vehicle stability and accident detection, especially as ADAS technologies advance.

The shock sensor market is benefiting from the growing focus on road safety, with the automotive sector increasingly integrating sensors to enhance vehicle safety systems. As part of efforts to reduce traffic fatalities and improve accident detection, shock sensors are essential in systems such as crash detection and vehicle stability control. The rise of advanced safety features, including those in autonomous vehicles, is boosting demand for these sensors. Studies have shown that advancements in automotive sensor technology are leading to more reliable detection of extreme driving conditions, enabling real-time data capture and enhanced response to potential hazards. The automotive industry's drive for smarter safety technologies such as in-cabin sensing solutions and collision avoidance systems further accelerates the adoption of shock sensors in both conventional and electric vehicles, aligning with ongoing efforts to prevent accidents and improve overall vehicle safety.

Restraints

-

Calibration Challenges in the Shock Sensor Market Overcoming Complexity for Optimal Performance

Shock sensors, especially in high-precision applications like automotive safety systems, require meticulous calibration to measure impact forces accurately and consistently. This process involves specialized equipment and techniques, such as shock exciters and accelerometer calibration systems, which add both time and cost. Additionally, the need for recalibration in varying environmental conditions further complicates the process, making it an ongoing challenge for manufacturers. These calibration complexities can lead to higher costs and potentially slow adoption in industries where affordability is a key consideration. Moreover, the performance of shock sensors may degrade over time, requiring frequent recalibration to maintain optimal functionality, especially in demanding environments. Therefore, overcoming these calibration challenges is critical to reducing costs and enhancing the long-term reliability of shock sensors across various industries.

Shock Sensor Market Segmentation Analysis

By Type

The Piezoelectric segment is a dominant player in the shock sensor market, holding approximately 30% of the market share in 2023. Advancements in materials and manufacturing techniques, improving sensor sensitivity and accuracy. The development of new piezoelectric materials, such as composites and nanomaterials, has enhanced sensor performance, allowing for greater durability and higher precision. Innovations in miniaturization and integration with other sensing technologies have expanded their applications across industries. In automotive systems, piezoelectric shock sensors are increasingly integrated into Advanced Driver Assistance Systems (ADAS), offering real-time data to optimize vehicle safety features. Additionally, the growing demand for shock sensors in industrial applications, such as machinery monitoring and robotics, further contributes to the segment's development. As piezoelectric technology continues to evolve, it is expected to maintain its leading position in the market due to its versatility and high-performance capabilities.

By End Use

The automotive segment holds the largest share in the shock sensor market, accounting for around 35% of revenue in 2023. This dominance is attributed to the increasing demand for advanced safety features and performance optimization in vehicles. Shock sensors play a critical role in vehicle stability control, crash detection, suspension systems, and real-time data collection for driver assistance systems like ADAS. As the automotive industry shifts towards electric vehicles (EVs) and autonomous driving, the need for high-performance shock sensors continues to rise. Additionally, innovations in sensor technologies and the integration of shock sensors into smart mobility solutions further contribute to the segment's growth. The automotive sector's commitment to improving safety standards and overall vehicle performance drives substantial investment in shock sensor technology.

Shock Sensor Market Regional Overview

North America dominates the shock sensor market, accounting for approximately 40% of the global share in 2023. This leadership is driven by the region's strong automotive industry, particularly in the U.S., where advanced driver-assistance systems (ADAS) and electric vehicle (EV) development are rapidly expanding. The demand for high-performance shock sensors is also fueled by stringent safety regulations and the adoption of smart technologies in both commercial and consumer vehicles. Moreover, significant advancements in sensor technology and R&D investments in the U.S. continue to foster growth. Additionally, Canada's automotive sector contributes to the market's strength, with innovations in sensor integration for enhanced vehicle stability and crash detection systems. North America's dominance is also supported by the presence of major manufacturers, making it a key hub for shock sensor market growth.

