Rugged Electronics Market Size

Get PDF Sample Report on Rugged Electronics Market - Request Sample Report

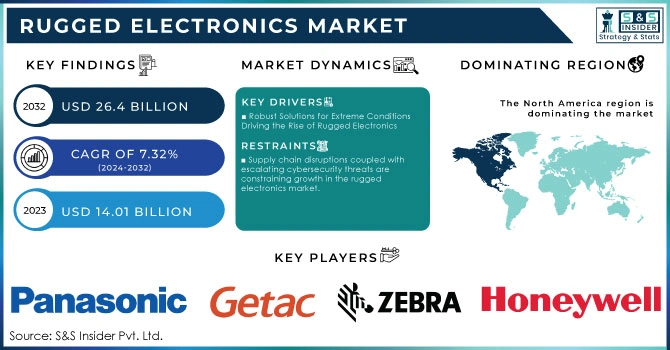

The Rugged Electronics Market Size was valued at USD 14.01 Billion in 2023 and is expected to grow to USD 26.4 Billion by 2032 and grow at a CAGR of 7.32% over the forecast period of 2024-2032.

The rugged electronics market is witnessing robust growth, fueled by escalating demand across various sectors, notably military, construction, and outdoor activities. These devices are engineered to withstand extreme environmental conditions such as moisture, temperature variations, and physical impacts providing reliability where standard electronics often falter. Major players, including Saab, are at the forefront of this trend, focusing on advanced passive sensor technologies for electronic warfare, which facilitate stealthy signals intelligence (SIGINT) collection without detection. Consumer preferences further drive this market, as seen in the notable rise in demand for durable Bluetooth speakers and sound bars, with a 55% increase in popularity among outdoor enthusiasts. This trend is exemplified by products like the Bang & Olufsen Beosound A1, now available for USD 188 (down from USD 299), and the Bose Sound Link Revolve+, which is currently 41% off, highlighting the growing consumer interest in high-quality portable audio solutions. Moreover, advancements in wireless charging technology and the rising popularity of portable power banks are complementing the rugged electronics segment, enabling users to charge their devices conveniently in remote locations. Approximately 65% of college students have purchased portable power banks, underscoring the increasing demand for mobile charging solutions. The global rugged electronics market is projected to continue its upward trajectory, driven by ongoing technological innovations and rising investments in durable electronic devices. Industries are prioritizing safety and situational awareness, which amplifies the demand for rugged electronics that offer advanced features such as low size, weight, and power (SWaP) solutions. This unique blend of functionality and durability positions rugged electronics as essential tools for professionals and outdoor enthusiasts alike, marking a significant shift in today’s technology landscape.

Rugged Electronics Market Dynamics

Drivers

-

Robust Solutions for Extreme Conditions Driving the Rise of Rugged Electronics

One of the key drivers of growth in the rugged electronics market is the increasing demand for durable and reliable devices that can operate effectively in extreme environmental conditions. As industries such as military, transportation, and construction continue to expand, the need for equipment that can withstand harsh elements—such as moisture, temperature fluctuations, and physical impacts—has become critical. Rugged electronics, designed to meet these demanding requirements, play a vital role in enhancing operational efficiency and safety. For instance, devices like the MEN DC2 panel computer exemplify the latest advancements in rugged electronics. This panel computer features a capacitive touch system integrated into a fanless design, making it maintenance-free and ideal for mobile applications in tough environments. With a 10.4-inch LCD TFT display offering a resolution of 1,024px x 768px and a rapid response time of approximately 25ms, the DC2 is specifically designed for use in applications like train driver cabins and agricultural machinery. Powered by an Intel Atom XL Z520PT processor operating at 1.33GHz with a power consumption of only 12W, the DC2 highlights the trend toward low-power yet high-performance solutions. It offers connectivity options including fast Ethernet and USB ports, allowing for seamless integration with other systems. Built to endure extreme temperatures ranging from -40°C to +70°C and equipped with shock and vibration-resistant components, the DC2 adheres to strict industry standards, ensuring its reliability in critical applications. As the need for safety, efficiency, and robust performance continues to rise, the rugged electronics market is poised for sustained growth, driven by technological advancements and the evolving demands of various industries.

Restraints

-

Supply chain disruptions coupled with escalating cybersecurity threats are constraining growth in the rugged electronics market.

Supply chain vulnerabilities pose a significant restraint in the rugged electronics market, as disruptions often lead to production delays and increased costs. Factors such as geopolitical tensions, natural disasters, and health crises like pandemics complicate the sourcing and manufacturing of essential components. For example, U.S. regulations like CMMC 2.0 have forced companies to revamp compliance protocols, impacting the timely procurement of materials critical for rugged electronics. Logistical issues, including recent U.S. port strikes, further intensify delays and elevate transportation costs, affecting industries like electronics. Cybersecurity threats compound these challenges, as the frequency of ransomware attacks has surged, particularly those stemming from the software supply chain. Recent data show that nearly 40% of organizations have faced or are uncertain about ransomware attacks linked to supply chain partners. Among those affected, 62% report that ransomware incidents originated within their software supply chain, prompting 90% to increase collaboration with software vendors to enhance security practices. With 91% of companies now expressing concerns over ransomware risks from third-party partners, recent breaches by industry players like Change Healthcare and CDK Global have heightened awareness, leading 49% of companies to reconsider vendor relationships. To mitigate risks, companies are investing in cybersecurity, with 74% implementing formal assessments of supplier practices. Additionally, cloud security and regular security training have become priorities, as 62% of SMBs are increasing cloud security investments. These measures, while costly, are essential for protecting rugged electronics from supply chain disruptions, helping stabilize the market by addressing vulnerabilities that could otherwise impede growth.

