Get More Information on Scrap Metal Recycling Market - Request Sample Report

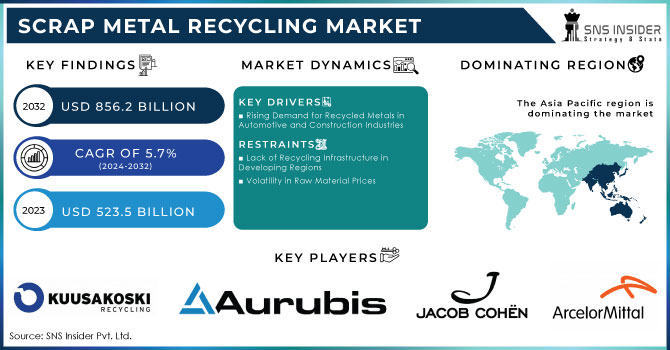

The Scrap Metal Recycling Market Size was valued at USD 523.5 Billion in 2023 and is expected to reach USD 856.2 Billion by 2032, growing at a CAGR of 5.7% over the forecast period 2024-2032.

Urbanization and industrialization have been driving the scrap metal recycling market as they generate a significant amount of scrap metal. Innovations in the field of scrap metal processing such as the use of automation and robotics have made the process of recycling more efficient and of higher quality, reducing manual labor and errors. Recent trends have included the use of blockchain technology to track scrap metal better, ensure its authenticity, and make transactions more transparent while also reducing chain fraud. In addition, the increasing adoption of electric vehicles is leading to a rapid and continuous supply of scrap batteries and components containing lithium, cobalt, and nickel, among others, which can be recycled for these valuable metals, further driving the scrap metal recycling market’s growth.

Government regulation is also important in estimating the market further; the EU, for example, plans to recycle 75% of aluminum packaging by 2025, and India’s National Steel Policy calls for 30-40% of steel production to be produced through the electric arc furnace route, which is heavily dependent on scrap steel as a raw material. Furthermore, recycling 1 ton of steel saves 1.5 tons of iron ore, 0.5 tons of coal, and 40% of the water used which shows the substantial impact of scrap metal recycling on the environment and the growth of this market.

The global recycling rate for aluminum has reached approximately 76%, making it one of the most recycled materials worldwide. This high recycling rate is largely attributed to the growing demand for aluminum in lightweight automotive designs and packaging, which encourages manufacturers to incorporate recycled content. Additionally, about 95% of the energy required to produce aluminum from recycled materials is saved compared to producing it from bauxite ore. In terms of economic impact, the scrap metal recycling industry contributes roughly $90 billion to the global economy annually, highlighting its significance not only in waste management but also in fostering a sustainable manufacturing landscape.

|

Metal Type |

Subtypes |

Key Characteristics |

Industry Applications |

Stats |

Environmental Regulations |

|---|---|---|---|---|---|

|

Ferrous |

Carbon Steel, Stainless Steel, Cast Iron |

Contains iron, magnetic, prone to rust, high tensile strength |

Automotive (body parts, engines), Construction (reinforced steel), Manufacturing (machinery, tools) |

Ferrous metals account for over 90% of total recycled metals globally. Recycling steel reduces energy consumption by 60-74% compared to new production. |

The EU's Waste Framework Directive mandates recycling targets for metals, aiming for 70% recycling of construction and demolition waste by 2025. |

|

Non-Ferrous |

Aluminum, Copper, Zinc, Lead, Nickel |

No iron content, non-magnetic, corrosion-resistant, lightweight |

Electrical (wiring, cables), Aerospace (lightweight structures), Packaging (aluminum cans), Construction (roofing, piping) |

Copper recycling saves up to 85% of the energy compared to new production. Aluminum has a recycling rate of around 75%. |

The Resource Conservation and Recovery Act (RCRA) in the U.S. encourages recycling and proper disposal of non-ferrous metal waste to minimize environmental impact. |

Scrap Metal Recycling Market Dynamics

Drivers:

Rising Demand for Recycled Metals in Automotive and Construction Industries

The automotive and construction industries are under increasing pressure to adopt sustainable practices and reduce their carbon footprints. Recycled metals provide an eco-friendly alternative to virgin metals, as they require less energy for processing and produce fewer greenhouse gas emissions. This makes them highly attractive for industries aiming to meet sustainability targets and adhere to environmental regulations. In the automotive sector, it is estimated that approximately 25% of the steel used in car production comes from recycled materials. Moreover, recycling aluminum can save up to 92% of energy compared to new aluminum production, making it a critical material in the shift towards lighter and more fuel-efficient vehicles. The construction industry also heavily relies on recycled metals, with over 40% of global steel production now derived from recycled scrap, contributing to sustainable infrastructure development.

