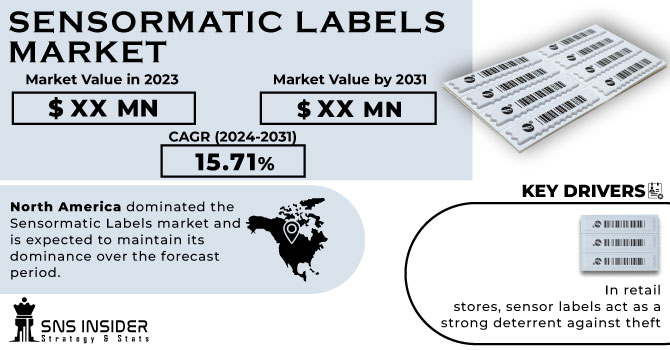

The Sensormatic Labels Market is expected to grow at a CAGR of 15.71% over the forecast period of 2024-2031.

Sensormatic Labels and tags aim to help retailers and shops fight shoplifters and thieves. The labels work with radio frequency retail systems and protect hard-to-tag items, packaged goods, cosmetics, pharmaceuticals, and more.

Get More Information on Sensormatic Labels Market - Request Sample Report

The main factor accelerating market growth in Sensormatic Labels is an increase in demand for fast moving consumer goods. The growth of the Sensormatic Labels market is also expected to be stimulated by increased production and proper inventory management, a rising number of investments in developing advanced and technical products, adoption of radio frequency identification tags and electronic article surveillance technology.

The Sensormatic Labels market is being hampered by growing preference for conventional barcode and label printing among manufacturers of small-scale industries, which will limit the growth of this market in comparison to laser printers that are more expensive. Moreover, the Sensormatic Labels label market will have ample opportunity to grow as a result of increasing demand from different sectors.

KEY DRIVERS:

In retail stores, sensor labels act as a strong deterrent against theft

Retailers are investing in these labels for protection of their goods, reducing shrinkage and minimising losses caused by theft.

The demand for Sensormatic Labels is increasing in order to secure a growing number of stores and goods due to the expansion of retail chains both at home and abroad.

RESTRAIN:

False alarm and inconvenience to customers

Customers may be inconvenienced and have negative shopping experiences, due to false alarms which arise from Sensormatic Labels. The key is to strike the right balance of security with minimising inconvenience.

OPPORTUNITY:

Advances in the Technology of Sensormatic Labelling

The opportunities to enhance detection capacity, increase data accuracy and facilitate the integration of retail systems are presented by continuing innovation in sensor labelling technology such as RFID Nearmatic labels or NFCNFC Field Communication technologies.

An opportunity to take advantage of a significant part of the retail market is provided by offering tailor made cost effective Sensormatic Labels solutions and packages for SMEs which may be subject to budgetary constraints.

CHALLENGES:

In order to preserve the integrity and security of shopping environments, it is vital that sensorial labelling systems be protected from cyber threats such as attempted hackers or data breaches.

The war damaged the supply lines, leading to higher prices for raw materials like paper and adhesives. Paper prices have increased by 10% since the beginning of the war. Adhesive prices have gone up by 5% since the beginning of the war. By now, the paper imports had risen to more than INR 1 00,000 per tonne, which had been priced at around INR 70,000 per tonne before the war. The cost of the Sensormatic Labels label has increased by 3% since the beginning of the war.

As a result of the sanctions imposed on Russia, Europe could fall into recession, leading to reduced demand for Sensormatic Labels packaging. Eastern Europe's largest markets for Sensormatic Labels are Russia and Ukraine. Due to the war, there was a steep drop in demand from those countries due to business closures and cutbacks.

The ongoing recession is expected to have a negative impact on this growth of Sensormatic Labels. The recession may also lead to an increase in the cost of doing business, thus making it more difficult for firms to raise their Sensormatic Labels Labelling expenditure.

The effect of the recession will vary between Sensormatic Labels labelling markets, depending on the region. Consequently, it is expected that North American markets will have a larger effect compared to the Asia Pacific. For example, the North American region has been more advanced and consumer spending is higher.

