Rugged Display Market Size & Growth Trends:

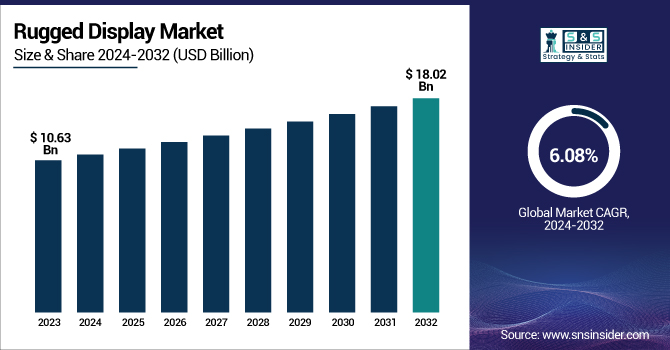

The Rugged Display Market Size was valued at USD 10.63 Billion in 2023 and is expected to reach USD 18.02 Billion by 2032 and grow at a CAGR of 6.08% over the forecast period 2024-2032. The rugged field of display is advancing towards better ruggedness, sunlight readability, and touch technologies leveraging reinforced glass and anti-glare coatings to enhance usability and haptic feedback in touch as the decade moves forward.

To Get more information on Rugged Display Market - Request Free Sample Report

With demand accelerating in the defense, industrial, and automotive sectors, fab capacity utilization will continue to be an important metric for manufacturers as they try to maximize production efficiency to meet demand. Trends in connectivity emphasize 5G, IoT connection, and wireless communication to facilitate data exchange in a challenging environment. Power consumption efficiency is also increasing with technologies such as adaptive brightness, low-power processors, and energy-efficient display panels, extending their operational life, particularly for battery-powered rugged devices used in mission-critical applications such as military, aerospace, and field services.

The U.S. Rugged Display Market is estimated to be USD 3.04 Billion in 2023 and is projected to grow at a CAGR of 5.94%. The rugged display market in the U.S. is gaining momentum as a result of increasing military modernization programs, as well as the overall growth in autonomous vehicles, and growing demand for the development of mission-critical communication systems. Market growth is also driven by the demand for long-lasting high-performance displays in extreme environments and innovation in AI-enabled diagnostics and real-time data visualization.

Rugged Display Market Dynamics

Key Drivers:

-

Rugged Display Market Grows with Rising Demand in Defense Industrial Automation and Advanced Display Technologies

Demand for tough displays in industries like military, aerospace, automotive, and industrial automation is boosting growth in the rugged display market. One of the growth drivers is the increasing utilization of ruggedized handheld devices, tablets, and vehicle-mounted computers in field operations, logistics, and defense applications. Essentially the growing requirement for ultra-rugged & fully rugged displays because displays need to be capable of sustaining and functioning in extreme environments including high temperatures, vibrations, and moisture is driving the growth of the market. Furthermore, display technologies such as OLED, sunlight-readable displays, and impact-resistant touch panels are likely to promote the adoption of the products. Another factor contributing to the high demand for rugged displays is the increasing use of IoT and AI in industrial automation as the new-age rugged displays provide real-time monitoring and data visualization in harsh environments.

Restrain:

-

The Rugged Display Market Faces Challenges in Balancing Durability High-Performance Visibility and Next-Gen Integration

The critical obstacle in the rugged display market deals with the technology that is restricted by ruggedness. Rugged displays withstand extreme conditions however providing high-performance features like ultra-high resolution, fast refresh rates, and advanced touch without losing on durability is a challenge. While there have been improvements in anti-glare and high-brightness technologies, visibility problems under direct sunlight, still linger among many rugged displays. Further, human-machine interface with glove-wearers and wet-condition usage is still seen as a technical challenge for industries like defense, aviation, and industrial automation, employing workers in harsh working situations. Rugged display manufacturers are also suffering from integration challenges when it comes to compatibility with next-gen connectivity standards, i.e., 5G and AI-based interfaces.

Opportunity:

-

Rugged Display Market Sees Growth with Industry 4.0 Smart Factories 5G Expansion and Defense Modernization

Emerging markets and Industry 4.0 are expected to offer significant opportunities as rugged displays are increasingly used in smart factories, mines, and construction sites. 5G expansion and edge computing, are also predicted to increase connectivity and productivity for ruggedized mobile devices. Moreover, increasing investment in defense modernization and the advent of autonomous military vehicles is creating profitable growth opportunities for rugged display manufacturers. Going forward, companies that balance lightweight, low-energy and AI-driven rugged displays will have a competitive advantage.

