Servo Motors and Drives Market Size & Trends:

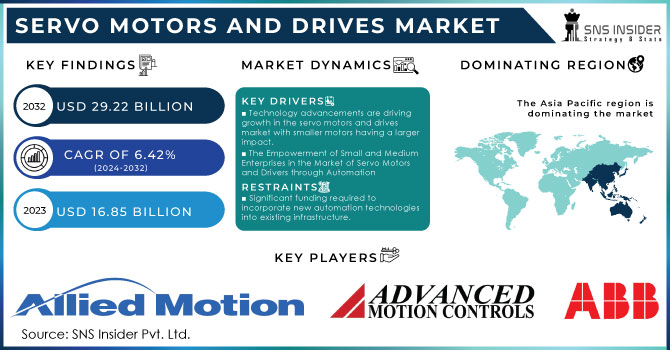

The Servo Motors and Drives Market Size was valued at USD 16.85 billion in 2023, and is expected to reach USD 29.22 billion by 2032, and grow at a CAGR of 6.42% over the forecast period 2024-2032.

The rise of automation in US manufacturing is a key factor propelling the growth of the Servo Motors and Drives Market. Unlike standard motors, servo motors offer exceptional control over their position, speed, and torque. This accurate manipulation is accomplished by a closed-loop system that continuously checks the motor's current position and compares it to the intended one. Any deviation triggers adjustments by the servo drive, ensuring the motor reaches and maintains the exact intended location.

Get More Information on Servo Motors and Drives Market - Request Sample Report

Servo drives act as the brain of the system, receiving control signals and sending precise adjustments to the motor. This unmatched precision makes servo motors ideal for various automated systems within US manufacturing. The recent surge in US manufacturing activity, driven by legislation like the Infrastructure Investment and Jobs Act (IIJA), the CHIPS and Science Act, and the Inflation Reduction Act (IRA), is creating a strong demand for automation. These laws prioritize areas like clean energy and electric vehicles, which heavily rely on automation for efficient production. Due to this, there is anticipation of a continual increase in the US market for servo motors and drives, which are essential for accurate automation. For instance, the aforementioned legislation has spurred record private-sector investment in US manufacturing.

Investments in semiconductor and clean technology manufacturing have nearly doubled compared to 2021, and are nearly 20 times higher than 2019 allocations. Since the IRA's passage, close to 200 new clean technology manufacturing facilities have been announced, representing a significant USD 88 billion investment and expected to create over 75,000 new jobs. Construction spending within the manufacturing industry has also seen a significant increase following the passage of these acts. As of July 2023, annual construction spending in manufacturing stands at USD 201 billion, a staggering 70% year-over-year increase, paving the way for further industry growth in 2024. This growth in US automation, fueled by legislative initiatives, creates a promising outlook for the Servo Motors and Drives market.

The rise of Industry 4.0 in the US, marked by smart and connected factories, is fueling demand for the Servo Motors and Drives market. Unlike regular motors, servo systems provide unmatched precision through constant monitoring and adjustment of motor position. This accuracy is crucial for the smooth operation of robots, a key component of Industry 4.0. This surge in robotics aligns with the increasing investment in Industry 4.0 by US manufacturers, with 84% planning to boost factory connectivity spending within the next two years. Furthermore, servo drives seamlessly communicate with IIoT sensors in real-time, allowing for dynamic adjustments and data-driven optimization within interconnected factories – a hallmark of Industry 4.0. This ability to integrate with robots, IIoT, and real-time data analysis positions servo motors and drives as a vital technology for powering the smart and connected factories of the future, propelling growth in the US Servo Motors and Drives market.

Servo Motors and Drives Market Dynamics

Drivers

-

Technology advancements are driving growth in the servo motors and drives market with smaller motors having a larger impact.

The Servo Motors and Drives market is driven not only by industry trends, but also by ongoing advancements in servo motor technology. These developments are similar to reducing the motor's size while increasing its effectiveness. Miniaturization enables lighter, more compact servo motors, providing increased design flexibility for their integration into smaller machinery. Enhanced effectiveness, resulting from advancements in motor design and materials, leads to substantial cost savings by lowering energy usage. Ultimately, improved communication protocols allow for smooth integration with Industrial IoT systems, facilitating instantaneous control and enhanced performance in connected factories. The merging of these technological advancements is a significant factor driving the advancement of the Servo Motors and Drives market.

