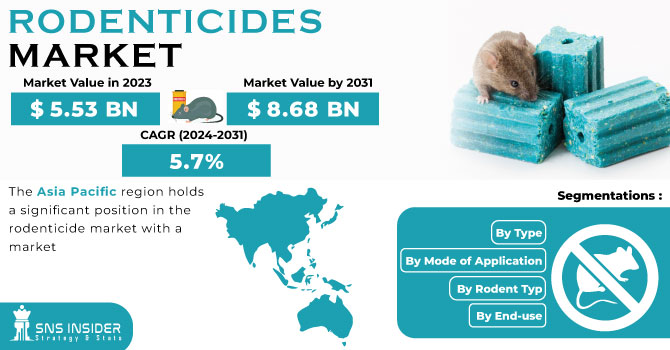

The Rodenticides market size was valued at USD 5.52 billion in 2023 and is expected to reach USD 9.10 billion by 2032, growing at a CAGR of 5.72% over the forecast period of 2024-2032. The Rodenticides market report provides a comprehensive analysis of production volumes and utilization rates across key countries, highlighting supply chain efficiency and capacity trends. It examines raw material price fluctuations by type and region, offering insights into cost dynamics. The report also evaluates the impact of regulatory frameworks on market growth, covering compliance requirements and restrictions. Additionally, it presents environmental and safety metrics, including toxicity levels and disposal practices, along with advancements in biodegradable formulations, innovation trends in next-generation rodenticides and market adoption patterns across industries such as agriculture and urban pest control are also explored.

Get More Information on Rodenticides Market - Request Sample Report

Drivers

Rising Demand for Integrated Pest Management (IPM) Solutions drives the market growth.

The demand for Integrated pest management (IPM), is one of the key factors that are driving up the rodenticides market. Integrated pest management (IPM) is an environmentally sound strategy that uses a combination of practices to control rodent populations in ways that are economical and limit environmental disruption. There is growing governmental and regulatory support for IPM practices as a means to reduce reliance on harmful chemicals and for sustainable pest management in agriculture, urban areas, and food storage. The increasing recognition of the negative impact of conventional rodenticides on non-target species and ecosystems has also exacerbated the uptake of IPM-based rodent control. In addition to rodenticide formulations like non-anticoagulant and biodegradable rodenticides being in line with IPM principles, it promotes adoption across multiple sectors as well.

Restraint

Stringent Regulations on Rodenticide Usage Restrict Market Growth

The rodenticide market is severely restrained by the various stringent regulations set by numerous government authorities and environmental agencies. The use of many rodenticides can potentially harm non-target species such as pets, livestock, and wildlife particularly anticoagulant-based products and such risks have led to increasing restrictions on rodenticide use. Due to restrictions imposed by regulatory bodies including the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), some toxic compounds are limited in their residential and agricultural use. Moreover, growing concerns about chemical residues from food production and water sources have led to bans and restricted use of rodenticides. These regulatory guidelines hold manufacturers up-noteworthy challenges and urge them to innovate alternative and environmentally-friendly solutions that are safe and effective at the same time and do not compromise on the performance of rodent control.

Opportunities

Growing Adoption of Eco-Friendly and Biodegradable Rodenticides Presents Lucrative Opportunities

The demand for rodenticides specifically caters to its sustainability and environmental safety trend which will enhance growth in the market. To stay within strict regulations banning dangerous chemicals, manufacturers are focusing on research and development of botanical and natural rodenticides that can control the rodent population while remaining harmless to the non-target species and the ecosystem. Bio-based formulations, like cholecalciferol and corn-based rodenticides, are also emerging because of the lack of damage to ecosystems. Increasing inclination towards green pest control solutions, particularly in sectors such as agriculture, food storage, and urban pest control is projected to propel demand for sustainable rodenticides, creating new growth opportunities for the market.

Challenges

The development of rodent resistance to conventional rodenticides poses a major challenge to market growth.

One of the challenges being faced in the rodenticides market is resistance of common rodent populations to standard anticoagulant and non-anticoagulant rodenticides. The long and mainstream use of these chemical formulations has resulted in evolution in the rodent population and traditional rodenticides have become less effective. This resistance creates a push for pest control companies and agricultural industries to look for alternative methods, whether that be stronger active ingredients or combined treatments where insecticides will be mixed, both of which bring regulatory and environmental challenges. Consequently, the urgent pursuit of novel formulations and integrative pest management (IPM) strategies for rodent control hinges on a rigorous research and innovation agenda.

By Product

Anticoagulant rodenticides dominated and held the largest market share around 74%in 2023. It is preferred by consumers owing to its effectiveness over the long term in controlling the rodent population. These types of rodenticides act as anticoagulants to prevent blood clotting in the pests, which results in death after they eventually bleed out internally, making them highly effective in pest control. Their delayed action makes them popular in agricultural, household, and commercial areas, since rodents are not able to associate the bait with immediate damage, resulting in higher consumption rates. Moreover, these anticoagulants are provided in various types like visit pellets, blocks, and powder, which gives multiple options for application necessities.

