Sensor Hub Market Size & Trends Analysis:

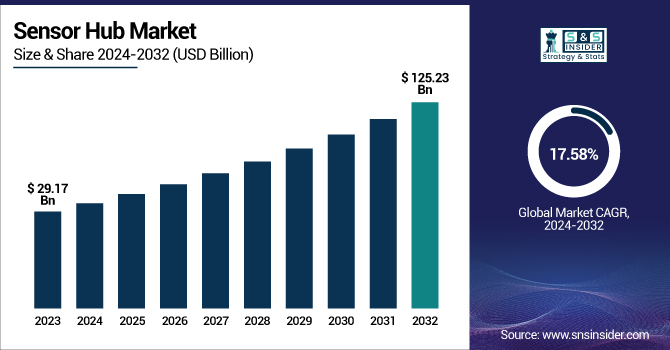

The Sensor Hub Market was valued at USD 29.17 billion in 2023 and is projected to reach USD 125.23 billion by 2032, growing at a CAGR of 17.58% from 2024 to 2032.

To Get more information on Sensor Hub Market - Request Free Sample Report

Some of the key factors triggering this development are growing adoption trends across various industries which includes automotive, healthcare, consumer electronics etc. especially in the IoT and smart devices. In addition, edge computing and data processing will also help the sensor hub systems be more efficient and faster while allowing for real-time data processing.

In the U.S., the market was valued at USD 7.02 billion in 2023 and is expected to grow to USD 26.33 billion by 2032, with a CAGR of 15.82%. There is also increasing demand for multi-functionality, whereby manufacturers wish to combine multiple types of sensor into single hubs to save cost and enhance performance. Furthermore, regulations and environmental effects are impacting the market and driving it toward the more energy-efficient, compact, and environmental-friendly solutions in the automotive, and healthcare, among others.

Sensor Hub Market Dynamics:

Drivers:

-

The increasing deployment of IoT devices across various industries is significantly driving the growth of the Sensor Hub market.

As an increasing number of sectors such as automotive, healthcare, consumer electronics and manufacturing implement IoT technologies, the need for sensor hubs that can process and amalgamate data from multiple sensors has expanded tremendously. For example, Novatek started working with CEVA on the latest DSP from CEVA, SensPro2, which features incredible pricing benefits (6X increased DSP performance for computer vision, 2X AI inferencing, and 20% lower power consumption than its previous model). The solution addresses the increasing demand for small size and powerful solutions for connected devices. In addition, the increasing implementation of IoT devices through smart homes, wearables, and connected vehicles is boosting the adoption of sensor hubs. This trend underscores the increasing reliance on these hubs for real-time data processing and decision-making, fueling further market growth. As industries such as automotive, healthcare, consumer electronics, and manufacturing increasingly integrate IoT technologies, the demand for sensor hubs capable of processing and integrating data from multiple sensors has surged. For instance, Novatek and CEVA's collaboration has led to the development of SensPro2, CEVA's latest DSP, which delivers remarkable performance improvements, including a 6X boost in DSP performance for computer vision, a 2X increase in AI inferencing, and 20% lower power consumption compared to its predecessor. This innovation meets the growing need for compact and high-performance solutions for connected devices. Moreover, the widespread deployment of IoT devices in smart homes, wearables, and connected vehicles is accelerating the adoption of sensor hubs. This trend underscores the increasing reliance on these hubs for real-time data processing and decision-making, fueling further market growth.

Restraints:

-

Integration issues limit the widespread adoption of sensor hubs across industries.

Integrating sensor hubs with various types of sensors and ensuring smooth operation with systems like cloud computing, edge devices, and existing infrastructure is a complex task. Sensor hubs must efficiently combine data from multiple sensors and process, analyze, and transmit it in real time for effective decision-making. This process becomes more challenging when integrating legacy systems not originally designed for IoT or multi-sensor communication. Ensuring compatibility between sensor hubs and cloud or edge systems requires synchronization and secure data transmission across platforms with different protocols and standards. These integration complexities often result in longer development times, increased costs, and potential delays in the deployment of sensor hub solutions. This can slow their adoption, especially in industries where sophisticated systems and real-time data processing are critical for success.

Opportunities:

-

Sensor Hubs Fueling Innovation and Growth in Health and Fitness Wearables

The increasing proliferation of health and fitness wearables represents a sizable opportunity for sensor hubs as they will be an integral component in extending the usefulness of these devices. Sensor hubs allow real-time processing and analysis of data collected from multiple sensors that are built into wearables, such as heart rate monitors, accelerometers, and gyroscopes. This makes it possible for applications such as heart rate and activity monitoring, sleep analysis, and even stress monitoring to increase their accuracy and responsiveness to the user's feedback, giving them real-time data as to the status of their health and wellness. As consumers’ focus fixed on fitness and personal well-being, the number of more advanced, efficient, and compact wearable devices in high demand. Multi-sensor-enabled devices perform better, stay responsive and last longer, but they need to be handled by sensor hubs that can process data from multiple sensors under low power consumption.

