Satellite Launch Vehicle (SLV) Market Report Scope & Overview:

To get more information on Satellite Launch Vehicle (SLV) Market - Request Free Sample Report

The Satellite Launch Vehicle (SLV) Market Size was valued at USD 17.8 billion in 2023 and is expected to reach USD 48.26 billion by 2031 with an emerging CAGR of 13.2% over the forecast period 2024-2031.

Rising development in the satellite launch vehicle sector around the world for climate monitoring, route, correspondence, and remote detecting applications will aid the growth of the Satellite Launch Vehicle Market over the forecast time period. These satellite dispatch vehicles aid in the transportation of the shuttle to space. The dispatch vehicle, the platform, and several designs comprise the initial structure. The satellite dispatch trucks are arranged in a circle based on the mass delivered and the number of stages. Satellite dispatch vehicles use supports to provide initial thrust and reduce the weight of subsequent stages, allowing larger cargo to be carried into the circle.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing Defense Expenditure & regular Military Satellite Launches

-

Important Space Industry Investment by Venture Capital Firms

RESTRAINTS

-

High Development and launch costs

OPPORTUNITY

-

Reusable Launch Vehicles Development

-

The Creating Of launch Vehicles For Small Satellites

IMPACT OF COVID-19

The COVID-19 epidemic has caused a few dispatch delays, inventory network disruptions, labour force shortages, and the disappearance of income streams for a few new enterprises and smaller players on the lookout. Recently, there has been a surge in interest in satellites from the general/government, commercial, and military sectors. Currently, nations such as the United States, India, China, Russia, Japan, and a few European countries have considerable satellite manufacturing capacity. However, with the growing movement toward assembly reasonable and less polished tiny satellites, it is typical that the satellite assembling base is expanding to a few different nations across the world.

The global satellite launch vehicle market is divided into four categories: orbit, payloads, launch activity, and applications. The market is divided into four categories based on orbit: sun-synchronous orbit (SSO), medium earth orbit (MEO), low earth orbit (LEO), and geosynchronous orbit (GEO). The market is divided into three sections based on payloads: primary alone, 6 to 10, and 2 to 5. The market is divided into two categories based on launch activity: non-commercial and commercial. The market is divided into applications such as research and development, navigation, communication, scientific, meteorology, earth observation, and remote sensing.

One of the key factors driving the growth of the satellite dispatch vehicle market is the increasing development of remote detection applications. However, administrative guidelines restricting the assets and information, as well as the sharing of advances identified with the dispatch inferable from critical applications, are critical factors controlling the development of the satellite dispatch vehicle market.

An increase in the size of the satellite launch vehicle market, with an emphasis on interplanetary missions and numerous follow-on missions planned, is expected to promote the growth of the satellite dispatch vehicle industry.

Several satellites represent the increase in satellite payloads market growth, and testing test dispatches act as drivers for the development of the Satellite Launch Vehicle Market.

Furthermore, larger government initiatives and private assets influence market development overall. However, significant startup costs connected to delivery administrations act as a market constraint. Furthermore, the small satellite launch vehicle market concerns addressed by organisations stifle industry progress. Another factor impeding market expansion is the lack of a skilled labour force and resistance to new technological improvements. Meanwhile, efforts to reduce the cost of dispatch administrations present a profitable opportunity for market players in the Satellite Launch Vehicle Market industry.

KEY MARKET SEGMENTATION

By Number of Payloads

-

Primary Only

-

2 to 5

-

6 to 10

By Launch Activity

-

Non-Commercial

-

Commercial

By Application

-

Research & Development

-

Navigation

-

Communication

-

Scientific

-

Meteorology

-

Earth Observation

-

Remote Sensing

By Orbit

-

Sun-Synchronous Orbit

-

Medium Earth Orbit

-

Low Earth Orbit

-

Geosynchronous Orbit

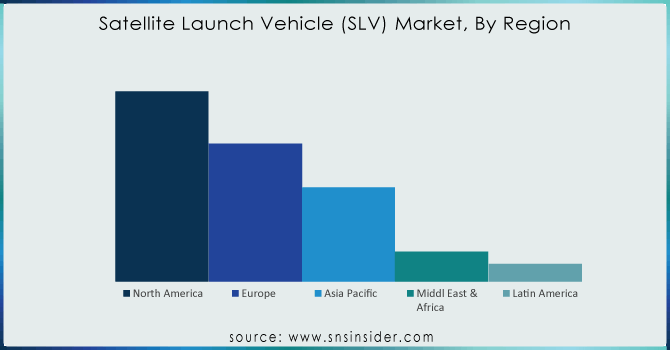

REGIONAL ANALYSIS

North America accounts for around 55% of the market. The presence of key market participants, the widespread use of cutting-edge technologies, and the availability of a large technically skilled workforce all contribute to the expansion of the regional satellite launch vehicle market.

The APAC market is expected to grow at the fastest rate, of more than 4%, in the future years, due to an increase in satellite launches for space exploration and communication. Furthermore, the increasing participation of private firms and government expenditure to develop the 5G network boost market growth.

Need any customization research on Satellite Launch Vehicle (SLV) Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Blue Origin, Space Exploration Technologies Corporation, Eurockot Launch Services GmbH, Bristol Airspace, Arca Space Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Mitsubishi Heavy Industries, Ltd, Indian Space Research Organization and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.8 Billion |

| Market Size by 2031 | US$ 48.26 Billion |

| CAGR | CAGR of 13.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Number of Payloads (Primary Only, 2 to 5 and 6 to 10) • By Launch Activity (Non-Commercial and Commercial) • By Application (Research & Development, Navigation, Communication, Scientific, Meteorology, Earth Observation, and Remote Sensing) • By Orbit (Sun-Synchronous Orbit [SSO], Medium Earth Orbit [MEO], Low Earth Orbit [LEO], and Geosynchronous Orbit [GEO]) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Blue Origin, Space Exploration Technologies Corporation, Eurockot Launch Services GmbH, Bristol Airspace, Arca Space Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Mitsubishi Heavy Industries, Ltd, Indian Space Research Organization. |

| DRIVERS | • Increasing Defense Expenditure & regular Military Satellite Launches • Important Space Industry Investment by Venture Capital Firms |

| RESTRAINTS | • High Development and launch costs |