By Form

Block segment held the largest market share around 38% in 2023. It is because of their better durability over time, extended shelf life, and convenience of use in diverse environments. Block rodenticides are highly weather resistant, so they are more suited for outdoor usage such as in agricultural settings, warehouses, and industrial locations. Because they are in the solid state, there is less chance of spilling or overconsumption which makes them suitable for controlled and efficient rodent elimination. Furthermore, blocks are designed with an attractant that improves palatability in combination with being moisture and mold-stable, making them more efficient in wet or high-humid environments. The ease of position and the ability to securely fasten within bait stations also contribute to their popularity in residential and commercial pest control use.

By Application

The pest control segment held the largest market share around 56% in 2023. It is owing to the growth in demand for effective rodent control management in the residential, commercial, and industrial sectors. Increasing population flow towards urban areas coupled with rising concern towards cleanliness and food security has further driven the pest control market. Also, regulations that compel the food processing and hospitality industries to keep their surroundings rodent-free have spurred market growth. Rodenticides are used extensively by pest control companies because they are cheaper, easy to handle and work effectively for a long-period of time to control infestations. Additionally, improvements in bait formulations and integrated pest management (IPM) strategies have made rodenticides more efficient and they are now regarded as the first-line tool in large-scale rodent control initiatives.

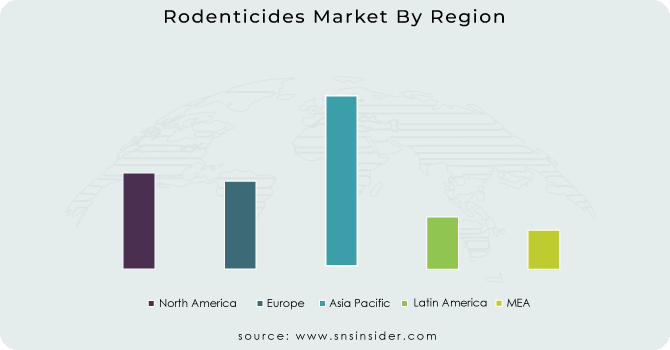

Asia Pacific held the largest market share around 34% in 2023. The growing agricultural activities and rising food security concerns in the region. In China, India, and Japan, the high density of population with increased production of garbage, rainfall, and other favorable weather conditions have led to an increase in the number of rodent infections. Rodenticides are also widely used in the agricultural sector, as rodents are a known threat to crops across the Asia-Pacific region, making rodent control an important agricultural activity producing economic loss. Moreover, increasing awareness regarding cleanliness and pest control, accompanied by governmental policies encouraging rodent control within food processing and storage units, has been another major factor bolstering market growth. The presence of the key rodenticide-producing companies and their growing adoption of integrated pest control management (IPM) solutions has proved vital in Asia-Pacific for being the regional market leader.

North America held a significant market share and growing in the forecast period. This is owing to the stringent regulation policies, rising worry about rodent-borne diseases, and higher demand for effective pest control solutions. There is a rich legacy of pest management in the region whereby rodenticides are extensively used across domestic, commercial, and agricultural arenas. Demand for rodenticides is also propelled by the strict need for pest management in the food processing, food storage, and hospitality sectors due to stringent food safety and sanitation regulations in the U.S. and Canada. Furthermore, urbanization and the growth of urban infrastructure have resulted in higher rodent strikes which create the need for more sophisticated rodent control methods. The leading position in this region can also be attributed to the presence of major pest control service providers and increasing investment in eco-friendly rodenticide research and development.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Bayer AG (Racumin, Klerat)

Syngenta (Talon, Weatherblok)

BASF SE (Storm, Selontra)

Anticimex (Smart Pest Control, Rodent Bait Stations)

UPL Ltd. (Ratol, Brodifacoum Bait)

Rollins (Orkin Bait, Orkin Traps)

Abell Pest Control (Rodent Bait Stations, Abell Snap Traps)

Truly Nolen (Rodent Shield, Exclusion Bait)

Liphatech Inc. (Generation, Maki)

JT Eaton (Bait Block, Nectus)

Pelgar International (Roban, Rodex)

Neogen Corporation (Havoc, CyKill)

Bell Laboratories (Contrac, Ditrac)

Senestech Inc. (ContraPest, Rodent Fertility Control)

Ecolab (Rodent Bait Stations, Multi-Catch Traps)

Impex Europa (Rodenticide Bait Blocks, Pellets)

Rentokil Initial Plc (Rodent Control Baits, Trap Systems)

Terminix (Rodent Defense, Bait Stations)

Lipatech (FirstStrike, Resolv)

Motomco (Jaguar, Tomcat)

In October 2024, BASF SE relaunched its Neosorexa rodenticide brand with flocoumafen as the new active ingredient, enhancing its effectiveness against various rodent species. This move aims to improve rodent control solutions while ensuring regulatory compliance.

