Shipping Software Market Report Scope & Overview:

To Get More Information on Shipping Software Market - Request Sample Report

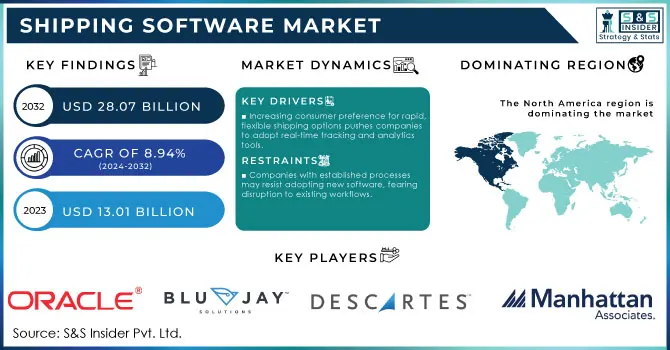

Shipping Software Market was valued at USD 13.01 billion in 2023 and is expected to reach USD 28.07 Billion by 2032, growing at a CAGR of 8.94% from 2024-2032.

The Shipping Software Market is rapidly expanding as e-commerce, logistics, and supply chain industries increasingly adopt digital tools to manage shipping operations. Shipping software simplifies order fulfillment, tracking, and documentation, significantly enhancing efficiency for businesses of all sizes. This software is particularly impactful in e-commerce, where there is high demand for swift and reliable delivery solutions. For instance, with global e-commerce surpassing USD 5.5 trillion in 2022, businesses face growing pressure to implement optimized shipping solutions. Real-time integration with carriers, inventory systems, and customer relationship management platforms is crucial for operational visibility and streamlined workflows.

One of the key growth drivers is the rising consumer demand for faster, more flexible shipping options. To meet this need, companies are investing in tools for real-time shipment tracking and predictive analytics. As a result, the adoption of shipping software among small and medium-sized enterprises (SMEs) has increased significantly, with approximately 60% of U.S. SMEs using software for logistics management in 2023. Additionally, the rise in cross-border e-commerce has driven demand for complex, multi-carrier solutions that support international shipping. In Asia-Pacific, where over 60% of retail sales are online, businesses increasingly turn to software to navigate regional regulations and customs smoothly.

Furthermore, advancements in artificial intelligence and machine learning allow shipping software to optimize routes, reduce delivery times, and control costs. For example, in 2024, DHL implemented AI-driven shipping software in its European operations, enabling it to forecast peak periods and optimize delivery routes, achieving nearly 20% savings on transportation costs. Software-as-a-service (SaaS) models have also made these solutions more accessible to businesses of all sizes.

Overall, the Shipping Software Market is growing as companies continue to digitize operations to enhance efficiency, reduce costs, and improve customer satisfaction, fueled by the ongoing expansion of global online retail and continuous technological advancements.

Shipping Software Market Dynamics

Drivers

-

Increasing consumer preference for rapid, flexible shipping options pushes companies to adopt real-time tracking and analytics tools.

-

Growth in international online sales requires complex, multi-carrier software to navigate customs and regional regulations seamlessly.

-

AI and machine learning are enabling route optimization, predictive analytics, and cost savings in shipping operations.

The Shipping Software Market is experiencing a sea change propelled by AI and machine learning, leading to advanced route optimization, predictive analytics, and cost management—elements that are building blocks for agile shipping operations. These technologies leverage data analysis at scale to enable software to predict the best paths for delivery, accounting for distance and timing alongside traffic conditions or weather and scheduling relays. This optimization also reduces fuel consumption and transportation costs, thereby contributing to sustainable logistics practices while enabling timely deliveries. In fact, logistics companies harness machine learning to predict peak delivery hours and respond by adjusting routes and schedules in advance, alleviating delays while improving the customer experience.

With AI-based predictive analytics, further enables the companies to predict changes in shipping demand and respond to variations. Using historical data as well as real-time inputs, these predictive tools give businesses advance notice of demand spikes typically seen during holidays or major sales events, allowing for more effective resource allocation. By 2024, top-tier companies such as DHL adopted AI-based software to forecast shipment volumes and allocate resources accordingly, which helped them save almost 20% on transportation costs. This proactive strategy allows businesses to provide flawless service during periods of high demand and, in turn, enhance customer experience.

Moreover, Artificial Intelligence and Machine Learning also provide cost-effective solutions while managing inventory or warehouses. By utilizing AI empowered shipping software, they will be able to predict inventory requirements, have stock levels adjusted, and order fulfillment processed to avoid costly last-minute changes and the additional expensive storage charges that come alongside excess stock. Additionally, AI-powered tracking in real-time assists in preventing lost or delayed parcels, which are expensive to replace or expedite.

