Secure Logistics Market Report Scope & Overview:

Get More Information on Secure logistics Market - Request Sample Report

The Secure Logistics Market Size was valued at USD 86 billion in 2023 and is projected to reach USD 173.35 billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

The secure logistics market is poised for healthy growth as globalization and complex supply chains create a demand for safeguarding valuable goods. With increased risks of theft and breaches across borders, businesses require secure transport and storage solutions.

This trend is fueled by trade agreements like the India-Australia ECTA (India-Australia Economic Cooperation and Trade Agreement), which is expected to significantly boost bilateral trade, fostering new employment opportunities and promoting the overall well-being of both Indian and Australian citizens. Leading players like G4S and Gardaworld, holding a combined 13.5% market share, are fortifying their positions through advanced technologies strategic partnerships, workforce development, and expansion into emerging markets. By complying with regulations and offering diverse services, these companies are building resilience in the ever-changing secure logistics landscape.

MARKET DYNAMICS

KEY DRIVERS:

Global trade is becoming increasingly interconnected, with businesses operating across international borders.

The transportation industry is experiencing a significant increase in the movement of high-value goods.

The e-commerce boom and faster delivery demands are fueling the need for secure transport. Companies are investing in secure logistics solutions to safeguard valuable goods from theft, damage, and other threats. Advanced technologies like GPS tracking, RFID tags, and smart lockers are gaining traction, providing real-time monitoring and enhanced security throughout the entire transportation journey.

RESTRAINTS:

A security lapse resulted in the unauthorized access of sensitive data.

The global market faces hurdles due to a disparity in regulatory practices implemented by different countries.

The secure logistics industry faces a challenge such as a patchwork of regulations across different countries. This inconsistent regulatory landscape creates confusion for global logistics providers, who struggle to determine the legal requirements for each market they operate in. This complexity translates to higher operational costs and acts as a barrier to entry for companies seeking to expand into new territories.

OPPORTUNITY:

High-tech solutions like IoT, GPS, real-time tracking, and data analysis are driving the secure logistics market forward.

The secure and transparent nature of blockchain technology is making it a popular choice for applications within the logistics industry.

Logistics companies are increasingly turning to blockchain technology for its unique security features. This tamper-proof system creates an unchangeable record of every transaction and movement within a supply chain. This transparency translates to enhanced security, reduced fraud risk, and improved traceability all critical factors for high-value or sensitive goods.

CHALLENGES:

The adoption of cutting-edge security solutions can present a significant financial hurdle for logistics companies

Cutting-edge surveillance systems, secure storage facilities, and advanced tracking technologies are the guardians of valuable goods, but they can also be a financial burden. This can be a major obstacle for smaller businesses or those in cost-sensitive industries, potentially slowing down the adoption of these essential security measures.

The ever-increasing intricacies of secure logistics operations pose a significant challenge for the industry.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine disrupts secure logistics in the Black Sea, a critical trade route for vital goods. Ports in the region struggles with import surges and labor shortages, hindering efficient operations. The ripple effects of the conflict are felt globally as well. Shipping routes are lengthened due to sanctions imposed on Russia, forcing vessels to take longer journeys. This, in turn, disrupts established trade patterns and adds uncertainty to the already complex task of securing cargo during transport. Furthermore, the war has contributed to a rise in the number of ships operating as a "dark fleet." These vessels operate outside regulations, often lacking proper insurance and maintenance, raising concerns about safety and security standards across the board. While the overall impact on global trade volume hasn't been drastic yet, the war in Ukraine undeniably adds a layer of complexity and uncertainty to secure logistics. The long-term consequences could potentially affect costs, routes, and overall efficiency within the secure logistics market.

IMPACT OF ECONOMIC SLOWDOWN

As demand for goods fluctuates, businesses may cut back on orders, leading to potential stock surpluses and strained supplier relationships. This, coupled with rising material costs, could force secure logistics companies to adjust their pricing strategies. Additionally, reduced revenue due to lower demand might push companies to hold onto existing stock, impacting cash flow and potentially delaying investments in security upgrades.

KEY MARKET SEGMENTS

By Service

Static

Mobile

Static security dominates with nearly 60% market share due to the growing need for robust protection of valuable assets throughout storage and transport. Complex global supply chains and the rise of high-value industries like pharmaceuticals and electronics are driving the demand for these services. Static security solutions offer constant monitoring and robust safeguards, mitigating risks and ensuring peace of mind.