Rugged Electronics Market Segmentation Overview

by Type

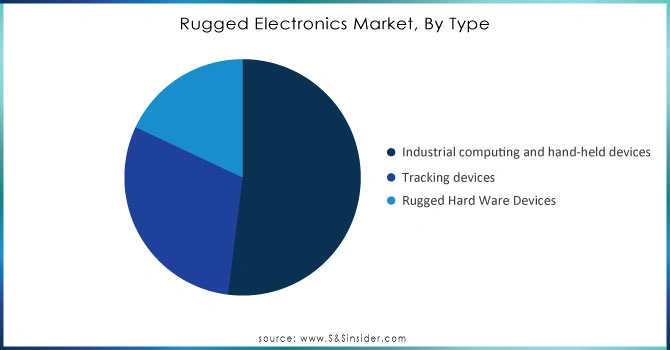

In 2023, the industrial computing and hand-held devices segment led the rugged electronics market, securing the largest revenue share in 60%. This growth can be attributed to the increasing adoption of durable computing solutions across various industries, including manufacturing, logistics, and field services. Designed to endure extreme temperatures, dust, moisture, and physical impacts, rugged tablets and laptops are essential for operations requiring reliability in harsh environments. Hand-held rugged devices are especially critical in sectors such as logistics, construction, and defense, where portability and resilience are paramount. Notable companies like Panasonic, with its Toughbook line, have played a key role in this segment, providing robust laptops and tablets that meet demanding specifications. Getac has also made significant advancements in rugged computing tailored for first responders and military applications. Furthermore, Zebra Technologies has introduced a range of hand-held mobile computers that enhance data capture and communication in logistics and retail settings. The demand for hand-held rugged devices has surged due to their advanced features, such as GPS, real-time data collection, and reliable connectivity, capable of withstanding shocks and drops.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Application

In 2023, the defense sector emerged as the largest revenue generator in the rugged electronics market, capturing around 36% of the total share. This leading position is attributed to the essential requirement for reliable and durable technology in military operations, where rugged devices are crucial for effective communication, data collection, and situational awareness in harsh environments. Designed to endure extreme conditions such as severe temperatures, moisture, dust, and physical shocks, rugged electronics are particularly well suited for field deployments. Rugged computing solutions including handheld devices, laptops, and communication systems significantly enhance the operational efficiency and effectiveness of defense personnel. These devices boast advanced features like GPS, real-time data processing, and robust connectivity options, facilitating seamless communication and information sharing essential for mission success. Key players in this segment include General Dynamics, offering a variety of rugged laptops and tablets tailored for military applications, and Raytheon Technologies, known for its cutting-edge communication systems. Additionally, Panasonic and Getac provide reliable rugged computing solutions that meet the needs of defense forces in the field. As nations continue to modernize and integrate technology into military operations, the demand for rugged electronics in the defense sector is anticipated to grow, driven by an ongoing need for durability and performance in critical tasks.

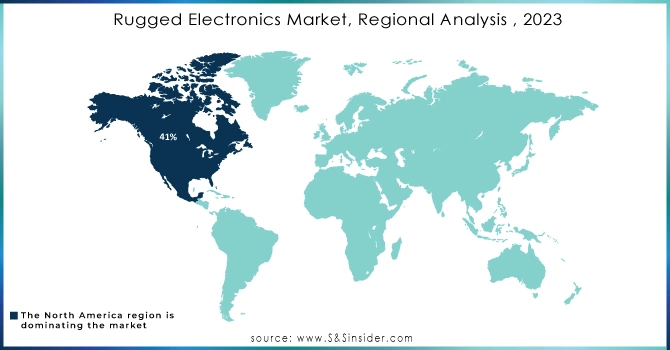

Rugged Electronics Market Regional Analysis

In 2023, North America maintained a leading position in the rugged electronics market, accounting for approximately 41% of total revenue. This robust performance is largely due to the region's sophisticated technological environment, significant defense expenditures, and an increasing focus on durable electronics across multiple industries. Key sectors driving demand include defense, manufacturing, logistics, and construction, where the reliability and performance of rugged devices are essential in harsh conditions. The United States plays a pivotal role in this dominance, with ongoing government investments aimed at modernizing military capabilities, which require rugged laptops, tablets, and communication systems for effective operations in the field. Meanwhile, Canada is experiencing growth in its rugged electronics sector, fueled by rising investments in infrastructure and industrial initiatives that enhance the need for durable solutions. Additionally, the growing emphasis on automation and the Internet of Things (IoT) in manufacturing and logistics is further boosting demand for rugged devices capable of withstanding challenging environments while enabling seamless connectivity and efficient data collection. The combination of established manufacturers, technological advancements, and heightened awareness of the necessity for durable electronics positions North America for sustained leadership in the rugged electronics market, ensuring continued investment in solutions that enhance operational efficiency and resilience.

