Semi-Autonomous Vehicle Market Report Scope & Overview:

To get more information on Semi-Autonomous Vehicle Market - Request Free Sample Report

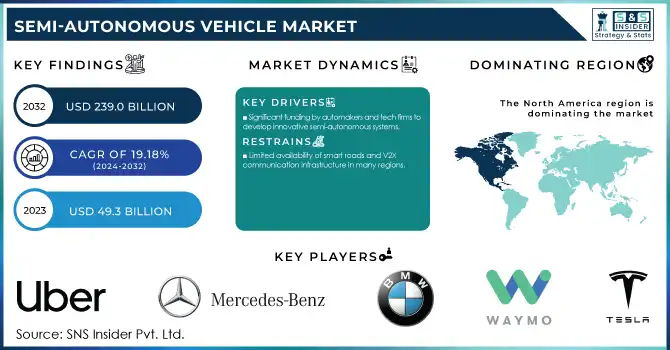

The Semi-Autonomous Vehicle Market was valued at USD 49.3 Billion in 2023 and is expected to reach USD 239.0 Billion by 2032, growing at a CAGR of 19.18% from 2024-2032.

The semi-autonomous Vehicle market is witnessing rapid growth owing to the evolution of automotive technology and increasing consumer demand for enhanced safety and comfort. One of the main accelerants in recent times has been the adoption of advanced driver assistance systems such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. Such systems can also improve the safety of the road while making the driving experience smoother and offering attractive features to the buyer of a vehicle. The expansion is also significantly boosted by automakers and technology firms investing billions in research and development of these technologies. Formal collaborative processes are behind the development of new semi-autonomous systems, which are beginning to be integrated into mid-range and luxury-grade vehicle lines. Also, with a growing focus on sustainability and fuel efficiency, demand has increased as these technologies increase driving efficiency while cutting fuel consumption.

The other major factors are growing road safety awareness and implementing stringent safety norms. This creates the ideal atmosphere for the launch of semi-autonomous vehicles as governments and regulatory bodies actively promote the adoption of technologies directed toward reducing traffic accidents and deaths. Consumers are showing a preference for cars that have a tech-savvy character along with comfort, efficiency, and the best forward-looking capability behind the wheel. Though the market looks promising, hurdles like expensive production costs and a stable infrastructure to provide support for semi-autonomous capabilities are limitations. However, rapid development and wider acceptance by consumers are likely to soften this challenge to enable deployment in the near term. With escalating affordability and widespread accessibility of these technologies, this market is expected to reach phenomenal growth and penetrate through various vehicle categories.

Market Dynamics

Drivers

-

Significant funding by automakers and tech firms to develop innovative semi-autonomous systems.

The semi-autonomous vehicle market will continue to be significantly supported by massive investments by automakers and technology companies. These funds go toward funding research and development to innovate systems that drive both safety and functionality. Collaborations between automakers and tech firms are helping automakers integrate sophisticated tech components such as advanced automation, sensors, and other solutions into semi-autonomous vehicles to improve the driving experience and reduce accidents through enhanced safety.

Automation and tech giant features sought by consumers drive R&D demand in the hyper-competitive automotive industry as automakers scramble to keep pace with consumer sophistication. At the core of these are the solutions for LiDAR, radar, and high-res cameras to teach these vehicles to interpret what they see and make decisions in real-time. Such technological breakthroughs are critical to bridging the divide between semi-autonomous and fully autonomous systems. Additionally, automakers and tech giants have formed strategic alliances to boost innovation. These partnerships combine resources and expertise needed to tackle technical challenges improving the reliability and scalability of such semi-autonomous systems. Development costs and lead times concerning market delivery are also reduced making the technology much cheaper and more readily accessible. This all translates to the semi-autonomous vehicle market expanding as more funding is poured into R&D from companies, which allows for better, safer, and more advanced forms of transport to be built.

-

Integration of advanced driver assistance systems like adaptive cruise control and lane-keeping assist.

-

Rising demand for features that reduce traffic accidents and enhance driver safety.

