Satellite Internet Market Report Scope & Overview:

The Satellite Internet Market was valued at USD 8.16 billion in 2023 and is expected to reach USD 29.44 billion by 2032, growing at a CAGR of 15.39% from 2024-2032.

To Get more information on Satellite Internet Market - Request Free Sample Report

This report includes insights into bandwidth and speed trends, investment and funding patterns, cost structures, satellite deployment strategies, and regulatory compliance statistics. Increasing demand for high-speed internet, particularly in remote areas, is driving market expansion. Investments in satellite constellations and advancements in low-latency solutions are enhancing network efficiency. Pricing strategies are evolving to improve affordability, while regulatory frameworks aim to balance innovation with compliance. Growing satellite capacity is expected to meet rising data consumption needs. As technology advances, competition among providers is intensifying, fostering innovation and market expansion.

U.S. Satellite Internet Market was valued at USD 2.24 billion in 2023 and is expected to reach USD 8.03 billion by 2032, growing at a CAGR of 15.23% from 2024-2032

The U.S. Satellite Internet Market is expanding due to increasing demand for high-speed connectivity in rural and underserved areas. Rising reliance on digital services, remote work, and IoT applications is driving adoption. Advancements in low Earth orbit (LEO) satellites are improving latency and network performance, attracting more users. Government initiatives and private investments are accelerating satellite deployments, enhancing coverage and affordability. Additionally, growing competition among providers is fostering innovation, leading to cost reductions and improved service quality, further fueling market growth.

Satellite Internet Market Dynamics

Drivers

-

Growing Need for High-Speed Satellite Internet in Remote and Underserved Areas with Limited Terrestrial Connectivity

Inadequate infrastructure in rural and distant regions has established a wide disparity in internet connectivity, necessitating satellite-based connections. Conventional broadband networks fail to extend their reach to geographically difficult terrain, leaving tens of millions of people without secure internet connectivity. The increasing use of digital services, e-learning, telemedicine, and remote work has added to the imperative for high-speed connectivity in these underserved communities. Satellite internet offers an efficient and scalable solution, which ensures uninterrupted coverage irrespective of landscape or population distribution. Governments and businesses are actively investing in satellite-based solutions to close the digital divide, which ensures inclusive connection for communities beyond the scope of fiber or mobile networks. Satellite constellations expanding continuously extend internet access, driving economic growth and social progress in areas once left disconnected.

Restraints

-

High Capital and Operational Costs of Satellite Networks Limiting Growth and Market Expansion

The large capital to launch and operate satellite constellations is a significant issue for the providers. Satellite networks entail high up-front investment in satellite production, launch provision, and ground station infrastructure. Moreover, operational expenses for running the networks such as maintenance, upgrades, and data transmission add to high long-term costs. Such financial pressures render it challenging for smaller businesses to compete and constrain profitability for current market participants. As technology progresses, with the intention of lowering costs, the cost of supporting large-scale satellite constellations and guaranteeing constant provision of service is an undertaking that demands continuous financial investment. Consequently, the high-cost basis can delay market adoption, especially in price-conscious markets, and can impede the rate at which satellite internet services can be scaled worldwide.

Opportunities

-

Rising Demand for Global Connectivity Driven by IoT Devices and Smart City Initiatives Boosting Satellite Internet Adoption

The rapid growth in Internet of Things (IoT) devices and the increasing popularity of smart city projects are fueling the demand for trusted, global connectivity. As billions of IoT devices go live across the globe, a smooth and uninterrupted internet connection is vital to the effective functioning of such systems. Satellite internet, being capable of reaching vast geographic areas, rural and remote, makes it a major facilitator for smart cities, agriculture, health, transportation, and many more. With cities increasingly relying on networked infrastructure for the management of resources and services, satellite networks are in a good position to augment such systems with low latency and high-speed data transmission. The need for this kind of strong connectivity will keep increasing, creating opportunity for the growth of satellite internet providers in the emerging as well as developed world.

