SCADA Market Report Scope & Overview:

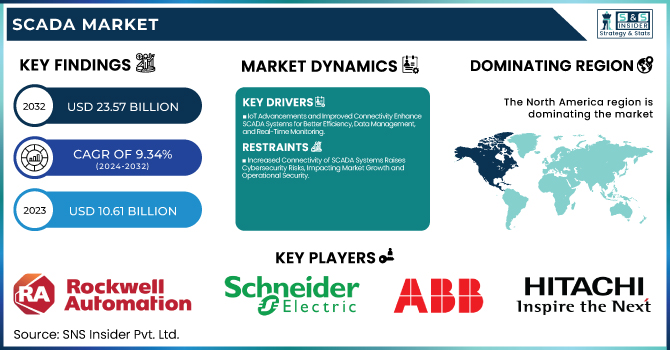

The SCADA Market was valued at USD 10.61 billion in 2023 and is expected to reach USD 23.57 billion by 2032, growing at a CAGR of 9.34% from 2024-2032.

To Get more information on SCADA Market - Request Free Sample Report

The SCADA market is currently growing significantly, primarily due to the increasing need for automation in various industries to achieve better operational efficiency. As automation is being embraced by industries, the demand for SCADA systems is also rising to provide real-time data acquisition and remote monitoring, especially in energy, water, and manufacturing sectors. The use of SCADA solutions is further enhanced by integration with IoT and cloud technologies, where different industries can make prompt decisions and enhance the resilience of their systems. As of 2024, the integration of IoT and cloud technologies in SCADA systems is still enhancing systems such as Siemens' SIMATIC DCS / SCADA infrastructure through single data exchange and communication between other platforms. That has made SCADA systems indispensable across various sectors due to the complexity of modern infrastructure systems and a transition towards digitalization.

As industries continue to prioritize safety, energy efficiency, and cost reduction, the demand for SCADA systems intensifies, particularly within utilities and manufacturing. As these sectors will require high-availability monitoring for optimal performance without downtime, together with the legal requirements for the real-time reporting and monitoring aspects, SCADA systems are always in demand. With investments in infrastructure modernization and digital transformation, business organizations continue to make, making SCADA an essential component for competitiveness and industry standards and regulatory compliance. As such, SCADA systems serve as a major tool for tackling both operational and regulatory challenges within modern industries.

Looking ahead, the SCADA market is expected to see substantial expansion, with strong growth in the near future. It is propelled by the rapid growth of artificial intelligence, machine learning, and predictive analytics technologies, which help to enhance the capabilities of SCADA systems, especially in predictive maintenance and fault detection, which leads to the better performance and reliability of systems. As smart grids, smart cities, and Industry 4.0 projects grow, intelligent SCADA systems are going to grow in tandem. Alongside these, developing opportunities in the remote operations segment, cybersecurity segment, and finally, the utilization of 5G technology in SCADA further revolutionize its landscape, hence providing faster communication and more dependable communication and spreading the scope for SCADA.

In August 2024, vulnerabilities in Hitachi Energy's MicroSCADA X SYS600 were revealed, posing significant risks to SCADA-controlled power systems due to SQL injection and authentication bypass flaws. This highlights the importance of robust cybersecurity measures as SCADA systems evolve.

SCADA Market Dynamics

Drivers

-

IoT Advancements and Improved Connectivity Enhance SCADA Systems for Better Efficiency, Data Management, and Real-Time Monitoring.

The Internet of Things and enhanced connectivity have revolutionized the capabilities of SCADA systems. With the integration of IoT devices, SCADA systems can now seamlessly connect to a wide range of sensors, machinery, and equipment, providing real-time data and control over complex processes. This level of integration improves operational efficiency, reduces downtime, and enhances decision-making by offering better data management and analysis. Added benefits of the solution are that SCADA ensures agile operations in case of industries, like utilities, manufacturing, or oil & gas. Continued IoT networks growth with fast connectivity speeds improve scalability and performance for a broader application and widespread use among the industries requiring smarter, efficient operations.

-

SCADA Systems Use Data Analytics for Better Decision-Making, Predictive Maintenance, and Operational Efficiency.