Challenges:

-

Rugged Display Market Faces Challenges with Size Weight Ergonomics and Lack of Industry Standardization

Size and weight limitations can be also a huge restraint besides the above which can affect how portable and usable a rugged display is in applications where small size and weight are important. The high level of added protection of rugged displays tends to result in very bulky designs, which lose some degree of ergonomic comfort for handheld and wearable applications. Fragmentation is also created in the market as there is little standardization across industries which also means that manufacturers often cannot build rugged displays that will be compatible across all sectors. Solving these problems will demand advances in material science, engineering display efficiency, and ergonomics to mitigate the often very high-performance display features at the compromise of durability.

Rugged Display Industry Segment Analysis

By Product

The Smartphone & Handheld Computer segment held the largest share of the rugged display market with 34.6% of the total market share in 2023. Growing demand for rugged smartphones and handheld devices in military, logistics, construction, and field services has fueled this dominance. This is useful for professionals whose work environments may be harsh therefore these devices have extra durability, impact resistance, and water/dust protection. The 5G connectivity, AI applications, and an advanced touchscreen have fueled their adoption.

During the forecast period 2024 to 2032, the Vehicle-Mounted Computer segment is expected to grow at the most rapid CAGR. This growth comes from increasing demand for fleet management solutions, warehouse automation, and military vehicle systems. Features such as Real-time data access, GPS tracking, and communication further improve the operational efficiency offered by these rugged displays. The growing demand for autonomous vehicles, smart logistics, and connected transportation has also been driving market growth.

By Display Size

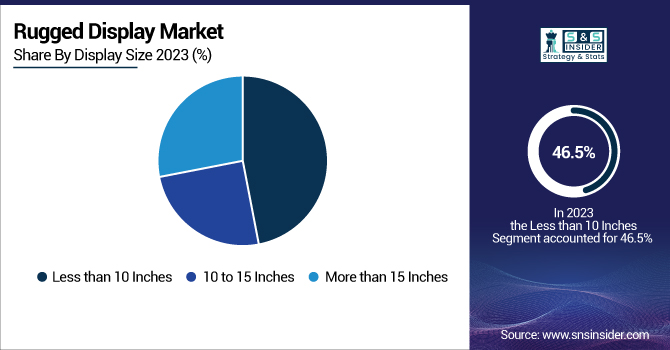

The Less than 10 Inches segment dominated the market share with 46.5% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2032 The growth is attributed to rugged smartphones, handheld computers, and handheld industrial devices gaining widespread usage in industries including logistics, defense, healthcare, and manufacturing. These smaller-sized rugged displays are portable, and robust, and can support high-performance touchscreen operation making them perfect for field applications and rough environments Other trends such as sunlight-readable displays, impact-resistant screens, and energy-efficient technologies are also contributing to their increasing demand. Additionally, the growing focus on IoT-based smart devices, real-time data monitoring, and AI-based industrial automation is further prompting the rapid growth of this segment.

By Level of Ruggedness

The Fully Rugged segment accounted for the largest market share as of 2023 with 45.7% as it continues to see the most penetration in military, aerospace, industrial, and public safety applications. These displays are designed for mission-critical operations where durability, exposure to extreme temperatures, shock, and moisture are a must. The growth of market growth is further fueled by Government and Defense as well as Industrial use of rugged laptops, tablets, and hand devices. Moreover, improvements in touch panels with impact resistance, sunlight-readable displays, and connectivity features have added to the demand for fully rugged displays.

Due to the increasing demand for high durability required for mining, oil & gas, and military operations, the Ultra-Rugged segment will witness the fastest CAGR from 2024-2032. These screens are created to be used under the most extreme conditions, involving high pressure, significant impact, and highly corrosive material. Relentless demand is expected as rugged displays fit in line with industries' preference for uncompromised reliability and lifespan.

By Vertical

The Automotive & Transportation segment held the largest market share in 2023 at 34.9%, attributed to the growing adoption of rugged displays for use in commercial vehicles, fleet management as well as railway systems. This information will also be displayed on many of the in-car displays which are playing an ever-expanding role in GPS and infotainment systems as well as advanced driver-assistance systems (ADAS) to aid in operational performance and optimize safety. This dominance is due to an increased trend towards connected and autonomous vehicles as well as the growing need for rugged, high-performance touch screens in vehicles. Also, improvements in sunlight-readable and vibration-resistant display technologies have driven more adoption in trucking, aviation, and maritime applications.

Due to the quick uptake of Industry 4.0 and IoT-enabled manufacturing, as well as the usage of automation technology, the Industrial segment is anticipated to achieve the highest CAGR from 2024 to 2032. Rugged displays serve in factories, warehouses, and outdoor industrial sites, where extreme conditions need a shockproof screen and a waterproof and dustproof screen. This increasing need for smart and connected industrial systems will propel this market ahead.

