Get More Information on Search and Rescue Robots Market - Request Free Sample Report

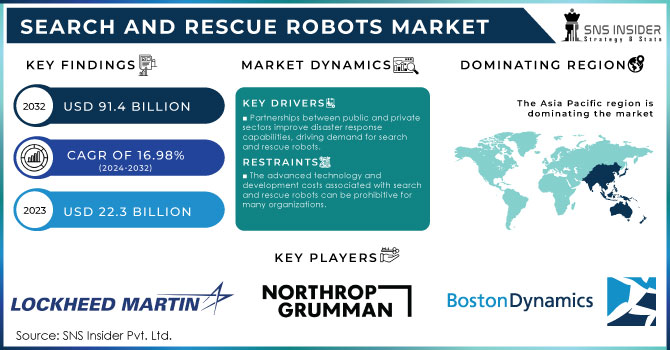

The Search and Rescue Robots Market Size was valued at USD 22.3 billion in 2023 and is expected to reach USD 91.4 Billion by 2032, growing at a CAGR of 16.98% from 2024-2032.

One of the booming markets in recent years is the Search and Rescue Robots Market, which is a response to the growing need for effective disaster response. These robots can work in environments where a human rescue operation would be too dangerous or impossible, such as natural disasters, hazardous material spills, and complex urban environments. With modern technologies, such as artificial intelligence, machine learning, sensor systems, and more, search and rescue robots can detect human presence and find a way through debris while providing real-time situational awareness to rescue teams. A notable example of this market is the use of drones for disaster relief. In February 2023, an earthquake struck Turkey, and various organizations rushed to help the recovery efforts of the affected regions. Drones equipped with thermal imaging cameras were used to find people trapped in debris, providing the rescue teams with real-time data to assist in their prioritization of areas. The reports state that the earthquake left over 500,000 people homeless. Undoubtedly, these robots are an important and effective solution, which is evident from their use in such emergencies.

The Search and Rescue Robots Market is on the rise due to a various reasons. First, the growing threat of natural disasters, such as earthquakes, floods, wildfires, and others necessitates that fast and effective responses are implied. Therefore, the use of robots becomes an indispensable element of disaster mitigation for various reasons, one of which is the more efficient use of time and other resources. Second, the processes of industrialization and the enhancement of technology have provided search and rescue robots with several new characteristics. In particular, through the use of artificial intelligence, machine learning, and sensor systems, modern search and rescue robots have gained the capacity to function relatively independently and recognize and follow humans in challenging environments. The fact that the use of human workers as search and rescue teams post a significant risk for the people involved largely supports the use of robots by the targeted audience.

In addition to the factors segregated above, the promotion of the use of robots by the governments and organizations allocating funds to robotics in the realm of disaster response programs has become the new normal. Another crucial factor that also boosts the market growth is the increasing use of drones for data collection and reconnaissance during search and rescue missions. The use of drones becomes increasingly popular in the context of emergency response programs, making the demand for search and rescue robots grow at a relatively fast pace. Overall, these factors shape the development of the Search and Rescue Robots Market and reshape the existing landscape.

Drivers

Partnerships between public and private sectors improve disaster response capabilities, driving demand for search and rescue robots.

Growing recognition of risks faced by human rescuers in hazardous environments boosts acceptance of robotic solutions.

Rising frequency and severity of disasters like earthquakes and floods necessitate efficient response solutions.

The rising frequency and severity of natural disasters, such as earthquakes and floods, significantly increase the demand for effective response solutions in the Search and Rescue Robots Market. As climate change exacerbates weather patterns, the probability of catastrophic events rises, prompting emergency services to implement innovative technologies to improve their response capabilities. Search and rescue robots play a vital role in tackling the challenges posed by these disasters. Unlike human rescuers, these robots can operate in dangerous environments where safety is a concern, such as unstable buildings or flooded areas. Equipped with advanced technologies like artificial intelligence, machine learning, and sensor systems, they can autonomously navigate complex terrains, locate survivors, and deliver real-time data to rescue teams.

A rapid response during disasters is crucial, as every second is critical for saving lives. Traditional rescue methods can be slow and labor-intensive, often hindered by difficult conditions. In contrast, robotic solutions can swiftly assess disaster zones, providing essential information that aids in prioritizing rescue efforts and allocating resources more effectively.

|

Advantages of Search and Rescue Robots |

Description |

|---|---|

|

Enhanced Safety |

Operate in hazardous environments without risking human lives. |

|

Rapid Deployment |

Quickly assess disaster zones, allowing for immediate response. |

|

Autonomous Navigation |

Use AI and sensors to navigate complex terrains and obstacles. |

|

Real-Time Data Collection |

Provide crucial information to rescue teams for better decision-making. |

|

Operational Efficiency |

Streamline rescue operations by prioritizing areas and resources. |

Restraints

The advanced technology and development costs associated with search and rescue robots can be prohibitive for many organizations.