-

The Empowerment of Small and Medium Enterprises in the Market of Servo Motors and Drivers through Automation

Despite the decline in productivity in the US manufacturing industry, there is a positive aspect for Small and Medium Enterprises (SMEs) which account for 90% of businesses in the US. Companies are focusing on speed, accuracy, and flexibility in their machinery, with servo motors and drives providing a robust solution. In sectors such as automotive, packaging, and textiles, servo systems are driving automated production lines, resulting in notable improvements in productivity and cost-effectiveness. This movement, along with lower automation expenses, is anticipated to drive the market for Servo Motors and Drives. Research indicates that small and medium-sized enterprises in the US are not as productive as bigger manufacturers because they are not adopting technology effectively. This is important because Industry 4.0 technologies, such as servo-powered robotics, can increase SME productivity by up to 50%. Research conducted by the Information Technology and Innovation Foundation (ITIF) indicates a sluggish rate of digital adoption, with AI being utilized by just 5% of mid-sized manufacturers surveyed, and specialized software being used by only 42%. This emphasizes the importance of programs promoting the adoption of digital technologies such as servo systems by US SMEs. US small and medium-sized enterprises can improve their productivity and competitiveness in the global market by closing the technology gap and leveraging the benefits of servo motors and drives, leading to a stronger manufacturing sector in the US.

Restraints

-

Significant funding required to incorporate new automation technologies into existing infrastructure.

There is a significant investment required to incorporate new automation technologies into the existing infrastructure. Incorporating new technologies into the existing infrastructure is a key aspect of factory automation. Investing in the advancement of automation technologies comes with significant expenses to upgrade the entire infrastructure. Small and medium-sized businesses face challenges in obtaining funds for investing in Industry 4.0 technologies. Several manufacturers may find this investment to be a hindrance. Servo motors in this situation require higher total system and installation expenditures in comparison to other types of motors because of the inclusion of feedback components.

Servo Motors and Drives Market Segment Analysis

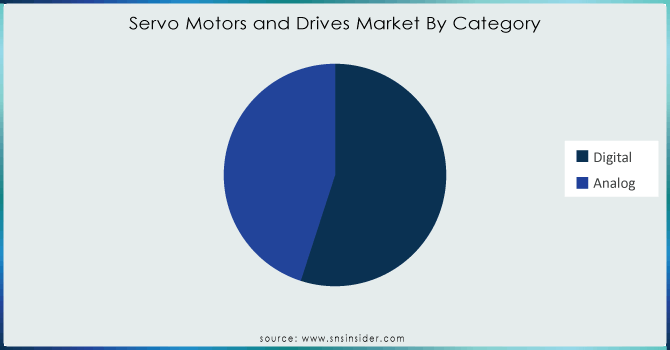

In terms of category, Digital holds the majority of the servo motors and drives market with a 55% share in 2023, showcasing a trend towards more advanced systems among customers. The increase is caused by customers' desire for more advanced systems. Siemens and Mitsubishi Electric are leading the way by creating cutting-edge devices with top-notch control and staying power. This pattern is in line with larger changes in the industry towards automation and energy efficiency. With the growth of manufacturing and increased investment in automation, digital servo systems are ready to seize new opportunities with their improved abilities.

Based on Drives, AC Drives dominated the servo motor and drives market with 56% of share in 2023. Due to improved operational features for efficiently managing high current spikes, increased torque, high speeds, and reduced noise functions. Additionally, swift technological progress and supportive administrative policies focused on strengthening operations will also contribute to the growth of the AC servo motors & drives market. As an example, during September of 2022, Kollmorgen launched a new range of improved brushless AC servo motors known as the EKM series. The new product is specially created to endure harsh environments and offer benefits like fast speed ratings up to 8000 RPM, effective sealing against the environment, high power & torque density, and insulation for voltages up to 480 VAC.

Need any customization research on Servo Motors and Drives Market - Enquiry Now

Servo Motors and Drives Market Regional Overview

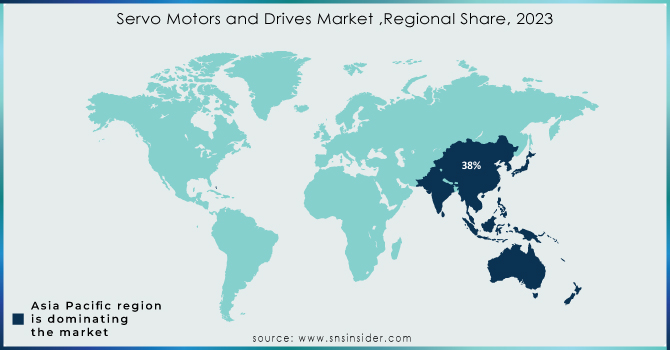

In 2023, the Asia Pacific region holds a leading position in the servo motor and drivers market, capturing 38% of the market share, due to increasing investments in the expansion of manufacturing and process industries, as well as rising investments in research and development activities. Positive efforts from developing economies to enhance digital transformation, combined with the incorporation of technology upgrades for real-time performance monitoring, will enhance the industry environment. As an example, in September 2023, Panasonic Corporation from Japan launched a top AI-equipped servo system, reducing human work time by 90%. The MINAS A7 family servo system from the company offers exact tuning work, improved energy efficiency, precise control, and is scheduled for a Japan debut in January 2024, followed by a worldwide launch.