Rugged Display Market Regional Overview

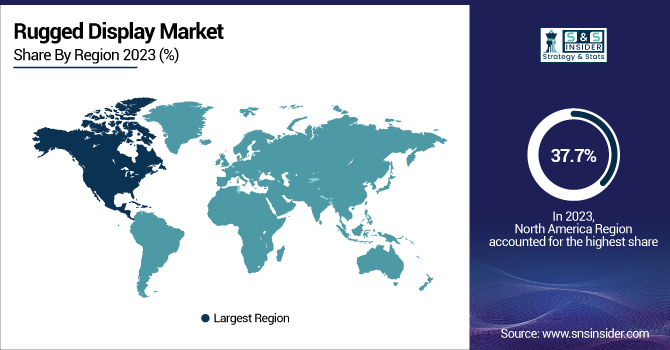

In 2023, North America was the leading regional market for rugged displays with a 37.7% share, supported by the military, aerospace, automotive, and industrial applications. Shifts in the ruggedized mission-critical displays market Ruggedized mission-critical displays have experienced an upward shift, following the arrival of prime defense contractors Lockheed Martin, Boeing, and Raytheon. Tesla and Ford use rugged displays in autonomous vehicle systems due to innovative uses in fleet management solutions in the automotive and transportation sectors. Furthermore, smart warehouses & automated logistics gaining traction, spearheaded by Amazon and FedEx, have witnessed increased demand for rugged handheld computers and vehicle-mounted displays in logistics and supply chain management. R&D Enhancement in this region and government initiatives to modernize the defense sector and defense manufacturing industry are contributing to the regional market growth.

Due to rapid industrialization, growing military expenditure, and a strong automotive industry, Asia Pacific is projected to register the highest CAGR during the years 2024 to 2032. With China and India heavily investing in defense and aerospace, the demand for ultra-rugged displays is expected to increase in military vehicles and aircraft. For instance, in the manufacturing sector, companies such as Foxconn and Tata Group are integrating rugged displays in smart factories and automated production lines. With the increasing logistics and e-commerce sector presence and expansion of domestic giants such as Alibaba and Flipkart in the region, demand for rugged tablets and handheld devices for warehouse automation and last-mile delivery is expected to spur significantly. Asia Pacific is anticipated to be one of the fastest-growing markets due to the rapid rollout of 5G connectivity, IoT integration, and smart city projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Rugged Display Market are:

-

Dell Inc. (Latitude Rugged Series)

-

Getac Technology Corp. (Getac F110 Rugged Tablet)

-

General Dynamics Corp. (Itronix GD8000)

-

Zebra Technologies Corp. (Zebra ET5X Rugged Tablet)

-

L3 Technologies Inc. (L3 Ruggedized Display Systems)

-

Panasonic Corporation (Toughbook Series)

-

Curtiss-Wright Corp. (Rugged LCD Mission Displays)

-

Aayur Technology Solutions Pvt. Ltd (Custom Rugged Flat Panel Displays)

-

Vista Consoles Electronics Pvt Ltd (MIL Grade Rugged Displays)

-

E3 Displays (Rugged Industrial Touchscreen Solutions)

-

Mulder-Hardenberg (Marine and Military Rugged Displays)

-

Sparton Corp. (Ruggedized Displays for Defense Applications)

-

SCIO Teq (Rugged Avionics Displays)

-

Honeywell International Inc. (Rugged Mobile Computers)

-

Trimble Inc. (Rugged Handheld Computers)

Rugged Display Market Trends

-

In November 2024, Dell's new Pro Rugged 14 laptop now features the NVIDIA RTX 500 Ada GPU, enhancing graphics and AI performance for demanding field applications.

-

In March 2025, Hertz deployed Getac’s UX10 rugged tablets to enhance customer service and streamline operations, reducing wait times and improving efficiency. The devices aid in damage documentation, VIN scanning, and seamless vehicle tracking, ensuring reliability in various conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.63 Billion |

| Market Size by 2032 | USD 18.02 Billion |

| CAGR | CAGR of 6.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smartphone & Handheld Computer, Tablet PC, Panel PC & Mission-Critical Display, Laptop & Notebook, Avionics Display, Vehicle-Mounted Computer) • By Display Size (Less than 10 Inches, 10 to 15 Inches, More than 15 Inches) • By Level of Ruggedness (Ultra-Rugged, Fully Rugged, Semi-Rugged) • By Vertical (Automotive & Transportation, Government, Defense, & Aerospace, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dell Inc., Getac Technology Corp., General Dynamics Corp., Zebra Technologies Corp., L3 Technologies Inc., Panasonic Corporation, Curtiss-Wright Corp., Aayur Technology Solutions Pvt. Ltd, Vista Consoles Electronics Pvt Ltd, E3 Displays, Mulder-Hardenberg, Sparton Corp., SCIO Teq, Honeywell International Inc., Trimble Inc. |