Challenges in navigating complex terrains and extreme environmental conditions may hinder robot effectiveness.

Robots often require human operators for decision-making, which can slow response times during emergencies.

A significant challenge in the Search and Rescue Robots Market is the reliance on human operators for decision-making, which often undermines the overall efficiency of emergency responses. Despite the use of advanced technologies, such as artificial intelligence and machine learning, these robots often need to defer to human input when interpreting complex situations requiring a decision. In the case of an emergency, quick decision–making may be of the essence, as every second counts for saving a person’s life. If the robots in use face an obstacle they have not been programmed to deal with or need to evaluate unfamiliar information, they will often come to a halt, waiting for a human operator to come up with a solution. As a result, the use of search and rescue robots may often become more time–consuming, as timely actions have to be taken in a chaotic disaster to find and save survivors.

At the same time, the need for operators may limit the extent of the robots’ use in the event of a disaster. If there is only a small number of trained personnel available, they may not be sufficient to operate all of the robots sent out simultaneously, further impacting efficiency. Thus, robots operating in a search and rescue context improve the capabilities of dealing with hazardous environments. Still, the necessity of human oversight may create bottlenecks to achieving optimal efficiency for such robots during a disaster, as no advanced technology or algorithms appointed to guide the robots substitute for trained human personnel.

One of the most significant challenges in the Search and Rescue Robots Market is the incapacity of robots to navigate complex terrains and extreme environmental conditions. robotic solutions may be less effective for emergency cases. Various natural disasters tend to result in chaotic landscapes filled with debris, unstable structures, and other zones that people may avoid or not pass. As a result, it may be hard for the robotic operator to navigate such terrain. The absolute incapable of a robot to approach some target and offer the necessary assistance may become a disaster. Natural disasters are also accompanied by extreme environmental conditions. For instance, in case of wildfire, the temperatures are extremely high in the forests and their surroundings. In turn, in case of floods, the areas are extremely muddy. Many robots are not mobile or adapted for the given range of terrains. Their range of operation may dramatically decrease, and they are unable to locate and assist the target or survivors of an emergency. At the same time, extreme heat, cold, rainfall may harm the sensors of a robot, lower the period during which it can function, or lead to other significant complications. Naturally, these challenges may be less urgent due to the significant advancements in the technologies. However, the majority of the robotic systems still operate in a limited range of terrains and according to specific climatic conditions. As a result, although they are more efficient than people in searching and rescuing operations, robotic systems will go extinct in the market if the major issues of terrain navigation and adaptability to various environments are not resolved.

By Platform

Land-based segment dominated the market and held the largest revenue share in 2023. Search and rescue robots are developed for use on the ground and are able to effectively travel on different types of terrain, including uneven planes, stairs, or rubble. In particular, they are great for survivors located in hazardous ground areas. The first type is wheeled robots, which can pass on smooth or at least somewhat rough terrain due to the construction of wheels. They have different types of wheels and sensors: apart from them, they may come with manipulators arms. Also, they can have a gas of radiation sensor. The second type is tracked robots, which are uniquely built to travel on rough terrane. Their tracks can be of different types. Additionally, they may come with a built-in camera or a LiDAR. The overall, the market is increasing now and will continue to do to the benefit of the industry.

The aerial segment is anticipated to grow at highest CAGR during the forecast period. Driven by an increased frequency of natural disasters requires that stakeholders introduce solutions that would allow them to respond quickly and effectively, and drones serve extended roles of finding survivors and assessing the extent of damage. The second reason to believe that these technologies are used more widely lies in advances in these devices towing to the improved technology that allows them to last longer due to the incorporation of better batteries and apply sophisticated sensors, whereas transmission is instant. The final point can be attributed to the increasing demand for aerial robots in areas including the military and law enforcement segments, which further promotes their application and, therefore, the increased interest in the technology.

By Operation

Autonomous segment dominated the market and represented largest revenue share in 2023. The demand for robots that can operate autonomously in dangerous environments is stimulated by the growing number of efficient disaster response solutions. The advancements made in artificial intelligence, machine learning, and sensor integration have significantly improved the ability of autonomous robots to navigate complex terrains, find survivors, and make timely decisions independently from human supervision. Moreover, the introduction of automation in the emergency services sector is facilitating the widespread use of such robots that can ensure a quick and safe response during crises.

The remotely operated segment of the search and rescue robots market is experiencing notable growth, driven by several key factors. The increasing need for efficient disaster response solutions, especially in hazardous environments, propels the demand for remotely operated robots that can be controlled from a safe distance. These robots are essential in situations where human rescuers cannot safely operate, such as unstable structures or toxic environments. Advancements in communication technologies, including improved connectivity and real-time data transmission, enhance the effectiveness of remotely operated robots in search and rescue missions. Additionally, growing investments in emergency response infrastructure and training for operators further support market expansion.

Need any customization research on Search and Rescue Robots Market - Enquiry Now

The major key players are

Lockheed Martin Corporation - Sikorsky

Northrop Grumman Corporation - Global Hawk

Boston Dynamics - Spot

iRobot Corporation - Roomba

Thales Group - Scorpion

Kongsberg Maritime - HUGIN

Robotic Research, LLC - MULE

Textron Inc. - RQ-7 Shadow

AeroVironment, Inc. - Raven

DJI Technology Co., Ltd. - Matrice

FLIR Systems, Inc. - SkyRanger

Yamaha Motor Co., Ltd. - RMAX

Clearpath Robotics - Husky

Samsung Techwin - SNV-6011

Harrison Global - EMILY

Oceaneering International, Inc. - OceanSmart

Ascend Robotics - Guardian

QinetiQ Group plc - Talon

RoboCup Rescue - Rescue Robot

Cyberhawk Innovations Ltd. - Falcon UAV

Boeing

Harris Corporation

Texas Instruments

Raytheon

DNV GL

Siemens

Bell Helicopter

BAE Systems

Intel

Teledyne

Mitsubishi

NVIDIA

Qualcomm

Northrop Grumman

Schlumberger

ABB

Rolls-Royce

Denso

Emerson

In November 2023, Austal Australia partnered with Greenroom Robotics to integrate GAMA, an Uncrewed Surface Vessel (USV) control software, into the decommissioned Armidale-class Patrol Boat, Sentinel, enabling autonomous navigation and mission planning for the Australian Navy.

In May 2023, Squishy Robotics Inc. developed a customizable, impact-resistant spherical robot, funded by USD 500,000 from NASA, designed to detect gas leaks and other hazards for public safety and military applications. These innovative robotic solutions enhance disaster response capabilities and operational efficiency in challenging environments.

| Report Attributes | Details |

|---|---|

| CAGR | CAGR of 16.98% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Ground, Marine, Aerial) • By Operation (Remotely operated, Fully-autonomous, semi-autonomous) • By Application (Fire-fighting robots, Medical robots, Military robots, Path opening robots, Snake robots) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Howe & Howe Technologies, Inc., Kongsberg Maritime, Lockheed Martin Corporation, Pliant Energy Systems LLC, Saab AB, Thales Group., Boston Dynamics, FLIR Systems, Inc., Hydronalix, Northrop Grumman Corporation, and other players. |

| DRIVERS | • Increasing Defense Spending • Technology advancements, increased use of robots in places afflicted by chemical, biological, radio logical, and nuclear (CBRN) rescue missions, and being conveniently reachable in confined and hazardous situations are boosting market expansion. |

| RESTRAINTS | • Hardware and software failures are projected to hinder market expansion. • The majority of operational robots are powered by batteries. |

Ans- Search and Rescue Robots Market was valued at USD 22.3 billion in 2023 and is expected to reach USD 91.4 Billion by 2032, growing at a CAGR of 16.98% from 2024-2032.

Ans- the CAGR of Search and Rescue Robots Market during the forecast period is of 16.98% from 2024-2032.

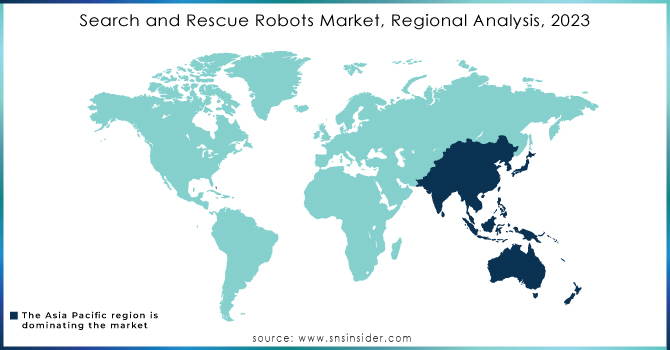

Ans- In 2023, North America led the Search and Rescue Robots Market, capturing a significant revenue share.

Ans- one main growth factor for the Search and Rescue Robots Market is

Ans- challenges in Search and Rescue Robots Market are

The advanced technology and development costs associated with search and rescue robots can be prohibitive for many organizations.