North America is the fastest growing in the servo motor and drivers market with 25% in 2023. This increase is powered by three factors. Government projects such as infrastructure improvements, investments in clean energy, and bringing manufacturing back are boosting the need for sophisticated automation. An illustration of this is seen in the emphasis placed by the United States on developing a local semiconductor sector, which results in a demand for precise servo systems in chip manufacturing facilities. North American manufacturers are giving importance to automation and embracing Industry 4.0 in order to stay competitive. Ford and General Motors are making significant investments in robotic assembly lines that use servo systems for power. Ultimately, significant North American servo motor and drive producers such as Rockwell Automation and Emerson Automation Solutions are continuously developing new technologies. The latest improvements in small and eco-friendly servo systems address the increasing need for sustainable manufacturing methods. The combination of government backing, emphasis on advanced manufacturing, and technological progress sets North America up for significant growth in the Servo Motors and Drives market, securing its position as a leader in the future.

Key Players

Some of the major players in Servo Motors and Drivers Market with product:

-

ABB (Industrial Robots, Servo Motors, Drives)

-

Advanced Motion Controls (Servo Drives, Motion Control Solutions)

-

Allied Motion, Inc. (Servo Motors, Controllers, Motion Control Solutions)

-

Baumüller (Servo Motors, Inverters, Drive Systems)

-

Bosch Rexroth AG (Electric Drives and Controls, Linear Motion, Servo Motors)

-

Danfoss (Variable Frequency Drives, Servo Drives, Motion Controllers)

-

Delta Electronics, Inc. (Servo Motors, Variable Frequency Drives, Industrial Automation Products)

-

ESTUN Automation Co., Ltd (Servo Motors, Servo Drives, Industrial Robots)

-

Fuji Electric Co., Ltd. (Inverters, Servo Motors, Drives)

-

Hitachi (AC Servo Motors, Industrial Motors, Drives)

-

Ingenia Cat S.L.U. (High-Performance Servo Motors, Motion Control Solutions)

-

KEB Automation KG (Servo Motors, Industrial Automation, Drive Technology)

-

Kollmorgen (Servo Motors, Motion Controllers, Integrated Motion Systems)

-

Mitsubishi Electric Corporation (Servo Motors, Motion Controllers, Programmable Logic Controllers)

-

NIDEC Corporation (AC Servo Motors, DC Motors, Drives)

-

Panasonic Corporation (Servo Motors, AC Drives, Motion Controllers)

-

Rockwell Automation, Inc. (Servo Drives, Programmable Logic Controllers, Motion Control Products)

-

Schneider Electric (Servo Motors, Variable Speed Drives, Motion Control Products)

-

Siemens (Servo Motors, Industrial Automation, Motion Control Systems)

-

YASKAWA Electric Corporation (Servo Motors, Inverters, Motion Control Solutions)

List of Suppliers that provide raw materials and components for the Servo Motors and Drivers Market:

-

NIDEC Corporation

-

Hitachi Metals, Ltd.

-

Mitsubishi Materials Corporation

-

Daewoo International Corporation

-

JFE Steel Corporation

-

Stanley Electric Co., Ltd.

-

Taiyo Yuden Co., Ltd.

-

TDK Corporation

-

Panasonic Corporation

-

Schaeffler Group

Recent Developments

-

In January 2024, Applied Motion Products, Inc. launched an extension to its SV200 line of servo drives called M5 Servo Drive Series. The new product is designed to deliver a wide range of power from 200 W to 3,000 W while equipped with enhanced safety function to provide various advantages including precise motion control, smooth motion, high throughput, and customized OEM solutions, among other features.

-

In May 2023, Siemens introduced a new servo drive system called Sinamics S200, designed for a range of precise applications primarily across the electronics, battery manufacturing, and other industries. The system includes robust servo motors, accurate servo drive, and accessible cables, covering a power range of 0.1 -1kW at 200V along with 0.2 - 7kW at 400V to deliver high dynamic performance for applications demanding speed & torque precision.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 16.85 Billion |

| Market Size by 2032 | USD 29.22 Billion |

| CAGR | CAGR of 6.42 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Category (Digital, Analog) • By Drive (AC drive, DC drive) • By Application(Oil & gas, Meta cutting & forming, Material handling equipment, Packaging and labeling machinery, Robotics, Medical robotics, Rubber & plastics machinery, Warehousing, Automation, Extreme environment applications, Semiconductor machinery, AGV, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Servo Motor and Drives Market are ABB, ADVANCED Motion Controls, Allied Motion, Inc., Baumüller, Bosch Rexroth AG ,Danfoss, Delta Electronics, Inc, ESTUN AUTOMATION CO., LTD ,Fuji Electric Co., Ltd., Hitachi, Ingenia Cat S.L.U., KEB Automation KG, Kollmorgen, Mitsubishi Electric Corporation, NIDEC CORPORATION, Panasonic Corporation Rockwell Automation, Inc., Schneider Electric, Siemens, YASKAWA ELECTRIC CORPORATION and others. |

| Key Drivers | • Technology advancements are driving growth in the servo motors and drives market with smaller motors having a larger impact. • The Empowerment of Small and Medium Enterprises in the Market of Servo Motors and Drivers through Automation. |

| RESTRAINTS | • Significant funding required to incorporate new automation technologies into existing infrastructure. |