Challenges

-

Ongoing Latency and Bandwidth Limitations in Satellite Internet Affecting Real-Time Application Performance and User Experience

Even with tremendous improvement in satellite technology, satellite internet continues to lag behind terrestrial broadband networks in terms of higher latency. The physical distance between the Earth and satellites, particularly those in geostationary orbit, is the cause of delayed data transmission. This latency may have a severe impact on the performance of real-time applications like video conferencing, online games, and financial transactions. Additionally, satellite internet networks tend to be bandwidth-constrained, particularly as the need for high-speed data grows. These limitations can lead to decreased speeds and congestion during high usage times, which decreases the overall user experience. Although low Earth orbit (LEO) satellites are helping alleviate some of these issues, finding an ideal blend of speed, latency, and coverage is still a barrier for mass adoption and market expansion.

Satellite Internet Market Segment Analysis

By Industry

The Government & Public Sector segment dominated the Satellite Internet Market with the highest revenue share of about 20% in 2023. Governments across the globe are increasingly investing in satellite internet to enhance connectivity in remote, rural, and underserved regions. The need for secure communication systems, national defense, disaster response, and efficient administration of public services contributes to the sector’s dominance. Satellite internet is seen as an essential infrastructure for public services, particularly in areas where traditional broadband is unavailable.

The Media & Broadcasting segment is expected to grow at the fastest CAGR of about 17.96% from 2024 to 2032. As demand for high-quality streaming, live broadcasts, and on-demand content increases globally, satellite internet provides a reliable solution for media companies operating in remote or underserved regions. Satellite networks are also critical for broadcasting in real-time and ensuring uninterrupted service in hard-to-reach areas, driving the sector’s rapid growth.

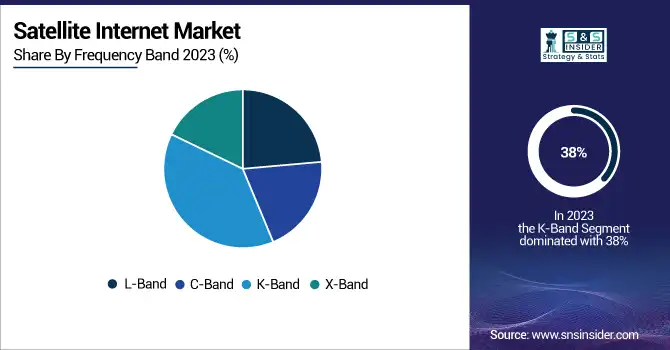

By Frequency Band

The K-band segment dominated the Satellite Internet Market with the highest revenue share of about 38% in 2023. This is primarily due to its ability to provide higher data rates and broader bandwidth compared to other frequency bands. The K-band is ideal for high-throughput satellite systems and is widely used for services such as broadband internet, telecommunication, and media broadcasting. Its ability to deliver faster speeds and higher capacity makes it the preferred choice for satellite internet providers.

The C-band segment is expected to grow at the fastest CAGR of about 17.99% from 2024 to 2032. C-band's ability to provide reliable service even in adverse weather conditions, such as heavy rain or storms, makes it particularly appealing for satellite internet. This frequency band offers stable connectivity over large geographic areas and is less prone to signal interference, making it an attractive option for applications in remote regions and critical communications.