In 2023, the Asia Pacific region emerged as the fastest-growing market for rugged electronics, fueled by rapid industrialization, heightened technology investments, and an increasing demand for durable devices across various industries. Leading countries like China, India, Japan, and Australia are pivotal to this growth as they work to enhance manufacturing capabilities and improve infrastructure. China’s drive for modernization and its role as a manufacturing powerhouse have significantly boosted the demand for rugged devices capable of withstanding harsh conditions. Government initiatives promoting smart manufacturing and technological advancements further stimulate the adoption of rugged electronics in logistics, construction, and defense sectors. India is also experiencing notable growth due to infrastructure projects and a push for digital transformation, with rising needs for rugged devices in agriculture, transportation, and defense. Local companies are investing in research and development to create tailored rugged solutions. Meanwhile, Japan and Australia are leveraging their advanced technology sectors, focusing on automation and connectivity, particularly in logistics and manufacturing. Recent launches of rugged laptops and handheld devices aim to improve operational efficiency in fields like emergency services. With the increasing integration of the Internet of Things (IoT), the rugged electronics market in Asia Pacific is poised for sustained growth, highlighting the region's potential in the global landscape

Key Players

Some of the major players in Rugged Electronics market with product:

-

Panasonic (Toughbook Series)

-

Getac (B300 Rugged Laptop)

-

Zebra Technologies (Zebra L10 Rugged Tablet)

-

Dell (Latitude Rugged Series)

-

Honeywell (RT10 Rugged Tablet)

-

ASUS (ZenBook 14 Rugged)

-

Xplore Technologies (XSLATE R12 Rugged Tablet)

-

Trimble (T10 Rugged Tablet)

-

JLT Mobile Computers (JLT1214P Rugged Computer)

-

Advantech (UNO-2271G Rugged Embedded System)

-

MobileDemand (X rugged Tablet)

-

Getac (F110 Rugged Tablet)

-

Acer (Enduro N3 Rugged Laptop)

-

Samsung (Galaxy Tab Active Series)

-

Robustel (R3000 Series Routers)

-

Sonim Technologies (XP8 Rugged Phone)

-

MilDef (MilDef RUGGED R2)

-

Datalogic (P/9200 Rugged Handheld)

-

L3Harris Technologies (Falcon III Radio)

-

Odin Technologies (Rugged Data Loggers)

List of suppliers that provide component parts for rugged electronics:

-

Molex

-

TE Connectivity

-

Schneider Electric

-

Amphenol

-

3M

-

Vishay

-

Honeywell

-

NXP Semiconductors

-

Texas Instruments

-

Analog Devices

-

STMicroelectronics

-

Infineon Technologies

-

Maxim Integrated

-

Murata Manufacturing

-

Eaton

Recent Development

-

August 05, 2024 Recent advancements in naval electronics focus on enhancing the durability and reliability of systems through improved ruggedization techniques, ensuring they can withstand extreme conditions such as high humidity, saltwater exposure, and significant vibrations during long deployments. This development aims to bolster operational readiness and effectiveness for modern naval vessels.

-

September 09, 2024 ATP Electronics has launched the Industrial Enterprise N651Sie Series SSDs, featuring NVMe PCIe Gen4x 4 technology, designed for rugged edge environments and available in M.2, U.2, and E1.S formats. These SSDs offer various endurance ratings, exceptional data retention capabilities, and high sequential read/write speeds, making them ideal for demanding industrial applications.

-

9th June 2024, Cinch Connectivity Solutions has launched a solderless 100Gbit/s optical transceiver, the H28-100G-SR4, designed for demanding environments such as aerospace, industrial, and military applications. This transceiver features four transmit and four receive channels, each rated at 25.78Gbit/s, and utilizes temperature-compensated 850nm VCSELs for transmission.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.01 Billion |

| Market Size by 2032 | USD 26.4 Billion |

| CAGR | CAGR of 7.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Industrial computing and hand-held devices, Tracking devices, Rugged Hard Ware Devices) • By Application (Mining and Metal, Power, Chemicals, Transportation, Healthcare, Defense, Adventure Sports) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Panasonic, Getac, Zebra Technologies, Dell, Honeywell, ASUS, Xplore Technologies, Trimble, JLT Mobile Computers, Advantech, MobileDemand, Acer, Samsung, Robustel, Sonim Technologies, MilDef, Datalogic, L3Harris Technologies, and Odin Technologies. |

| Key Drivers | • Robust Solutions for Extreme Conditions Driving the Rise of Rugged Electronics. |

| RESTRAINTS | • Supply chain disruptions coupled with escalating cybersecurity threats are constraining growth in the rugged electronics market. |