In May 2023, World Pest Control partnered with Rentokil North America to enhance its pest control services by utilizing Rentokil's vast network and industry expertise. This collaboration aimed to strengthen service offerings and expand market reach.

In July 2023, Syngenta made an exciting announcement regarding the launch of their latest product, the Talon Soft XT concentration. This innovative rodenticide, built upon their renowned brodifacoum formula, promises exceptional efficacy in combating resistance while adhering to regulatory requirements. By reducing the concentration of the active ingredient, Syngenta has successfully met the demands set by governing bodies without compromising on its effectiveness.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.52 Bn |

| Market Size by 2032 | US$ 9.10 Bn |

| CAGR | CAGR of 5.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Anticoagulant, Non-anticoagulant), • By Outlook (Pellets, Blocks, Powder) • By Application (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Household) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bayer AG, Syngenta, BASF SE, Anticimex, UPL Ltd., Rollins, Abell Pest Control, Truly Nolen, Liphatech Inc., JT Eaton, Pelgar International, Neogen Corporation, Bell Laboratories, Senestech Inc., Ecolab, Impex Europa, Rentokil Initial Plc, Terminix, Lipatech, Motomco |

Ans: The Rodenticides Market was valued at USD 5.52 billion in 2023.

Ans: The expected CAGR of the global Rodenticides Market during the forecast period is 5.72%.

Ans: Stringent Regulations on Rodenticide Usage Restrict Market Growth

Ans: The Anticoagulants rodenticide hold the largest revenue share of the rodenticide market in 2023.

ANS: Yes, you can ask for the customization as pas per your business requirement.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Rodenticides Market Segmentation, by Product

7.1 Chapter Overview

7.2 Anticoagulant

7.2.1 Anticoagulant Market Trends Analysis (2020-2032)

7.2.2 Anticoagulant Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-anticoagulant

7.3.1 Non-anticoagulant Market Trends Analysis (2020-2032)

7.3.2 Non-anticoagulant Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Rodenticides Market Segmentation, by Form

8.1 Chapter Overview

8.2 Pellets

8.2.1 Pellets Market Trends Analysis (2020-2032)

8.2.2 Pellets Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Blocks

8.3.1 Blocks Market Trends Analysis (2020-2032)

8.3.2 Blocks Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Powder

8.4.1 Powder Market Trends Analysis (2020-2032)

8.4.2 Powder Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Rodenticides Market Segmentation, by Application

9.1 Chapter Overview

9.2 Agriculture

9.2.1 Agriculture Market Trends Analysis (2020-2032)

9.2.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Pest Control Companies

9.3.1 Pest Control Companies Market Trends Analysis (2020-2032)

9.3.2 Pest Control Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Warehouses

9.4.1 Warehouses Market Trends Analysis (2020-2032)

9.4.2 Warehouses Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.5 North America Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.6.3 USA Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.7.3 Canada Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.8.3 Mexico Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.6.3 Poland Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.7.3 Romania Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.5 Western Europe Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.6.3 Germany Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.7.3 France Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.8.3 UK Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.9.3 Italy Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.10.3 Spain Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.13.3 Austria Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.5 Asia Pacific Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.6.3 China Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.7.3 India Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.8.3 Japan Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.9.3 South Korea Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.10.3 Vietnam Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.11.3 Singapore Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.12.3 Australia Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.5 Middle East Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.6.3 UAE Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.5 Africa Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Rodenticides Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.5 Latin America Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.6.3 Brazil Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.7.3 Argentina Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.8.3 Colombia Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Rodenticides Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Rodenticides Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Rodenticides Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Bayer AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 Syngenta

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 BASF SE

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 Anticimex

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 UPL Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Rollins

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 Abell Pest Control

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Truly Nolen

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 Liphatech Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 JT Eaton

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Anticoagulant

Non-anticoagulant

By Form

Pellets

Blocks

Powder

By Application

Agriculture

Pest Control Companies

Warehouses

Urban Centers

Household

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Butane Market size was USD 105.84 billion in 2023 and is expected to reach USD 163.23 billion by 2032 and grow at a CAGR of 4.93% over the forecast period of 2024-2032.

Oxidized Polyethylene Wax Market was valued at USD 811.70 Mn in 2023 and is expected to reach USD 1,313.78 Mn by 2032, at a CAGR of 5.50% from 2024 to 2032.

The Tire Recycling Market size was USD 6.00 Billion in 2023 and is expected to reach USD 8.21 Billion by 2032, growing at a CAGR of 3.55% from 2024 to 2032.

The Natural Refrigerants Market size was USD 1.59 billion in 2023 and is expected to Reach USD 2.77billion by 2032 and grow at a CAGR of 6.34% over the forecast period of 2024-2032.

The Butyric Acid Market size was valued at USD 290.4 Million in 2023 and will reach to USD 715.6 Million by 2032 and grow at a CAGR of 10.6% by 2024-2032.

Chromium Phosphate Market size was USD 131.01 Million in 2023 and is expected to reach USD 328.76 Million by 2032, growing at a CAGR of 10.76% from 2024-2032.

Hi! Click one of our member below to chat on Phone