By Labelling

RFID Labels

Sensing Labels

EAS Labels

Others

By Printing Technology

Digital

Flexographic

Others

By Application

Logistics

Retail

Healthcare & Pharmaceuticals

Food & Beverage

Cosmetic & Personal Care

Others

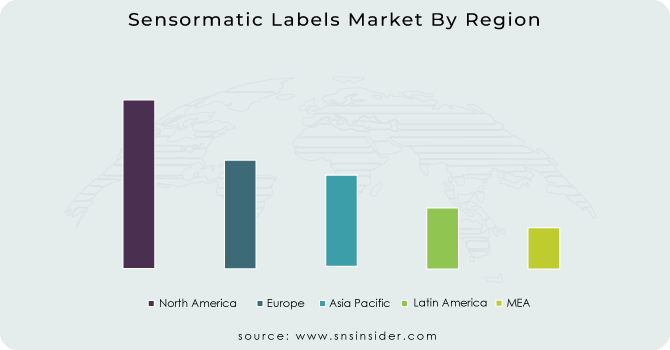

As a result of the fast demand from retail and logistics industry in this region, North America dominated the Sensormatic Labels market and is expected to maintain its dominance over the forecast period. In this region, increasing retail and logistics sectors are demanding efficient tracking solutions to drive demand for sensor labels. According to the USA grocery manufacturer's association, by 2023, 80% of foods and beverages, pet food, personal care or household goods would have a Smart Label.

However, the increase in demand from end user industries as well as growing labelling and packaging sectors will lead to Asia Pacific registering highest growth rates for this period.

To Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Sensormatic Labels market are Johnson Controls, CCL Industries Inc, Custom Security Industries Inc, Avery Dennison Corporation, Honeywell International Inc, Star Label Products, Watson Label Products, MEGA FORTRIS GROUP, ALL-TAG Corporation, Henkel Adhesives Technologies India Private Limited and other players.

A new acousto magnetic metal label designed to protect high risk products such as cookware, canned food, power tools and more has been recently introduced by Sensormatic Labels Solutions in the global retail solutions portfolio of Johnson Controls.

| Report Attributes | Details |

| CAGR | CAGR of 15.71% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Labelling (RFID Labels, Sensing Labels, EAS Labels, Others) • by Printing Technology (Digital, Flexographic, Others) • by End Use (Logistics, Retail, Healthcare & Pharmaceuticals, Food & Beverage, Cosmetic & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Johnson Controls, CCL Industries Inc, Custom Security Industries Inc, Avery Dennison Corporation, Honeywell International Inc, Star Label Products, Watson Label Products, MEGA FORTRIS GROUP, ALL-TAG Corporation, Henkel Adhesives Technologies India Private Limited |

| Key Drivers | • In retail stores, sensor labels act as a strong deterrent against theft • The demand for Sensormatic Labels is increasing in order to secure a growing number of stores and goods due to the expansion of retail chains both at home and abroad. |

| Key Opportunities | • Advances in the Technology of Sensormatic Labelling • An opportunity to take advantage of a significant part of the retail market is provided by offering tailor made cost effective Sensormatic Labels solutions and packages for SMEs which may be subject to budgetary constraints. |

Ans: The Sensormatic Labels Market is expected to grow at a CAGR of 15.10 %.

Ans: Advances in the Technology of Sensormatic Labels can provide growth opportunities for the market.

Ans: The demand for Sensormatic Labels is increasing in order to secure a growing number of stores and goods due to the expansion of retail chains both at home and abroad.

Ans: False alarm and inconvenience to customers can hinder the market growth.