SCADA systems capture large volumes of data from varying industrial processes now, changing everything about how an organization runs itself. SCADA systems allow corporations to gain significant insights into activities, which form the basis for more informed strategic decisions. On the integration front, businesses incorporate data analytics on patterns, trends, and potential inefficiencies the system could uncover that were inapparent and unknown. This data-driven approach improves the performance of operations but also enables predictive maintenance in reduction of downtime and increase in the equipment lifespan. In addition, data analysis leads to the optimization of resource allocation, thus ensuring cost-effective operation. The SCADA systems are becoming indispensable for industries in the energy, manufacturing, and utility sectors as they convert vast amounts of data into actionable intelligence to enhance productivity, safety, and compliance. Data analytics are changing the way organizations run and adapt to constantly shifting market pressures.

Restraints

-

Increased Connectivity of SCADA Systems Raises Cybersecurity Risks, Impacting Market Growth and Operational Security.

SCADA systems more exposed to cyber threats as their enhanced operational efficiency promotes connectivity. A breach in any of these interlinked networks could lead to great operational disruptions or financial losses in the worst possible scenario, making safety hazards the most severe possibility. However, the implementation of strong cybersecurity is a necessity with most organizations hampered by insufficient resources or limited expertise. Not only does a bad cybersecurity infrastructure allow for unauthorized access and, worse, data theft, but also poses a potential risk of damage to critical infrastructure. With increasing reliance on SCADA for real-time monitoring and control, therefore, strong cybersecurity measures are undoubtedly important. Without viable solutions to offset the flaws highlighted by these vulnerabilities, growth in SCADA-related systems may be limited, especially in sensitive fields like energy, utilities, and manufacturing.

-

High Initial Costs of SCADA Systems Limit Adoption Among Small and Medium-Sized Enterprises

The considerable upfront expenditure necessary for implementing SCADA systems presents a challenge for numerous companies, especially small and medium-sized enterprises. The costs associated with obtaining the required hardware, software, and incorporating them into current systems can be excessively high. SMEs frequently encounter financial limitations, which makes it hard to rationalize the expense of implementing SCADA systems, despite their long-term operational advantages. Moreover, the requirement for qualified staff to set up, manage, and upkeep SCADA systems contributes an extra financial strain. For companies working with narrow margins, these initial expenses can hinder implementation. Consequently, SMEs might be reluctant to invest in SCADA systems, restricting the overall expansion of the market. The significant expense of implementation continues to be a crucial element influencing the broad adoption of SCADA systems in various sectors.

SCADA Market Segment Analysis

By Component

The Remote Terminal Unit segment dominated the SCADA market with the highest revenue share of approximately 32% in 2023. RTUs play a crucial role in data acquisition and control in remote and geographically dispersed locations, making them ideal for industries such as utilities, oil & gas, and water management. Their ability to efficiently collect, process, and transmit real-time data from remote assets ensures seamless monitoring, which is essential for maintaining operational efficiency and safety. This widespread adoption across critical infrastructure sectors contributed significantly to the segment’s dominance in 2023.

The Programmable Logic Controller segment is expected to grow at the fastest compound annual growth rate of 10.89% from 2024 to 2032. The increasing demand for flexibility, automation, and real-time control in manufacturing and industrial processes has propelled PLCs to the forefront of SCADA applications. Their integration with SCADA systems enables precise control and monitoring of production lines, machinery, and industrial processes, making them increasingly vital for businesses striving for greater operational efficiency. As industries continue to seek advanced automation and smarter control systems, the PLC segment is poised for rapid growth.

By End User

The Utilities segment led the SCADA market with the highest revenue share of approximately 41% in 2023. This dominance is attributed to the critical role SCADA systems play in the efficient management of utility operations, including electricity, water, and gas distribution. SCADA systems allow real-time monitoring, control, and automation, which is essential for ensuring the reliability, safety, and optimization of these services. As utilities continue to modernize infrastructure and adopt smart grid technologies, the demand for advanced SCADA systems has surged, driving the segment’s substantial market share.

The Discrete Manufacturing segment is poised to experience the fastest compound annual growth rate of 11.17% from 2024 to 2032. This growth is driven by the increasing need for automation, real-time monitoring, and precision in production processes. SCADA systems integrated with programmable logic controllers enable discrete manufacturers to enhance operational efficiency, reduce downtime, and ensure quality control. As the demand for advanced manufacturing solutions continues to rise, the Discrete Manufacturing segment is set to expand rapidly, reflecting the broader industry trend towards digital transformation and smarter production systems.