Restraints:

Lack of Recycling Infrastructure in Developing Regions

Volatility in Raw Material Prices

The scrap metal recycling industry is highly sensitive to fluctuations in raw material prices. When the prices of primary metals drop due to factors such as decreased demand or oversupply, it becomes less economically viable for manufacturers to use recycled metals. This leads to lower demand for scrap, affecting profitability for recyclers. Additionally, volatile prices can disrupt the supply chain, as collectors and recyclers may hoard scrap metal during periods of low prices, waiting for the market to improve, which further exacerbates supply instability. For instance, in 2020, steel prices dropped by nearly 20% during the pandemic, leading to a sharp decline in scrap metal demand. This price volatility directly impacts recycling margins and deters investment in recycling infrastructure.

By Metal Type

The ferrous segment led the scrap metal recycling market with the highest revenue share of more than 85.22% in 2023. This dominance is attributed to the high recycling rate of steel, which exceeds 85% globally. The recycling of ferrous metals, particularly steel, is significantly more cost-effective than producing new steel from iron ore. For instance, according to the U.S. Environmental Protection Agency, “recycling steel can reduce energy consumption by approximately 60-74% compared to producing new steel, depending on the production method used”. This energy savings translates into lower production costs and improved profitability for recyclers. In 2022, a total of around 1.9 billion metric tons of crude steel were produced worldwide, with a substantial portion derived from recycled sources. The widespread use of recycled steel in various industries, especially construction, where about 40% of the steel utilized is recycled, highlights the ongoing demand and economic viability of the ferrous segment in the scrap metal recycling market. Recycling steel also provides significant environmental benefits, reducing carbon emissions by about 58% compared to new steel production from primary materials. This alignment with sustainability goals, coupled with economic advantages, ensures that the ferrous segment remains a dominant player in the scrap metal recycling landscape.

By End-use Industry

The construction Industry held the highest revenue share of more than 41.88% in 2023 and is expected to grow significantly during the forecast period. This growth is fueled by global infrastructure investments, expected to reach around $94 trillion by 2040, driven by urbanization and population growth. As the demand for construction materials, particularly steel and aluminum, rises, the recycling of scrap metals becomes increasingly vital. Additionally, green building initiatives are gaining traction, with approximately 40% of materials used in such projects being recycled. Rising costs of primary materials further encourage construction companies to source from recycled supplies, making recycled metals a more attractive option.

Government regulations and incentives also play a crucial role in this trend. Many governments are implementing stringent policies to promote recycling within the construction sector. For example, initiatives like the LEED certification in the U.S. encourage the use of recycled materials in building projects, while the European Union has set ambitious recycling targets, aiming for a 70% recycling rate for construction and demolition waste by 2025. In China, the government is pushing for around 80% of its steel production to come from recycled sources by 2025, emphasizing a strong focus on sustainability within the construction industry. This combination of economic factors and regulatory support solidifies the construction sector's dominance in the scrap metal recycling market, highlighting its reliance on recycled materials to meet growing demand and sustainability objectives.

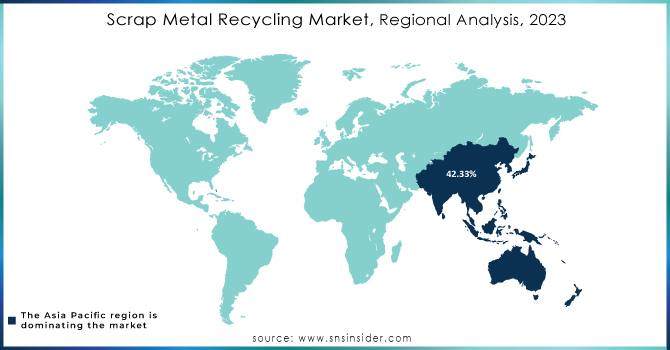

Asia Pacific dominated the scrap metal recycling market in 2023 with a revenue share of more than 42.33% and is expected to continue its dominance over the forecast period. One of the key drivers of this growth is Japan's robust recycling infrastructure and technological advancements in the recycling process. Japan boasts one of the highest recycling rates globally, with about 90% of metals being recycled, due to efficient collection and processing systems. The country's emphasis on sustainability is reflected in initiatives such as the Sound Material-Cycle Society law, which promotes the effective use of resources and mandates recycling across various sectors, further bolstering the market.