Ans: North America dominated the Sensormatic Labels market and is expected to maintain its dominance over the forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Sensormatic Labels Market Segmentation, By Labelling

8.1 RFID Labels

8.2 Sensing Labels

8.3 EAS Labels

8.4 Others

9. Sensormatic Labels Market Segmentation, By Printing Technology

9.1 Digital

9.2 Flexographic

9.3 Others

10. Sensormatic Labels Market Segmentation, By End Use

10.1 Logistics

10.2 Retail

10.3 Healthcare & Pharmaceuticals

10.4 Food & Beverage

10.5 Cosmetic & Personal Care

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Sensormatic Labels Market by Country

11.2.2 North America Sensormatic Labels Market by Labelling

11.2.3 North America Sensormatic Labels Market by Printing Technology

11.2.4 North America Sensormatic Labels Market by End Use

11.2.5 USA

11.2.5.1 USA Sensormatic Labels Market by Labelling

11.2.5.2 USA Sensormatic Labels Market by Printing Technology

11.2.5.3 USA Sensormatic Labels Market by End Use

11.2.6 Canada

11.2.6.1 Canada Sensormatic Labels Market by Labelling

11.2.6.2 Canada Sensormatic Labels Market by Printing Technology

11.2.6.3 Canada Sensormatic Labels Market by End Use

11.2.7 Mexico

11.2.7.1 Mexico Sensormatic Labels Market by Labelling

11.2.7.2 Mexico Sensormatic Labels Market by Printing Technology

11.2.7.3 Mexico Sensormatic Labels Market by End Use

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Sensormatic Labels Market by Country

11.3.1.2 Eastern Europe Sensormatic Labels Market by Labelling

11.3.1.3 Eastern Europe Sensormatic Labels Market by Printing Technology

11.3.1.4 Eastern Europe Sensormatic Labels Market by End Use

11.3.1.5 Poland

11.3.1.5.1 Poland Sensormatic Labels Market by Labelling

11.3.1.5.2 Poland Sensormatic Labels Market by Printing Technology

11.3.1.5.3 Poland Sensormatic Labels Market by End Use

11.3.1.6 Romania

11.3.1.6.1 Romania Sensormatic Labels Market by Labelling

11.3.1.6.2 Romania Sensormatic Labels Market by Printing Technology

11.3.1.6.4 Romania Sensormatic Labels Market by End Use

11.3.1.7 Turkey

11.3.1.7.1 Turkey Sensormatic Labels Market by Labelling

11.3.1.7.2 Turkey Sensormatic Labels Market by Printing Technology

11.3.1.7.3 Turkey Sensormatic Labels Market by End Use

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Sensormatic Labels Market by Labelling

11.3.1.8.2 Rest of Eastern Europe Sensormatic Labels Market by Printing Technology

11.3.1.8.3 Rest of Eastern Europe Sensormatic Labels Market by End Use

11.3.2 Western Europe

11.3.2.1 Western Europe Sensormatic Labels Market by Country

11.3.2.2 Western Europe Sensormatic Labels Market by Labelling

11.3.2.3 Western Europe Sensormatic Labels Market by Printing Technology

11.3.2.4 Western Europe Sensormatic Labels Market by End Use

11.3.2.5 Germany

11.3.2.5.1 Germany Sensormatic Labels Market by Labelling

11.3.2.5.2 Germany Sensormatic Labels Market by Printing Technology

11.3.2.5.3 Germany Sensormatic Labels Market by End Use

11.3.2.6 France

11.3.2.6.1 France Sensormatic Labels Market by Labelling

11.3.2.6.2 France Sensormatic Labels Market by Printing Technology

11.3.2.6.3 France Sensormatic Labels Market by End Use

11.3.2.7 UK

11.3.2.7.1 UK Sensormatic Labels Market by Labelling

11.3.2.7.2 UK Sensormatic Labels Market by Printing Technology

11.3.2.7.3 UK Sensormatic Labels Market by End Use

11.3.2.8 Italy

11.3.2.8.1 Italy Sensormatic Labels Market by Labelling

11.3.2.8.2 Italy Sensormatic Labels Market by Printing Technology

11.3.2.8.3 Italy Sensormatic Labels Market by End Use

11.3.2.9 Spain

11.3.2.9.1 Spain Sensormatic Labels Market by Labelling

11.3.2.9.2 Spain Sensormatic Labels Market by Printing Technology

11.3.2.9.3 Spain Sensormatic Labels Market by End Use

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Sensormatic Labels Market by Labelling

11.3.2.10.2 Netherlands Sensormatic Labels Market by Printing Technology

11.3.2.10.3 Netherlands Sensormatic Labels Market by End Use

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Sensormatic Labels Market by Labelling