Get More Information on Secure Logistics Market - Enquiry Now

By Mode of Transportation

Roadways

Railways

Airways

Waterways

Roadways segment domiantes in secure logistics market, holding the top spot in market share. Trucks are the kings of the road because of their flexibility and ability to get deliveries done securely. Advanced GPS, real-time tracking systems, and well-established safety protocols further solidify road's dominance as the go-to mode for secure transport. Air cargo takes flight with fastest growth due to speed for valuable goods. Secure logistics providers ensure top-notch screening, facilities, and compliance.

By Application

Cash management

Precious metals

Confidential documents

Sensitive electronics

Others

Cash management holds dominance in the market with over 40.5% market share, when it comes to secure transport. The need to safeguard valuable currency from theft or loss fuels the cash management segment, with armored vehicles, GPS tracking, and real-time monitoring keeping cash safe on the move. As physical currency remains important in many sectors, secure cash management logistics are essential to ensure financial stability and minimize risk.

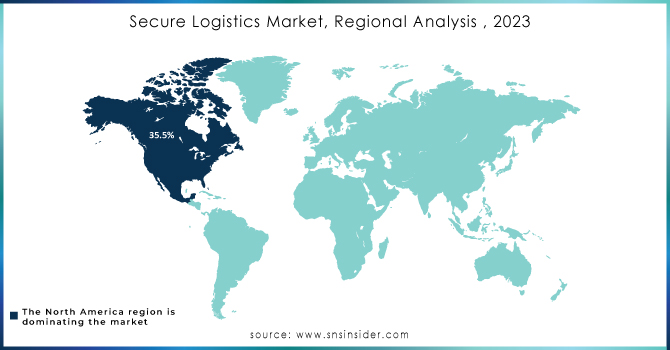

REGIONAL ANALYSIS

North America dominates in secure logistics market, holding a dominant 35.5% market share. This dominance due to a powerful combination of factors. The region boasts a strong economy, extensive cross-border trade, and a thriving high-tech sector, all of which necessitate secure transportation and storage solutions for valuable goods like pharmaceuticals and electronics. Furthermore, strict regulations and rising security concerns compel businesses to invest in secure logistics to ensure compliance and safeguard against threats. Finally, the ongoing adoption of technologies like IoT and real-time tracking keeps the North American secure logistics market at the forefront of innovation, perfectly positioned to meet the ever-changing security demands of the region.

Europe’s’ dominance is fueled by a growing network of ATMs, booming cash circulation, and frequent trade between European countries all create a strong demand for secure transport and storage solutions. Trade policies and lingering Brexit issues could shift the landscape, while the rise of electronic payments in some countries might pose a challenge.

The Asia Pacific secure logistics market is poised for explosive growth. Several factors are fueling this takeoff that are a surge in demand for ATMs, the expansion of financial institutions, and a relentless battle against cargo theft. Governments and industry leaders are taking a proactive stance against theft through initiatives like Australia's RAFT project and the collaborative TAPA forum.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

Some of the major players in the Secure Logistics Market are CMS Info Systems (CMS), CargoGuard, Brink’s Incorporated, Lemuir Group, PlanITROI, Inc., Maltacourt, Prosegur, Allied Universal, Securitas AB, G4S Limited, Loomis AB, GardaWorld, SIS Group Enterprise , SECURE LOGISTICS LLC And Others Players.

RECENT DEVELOPMENTS

Industry leaders, Prosegur Cash and Armaguard, joined forces in June 2023 by merging their Australian cash management operations. This significant move consolidates cash transportation, management, technical services, and ATM networks, solidifying the future of cash as a secure and cost-efficient payment option for both businesses and consumers in Australia.

Securitas bolstered its partnership with Microsoft in July 2023 by signing a new, five-year agreement to safeguard data centers across 31 countries.

GardaWorld Security Systems ups its commitment to cutting-edge security solutions by partnering with Artificial Intelligence Technology Solutions (AITX) in July 2023. This collaboration brings RAD's (AITX's subsidiary) security products to GardaWorld's customers across Canada.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 86 Bn |

| Market Size by 2032 | US$ 173.35 Bn |

| CAGR | CAGR of 8.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service(Static, Mobile) • By Mode Of Transportation(Roadways, Railways, Airways, Waterways) • By Application(Cash Management, Precious Metals, Confidential Documents, Sensitive Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CMS Info Systems (CMS), CargoGuard, Brink’s Incorporated, Lemuir Group, PlanITROI, Inc., Maltacourt, Prosegur, Allied Universal, Securitas AB, G4S Limited, Loomis AB, GardaWorld, SIS Group Enterprise , SECURE LOGISTICS LLC |

| Key Drivers | • Global trade is becoming increasingly interconnected, with businesses operating across international borders. • The transportation industry is experiencing a significant increase in the movement of high-value goods. |

| Key Restraints | • A security lapse resulted in the unauthorized access of sensitive data. • The global market faces hurdles due to a disparity in regulatory practices implemented by different countries. |

Ans: The Secure Logistics Market is expected to grow at a CAGR of 8.1%.