In addition to Japan, India is also making significant strides in the scrap metal recycling market. The Indian government has introduced policies aimed at increasing recycling rates, such as the Plastic Waste Management Rules, which indirectly promote metal recycling by encouraging the recovery of materials from waste streams. With urbanization on the rise, the demand for construction and manufacturing materials will continue to surge, enhancing the need for recycled metals. Furthermore, there is a growing consumer awareness of sustainability, with more than 65% of Indian consumers expressing a preference for products made from recycled materials. This combination of strong regulatory frameworks, rising urban demand, and increasing consumer awareness positions the Asia-Pacific region as a leader in the scrap metal recycling market.

Need any customization research on Scrap Metal Recycling Market- Enquiry Now

In September 2024, Aurubis AG entered into a development agreement with Australian battery materials and technology company Talga Group Ltd to create a recycled graphite anode product derived from lithium-ion batteries.

In March 2023, Sims Metal, a global leader in metal recycling, announced its acquisition of the commercial and operational assets of Northeast Metal Traders (NEMT), a Pennsylvania-based wholesaler and broker of non-ferrous scrap metal.

In February 2023, recycling pioneer Kuusakoski announced a €25 million investment in a new production line being constructed at its recycling plant in Heinola, Finland, to meet rising demand.

In December 2022, ArcelorMittal revealed that it had signed an agreement to acquire the Polish scrap metal recycling firm, Zakład Przerobu Złomu (“Złomex”).

ArcelorMittal

COHEN

Aurubis AG

Kuusakoski Group Oy

The David J. Joseph Company

European Metal Recycling (EMR)

Nucor Corporation

AIM Recycling

Sims Limited

OmniSource, LLC

Metallon Recycling Pte Ltd.

Radius Recycling, Inc.

Tata Steel Limited

SA Recycling LLC

Commercial Metals Company (CMC)

TKC Metal Recycling Inc.

Dowa Holdings Co., Ltd.

Hindalco

Upstate Shredding – Weitsman Recycling

Harsco

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 523.5 Billion |

| Market Size by 2032 | USD 856.2 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Metal Type (Ferrous, Non-Ferrous) • By End-use Industry (Automotive, Shipbuilding, Construction, Mining, Energy & Power, Railway & Transportation, Aerospace & Defense, Oil & Gas, Heavy Equipment Industry, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, COHEN, Aurubis AG, Kuusakoski Group Oy, The David J. Joseph Company, European Metal Recycling (EMR), Nucor Corporation, AIM Recycling, Sims Limited, OmniSource, LLC, Metallon Recycling Pte Ltd., Radius Recycling, Inc., Tata Steel Limited, SA Recycling LLC, Commercial Metals Company (CMC), TKC Metal Recycling Inc., Dowa Holdings Co., Ltd., Hindalco, Upstate Shredding – Weitsman Recycling, Harsco, and Others. |

| Key Drivers | • Rising Demand for Recycled Metals in Automotive and Construction Industries |

| RESTRAINTS | • Lack of Recycling Infrastructure in Developing Regions • Volatility in Raw Material Prices |

Scrap metal recycling involves collecting, processing, and reusing metal materials that have been discarded or are no longer in use. It helps recover valuable metals like steel, aluminum, copper, and iron, reducing the need for virgin metal production.

Scrap metal recycling is used in industries such as automotive (recycling car parts), construction (reusing steel and aluminum), manufacturing, and electronics, where recovered metals are reprocessed into new products, reducing waste and conserving natural resources.

Key trends include advancements in metal sorting and recovery technologies, the increasing use of recycled metals in the construction and automotive industries, rising demand for sustainable materials, and government regulations promoting recycling and waste reduction.

Leading companies include Sims Metal Management, Nucor Corporation, Aurubis AG, Commercial Metals Company, and Schnitzer Steel Industries, which specialize in metal recycling, offering solutions for scrap collection, processing, and resale to various industries.

Growth is driven by the increasing demand for sustainable practices, government regulations encouraging recycling, rising prices of raw metals, and the need for efficient waste management solutions in sectors like construction, automotive, and electronics.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Volume of Scrap Metal Recycled, by Type (Ferrous, Non-ferrous) and Region (2023)

5.2 Adoption Trends of Advanced Recycling Technologies, by Region (2023)

5.3 Scrap Metal Collection and Processing Capacity, by Region (2020-2032)

5.5 Trends in Metal Recycling Efficiency and Recovery Rates (2023)

5.6 Regulatory Trends Impacting Scrap Metal Recycling, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Scrap Metal Recycling Market Segmentation, by Metal Type