11.3.2.11.2 Switzerland Sensormatic Labels Market by Printing Technology

11.3.2.11.3 Switzerland Sensormatic Labels Market by End Use

11.3.2.1.12 Austria

11.3.2.12.1 Austria Sensormatic Labels Market by Labelling

11.3.2.12.2 Austria Sensormatic Labels Market by Printing Technology

11.3.2.12.3 Austria Sensormatic Labels Market by End Use

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Sensormatic Labels Market by Labelling

11.3.2.13.2 Rest of Western Europe Sensormatic Labels Market by Printing Technology

11.3.2.13.3 Rest of Western Europe Sensormatic Labels Market by End Use

11.4 Asia-Pacific

11.4.1 Asia-Pacific Sensormatic Labels Market by country

11.4.2 Asia-Pacific Sensormatic Labels Market by Labelling

11.4.3 Asia-Pacific Sensormatic Labels Market by Printing Technology

11.4.4 Asia-Pacific Sensormatic Labels Market by End Use

11.4.5 China

11.4.5.1 China Sensormatic Labels Market by Labelling

11.4.5.2 China Sensormatic Labels Market by Printing Technology

11.4.5.3 China Sensormatic Labels Market by End Use

11.4.6 India

11.4.6.1 India Sensormatic Labels Market by Labelling

11.4.6.2 India Sensormatic Labels Market by Printing Technology

11.4.6.3 India Sensormatic Labels Market by End Use

11.4.7 Japan

11.4.7.1 Japan Sensormatic Labels Market by Labelling

11.4.7.2 Japan Sensormatic Labels Market by Printing Technology

11.4.7.3 Japan Sensormatic Labels Market by End Use

11.4.8 South Korea

11.4.8.1 South Korea Sensormatic Labels Market by Labelling

11.4.8.2 South Korea Sensormatic Labels Market by Printing Technology

11.4.8.3 South Korea Sensormatic Labels Market by End Use

11.4.9 Vietnam

11.4.9.1 Vietnam Sensormatic Labels Market by Labelling

11.4.9.2 Vietnam Sensormatic Labels Market by Printing Technology

11.4.9.3 Vietnam Sensormatic Labels Market by End Use

11.4.10 Singapore

11.4.10.1 Singapore Sensormatic Labels Market by Labelling

11.4.10.2 Singapore Sensormatic Labels Market by Printing Technology

11.4.10.3 Singapore Sensormatic Labels Market by End Use

11.4.11 Australia

11.4.11.1 Australia Sensormatic Labels Market by Labelling

11.4.11.2 Australia Sensormatic Labels Market by Printing Technology

11.4.11.3 Australia Sensormatic Labels Market by End Use

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Sensormatic Labels Market by Labelling

11.4.12.2 Rest of Asia-Pacific Sensormatic Labels Market by Printing Technology

11.4.12.3 Rest of Asia-Pacific Sensormatic Labels Market by End Use

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Sensormatic Labels Market by Country

11.5.1.2 Middle East Sensormatic Labels Market by Labelling

11.5.1.3 Middle East Sensormatic Labels Market by Printing Technology

11.5.1.4 Middle East Sensormatic Labels Market by End Use

11.5.1.5 UAE

11.5.1.5.1 UAE Sensormatic Labels Market by Labelling

11.5.1.5.2 UAE Sensormatic Labels Market by Printing Technology

11.5.1.5.3 UAE Sensormatic Labels Market by End Use

11.5.1.6 Egypt

11.5.1.6.1 Egypt Sensormatic Labels Market by Labelling

11.5.1.6.2 Egypt Sensormatic Labels Market by Printing Technology

11.5.1.6.3 Egypt Sensormatic Labels Market by End Use

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Sensormatic Labels Market by Labelling

11.5.1.7.2 Saudi Arabia Sensormatic Labels Market by Printing Technology

11.5.1.7.3 Saudi Arabia Sensormatic Labels Market by End Use

11.5.1.8 Qatar

11.5.1.8.1 Qatar Sensormatic Labels Market by Labelling

11.5.1.8.2 Qatar Sensormatic Labels Market by Printing Technology

11.5.1.8.3 Qatar Sensormatic Labels Market by End Use

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Sensormatic Labels Market by Labelling