Ans: Secure Logistics Market size was USD 86 billion in 2023 and is expected to Reach USD 160.36 billion by 2031.

Ans: Global trade is becoming increasingly interconnected, with businesses operating across international borders.

Ans: The global market faces hurdles due to a disparity in regulatory practices implemented by different countries.

Ans: North America holds the dominant position with market share of 35.5

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Secure Logistics Market Segmentation, By Service

9.1 Introduction

9.2 Trend Analysis

9.3 Static

9.4 Mobile

10. Secure Logistics Market Segmentation, By Mode of Transportation

10.1 Introduction

10.2 Trend Analysis

10.3 Roadways

10.4 Railways

10.5 Airways

10.6 Waterways

11. Secure Logistics Market Segmentation, By Application

11.1 Introduction

11.2 Trend Analysis

11.3 Cash management

11.4 Precious metals

11.5 Confidential documents

11.6 Sensitive electronics

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Secure Logistics Market by Country

12.2.3 North America Secure Logistics Market By Service

12.2.4 North America Secure Logistics Market By Mode of Transportation

12.2.5 North America Secure Logistics Market By Application

12.2.6 USA

12.2.6.1 USA Secure Logistics Market By Service

12.2.6.2 USA Secure Logistics Market By Mode of Transportation

12.2.6.3 USA Secure Logistics Market By Application

12.2.7 Canada

12.2.7.1 Canada Secure Logistics Market By Service

12.2.7.2 Canada Secure Logistics Market By Mode of Transportation

12.2.7.3 Canada Secure Logistics Market By Application

12.2.8 Mexico

12.2.8.1 Mexico Secure Logistics Market By Service

12.2.8.2 Mexico Secure Logistics Market By Mode of Transportation

12.2.8.3 Mexico Secure Logistics Market By Application

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Secure Logistics Market by Country

12.3.2.2 Eastern Europe Secure Logistics Market By Service

12.3.2.3 Eastern Europe Secure Logistics Market By Mode of Transportation

12.3.2.4 Eastern Europe Secure Logistics Market By Application

12.3.2.5 Poland

12.3.2.5.1 Poland Secure Logistics Market By Service

12.3.2.5.2 Poland Secure Logistics Market By Mode of Transportation

12.3.2.5.3 Poland Secure Logistics Market By Application

12.3.2.6 Romania

12.3.2.6.1 Romania Secure Logistics Market By Service

12.3.2.6.2 Romania Secure Logistics Market By Mode of Transportation

12.3.2.6.4 Romania Secure Logistics Market By Application

12.3.2.7 Hungary

12.3.2.7.1 Hungary Secure Logistics Market By Service

12.3.2.7.2 Hungary Secure Logistics Market By Mode of Transportation

12.3.2.7.3 Hungary Secure Logistics Market By Application

12.3.2.8 Turkey

12.3.2.8.1 Turkey Secure Logistics Market By Service

12.3.2.8.2 Turkey Secure Logistics Market By Mode of Transportation

12.3.2.8.3 Turkey Secure Logistics Market By Application

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Secure Logistics Market By Service