Restraints

-

Limited availability of smart roads and V2X communication infrastructure in many regions.

The development of the semi-autonomous vehicle market is hindered largely by the insufficient number of smart roads and Vehicle-to-Everything (V2X) communication infrastructure in several areas. V2X is necessary for real-time data sharing between vehicles, infrastructure, pedestrians, and other connected systems. It improves situational awareness and enables semi-autonomous vehicles to make informed decisions, whether that means identifying traffic signals, avoiding collisions, or reducing travel time by making route suggestions. In reality, however, the deployment of V2X infrastructure such as smart traffic lights, roadside sensors, and communication networks is still at an early stage in most parts of the world.

Semi-autonomous vehicles have limited capability with well-established infrastructure and will perform poorly within the range of unrecognizable environments undermining the ability of its features causing the consumer trust issue. For instance, Vehicles cannot know road conditions, traffic flow, and potential hazards without smart roads equipped with sensors and cameras. This constraint impacts the safety and efficacy of semi-autonomous systems, especially in high-density urban zones or difficult driving conditions. In addition to this, as establishing and maintaining V2X infrastructure is quite expensive, developing economies, which are in dire need of smart railroads, could find themselves struggling with such a technology. The lack of robust cooperation between automakers, technology vendors, and policymakers, only exacerbates the need for this vital infrastructure. These problems can only be tackled by investing considerable funds in smart city projects and encouraging public-private partnerships to speed up V2X deployment. As more of that infrastructure gets built out, semi-autonomous vehicles will be deployed beyond their current limited geographic range, where there will not be the technological infrastructure needed for such vehicles.

-

Incomplete reliability of semi-autonomous systems in complex traffic scenarios or adverse weather conditions.

-

Insufficient understanding of semi-autonomous features among consumers affects demand.

Segmentation Analysis

By Automation Level

In 2023, the level 1 automation segment dominated the market and represented a significant revenue share of 51%. The growing demand for autonomous driving technologies, coupled with increasing consumer awareness, is driving this strong performance. Level 1 automation presents the ideal compromise between control and convenience, with adaptive cruise control and advanced lane assist characteristics, Systems that require driver attention, but offer minimal levels of assistance, appealing to those consumers looking for specific self-driving features in their cars. Companies such as BMW and Mercedes-Benz are now pushing Level 1 automation on the market in a race against General Motors for bragging rights. This also represents great potential for the segment within emerging economies as such regions begin to apply regulations promoting the uptake of Level 1 driver assistance systems.

The Level 3 automation segment is expected to register the fastest CAGR during the forecast period. key automotive manufacturers are significantly investing in the deployment of advanced autonomous systems over the next decade (or two), partly due to the growing consumer interest in developed markets here in the middle of 2023. In contrast to Level 1 and Level 2 systems, Level 3 automation allows the vehicle to handle all driving tasks in certain situations like driving on a highway, without human assistance. They are capable of steering, acceleration, and braking, and they constantly monitor their environment and make decisions in real-time, which includes things like identifying obstructions, adjusting for changes in traffic, and responding in an emergency.