Challenges in navigating complex terrains and extreme environmental conditions may hinder robot effectiveness.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Search and Rescue Robots Market Segmentation, By Platform

7.1 Chapter Overview

7.2 Ground

7.2.1 Ground Market Trends Analysis (2020-2032)

7.2.2 Ground Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Marine

7.3.1 Marine Market Trends Analysis (2020-2032)

7.3.2 Marine Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Aerial

7.4.1 Aerial Market Trends Analysis (2020-2032)

7.4.2 Aerial Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Search and Rescue Robots Market Segmentation, by Operation

8.1 Chapter Overview

8.2 Remotely operated

8.2.1 Remotely operated Market Trends Analysis (2020-2032)

8.2.2 Remotely operated Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Fully-autonomous

8.3.1 Fully-autonomous Market Trends Analysis (2020-2032)

8.3.2 Fully-autonomous Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Semi-autonomous

8.4.1 Semi-autonomous Market Trends Analysis (2020-2032)

8.4.2 Semi-autonomous Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Search and Rescue Robots Market Segmentation, by Application

9.1 Chapter Overview

9.2 Fire-fighting robots

9.2.1 Fire-fighting robots Market Trends Analysis (2020-2032)

9.2.2 Fire-fighting robots Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Medical robots

9.3.1 Medical robots Market Trends Analysis (2020-2032)

9.3.2 Medical robots Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Military robots

9.4.1 Military robots Market Trends Analysis (2020-2032)

9.4.2 Military robots Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Path opening robots

9.5.1 Path opening robots Market Trends Analysis (2020-2032)

9.5.2 Path opening robots Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Snake robots

9.6.1 Snake robots Market Trends Analysis (2020-2032)

9.6.2 Snake robots Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Swarm robots

9.7.1 Swarm robots Market Trends Analysis (2020-2032)

9.7.2 Swarm robots Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.2.4 North America Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.5 North America Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.2.6.2 USA Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.6.3 USA Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.2.7.2 Canada Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.7.3 Canada Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.2.8.2 Mexico Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.8.3 Mexico Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.6.2 Poland Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.6.3 Poland Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.7.2 Romania Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.7.3 Romania Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.4 Western Europe Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.5 Western Europe Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.6.2 Germany Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.6.3 Germany Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.7.2 France Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.7.3 France Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.8.2 UK Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.8.3 UK Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.9.2 Italy Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.9.3 Italy Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.10.2 Spain Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.10.3 Spain Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.13.2 Austria Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.13.3 Austria Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.4 Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.5 Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.6.2 China Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.6.3 China Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.7.2 India Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.7.3 India Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.8.2 Japan Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.8.3 Japan Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.9.2 South Korea Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.9.3 South Korea Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.10.2 Vietnam Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.10.3 Vietnam Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.11.2 Singapore Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.11.3 Singapore Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.12.2 Australia Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.12.3 Australia Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.4 Middle East Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.5 Middle East Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.6.2 UAE Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.6.3 UAE Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.2.4 Africa Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.5 Africa Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Search and Rescue Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.6.4 Latin America Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.5 Latin America Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.6.6.2 Brazil Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.6.3 Brazil Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.6.7.2 Argentina Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.7.3 Argentina Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.6.8.2 Colombia Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.8.3 Colombia Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Search and Rescue Robots Market Estimates and Forecasts, Platform (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Search and Rescue Robots Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Search and Rescue Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Lockheed Martin Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Northrop Grumman Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Boston Dynamics

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 iRobot Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Thales Group

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Kongsberg Maritime

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Robotic Research, LLC

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Textron Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 AeroVironment, Inc

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 DJI Technology Co., Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Platform

Ground

Marine

Aerial

By Operation

Remotely operated

Fully-autonomous

semi-autonomous

By Application

Fire-fighting robots

Medical robots

Military robots

Path opening robots

Snake robots

Swarm robots

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automatic Identification System Market Size was valued at USD 276 million in 2023, expected to reach USD 518.47 million by 2032 with a growing CAGR of 7.3% over the forecast period 2024-2032.

The Aircraft Transparencies Market size was valued at USD 1.4 Billion in 2023 & is estimated to reach USD 2.3 Billion by 2030 with a growing CAGR of 5.77% Over the Forecast period of 2024-2032.

The Military Wearable Market Size was valued at USD 5.32 billion in 2022 and is expected to reach USD 9.41 billion by 2030 with a growing CAGR of 7.4% over the forecast period 2023-2030.

The Shipbuilding Market Size was valued at USD 156.65 billion in 2023 and is expected to reach USD 204.35 billion by 2031 with a growing CAGR of 3.38% over the forecast period 2024-2031.

Automatic Weapons Market size was valued at USD 8.71 Bn in 2023 and is expected to reach USD 15 Bn by 2031 and grow at a CAGR of 6.85 % over the forecast period 2024-2032.

The Aircraft Sensors Market Size was valued at USD 4.5 billion in 2023 and is expected to reach USD 6.98 billion by 2032 with a growing CAGR of 5% over the forecast. period 2024-2032.

Hi! Click one of our member below to chat on Phone