By Offering

The Hardware segment dominated the SCADA market with the highest revenue share of approximately 46% in 2023. This is primarily due to the essential role that hardware components, such as Remote Terminal Units, Programmable Logic Controllers, and sensors, play in the real-time data acquisition and control systems. These physical devices are the backbone of SCADA systems, enabling seamless integration, automation, and remote monitoring of critical infrastructure across industries such as utilities, oil & gas, and manufacturing. The ongoing need to upgrade and expand infrastructure further boosted the demand for SCADA hardware in 2023.

The Software segment is expected to grow at the fastest compound annual growth rate of 10.42% from 2024 to 2032. This growth is driven by the increasing demand for advanced analytics, data visualization, and enhanced decision-making capabilities offered by SCADA software solutions. As industries increasingly adopt automation and digital technologies, the need for sophisticated software to manage, analyze, and optimize data has surged. With ongoing advancements in AI, machine learning, and cloud computing, SCADA software is expected to play a pivotal role in transforming industrial operations, fostering faster growth in the coming years.

Regional Analysis

North America led the SCADA market with the highest revenue share of approximately 39% in 2023. This dominance can be attributed to the region’s advanced infrastructure and widespread adoption of automation technologies across industries such as energy, utilities, and manufacturing. North American companies are heavily investing in upgrading their SCADA systems to enhance efficiency, ensure regulatory compliance, and improve decision-making through real-time data. Additionally, the presence of leading SCADA solution providers and a strong focus on innovation has further solidified the region's market leadership.

Asia Pacific is expected to grow at the fastest compound annual growth rate of 11.27% from 2024 to 2032. The rapid industrialization, urbanization, and modernization of infrastructure in emerging economies like China and India are driving the demand for SCADA systems in the region. As industries increasingly rely on automation and smart technologies to optimize operations, SCADA solutions are becoming essential. Furthermore, government initiatives to enhance digital infrastructure and improve resource management in sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Rockwell Automation (FactoryTalk, Allen-Bradley ControlLogix)

-

Schneider Electric (EcoStruxure, Modicon PLC)

-

Emerson Electric (PlantWeb, Ovation SCADA)

-

Siemens (WinCC, SIMATIC S7)

-

ABB (ABB Ability, System 800xA)

-

Hitachi (Lumada, Hitachi SCADA Solutions)

-

IBM (Maximo, IBM Watson IoT)

-

Honeywell International (Experion, Honeywell SCADA)

-

Mitsubishi Electric (iQ Platform, MELSEC PLC)

-

Yokogawa Electric (Fast/Tools, Centum VP)

-

Omron (CX-Supervisor, Omron PLC)

-

Alstom (iPower SCADA, Grid SCADA)

-

General Electric (iFix, Proficy SCADA)

-

Iconics (Genesis64, AnalytiX)

-

Elynx Technologies (Elynx SCADA, Elynx Vision)

-

Enbase (Enbase SCADA, Enbase DataLogger)

-

Globalogix (Globalview, Modbus SCADA)

-

Inductive Automation (Ignition, Perspective)

Recent Developments:

-

In March 2024, Emerson introduced a comprehensive DeltaV automation platform, designed to enhance operational efficiency through advanced data management, analytics, and AI capabilities. This platform integrates seamlessly with plant systems, allowing for more agile decision-making from operations to enterprise levels.

-

In August 2024, ABB integrated its AquaMaster4 flowmeter with the Topkapi SCADA software to improve water conservation efforts globally. This integration enhances real-time data transmission for smart water management, supporting utilities in achieving sustainability goals with advanced diagnostics, flow, and pressure monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.61 Billion |

| Market Size by 2032 | USD 23.57 Billion |

| CAGR | CAGR of 9.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Component (Programmable Logic Controller, Remote Terminal Unit, Human-Machine Interface, Communication Systems, Other Components) • By End User (Process Industries, Discrete Manufacturing, Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rockwell Automation, Schneider Electric, Emerson Electric, Siemens, ABB, Hitachi, IBM, Honeywell International, Mitsubishi Electric, Yokogawa Electric, Omron, Alstom, General Electric, Iconics, Elynx Technologies, Enbase, Globalogix, Inductive Automation. |

| Key Drivers | • IoT Advancements and Improved Connectivity Enhance SCADA Systems for Better Efficiency, Data Management, and Real-Time Monitoring. • SCADA Systems Use Data Analytics for Better Decision-Making, Predictive Maintenance, and Operational Efficiency. |

| RESTRAINTS | • Increased Connectivity of SCADA Systems Raises Cybersecurity Risks, Impacting Market Growth and Operational Security. • High Initial Costs of SCADA Systems Limit Adoption Among Small and Medium-Sized Enterprises |