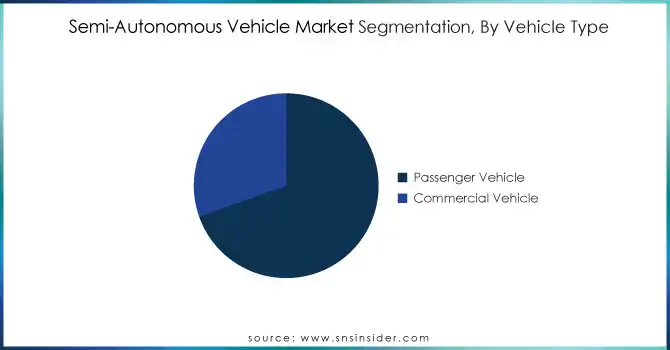

By Vehicle Type

The passenger cars segment dominated the market and accounted for a revenue share of more than 68% in 2023, mainly due to higher sales of passenger vehicles and higher consumer demand for autonomous functions in developed economies. With the help of a semi-autonomous system, sharp turns and traffic maneuvers become more comfortable and also, safer. In addition, the rise in connected solutions, obstacle avoidance systems, and ADAS functions, has pushed manufacturers to adopt them into their cars. The growth of the market is also expected to be accelerated by the strategic collaborations of manufacturers with various technology companies. Example of Waymo Partnership: In October 2024, Waymo announced a multi-year partnership with Hyundai Motor Company to integrate its sixth-generation fully autonomous 'Waymo Driver' technology onboard Hyundai's electrical IONIQ 5 SUV model.

The Commercial vehicle segment is expected to register the fastest CAGR during the forecast period. Autonomous features are increasingly being integrated into commercial vehicles designed for transporting goods over long distances. This switch is intended to facilitate the safe and efficient transportation of goods while lending itself to improved driver comfort and wellness over extended physically challenging journeys. Conversely, platooning technology enables multiple trucks to follow closely behind the lead truck, which guides brake and speed, as a means of lowering aerodynamic drag and maximizing fuel economy while creating a more cohesive traffic flow.

Regional Analysis

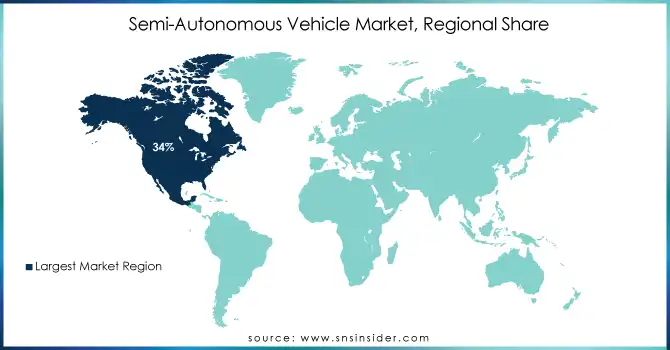

In 2023, the North American semi-autonomous vehicle market accounted for the largest revenue share of 34% in the market. The regional market is anticipated to grow due to such government initiatives supporting autonomous driving in the region along with regulations that support the implementation of safe and efficient context-based interaction in autonomous vehicles. The region has always led in the adoption of level 1–3 automated vehicles, with jurisdictions including Ontario, New York, British Columbia, and California setting regulatory frameworks addressing the testing and operation of such vehicles. For example, in British Columbia, vehicles with Level 1 and Level 2 automation can be used while those with an SAE autonomy rating of Level 3 and greater have been prohibited since April 2024 under a change to the province's Motor Vehicle Act.

The Asia Pacific region is expected to register the fastest CAGR during the years 2024 through 2032. The ongoing modernization of roadways and transport infrastructure in the region has resulted in continuous upgrades in safety and comfort for automobiles, making it likely that more semi-autonomous vehicles will be offered in economies like China, Japan, and India.

This growth has been fueled by strong government support, technological advancements from research institutes and vehicle manufacturers, and a rapidly expanding consumer market, collectively accounting for approximately 60% of the progress in developing and adopting semi-autonomous vehicles in China. The Chinese government has actively promoted these technologies through favorable policies, financial incentives, and a well-regulated environment to foster innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS:

Tesla, Waymo, BMW, Mercedes-Benz, General Motors, Audi, Ford Motor Company, Volvo, Toyota, Nissan, Honda, Uber, Baidu

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 49.3 Billion |

|

Market Size by 2031 |

USD 239.0 Billion |

|

CAGR |

CAGR of 19.18% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Automation Level (Level 1, Level 2, Level 3) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Tesla, Waymo, BMW, Mercedes-Benz, General Motors, Audi, Ford Motor Company, Volvo, Toyota, Nissan, Honda, Uber, Baidu |

|

Key Drivers |

• Integration of advanced driver assistance systems like adaptive cruise control and lane-keeping assist. |

|

RESTRAINTS |

• Incomplete reliability of semi-autonomous systems in complex traffic scenarios or adverse weather conditions. |