The shipment software market is experiencing a turnaround owing to the amalgamation of AI and machine learning, increasing efficiency, streamlining operations along with decreasing costs while renewing better responsiveness. From smart tools for route planning, demand forecasting to resource management improving operational efficiency and customer satisfaction, lies the core of why AI continues to be vital in modern logistics.

Restraints

-

Companies with established processes may resist adopting new software, fearing disruption to existing workflows.

-

Real-time tracking and AI-driven features require stable internet connectivity, which may not be consistent in all regions.

-

The handling of sensitive shipping and customer data raises security risks, leading to potential breaches and compliance issues.

Handling sensitive shipping and customer data introduces significant security and compliance risks in the Shipping Software Market. These systems manage vast amounts of critical data, such as customer addresses, payment information, product details, and shipment tracking, which are essential for seamless operations but make them prime targets for cyberattacks. This data breach can lead to major financial losses, reputational damage, and legal consequences for the affected businesses.

As shipping operations become more digitized, the risk of data breaches grows, particularly with the integration of third-party systems like payment processors, carriers, and inventory management platforms. Cybercriminals may exploit weaknesses in these interconnected systems to steal or alter sensitive data. Furthermore, shipping companies must adhere to strict data protection laws, such as GDPR in Europe and CCPA in California, with non-compliance resulting in significant fines and legal issues, making data security and regulatory adherence more complex.

To address these challenges, shipping software providers are implementing advanced encryption techniques, secure authentication protocols, and access control systems. Ongoing software updates, security patches, and employee training on data protection are essential defenses against cyber threats. However, securing data across interconnected systems with multiple stakeholders remains difficult, especially for smaller companies that may lack the resources or expertise to implement robust security measures, increasing their risk of breaches.

Securing sensitive data is paramount as the Shipping Software Market evolves with more advanced technologies. Companies must invest in comprehensive cybersecurity strategies, stay updated on evolving data protection regulations, and adopt the necessary tools to safeguard against potential breaches.

Shipping Software Market Segment Analysis

By Component

The e-commerce shipping segment dominated the Shipping Software Market and represented significant revenue share in 2023, boosted by fast-paced growth of e-commerce and an increasing demand among consumers for quicker and more efficient delivery solutions. With the growth of e-commerce on an international level, there is a rising need for shipping software with features such as handling large numbers of transactions and delivery routes and tracking real-time status notifications. The model being another important unique in this segment highlighted through acceleration by direct-to-consumer, also encourages cross-border shipping. Mobile commerce and international e-commerce are predicted to only further increase this growth in the coming years. Retailers are investing heavily in state-of-the-art e-commerce shipping solutions to improve delivery speed, reduce costs and offer seamless integrations with their online shop.

The freight management system segment is expected to see the highest compound annual growth rate (CAGR) in the Shipping Software Market during the forecast period, driven by the growing complexity of freight logistics and the need for businesses to streamline operations across multiple carriers, transport modes, and international boundaries. These systems offer solutions for route planning, freight cost management, carrier selection, and shipment tracking, all of which help businesses boost efficiency and reduce expenses. As global trade and freight volumes increase, more companies are adopting these systems for improved shipment management. The use of AI and machine learning to optimize shipping routes is also contributing to the rapid expansion of this segment. The demand for integrated logistics platforms and the emphasis on efficiency and cost reduction in freight shipping will further accelerate the adoption of freight management systems.

By Deployment

The cloud deployment segment dominated the Market and accounting for significant revenue share in 2023, driven by the widespread adoption of cloud technologies across various sectors. Cloud-based solutions offer greater flexibility, scalability, and cost-effectiveness compared to traditional on-premise systems. Through cloud deployment, businesses gain the ability to access real-time data, manage shipments from anywhere, and easily scale operations to meet growing demands. Moreover, the cloud model facilitates seamless integration with third-party services while reducing the need for substantial investments in physical infrastructure. With the rise of remote work, cloud solutions further enhance accessibility and collaboration. Looking ahead, the cloud deployment segment is poised for continued growth as businesses prioritize adaptable, scalable shipping solutions. The increasing demand for cost-effective, scalable, and accessible options, along with the growing adoption of cloud technologies, will further drive this segment's expansion.

