SerDes Market Size & Overview:

Get More Information on SerDes Market - Request Sample Report

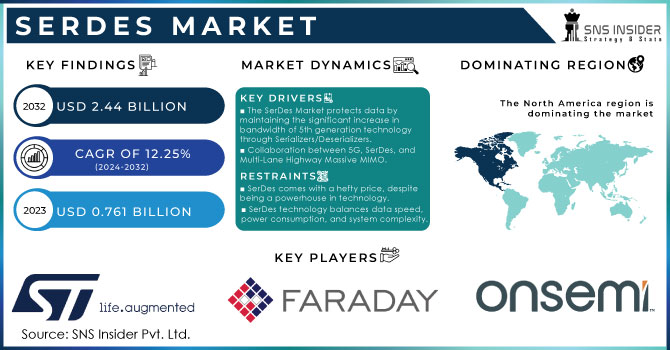

The SerDes Market Size was valued at USD 0.761 Billion in 2023, and expected to reach USD 2.44 Billion by 2032, and grow at a CAGR of 12.25% over the forecast period 2024-2032.

The SerDes chip, which is small in size, performs exceptionally well in high-speed data transmission. This incredible technology addresses the issue of efficiently transmitting data over long distances. Imagine a busy highway as a comparison to parallel data, with numerous data bits being sent at the same time. SerDes chips function as cutting-edge traffic directors, converting the high volume into a unified flow of serial data. This reduces the chance of data bits getting mixed up, while also allowing for faster data transmission through cables or fiber optic lines. The reduction in size of this technology has created opportunities for advancements in various industries that heavily depend on quick and dependable data transfer.

Apart from the major telecom and data center companies, SerDes technology is expanding into other interesting sectors. In the realm of High-Performance Computing (HPC), SerDes serves as the data highway that moves substantial datasets between processors and memory, facilitating quick transfers essential for intricate computations. The rapidly expanding field of Artificial Intelligence (AI) relies on SerDes for efficiently transmitting data within its systems during training and operations. This leads to quicker training of AI models and faster processing of information. The automotive industry is also benefitting from SerDes technology. With the rise of autonomous and connected vehicles, there is a growing demand for quick data sharing among the vehicle's systems. SerDes technologies are essential for supporting functionalities such as advanced driver assistance systems (ADAS), which rely on real-time data processing to improve driving safety. Emerging applications in progress demonstrate the versatile nature of SerDes technology, expanding limits and facilitating progress in diverse sectors.

SerDes Market acts as the central component of the system, facilitating fast communication between the vehicle's sensors (cameras, radar, and LiDAR) and its computational unit. These sensors generate huge volumes of data - several gigabytes per hour - necessitating immediate processing for important decisions. SerDes chips guarantee the smooth operation of high-speed data flow, which can exceed 10 Gbps in certain cases, allowing ADAS to operate effectively.

ADAS needs to operate efficiently. ADAS consists of different technologies that enhance the safety of your vehicle during operation. Research revealed that 94% of major accidents can be attributed to human error. ADAS software aims to address this problem by merging automatic detection, navigation, and avoidance capabilities within vehicles. The main goal of ADAS software is to enhance safety. The main objective of ADAS software is clear prioritize safety. These systems give cars almost superhuman abilities to prevent danger by enhancing their awareness of their environment and quick reaction times. LiDAR, radar, and video sensors work together to allow for pedestrian identification and lane departure warnings. ADAS goes beyond just ensuring safety. It can also reduce driver tiredness, enhance comfort and convenience, and lay the groundwork for self-driving cars.

|

Report Attributes |

Details |

|---|---|

|

Key Segments |

|

|

Regional Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

ON Semiconductor, Faraday Technology, STMicroelectronics, Maxim Integrated, Texas Instruments, NXP, Avago (Broadcom), Intesil (Renesas), Cypress, ROHM Semiconductor, Semtech, Vitesse (Microsemi), Corporation, MIPI Alliance, VSA, CREDO, INC., and others. |

Market Dynamics

Drivers

The SerDes Market protects data by maintaining the significant increase in bandwidth of 5th generation technology through Serializers/Deserializers.

5G networks, which provide a significant increase in data transfer rates, represent a revolutionary shift within the telecommunications industry. Effectively carrying out these impressive accomplishments necessitates handling vast amounts of data. In this scenario, SerDes technology acts as a silent hero by handling an impressive 90% of data traffic on a 5G network. Consider SerDes as the hidden data highway of 5G. In order to transmit efficiently, it compresses large data streams into a single, high-speed lane. This streamlined strategy ensures the seamless operation of the entire infrastructure, allowing you to make full use of 5G's new capabilities.

Collaboration between 5G, SerDes, and Multi-Lane Highway Massive MIMO.