Challenges:

-

Mitigating Security Risks in Sensor Hubs to Ensure Safe IoT Connectivity

With data transmission becoming a key-security concern for sensor hubs, the rise of connected devices poses a challenge for the sensors hub. These hubs are crucial for processing and transmitting the sensitive information gathered from a wide range of sensors, but this adds another point of vulnerability for the system and increases the risk of a data breach or unauthorized access. This ensures that data integrity and confidentiality is critical in sectors such as healthcare, automotive, and finance. If adequate security measures are not are into place like end to end encryption, secure communication protocols, real-time monitoring, etc., then the adversary can exploit the system vulnerabilities in this environment and can cause data theft, manipulation of the system, or other cyberattacks. The powerful capabilities of sensor hubs create an explosion of data across multiple platforms and devices and, as they are merged with cloud and edge computing platforms, contribute to the complexity of securing the same across devices and platforms. With demand of Internet of Things (IoT), Connected Innovation and Device deployment, security in these systems and prevention in security threat is one of the important aspects to build trust in sensor hub technologies.

Sensor Hub Industry Segmentation Overview:

By Processor Type

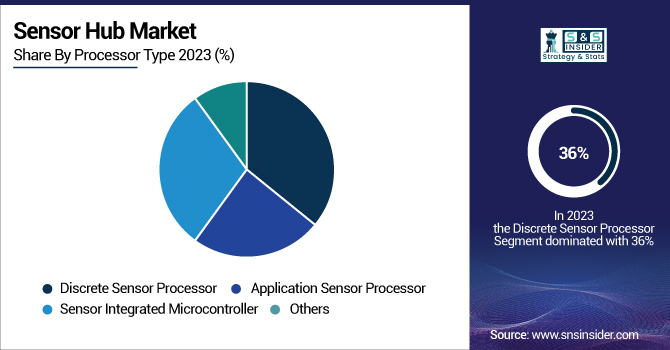

The Discrete Sensor Processor segment led the Sensor Hub Market with the largest revenue share of approximately 36% in 2023, driven by its ability to handle complex sensor data processing independently, without relying on the main processor. This allows for faster data acquisition, enhanced performance, and more efficient real-time decision-making, making it crucial in applications like automotive, healthcare, and industrial automation. As the demand for advanced, high-performance sensor hubs increases, especially in IoT and AI-driven applications, the Discrete Sensor Processor segment is expected to witness rapid growth from 2024 to 2032. The ability of discrete processors to operate with low power consumption, handle multiple sensors simultaneously, and offer superior data processing capabilities supports the increasing need for high-precision, low-latency sensor systems. This trend is anticipated to expand the segment’s dominance in the market throughout the forecast period.

By End Use

The Consumer Electronics segment dominated the Sensor Hub Market with a revenue share of around 45% in 2023, which can be attributed to the increasing acceptance of IoT-based devices such as smartphones, wearables, and smart home devices. For such advanced features, sensor hubs are responsible, as they combine information from multiple sensors and provide functions like touch sensing, motion detection, and environmental monitoring. With an increasing need for smarter and more efficient consumer electronics, the demand for sophisticated sensor hubs is on the rise. These hubs are capable of processing enormous amounts of data in real time, thus improving user experience and enhancing energy-saving, catering for the prevalent trend of connected devices. This trend is expected to continue, making the consumer electronics segment a key driver of market growth in the coming years.

The Automotive segment is projected to experience the fastest growth in the Sensor Hub Market from 2024 to 2032. The growing utilization of advanced driver-assistance systems (ADAS), autonomous vehicles, and electric vehicles (EVs) powered by sensors requires sensor hubs to process, integrate, and transform data into an actionable format in real-time, further propelling market growth. Automotive sensor hubs can be critical in enabling advanced features, such as collision avoidance, lane-keeping assistance, adaptive cruise control, and sensor fusion, all of which optimize vehicle safety and performance. (For example, demand for more advanced sensors in EVs and smart cars that require the processing of a large amount of collected data from various sources are also expected to boost the market.) With vehicle manufacturers adopting more and more IoT and AI technologies, the demand for dependable, high-performance sensor hubs will increase, establishing the automotive segment as a significant contributor to growth of the market in the forecast period.