12.3.2.9.2 Rest of Eastern Europe Secure Logistics Market By Mode of Transportation

12.3.2.9.3 Rest of Eastern Europe Secure Logistics Market By Application

12.3.3 Western Europe

12.3.3.1 Western Europe Secure Logistics Market by Country

12.3.3.2 Western Europe Secure Logistics Market By Service

12.3.3.3 Western Europe Secure Logistics Market By Mode of Transportation

12.3.3.4 Western Europe Secure Logistics Market By Application

12.3.3.5 Germany

12.3.3.5.1 Germany Secure Logistics Market By Service

12.3.3.5.2 Germany Secure Logistics Market By Mode of Transportation

12.3.3.5.3 Germany Secure Logistics Market By Application

12.3.3.6 France

12.3.3.6.1 France Secure Logistics Market By Service

12.3.3.6.2 France Secure Logistics Market By Mode of Transportation

12.3.3.6.3 France Secure Logistics Market By Application

12.3.3.7 UK

12.3.3.7.1 UK Secure Logistics Market By Service

12.3.3.7.2 UK Secure Logistics Market By Mode of Transportation

12.3.3.7.3 UK Secure Logistics Market By Application

12.3.3.8 Italy

12.3.3.8.1 Italy Secure Logistics Market By Service

12.3.3.8.2 Italy Secure Logistics Market By Mode of Transportation

12.3.3.8.3 Italy Secure Logistics Market By Application

12.3.3.9 Spain

12.3.3.9.1 Spain Secure Logistics Market By Service

12.3.3.9.2 Spain Secure Logistics Market By Mode of Transportation

12.3.3.9.3 Spain Secure Logistics Market By Application

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Secure Logistics Market By Service

12.3.3.10.2 Netherlands Secure Logistics Market By Mode of Transportation

12.3.3.10.3 Netherlands Secure Logistics Market By Application

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Secure Logistics Market By Service

12.3.3.11.2 Switzerland Secure Logistics Market By Mode of Transportation

12.3.3.11.3 Switzerland Secure Logistics Market By Application

12.3.3.1.12 Austria

12.3.3.12.1 Austria Secure Logistics Market By Service

12.3.3.12.2 Austria Secure Logistics Market By Mode of Transportation

12.3.3.12.3 Austria Secure Logistics Market By Application

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Secure Logistics Market By Service

12.3.3.13.2 Rest of Western Europe Secure Logistics Market By Mode of Transportation

12.3.3.13.3 Rest of Western Europe Secure Logistics Market By Application

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Secure Logistics Market by Country

12.4.3 Asia-Pacific Secure Logistics Market By Service

12.4.4 Asia-Pacific Secure Logistics Market By Mode of Transportation

12.4.5 Asia-Pacific Secure Logistics Market By Application

12.4.6 China

12.4.6.1 China Secure Logistics Market By Service

12.4.6.2 China Secure Logistics Market By Mode of Transportation

12.4.6.3 China Secure Logistics Market By Application

12.4.7 India

12.4.7.1 India Secure Logistics Market By Service

12.4.7.2 India Secure Logistics Market By Mode of Transportation

12.4.7.3 India Secure Logistics Market By Application

12.4.8 Japan

12.4.8.1 Japan Secure Logistics Market By Service

12.4.8.2 Japan Secure Logistics Market By Mode of Transportation

12.4.8.3 Japan Secure Logistics Market By Application

12.4.9 South Korea

12.4.9.1 South Korea Secure Logistics Market By Service

12.4.9.2 South Korea Secure Logistics Market By Mode of Transportation

12.4.9.3 South Korea Secure Logistics Market By Application

12.4.10 Vietnam

12.4.10.1 Vietnam Secure Logistics Market By Service

12.4.10.2 Vietnam Secure Logistics Market By Mode of Transportation

12.4.10.3 Vietnam Secure Logistics Market By Application

12.4.11 Singapore

12.4.11.1 Singapore Secure Logistics Market By Service

12.4.11.2 Singapore Secure Logistics Market By Mode of Transportation

12.4.11.3 Singapore Secure Logistics Market By Application

12.4.12 Australia

12.4.12.1 Australia Secure Logistics Market By Service

12.4.12.2 Australia Secure Logistics Market By Mode of Transportation

12.4.12.3 Australia Secure Logistics Market By Application

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Secure Logistics Market By Service

12.4.13.2 Rest of Asia-Pacific Secure Logistics Market By Mode of Transportation

12.4.13.3 Rest of Asia-Pacific Secure Logistics Market By Application

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Secure Logistics Market by Country

12.5.2.2 Middle East Secure Logistics Market By Service

12.5.2.3 Middle East Secure Logistics Market By Mode of Transportation

12.5.2.4 Middle East Secure Logistics Market By Application

12.5.2.5 UAE

12.5.2.5.1 UAE Secure Logistics Market By Service

12.5.2.5.2 UAE Secure Logistics Market By Mode of Transportation

12.5.2.5.3 UAE Secure Logistics Market By Application

12.5.2.6 Egypt

12.5.2.6.1 Egypt Secure Logistics Market By Service

12.5.2.6.2 Egypt Secure Logistics Market By Mode of Transportation

12.5.2.6.3 Egypt Secure Logistics Market By Application

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Secure Logistics Market By Service