5G introduces an innovative method of data transfer utilizing Massive MIMO (Multiple-Input and Multiple-Output) technology. Picture a crowded one-lane road that has been changed into a highway with multiple lanes. This is basically what Massive MIMO accomplishes by outfitting base stations and user devices (such as your phone) with numerous antennas - some estimates indicate up to 128! This brings about major benefits data speeds have the potential to increase by 5 times compared to 4G, and network capacity can also significantly expand, enabling more devices to connect at the same time. Handling the data flow among these numerous antennas poses a challenge. This is where SerDes (serializer/deserializer) technology steps in as an unnoticed savior, managing an impressive 90% of the data flow in a 5G network. Consider SerDes as a hidden traffic director, managing the movement of data. Data is serialized individually by each antenna, producing its own data stream. SerDes transforms parallel streams into single fast serial streams to reduce cable clutter during transmission. High-Speed Data Transfer SerDes guarantees seamless data communication among the many antennas, handling the large amount of data produced by Massive MIMO. Signal Integrity can be compromised due to the presence of numerous transmitting and receiving antennas, leading to potential interference issues. SerDes reduces signal distortion to ensure precise data transmission. Massive MIMO and SerDes work together seamlessly. This dynamic pair establishes high data rates and increased capacity in 5G networks by constructing a multi-lane data highway and effectively controlling traffic flow.

Restraints

SerDes technology manages the trade-off between data highway speed, power consumption, and system complexity.

The SerDes Market facilitates rapid data transmission between different systems, serving as the information superhighway of today's technology. Creating these high-speed SerDes chips is a complex undertaking. The three crucial factors to control are data speed, energy consumption, and reception strength.

It is crucial to maintain communication integrity to prevent corrupted data from disrupting the flow. There is a greater level of complication than what is being considered. Extended timeframes are often linked to the creation of high-speed SerDes chips. For SerDes chip design to attain the necessary performance balance, rigorous testing and tuning are essential, akin to the precision practice required in a challenging juggling routine. Focusing on small details could lead to increased construction expenses, which may discourage manufacturers with limited resources. There are numerous advantages to mastering this skillful balancing act. High-speed SerDes technology can enable significantly faster data transfer rates, driving advancements across several industries. Conquering these design challenges is vital to ensuring the widespread adoption and ongoing efficiency of SerDes technology as the need for ever-increasing data rates continues to grow.

SerDes comes with a hefty price, despite being a powerhouse in technology.

SerDes technology revolutionizes data transfer by enabling high speeds in various industries. There are financial obstacles to its execution. The complex designs and detailed manufacturing processes of SerDes chips lead to higher costs compared to simpler chips. The tale of expenses does not end there. Specialized equipment and professional skills are required to integrate high-speed SerDes interfaces. The specialized integration of SerDes can significantly increase the total expenses. For industries with tight budgets, these costs could pose a major barrier to implementation. Think about a small company trying to choose between using SerDes technology to speed up data transmission and using those resources for other important purposes. The expensive nature of SerDes could lead to second thoughts, especially if the performance benefits are not crucial for their business. There is always a bright side. With the maturation and expansion of SerDes technology, costs are expected to decrease over time. Enhancements in design and manufacturing are likely to result in more affordable SerDes options, ultimately allowing the SerDes market to grow. Creating cost-effective chip designs, exploring different integration methods, and offering tiered SerDes solutions for different budget requirements are important steps in increasing the accessibility of SerDes technology across various industries.

KEY SEGMENTS

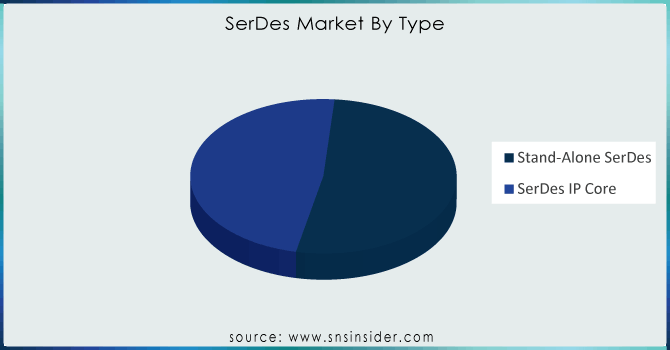

By Type

-

Stand-Alone SerDes

-

SerDes IP Core

Segment Analysis

By Type

-

Stand-Alone SerDes

-

SerDes IP Core

By type, Stand-alone segment dominated the SerDes Market with highest revenue share of more than 52% in 2023. Stand-alone cores are similar to pre-packaged bundles of efficient data transfer capabilities, designed to be easily incorporated into a range of systems with minimal need for customization. This easy-to-use method is perfect for designers who are new to SerDes or are working with tight time constraints. Convenience leads to a significant benefit in terms of quicker product launches. Engineers can fast-track the integration of SerDes features by skipping the complex process of designing chips from scratch, speeding up the development process. Their popularity extends beyond just being easy to use. For instance, data centers and 5G telecom infrastructure need reliable solutions to manage large amounts of data. Stand-alone cores fulfill this commitment by providing a straightforward yet dependable answer for rapidly moving data in specific defined situations.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