Sensor Hub Market Regional Analysis:

North America held the largest revenue share of around 35% in the Sensor Hub Market in 2023, driven by the region’s strong demand for advanced IoT technologies across various industries, including automotive, healthcare, and consumer electronics. The presence of key technology companies and a robust infrastructure for research and development further supports the growth of sensor hub adoption in the region. North America’s advanced manufacturing capabilities, high-tech applications in smart devices, and early adoption of next-gen technologies like AI and machine learning contribute to its dominance. Additionally, the region's focus on connected devices, autonomous systems, and the Internet of Things (IoT) further boosts the demand for efficient, real-time sensor data processing, solidifying its leading position in the market. This dominance is expected to continue throughout the forecast period.

Asia-Pacific is expected to experience the fastest growth in the Sensor Hub Market from 2024 to 2032, driven by the rapid adoption of IoT technologies across various sectors, including automotive, consumer electronics, and industrial automation. The region's booming economies, such as China, India, and Japan, are heavily investing in smart devices, wearables, and connected infrastructure, fueling demand for sensor hubs. Additionally, Asia-Pacific’s strong manufacturing base and leadership in semiconductor production position it as a key player in sensor hub development and deployment. The growing trend of smart cities, connected vehicles, and industrial IoT (IIoT) further accelerates the need for advanced sensor data processing. This region's fast-paced technological advancements, coupled with increasing demand for cost-effective, high-performance solutions, will contribute to its dominance in market growth over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Sensor Hub Market are:

-

Qualcomm Technologies Inc. (U.S): Snapdragon processors, 5G modems, IoT sensor hubs.

-

STMicroelectronics N.V. (Switzerland): MEMS sensors, pressure sensors, motion sensors.

-

Bosch Sensortec (Germany): Motion, environmental, and pressure sensors.

-

InvenSense Inc. (U.S): MEMS gyroscopes, accelerometers, motion tracking sensors.

-

Analog Devices Inc. (U.S): MEMS sensors, signal processing solutions, inertial measurement units.

-

NXP Semiconductors N.V. (Netherlands): IoT solutions, microcontrollers, automotive sensors.

-

Infineon Technologies AG (Germany): MEMS microphones, radar sensors, automotive sensors.

-

Microchip Technology Inc. (U.S): Microcontrollers, temperature/pressure/humidity sensors, IoT solutions.

-

RoHM Co. Ltd. (Japan): MEMS sensors, pressure sensors, voltage regulators.

-

Memsic Inc. (U.S): MEMS accelerometers, gyroscopes, inertial sensors.

-

Texas Instruments Inc. (U.S): Microcontrollers, precision analog sensors, signal processors.

-

Intel Corporation (U.S): IoT processors, integrated circuits, edge AI platforms.

-

Broadcom Limited (U.S): Wireless communication chips, Bluetooth/Wi-Fi modules, IoT sensor chips.

List of companies that provide raw materials and components for the Sensor Hub Market:

-

Honeywell International Inc.

-

3M Company

-

Rohm Co. Ltd.

-

Murata Manufacturing Co., Ltd.

-

Texas Instruments Inc.

-

STMicroelectronics N.V.

-

Analog Devices Inc.

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

Broadcom Limited

-

Qualcomm Technologies Inc.

-

Bosch Sensortec

-

InvenSense Inc.

-

Microchip Technology Inc.

-

ROHM Semiconductor

-

Memsic Inc.

-

Kyocera Corporation

-

Taiyo Yuden Co., Ltd.

Recent Development:

-

3April 2025, Qualcomm Technologies has partnered with Lantronix to launch the Open-Q 8550CS System-on-Module (SOM), featuring low-power AI and machine learning capabilities for edge computing. This advanced module, incorporating Qualcomm’s Dragonwing QCS8550 SoC, enhances video collaboration, smart camera integration, and complex AI/ML tasks in extreme edge environments.

-

On November 4, 2024, Geek+ and Intel introduced their Vision Only Robot Solution, utilizing Intel’s Visual Navigation Modules and RealSense cameras to enhance smart logistics with advanced AI and V-SLAM algorithms. The solution improves navigation, obstacle avoidance, and efficiency in complex environments like warehouses and factories.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 29.17 Billion |

| Market Size by 2032 | USD 125.23 Billion |

| CAGR | CAGR of 17.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor Type (Application Sensor Processor, Discrete Sensor Processor, Sensor Integrated Microcontroller, Others) • By End Use (Consumer Electronics, Automotive, Industrial, Military, Healthcare, Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies Inc., STMicroelectronics N.V., Bosch Sensortec, InvenSense Inc., Analog Devices Inc., NXP Semiconductors N.V., Infineon Technologies AG, Microchip Technology Inc., RoHM Co. Ltd., Memsic Inc., Texas Instruments Inc., Intel Corporation, and Broadcom Limited are key players in providing components for the sensor hub market. |