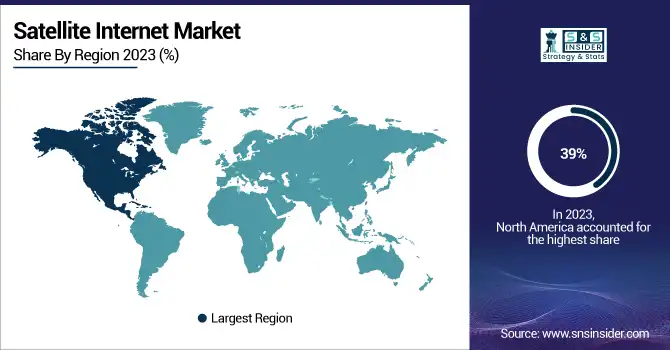

Regional Analysis

North America dominated the Satellite Internet Market with the highest revenue share of about 39% in 2023. This dominance is driven by the advanced technological infrastructure and high demand for satellite internet services in both urban and rural areas. Major players like SpaceX’s Starlink and Amazon’s Project Kuiper are contributing to the region's growth. Additionally, governments and private sectors are investing in satellite connectivity to enhance broadband access, especially in underserved regions and for critical applications such as defense and emergency services.

Asia Pacific is expected to grow at the fastest CAGR of about 16.96% from 2024 to 2032. The rapid digital transformation in emerging economies, along with increasing government initiatives to improve internet access in remote and rural areas, fuels the demand for satellite internet. As urbanization and IoT adoption rise in countries like India, China, and Southeast Asia, satellite internet becomes essential to bridge the connectivity gap and support economic growth and technological advancements in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Singtel Group (Fixed Satellite Services, Satellite Solutions)

-

Freedomsat (Starlink Satellite Internet, Satellite Broadband Internet)

-

EchoStar Corporation (HughesNet, JUPITER System)

-

Thuraya Telecommunications Company (Thuraya IP+, Thuraya SatSleeve)

-

Eutelsat Communications SA (Eutelsat ADVANCE, Tooway)

-

OneWeb (Low Earth Orbit Satellite Constellation, OneWeb Enterprise Solutions)

-

SpaceX (Starlink, Starlink Mini)

-

Viasat, Inc. (Exede, Viasat Community Wi-Fi)

-

Axess (Axess Networks Maritime Services, Axess Networks Enterprise Solutions)

-

DSL Telecom (Satellite Broadband Services, VoIP over Satellite)

-

Hughes Network Systems LLC (HughesNet Gen5, JUPITER Aero System)

-

Telesat (Telesat Lightspeed, Anik F2 Satellite Services)

-

Embratel (Star One Satellite Services, Embratel Claro Satellite Broadband)

-

Speedcast (Speedcast Managed Satellite Services, Speedcast Maritime Broadband)

-

SES S.A (SES Broadband, O3b MEO Services)

-

Intelsat (Intelsat Flex, Intelsat EpicNG)

-

L3 Technologies, Inc. (L3Harris VSAT Systems, L3Harris SATCOM Solutions)

-

SKY Perfect JSAT Group (JSAT Mobile Services, JCSAT Satellites)

-

GILAT SATELLITE NETWORKS (SkyEdge II-c, Gilat Cellular Backhaul)

-

Cobham Limited (EXPLORER 8100, SAILOR 600 VSAT)

Recent Developments:

-

In January 2024, Singtel integrated Starlink's satellite connectivity into its maritime services, enhancing digital solutions for ship operators. This partnership supports AI, 5G, and cloud services to improve operational efficiency, safety, and crew well-being.

-

In January 2024, Thuraya successfully launched the Thuraya 4 satellite into orbit through Space42. The satellite enhances broadband capacity, speed, and coverage across Africa, Europe, and the Middle East for next-generation services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.16 Billion |

| Market Size by 2032 | USD 29.44 Billion |

| CAGR | CAGR of 15.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency Band (L-band, C-band, K-band, X-band) • By Industry (Energy & Utility, Government & Public Sector, Transport & Cargo, Maritime, Military, Corporates/Enterprises, Media & Broadcasting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Singtel Group, Freedomsat, EchoStar Corporation, Thuraya Telecommunications Company, Eutelsat Communications SA, OneWeb, SpaceX, Viasat Inc., Axess, DSL Telecom, Hughes Network Systems LLC, Telesat, Embratel, Speedcast, SES S.A, Intelsat, L3 Technologies Inc., SKY Perfect JSAT Group, GILAT SATELLITE NETWORKS, Cobham Limited |