7.1 Chapter Overview

7.2 Ferrous

7.2.1 Ferrous Market Trends Analysis (2020-2032)

7.2.2 Ferrous Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Steel

7.2.3.1 Steel Market Trends Analysis (2020-2032)

7.2.3.2 Steel Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Iron

7.2.4.1 Iron Market Trends Analysis (2020-2032)

7.2.4.2 Iron Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-Ferrous

7.3.1 Non-Ferrous Market Trends Analysis (2020-2032)

7.3.2 Non-Ferrous Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Aluminum

7.3.3.1 Aluminum Market Trends Analysis (2020-2032)

7.3.3.2 Aluminum Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Copper

7.3.4.1 Copper Market Trends Analysis (2020-2032)

7.3.4.2 Copper Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Lead

7.3.5.1 Lead Market Trends Analysis (2020-2032)

7.3.5.2 Lead Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Nickel

7.3.6.1 Nickel Market Trends Analysis (2020-2032)

7.3.6.2 Nickel Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.7 Zinc

7.3.7.1 Zinc Market Trends Analysis (2020-2032)

7.3.7.2 Zinc Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.8 Brass

7.3.8.1 Brass Market Trends Analysis (2020-2032)

7.3.8.2 Brass Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.9 Tin

7.3.9.1 Tin Market Trends Analysis (2020-2032)

7.3.9.2 Tin Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.10 Gold

7.3.10.1 Gold Market Trends Analysis (2020-2032)

7.3.10.2 Gold Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.11 Other

7.3.11.1 Other Market Trends Analysis (2020-2032)

7.3.11.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Scrap Metal Recycling Market Segmentation, by End Use Industry

8.1 Chapter Overview

8.2 Automotive

8.2.1 Automotive Market Trends Analysis (2020-2032)

8.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Shipbuilding

8.3.1 Shipbuilding Market Trends Analysis (2020-2032)

8.3.2 Shipbuilding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Construction

8.4.1 Construction Market Trends Analysis (2020-2032)

8.4.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Mining

8.5.1 Mining Market Trends Analysis (2020-2032)

8.5.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Energy & Power

8.6.1 Energy & Power Market Trends Analysis (2020-2032)

8.6.2 Energy & Power Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Railway & Transportation

8.7.1 Railway & Transportation Market Trends Analysis (2020-2032)

8.7.2 Railway & Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Aerospace & Defense

8.8.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.8.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Oil & Gas

8.9.1 Oil & Gas Market Trends Analysis (2020-2032)

8.9.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Heavy Equipment Industry

8.10.1 Heavy Equipment Industry Market Trends Analysis (2020-2032)

8.10.2 Heavy Equipment Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.11 Other

8.11.1 Other Market Trends Analysis (2020-2032)

8.11.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.2.4 North America Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.2.5.2 USA Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.2.6.2 Canada Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.6.2 France Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.5.2 China Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.5.2 India Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.5.2 Japan Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.9.2 Australia Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.2.4 Africa Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Scrap Metal Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.6.4 Latin America Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Scrap Metal Recycling Market Estimates and Forecasts, by Metal Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Scrap Metal Recycling Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 ArcelorMittal

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Aurubis AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Kuusakoski Group Oy

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Nucor Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Dowa Holdings Co., Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Radius Recycling, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Tata Steel Limited

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Sims Limited

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 COHEN

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Metallon Recycling Pte Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Metal Type

Ferrous

Steel

Iron

Non-Ferrous

Aluminum

Copper

Lead

Nickel

Zinc

Brass

Tin

Gold

Other

By End-use Industry

Automotive

Shipbuilding

Construction

Mining

Energy & Power

Railway & Transportation

Aerospace & Defense

Oil & Gas

Heavy Equipment Industry

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Catalyst Carrier Market size was valued at USD 413 Million in 2023. It is expected to grow to USD 770.1 Million by 2032 and grow at a CAGR of 7.2% over the forecast period of 2024-2032.

The Plasticizers Market Size was valued at USD 17.57 Billion in 2023 and is expected to reach USD 28.05 Billion by 2032, growing at a CAGR of 5.34% over the forecast period of 2024-2032.

The Green Fertilizer Market Size was valued at USD 2.15 billion in 2023, and is expected to reach USD 3.53 billion by 2032, and grow at a CAGR of 5.65% over the forecast period 2024-2032.

Biogas Market Size was valued at USD 63.91 billion in 2023 and is expected to reach USD 95.80 billion by 2032, growing at a CAGR of 5.01% from 2024 to 2032.

The Toluene Market Size was valued at USD 28.6 Billion in 2023. It is expected to grow to USD 40.9 Billion by 2032, growing at a CAGR of 5.4% from 2024-2032.

The Concrete Blocks and Bricks Market size was USD 377.18 billion in 2023 and is expected to Reach USD 667.12 billion by 2032 and grow at a CAGR of 6.54% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone