Safety Valves Market Key Insights:

To Get More Information on Safety Valves Market - Request Sample Report

The Safety Valves Market size was estimated at USD 4.86 Billion in 2023 and is expected to reach USD 8.50 Billion by 2032 with a growing CAGR of 6.42% during the forecast period of 2024-2032.

The safety valves market is a crucial segment of the industrial equipment industry, designed to protect systems from overpressure by automatically releasing fluids when pressure reaches a dangerous level. These valves play a vital role in maintaining the safety and efficiency of various systems across sectors such as oil and gas, chemicals, power generation, and manufacturing. The demand for safety valves has been driven by the increasing need for advanced safety standards and regulatory requirements in industries where pressure vessels, pipelines, and other equipment are common. In sectors like oil and gas, where high-pressure systems are prevalent, safety valves ensure that equipment operates within the designated safety limits. In addition, the growing emphasis on industrial safety and reducing the risk of accidents has resulted in a rising need for these valves, especially in chemical plants, refineries, and power plants.

The market is also influenced by technological advancements, with manufacturers developing valves that offer enhanced reliability, longer lifespans, and more precise pressure control. Innovations such as automatic reset safety valves, corrosion-resistant materials, and digital monitoring capabilities have further boosted market growth. Additionally, the increasing adoption of automation and smart systems across industries is leading to higher demand for safety valves integrated with monitoring systems for real-time pressure analysis. According to research, it is estimated that over 60% of safety valve applications are in the oil and gas and chemical sectors, where the potential consequences of overpressure are more severe. Furthermore, over 30% of safety valves are now being designed with enhanced corrosion resistance and higher durability to withstand extreme environments. As industries continue to expand and regulations become stricter, the safety valve market is poised for further growth, ensuring the protection of both human life and industrial assets.

| Feature | Description | Commercial Products |

|---|---|---|

| High Pressure Tolerance | Designed to withstand high pressure and prevent equipment damage by releasing excess pressure. | LESER High Performance Safety Valves, Farris Pressure Relief Valves |

| Corrosion Resistance | Made from corrosion-resistant materials for durability in harsh environments, including chemical plants. | Crosby J-Series Safety Valves, Anderson Greenwood High-Pressure Valves |

| Quick Response Time | Ensures rapid pressure relief to protect systems and personnel in emergencies. | Emerson’s Enardo Series, Spirax Sarco SVL488 |

| Adjustable Set Pressure | Allows customization of set pressure to suit specific applications and operational requirements. | Kunkle 300 Series, Apollo 19K Series |

| Compact and Lightweight Design | Designed for ease of installation in limited spaces, suitable for various industrial setups. | Aquatrol Safety Relief Valves, Goetze Type 650 |

| Temperature Resistance | Withstands extreme temperatures, ensuring performance in hot or cold environments. | Pentair Anderson Greenwood, Mercer Type 510 |

| Low Maintenance Requirements | Built for minimal maintenance needs, reducing downtime and operational costs. | Consolidated Series 1900, Cash Valve D80 |

| Noise Reduction | Engineered to minimize noise during operation, suitable for environments where noise control is essential. | Bopp & Reuther Safety Valves, Leser API Safety Valves |

| Compliance with Industry Standards | Meets regulatory and industry standards (e.g., ASME, API) for reliable operation in safety-critical applications. | Clarke Safety Valves, Taylor Valve Technology |

| Ease of Testing and Certification | Features design aspects that facilitate testing and certification for safety compliance. | Danfoss SFA 10, Parker Hannifin Series 500 |

MARKET DYNAMICS

DRIVERS

- Stringent safety regulations across various industries are driving demand for certified safety valves to prevent hazardous incidents and ensure compliance with standards like ASME and API.

Stringent safety regulations are a critical driver in the safety valves market, as industries including oil & gas, pharmaceuticals, food processing, and chemicals operate under increasingly rigorous standards to prevent accidents and ensure operational safety. Regulations from agencies like the American Society of Mechanical Engineers (ASME) and the American Petroleum Institute (API) require the use of certified safety valves to manage pressure, protect equipment, and mitigate potential hazards. For instance, in the oil & gas sector, safety valves are vital in pipelines and processing plants to control sudden pressure changes, with adherence to ASME and API standards being mandatory.

As regulatory oversight intensifies worldwide, especially in sectors prone to high-risk incidents, the demand for reliable, high-quality safety valves is growing significantly. Studies indicate that regulatory requirements have driven nearly 40% of new safety valve installations across industrial facilities over the past few years. This demand for certified products affects the market by favoring established players with high-quality, compliant offerings, creating barriers for smaller, uncertified providers. Moreover, as countries introduce stricter safety norms, companies are required to retrofit or upgrade older facilities with compliant safety solutions, further increasing the adoption of safety valves. In the pharmaceutical sector, where contamination and pressure control are critical, adherence to regulatory requirements for pressure management is also intensifying. Overall, stringent safety regulations are propelling the adoption of advanced safety valves, fostering growth within the market, and driving innovation among manufacturers to meet compliance standards effectively.

- The rise in industrial automation across sectors like manufacturing, chemical, and energy is driving demand for advanced safety valves with quick response and remote operation capabilities.

The increasing adoption of industrial automation is significantly driving advanced safety valves market. Automation in industries like manufacturing, chemical processing, and energy production requires precision, safety, and efficiency, which makes automated safety valves indispensable. These valves are designed with quick-response capabilities and remote operation features, which align with automated systems to ensure effective pressure control, prevent equipment damage, and enhance operational safety. In chemical and energy sectors alone, where high pressures and hazardous materials are common, automated safety valves play a critical role in maintaining safe operating environments.

According to research, the adoption of automation in manufacturing is expected to reduce downtime by up to 20% and increase productivity by nearly 30%, making safety solutions, such as advanced safety valves, vital components. Furthermore, 70% of new installations in manufacturing now integrate smart, automated safety mechanisms. This trend is evident across regions with strong industrial growth, such as Asia-Pacific, where automated safety valves are increasingly deployed to meet stringent safety standards and operational efficiency needs. The demand for automated safety valves is also positively impacted by the rising focus on Industry 4.0 initiatives, as industries transition to interconnected and data-driven operations. Automated safety valves enable real-time monitoring and predictive maintenance, reducing manual interventions and enhancing efficiency. This shift toward automation boosts demand for innovative safety valve technologies, impacting the market by driving up the need for reliable, high-performance products that align with the evolving industrial landscape.

RESTRAIN

- High initial costs of premium safety valves, especially for high-pressure and high-temperature applications, may limit adoption among budget-constrained small and medium enterprises.

High initial costs pose a notable challenge in the safety valves market, particularly for high-quality valves used in demanding applications with high pressures or extreme temperatures. These specialized valves require robust materials, precise engineering, and advanced manufacturing processes, making them more expensive than standard valves. For small and medium-sized enterprises (SMEs), this upfront cost can be prohibitive, especially when balancing investment with other operational expenses. SMEs may hesitate to invest in premium safety valves, opting instead for lower-cost, less specialized alternatives, or delaying upgrades, which impacts overall market adoption rates and slows technological progress within the industry.

The impact of high initial costs is visible across industries like oil & gas, power generation, and chemical processing, where safety valves are essential but where cost-saving pressures are high. According to research, 42% cited cost as a primary factor influencing their safety valve purchasing decisions, with 27% indicating that budget constraints had previously led them to delay purchases. This tendency reduces market penetration in smaller businesses, ultimately slowing the adoption of innovative safety solutions that could enhance operational safety and efficiency. The market effect is further compounded as manufacturers are pressured to balance high production costs with competitive pricing, sometimes at the expense of profit margins. In the long run, these financial constraints limit opportunities for smaller companies to invest in robust safety systems, potentially impacting industry-wide safety standards and operational efficiency.

KEY SEGMENTATION ANALYSIS

By Material

The steel segment held the largest market share, accounting for over 38% in 2023, driven by its exceptional durability and high tensile strength. Steel safety valves are favored for their ability to endure extreme temperatures and pressures, making them highly suitable for critical applications in sectors such as oil and gas, power generation, and chemical processing. These industries demand reliable safety mechanisms that can resist corrosion and withstand rigorous operating conditions, and steel's robust characteristics fulfill these requirements effectively. Steel valves are also more versatile and reliable, ensuring consistent performance and safety across various demanding environments. As a result, steel remains the preferred choice for safety valves in heavy-duty applications where resilience and long-term functionality are essential, maintaining its dominant position within the market.

By Size

In 2023, the 1” to 6” segment dominated the market share over 34%. This size range is highly favored across diverse industries, such as oil and gas, chemicals, power generation, and manufacturing, due to its optimal balance between performance and cost-efficiency. Valves in this range are versatile and can handle a wide variety of operational requirements, making them the preferred choice for most applications. Their ability to maintain safety and control in systems under pressure is crucial in preventing accidents and ensuring smooth operations. This segment's dominance is also driven by the fact that these valves are commonly used in standard pipeline systems and pressure vessels, where effective regulation is essential. The cost-effectiveness, combined with their widespread application in critical infrastructure, further solidifies their position as the most commonly used size in the safety valve market.

KEY REGIONAL ANALYSIS

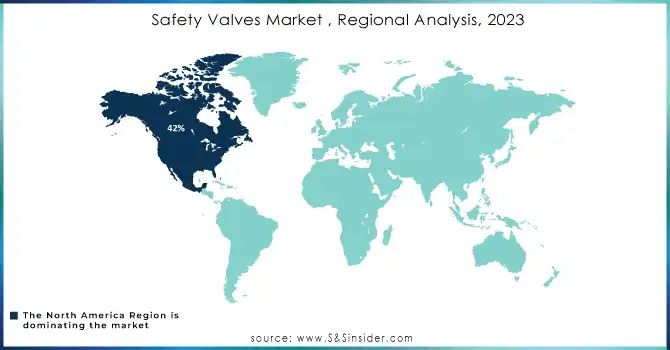

In 2023, the North America region held the largest share of the Safety Valves Market, accounting for over 42%. This dominance can be attributed to the region's robust industrial and manufacturing sectors, which have high demands for safety solutions to protect equipment and personnel. Stringent safety regulations, particularly in industries like oil and gas, chemicals, and power generation, further reinforce the need for reliable safety valves. Additionally, significant investments in infrastructure development and energy, particularly in the United States and Canada, drive the demand for advanced safety technologies. North America’s strong focus on maintaining high safety standards and adhering to regulatory requirements ensures the continuous growth of the safety valves market. The presence of well-established industrial infrastructure, coupled with ongoing technological advancements, strengthens the region's leadership position in the market.

The Asia Pacific region is witnessing rapid growth in the safety valves market, driven by extensive industrialization and urbanization across key economies such as China and India. As these countries continue to expand their industrial sectors, particularly in oil and gas, chemicals, and manufacturing, the demand for safety valves has surged. Safety valves play a crucial role in maintaining operational safety by regulating pressure and preventing accidents in critical industries. With the growth of infrastructure projects and manufacturing facilities, coupled with the need to comply with stricter safety standards and regulations, industries in the region are increasingly adopting advanced safety valve technologies. The rising awareness of workplace safety, environmental concerns, and the necessity for risk management solutions further fuels the demand for safety valves.

Do You Need any Customization Research on Safety Valves Market - Inquire Now

Key Players

-

Emerson Electric Co. (Fisher Safety Valves, Regulator Valves)

-

Schlumberger Limited (Flow Control Valves, Pressure Relief Valves)

-

General Electric (Farris Safety Valves, Pressure Relief Valves)

-

Curtiss-Wright Corporation (Valves, Actuators, Safety Valve Assemblies)

-

ALFA LAVAL (Safety Relief Valves, Pressure Control Valves)

-

LESER GmbH & Co.KG (Spring-loaded Safety Valves, Pilot-operated Safety Valves)

-

The Weir Group PLC (Pressure Relief Valves, Safety Valves for Oil & Gas)

-

Danfoss Bosch Rexroth AG (Relief Valves, Control Valves)

-

Spirax Sarco Limited (Steam Pressure Relief Valves, Safety Valves)

-

Metso Corporation (Pressure Safety Valves, Valve Solutions)

-

Pentair PLC (Pressure Relief Valves, Pressure Regulating Valves)

-

Schneider Electric (Industrial Safety Valves, Control Valves)

-

Flowserve Corporation (Safety Relief Valves, Valve Systems)

-

Honeywell International Inc. (Pressure Relief Valves, Safety Valves for Industrial Applications)

-

Cameron (A Schlumberger Company) (Pressure Relief Valves, Gas Valves)

-

KSB SE & Co. KGaA (Safety Valves, Industrial Valve Solutions)

-

Baker Hughes Company (Pressure Relief Valves, Safety Equipment for Oil & Gas)

-

Badger Meter, Inc. (Flow Meters, Pressure Relief Valves)

-

Emerson Process Management (Valves, Control Systems, Pressure Relief Valves)

-

Samson AG (Safety Relief Valves, Process Control Valves)

Suppliers Known for high-quality safety valves for various industries like oil & gas, petrochemical, and power generation of Safety Valves Market

-

Emerson Electric Co.

-

Swagelok

-

Pentair

-

Cameron (Schlumberger)

-

Crane Co.

-

Tyco International (now part of Johnson Controls)

-

Honeywell International Inc.

-

Koso Kent Introl Ltd.

-

Farris Engineering (A Flowserve Company)

-

Wangsu Valve

RECENT DEVELOPMENTS

-

In February 2023: Emerson Electric introduced the ASCO™ Series 262 and 263 combustion safety shutoff valves, marking the first certification of valves for use with biodiesel blends in industrial and commercial boilers across the Americas and Asia. These valves facilitate the transition of district heating and boiler burner systems to more sustainable energy sources, in line with evolving regulations aimed at reducing greenhouse gas emissions.

-

In October 2023: Flowserve Corporation introduced a new high-performance safety valve tailored for cryogenic applications, addressing the increasing demand for safety in the LNG industry.

-

In August 2024: CIRCOR International announced the sale of its DeltaValve and TapcoEnpro brands to SCF Partners. This strategic decision allows CIRCOR to refocus on its core operations while transferring ownership of these well-established brands, known for their severe-service industrial valves supporting global energy infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.86 Billion |

| Market Size by 2032 | USD 8.50 Billion |

| CAGR | CAGR of 6.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Steel, Cast Iron, Alloy, Cryogenic, Others (Brass, Bronze, and Plastic)) • By Size (Up To 1”, 1” to 6”, 6” to 25”, 25” to 50”, 50” and Larger) • By Industry (Oil & Gas, Energy & Power, Chemicals, Water & Wastewater, Building & Construction, Pharmaceuticals, Agriculture, Metal & Mining, Paper & Pulp, Food & Beverages, Others (Semiconductor, Textile, and Glass) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Schlumberger Limited, General Electric, Curtiss-Wright Corporation, ALFA LAVAL, LESER GmbH & Co.KG, The Weir Group PLC, Danfoss Bosch Rexroth AG, Spirax Sarco Limited, Metso Corporation, Pentair PLC, Schneider Electric, Flowserve Corporation, Honeywell International Inc., Cameron (A Schlumberger Company), KSB SE & Co. KGaA, Baker Hughes Company, Badger Meter, Inc., Emerson Process Management, Samson AG. |

| Key Drivers | • Stringent safety regulations across various industries are driving demand for certified safety valves to prevent hazardous incidents and ensure compliance with standards like ASME and API. • The rise in industrial automation across sectors like manufacturing, chemical, and energy is driving demand for advanced safety valves with quick response and remote operation capabilities. |

| RESTRAINTS | • High initial costs of premium safety valves, especially for high-pressure and high-temperature applications, may limit adoption among budget-constrained small and medium enterprises. |