-

Telecom

-

Automotive

-

Data Centers

-

Consumer Electronics

-

Others (industrial automation,)

By Application Data centers dominated the SerDes Market with highest revenue of 40%market share in 2023. Think of them as bustling urban centers, just for information. SerDes technology acts as a dependable traffic manager, guaranteeing the smooth and fast flow of data between servers and storage devices. Efficiency is crucial in present data-focused surroundings. The continuous growth of data center infrastructure is caused by the rising demand for data processing and storage. SerDes steps up to the challenge, well-suited to handle the growing requirements. SerDes technology allows for quicker and more effective data transfer, enabling data centers to handle substantial amounts of data and offer superior processing speeds. This uninterrupted data transfer is essential for various uses such as cloud computing, online shopping, scientific studies, and artificial intelligence.

By Channel

-

Short Reach

-

Long Reach

By End-User

-

Cloud Computing

-

Storage & Networking

-

Data Center

-

Automotive

-

Consumer & Enterprise

-

Others

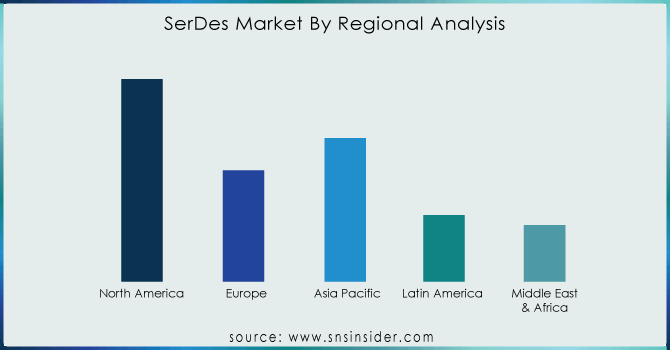

REGIONAL ANALYSES

By Region, North America centers dominated the SerDes Market with highest revenue of 35% market share in 2023. This superiority may stem from two key elements a flourishing culture of innovation and a robust infrastructure already in place. North America is a hub for leading innovations, encouraging the early use of the newest high-speed SerDes technology. These state-of-the-art solutions are perfect for satisfying the increasing data center and telecommunications network needs in the region. The increased demand for SerDes technology in North America is expected to surge due to ongoing upgrades of data centers and telecom networks. North America's SerDes industry is experiencing rapid growth primarily because of a special mix of factors such as a culture of innovation, robust infrastructure, and rising demand.

Asia Pacific is witnessing the fastest market growth, with a rate of 22% in 2023. Strong economies like China and India are experiencing considerable expansion in the telecommunications and data center industries, creating a high demand for SerDes technology. The continually changing terrain necessitates trustworthy data transfer technology, with SerDes providing the ideal option. Many countries in APAC are making significant investments in infrastructure upgrades such as data centers and 5G networks. These strategic activities will greatly accelerate SerDes implementation as demand for high-speed data transmission systems grows.

By Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players in the SerDes Market are ON Semiconductor, Faraday Technology, STMicroelectronics, Maxim Integrated, Texas Instruments, NXP, Avago (Broadcom), Intesil (Renesas), Cypress, ROHM Semiconductor, ROHM Semiconductor, Semtech, Vitesse (Microsemi), Corporation, MIPI Alliance, VSA, CREDO, INC., and others.

RECENT DEVELOPMENT

-

In February 04, 2024 - Faraday Technology Corporation, a leader in ASIC design services and IP solutions, announces its collaboration with Arm and Intel in initiating the development of a 64-core System-on-Chip (SoC) utilizing Intel 18A technology.

-

In March 13, 2024 -Texas Instruments announced that it will demonstrate new inserted processing and connectivity products for enabling a safer, smarter and more sustainable future at embedded world.

-

In March 13, 2024 -Texas Instruments announced that it will demonstrate new inserted processing and connectivity products for enabling a safer, smarter and more sustainable future at embedded world.

-

August 2023, The MIPI Alliance, a developer of technical specifications for the mobile ecosystem, and the Automotive SerDes Alliance announced the collaboration to standardize asymmetric SerDes technology. This partnership benefits the automotive industry due to the alignment of MIPI camera specifications with Automotive SerDes Alliance and MIPI-standardized SerDes solutions.

-

December 2022 VSA, a manufacturer of semiconductors for vehicles, announced the launch of the industry’s first high-speed SerDes silicon that aligns with the Automotive SerDes Alliance standard. The company showcased the performance of its new SerDes by conducting a live demonstration at IEEE Ethernet IP & Automotive Technology Day 2022.

-

August 2022,CREDO, INC., a provider of semiconductor solutions, unveiled PAM4 112G SerDes Intellectual Property for TSMC's N5 and N4 process technologies. This SerDes supports an extensive range of demands, including long reach plus (LR+) and extreme short reach (XSR) needed for various applications such as computing and machine learning.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.76 Billion |

| Market Size by 2032 | US$ 2.44 Billion |

| CAGR | CAGR of 12.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers |

|

| Restraints |

|