12.5.2.7.2 Saudi Arabia Secure Logistics Market By Mode of Transportation

12.5.2.7.3 Saudi Arabia Secure Logistics Market By Application

12.5.2.8 Qatar

12.5.2.8.1 Qatar Secure Logistics Market By Service

12.5.2.8.2 Qatar Secure Logistics Market By Mode of Transportation

12.5.2.8.3 Qatar Secure Logistics Market By Application

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Secure Logistics Market By Service

12.5.2.9.2 Rest of Middle East Secure Logistics Market By Mode of Transportation

12.5.2.9.3 Rest of Middle East Secure Logistics Market By Application

12.5.3 Africa

12.5.3.1 Africa Secure Logistics Market by Country

12.5.3.2 Africa Secure Logistics Market By Service

12.5.3.3 Africa Secure Logistics Market By Mode of Transportation

12.5.3.4 Africa Secure Logistics Market By Application

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Secure Logistics Market By Service

12.5.3.5.2 Nigeria Secure Logistics Market By Mode of Transportation

12.5.3.5.3 Nigeria Secure Logistics Market By Application

12.5.3.6 South Africa

12.5.3.6.1 South Africa Secure Logistics Market By Service

12.5.3.6.2 South Africa Secure Logistics Market By Mode of Transportation

12.5.3.6.3 South Africa Secure Logistics Market By Application

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Secure Logistics Market By Service

12.5.3.7.2 Rest of Africa Secure Logistics Market By Mode of Transportation

12.5.3.7.3 Rest of Africa Secure Logistics Market By Application

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Secure Logistics Market by country

12.6.3 Latin America Secure Logistics Market By Service

12.6.4 Latin America Secure Logistics Market By Mode of Transportation

12.6.5 Latin America Secure Logistics Market By Application

12.6.6 Brazil

12.6.6.1 Brazil Secure Logistics Market By Service

12.6.6.2 Brazil Secure Logistics Market By Mode of Transportation

12.6.6.3 Brazil Secure Logistics Market By Application

12.6.7 Argentina

12.6.7.1 Argentina Secure Logistics Market By Service

12.6.7.2 Argentina Secure Logistics Market By Mode of Transportation

12.6.7.3 Argentina Secure Logistics Market By Application

12.6.8 Colombia

12.6.8.1 Colombia Secure Logistics Market By Service

12.6.8.2 Colombia Secure Logistics Market By Mode of Transportation

12.6.8.3 Colombia Secure Logistics Market By Application

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Secure Logistics Market By Service

12.6.9.2 Rest of Latin America Secure Logistics Market By Mode of Transportation

12.6.9.3 Rest of Latin America Secure Logistics Market By Application

13. Company Profiles

13.1 CMS Info Systems (CMS)

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 CargoGuard, Brink’s Incorporated

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Lemuir Group

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 PlanITROI, Inc.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Maltacourt

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Prosegur

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Allied Universal

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Securitas AB

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 G4S Limited

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Loomis AB

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 GardaWorld

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 SIS Group Enterprise

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 SECURE LOGISTICS LLC

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Premade Pouch Packaging Market Size was USD 10.8 billion in 2023 & is projected to reach USD 16.47 billion by 2032 growing at a CAGR of 4.8% by 2024 to 2032

The E-Commerce Packaging Market size was USD 70 billion in 2023 and is expected to Reach USD 162.37 billion by 2032 and grow at a CAGR of 9.8 % over the forecast period of 2024-2032.

The Aluminum Foil Packaging Market size was USD 32.61 billion in 2023 and is expected to Reach USD 46.36 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The Active & Intelligent Packaging Market size was USD 25.59 billion in 2023 and is expected to reach USD 50.61 billion by 2031 and grow at a compound annual growth rate (CAGR) of 8.9 % over the forecast period from 2024 to 2031.

The Frozen Seafood Packaging Market Size was valued at USD 16.23 billion in 2023 and is projected to reach USD 26.06 billion by 2031 and grow at a CAGR of 6.1% over the forecast periods 2024 -2031.

Sugarcane Fiber Packaging Market Size, Share, and Industry Analysis by Type (Tableware, Food Packaging), By Application (Fresh Food, Dry and Frozen Food), By Region and Global Forecast, (2024-2032).

Hi! Click one of our member below to chat on Phone