11.5.1.9.2 Rest of Middle East Sensormatic Labels Market by Printing Technology

11.5.1.9.3 Rest of Middle East Sensormatic Labels Market by End Use

11.5.2 Africa

11.5.2.1 Africa Sensormatic Labels Market by Country

11.5.2.2 Africa Sensormatic Labels Market by Labelling

11.5.2.3 Africa Sensormatic Labels Market by Printing Technology

11.5.2.4 Africa Sensormatic Labels Market by End Use

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Sensormatic Labels Market by Labelling

11.5.2.5.2 Nigeria Sensormatic Labels Market by Printing Technology

11.5.2.5.3 Nigeria Sensormatic Labels Market by End Use

11.5.2.6 South Africa

11.5.2.6.1 South Africa Sensormatic Labels Market by Labelling

11.5.2.6.2 South Africa Sensormatic Labels Market by Printing Technology

11.5.2.6.3 South Africa Sensormatic Labels Market by End Use

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Sensormatic Labels Market by Labelling

11.5.2.7.2 Rest of Africa Sensormatic Labels Market by Printing Technology

11.5.2.7.3 Rest of Africa Sensormatic Labels Market by End Use

11.6 Latin America

11.6.1 Latin America Sensormatic Labels Market by country

11.6.2 Latin America Sensormatic Labels Market by Labelling

11.6.3 Latin America Sensormatic Labels Market by Printing Technology

11.6.4 Latin America Sensormatic Labels Market by End Use

11.6.5 Brazil

11.6.5.1 Brazil Sensormatic Labels by Labelling

11.6.5.2 Brazil Sensormatic Labels by Printing Technology

11.6.5.3 Brazil Sensormatic Labels by End Use

11.6.6 Argentina

11.6.6.1 Argentina Sensormatic Labels by Labelling

11.6.6.2 Argentina Sensormatic Labels by Printing Technology

11.6.6.3 Argentina Sensormatic Labels by End Use

11.6.7 Colombia

11.6.7.1 Colombia Sensormatic Labels by Labelling

11.6.7.2 Colombia Sensormatic Labels by Printing Technology

11.6.7.3 Colombia Sensormatic Labels by End Use

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Sensormatic Labels by Labelling

11.6.8.2 Rest of Latin America Sensormatic Labels by Printing Technology

11.6.8.3 Rest of Latin America Sensormatic Labels by End Use

12 Company profile

12.1 Johnson Controls

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 CCL Industries Inc

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Custom Security Industries Inc

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Avery Dennison Corporation

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Honeywell International Inc

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Star Label Products

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Watson Label Products

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 MEGA FORTRIS GROUP

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 ALL-TAG Corporation

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Henkel Adhesives Technologies India Private Limited

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Inclusive Packaging Market is rapidly growing, spurred by a focus on accessibility and convenience for diverse consumer groups, including those with disabilities and the elderly.

The Corrugated Boxes Market size was valued at USD 75.71 billion in 2023. It is expected to reach USD 107.75 billion by 2032 and grow at a CAGR of 4% over the forecast period 2024-2032.

The Returnable Packaging Market size was valued at USD 111.40 billion in 2023 and is expected to Reach USD 185.04 billion by 2032 and grow at a CAGR of 5.8 % over the forecast period of 2024-2032.

The Agriculture Packaging Market size was USD 6.8 billion in 2023 and is expected to Reach USD 11.3 billion by 2032 and grow at a CAGR of 5.8% over the forecast period of 2024-2032.

The Composite Packaging Market was USD 73.57 billion in 2023 and will reach USD 112.96 billion by 2032 reflecting a remarkable CAGR of 5.28% by 2024 to 2032

Tracing Paper Market Size was valued at USD 471 million in 2023 and is expected to reach USD 585.63 million by 2032 and grow at a CAGR of 2.45% over the forecast period 2024-2032

Hi! Click one of our member below to chat on Phone