On-premise deployment segment is anticipated to register highest CAGR during the forecast period. On-premise is a preferred choice for businesses operating in highly regulated sectors to improve data privacy and meet stringent regulatory requirements. These solutions provide more customization, enabling businesses to customize the software to their needs without depending on a third-party cloud service. Similarly, on-premise systems remove internet connectivity concerns and they will continue to work when the service gets disrupted. Although this segment will grow at a slower pace than cloud-based option, it continues to command high demand – our data shows that large businesses and those focused on security and control of their data remain staunch buyers. The market is anticipated to maintain a steady pace of study mainly in regions with strong data privacy legislation.

Regional Analysis

In 2023, North America dominated the market and represented significant revenue share. Primarily due to growth from various logistics and e-commerce companies, innovation sourcing, demand for innovative shipping solutions and technological advancements. Major shipping software providers are found in the United States, which has a highly developed logistics infrastructure. Due to widespread adoption of cloud technologies, shipping processes automated and a blossoming e-commerce industry the region seems well-positioned. The position of North America is furthered by the rapid expansion of major retail businesses and growing demand for efficient cross-border shipping. As we move towards the future, the area will continue to lead the way, driven by advanced logistics solutions, AI-based shipping options and omnichannel retail growth. As companies invest in supply chain optimization and better customer experiences, steady growth is expected.

The Asia Pacific Shipping Software Market is expected to achieve the highest compound annual growth rate (CAGR) during the forecast time period, as a result of increasing e-commerce and global trade activities in conjunction with recent significant infrastructure developments in China, India and Japan. A steep growth in need of cross border shipping solutions with growing logistics and transportation sector are some factors that boosts the demand for advanced shipping software in the region. Market growth is further fueled by the increasing proliferation of e-commerce giants, digital evolution of supply chains & processes and massive infrastructure investment opportunities by governments.

Do You Need any Customization Research on Shipping Software Market - Enquire Now

Key players

The major key players along with their products

-

SAP - SAP Integrated Business Planning (IBP)

-

Oracle - Oracle Transportation Management Cloud

-

BluJay Solutions - BluJay Global Trade Network (GTN)

-

Descartes Systems Group - Descartes Aljex

-

Manhattan Associates - Manhattan Transportation Management System (TMS)

-

Kewill - Kewill MOVE

-

ShipBob - ShipBob Fulfillment Software

-

CargoSmart - CargoSmart Shipping Management Solutions

-

FreightPOP - FreightPOP Shipping Software Platform

-

WiseTech Global - CargoWise One

-

Project44 - Project44 Supply Chain Visibility Platform

-

Transplace - Transplace Transportation Management System

-

Softeon - Softeon TMS

-

Cerasis - Cerasis Rater

-

3Gtms - 3Gtms Transportation Management System

-

Locus - Locus Route Optimization Software

-

ShipEngine - ShipEngine Shipping API

-

Easyship - Easyship Global Shipping Software

-

Onfleet - Onfleet Delivery Management Software

-

AfterShip - AfterShip Tracking API

Recent Developments

In the first quarter of 2024, Pitney Bowes launched updates to its SendPro Online platform, focusing on enhanced cross-border shipping and improved tracking capabilities for eCommerce businesses. This expansion aims to streamline international shipments with real-time updates and automated customs management

Metapack announced a partnership with major eCommerce retailers in February 2024 to deliver a comprehensive delivery experience. The updates to their Metapack Delivery Management Platform will enhance route optimization and improve delivery transparency

WiseTech Global upgraded its CargoWise platform in February 2024 to include more AI-driven logistics optimization tools, aimed at reducing shipping costs and improving route planning for international freight

| Report Attributes | Details |

| Market Size in 2023 | USD 13.01 billion |

| Market Size by 2031 | USD 28.07 Billion |

| CAGR | CAGR of 8.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premise, Cloud) • By Component (Software, Services) • By Application (Retail & eCommerce, 3PL/Contract Logistics, Courier & Postal Services, Freight/Cargo Forwarding) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

SAP, Oracle, BluJay Solutions, Descartes Systems Group, Manhattan Associates, Kewill, ShipBob, CargoSmart, FreightPOP, WiseTech Global, Project44, Transplace, Softeon |

| Key Drivers | •Increasing consumer preference for rapid, flexible shipping options pushes companies to adopt real-time tracking and analytics tools. •Growth in international online sales requires complex, multi-carrier software to navigate customs and regional regulations seamlessly. •AI and machine learning are enabling route optimization, predictive analytics, and cost savings in shipping operations. |

| Market Restraints | •Companies with established processes may resist adopting new software, fearing disruption to existing workflows. •Real-time tracking and AI-driven features require stable internet connectivity, which may not be consistent in all regions. •The handling of sensitive shipping and customer data raises security risks, leading to potential breaches and compliance issues. |