The Asia-Pacific region is the fastest-growing market for shock sensors, with significant growth projected from 2024 to 2032. This growth is driven by the booming automotive industry, particularly in China, Japan, and South Korea, where advancements in vehicle safety and the adoption of electric vehicles (EVs) are rapidly accelerating. The rising demand for advanced driver-assistance systems (ADAS) and enhanced safety features has further fueled the need for shock sensors. Additionally, the expanding industrial sector in countries like India and China is contributing to the increasing demand for sensors in manufacturing processes. The region’s robust technological innovations and cost-effective production methods also position it as a key player in the global shock sensor market, making it an essential market for future growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Shock Sensor Market Along with their product:

-

TE Connectivity (Piezoelectric Sensors, Strain Gage Sensors)

-

PCB Piezotronics, Inc. (Piezoelectric Shock Sensors, Accelerometers)

-

Honeywell International Inc. (MEMS Shock Sensors, Vibration Sensors)

-

DYTRAN INSTRUMENTS INCORPORATED (Piezoelectric Accelerometers, Shock Sensors)

-

Murata Manufacturing Co., Ltd. (Capacitive Sensors, MEMS Sensors)

-

Mobitron AB (Shock and Vibration Sensors, Monitoring Systems)

-

Meggitt PLC (Industrial Vibration Sensors, Shock and Impact Sensors)

-

SpotSee (Shockwatch, Drop Tag Sensors)

-

SignalQuest, LLC (Wireless Shock Sensors, Vibration Monitoring Systems)

-

Climax Technology Co., Ltd. (Wireless Shock Sensors, Alarm Sensors)

-

Kistler Instrumente AG (Piezoelectric Pressure and Shock Sensors)

-

Sensonor AS (MEMS Vibration Sensors, Accelerometers)

-

Bruel & Kjaer (B&K) (Shock and Vibration Sensors, Sound and Vibration Measurement)

-

Hansford Sensors Ltd. (Industrial Vibration and Shock Sensors)

-

Applied Measurements Ltd. (Strain Gage and Shock Sensors)

-

R&D Instrumentation, Inc. (Shock and Vibration Measurement Sensors)

-

Vibrant Technology, Inc. (Shock Sensors, Vibration Test Systems)

-

National Instruments (Vibration and Shock Monitoring Sensors)

-

DynaTronic Systems, Inc. (Vibration and Shock Detection Systems)

-

Accelerometer Technology, Inc. (Shock and Vibration Sensors, Data Acquisition Systems)

Lit of Suppliers who supplies raw material and component for the Shock Sensor Market:

-

3M

-

Dow Inc.

-

DuPont

-

BASF

-

Henkel AG & Co. KGaA

-

Kyocera Corporation

-

Murata Manufacturing Co., Ltd.

-

Texas Instruments

-

STMicroelectronics

-

Vishay Intertechnology

Recent Development

-

February 2024 – PCB Piezotronics has launched the Endevco Model 7330 triaxial angular rate sensor, designed for measuring rotational velocity in extreme environments like automotive testing. With full-scale angular rate ranges from ±100 to ±18,000 deg/sec, it provides a ±2V voltage output, making it suitable for automotive rollover, safety testing, and applications in sports, helmet, and aerospace testing.

Recent Trends

-

December 16, 2024 – NASA is preparing to test a shock-sensing probe for its X-59 supersonic aircraft. The cone-shaped probe, designed to measure sonic thumps, will capture precise pressure data during supersonic flights, with versions optimized for near-field and mid-field measurements. This test is part of ongoing efforts to reduce noise levels from supersonic flight.

-

Casio launched the G-Shock Move DWH5600MB1A4 and DWH5600MB8A9 in the US on November 11, 2024. These multi-sport watches feature heart rate monitoring, blood oxygen tracking, and Strava compatibility, with a 35-hour battery life and solar charging. The DWH5600MB1A4 has a black resin casing, while the DWH5600MB8A9 is light gray. The watches retail for USD 320, slightly higher than previous models.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1062.16 Million |

| Market Size by 2032 | USD 6504.91 Million |

| CAGR | CAGR of 22.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Piezoelectric, Piezoresistive, Capacitors, Strain Gaze, Others) • By End Use (Automotive, Aerospace, Industrial, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity, PCB Piezotronics, Inc., Honeywell International Inc., DYTRAN INSTRUMENTS INCORPORATED, Murata Manufacturing Co., Ltd., Mobitron AB, Meggitt PLC, SpotSee, SignalQuest, LLC, Climax Technology Co., Ltd., Kistler Instrumente AG, Sensonor AS, Bruel & Kjaer (B&K), Hansford Sensors Ltd., Applied Measurements Ltd., R&D Instrumentation, Inc., Vibrant Technology, Inc., National Instruments, DynaTronic Systems, Inc., Accelerometer Technology, Inc. |

| Key Drivers | • Shock sensors are vital for enhancing automotive safety by improving vehicle stability and accident detection, especially as ADAS technologies advance. |

| Restraints | • Calibration Challenges in the Shock Sensor Market Overcoming Complexity for Optimal Performance. |