Robotic Welding Market Report Scope & Overview:

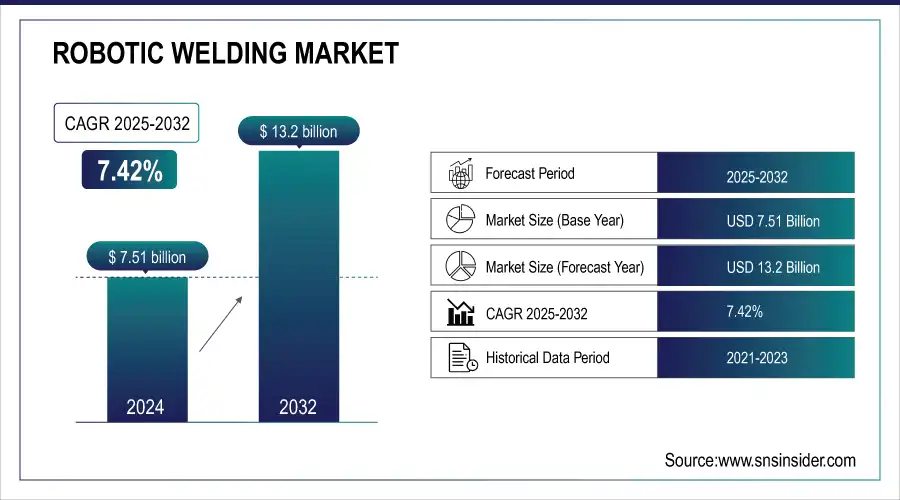

The Robotic Welding Market Size was valued at USD 7.51 billion in 2024 and is expected to reach USD 13.2 Bn by 2032, growing at a CAGR of 7.42% from 2025-2032.

Get More Information on Robotic Welding Market - Request Sample Report

Robotic Welding Market is one of the growing markets, as more and more industries are steering towards automation to achieve higher production speed along with quality. Because of the need for accuracy and repeatability, robotic-welding systems are being used in many businesses including automotive, aerospace, and manufacturing. As an example, in automotive sector, Each company such as Ford or Tesla are implementing advanced stiffened robotic welding technologies to automate assembly process, saving on labor costs and achieving quality welds. The demand for automated solutions to enhance operational efficiency is one of the primary growth factors for robotic welding market as well. Companies are using robotics to reduce human error and speed up production times. The worldwide move towards Industry 4.0 and smart manufacturing is also driving up demand for robotic welding systems as manufacturers realign themselves to embrace any new technology that promotes smartness in their manufacturing practices. Moreover, the entry of advanced robotic technologies, including collaborative robots (cobots) to work alongside human operators is further propelling market growth. These collaborative robots or cobots are characterised by a user-friendly design as well as ease of retrofitting, making them the best alternative for small and medium-sized enterprises (SMEs) wanting to automate without extensive redesigning of their production lines. In addition to this, increasing labor expenses and the lack of skilled workers are forcing industries to invest in robotic solutions. Annual global sales of robots rose by 31% in 2021, as indicated by a report from the International Federation of Robotics, indicating the rising trend towards manufacturing automation.

Market Size and Forecast:

-

Market Size in 2024 USD 7.51 Billion

-

Market Size by 2032 USD 13.2 Billion

-

CAGR of 7.42% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Robotic Welding Market Trends:

• Increasing adoption of Industry 4.0 and smart manufacturing initiatives driving automation in production processes.

• Integration of connected devices and IoT-enabled robotic welding systems for real-time monitoring and predictive maintenance.

• Emphasis on high accuracy, reproducibility, and tighter tolerances to meet growing quality demands in industries like automotive, aerospace, and electronics.

• Growing implementation of collaborative robots (cobots) that work safely alongside humans, enhancing flexibility on the shop floor.

• Data-driven decision-making enabling improved operational efficiency, minimized downtime, and faster production cycles.

Robotic Welding Market Growth Drivers:

The Robotic Welding Market is being revolutionized as industry approaches smart manufacturing and broadening Industry 4.0 initiatives are pushing new modernisation planning to realise state-of-the-art automation technologies in production processes. The focus of Industry 4.0 lies on connected devices, usage of data analysis, and automation to improve operational efficiency, adaptability, and product and service quality. With the field of Design and Construction evolving, manufacturers are increasingly bringing robotic welding solutions into their processes to enable them to keep pace with changing trends. These systems allow manufacturers to monitor, control and adjust on the fly robotics welding processes based on live feedback of data. This smart capability is one of the most important in a factory as it allows machines and systems to communicate seamlessly, serving as the backbone for an efficient and productive smart factory. Through the Internet of Things (IoT), manufacturers can now glean insights and information from welding robots for smart decisions and predictive maintenance. This minimizes downtime and improves productivity.

Robotic welding also provides high accuracy and reproducibility which are essential to meet the high demands of contemporary manufacturing. Industries, particularly automotive, aerospace, and electronics are growing more robust for quality over the years leading to robotic welding systems that allow increasingly tighter tolerances along with superior quality of weld as compared to manual process. This minimizes rework & scrap rates, but fast-tracks production schedules as well. Also, in some advanced robotic welding solutions, cobots work side by side with humans and allow human-robot cooperation on the shop floor safely. This adaptability allows robotic welding solutions to be seamlessly integrated into existing workflows with minimal interruption.

|

Driving Factors |

Description |

|---|---|

|

Increased Efficiency |

Automation reduces cycle times and increases throughput. |

|

Data Analytics Integration |

Real-time monitoring optimizes welding processes. |

|

Enhanced Quality |

Robotic systems ensure consistent and high-quality welds. |

|

Flexibility |

Cobots work alongside human operators, enhancing workflows. |

|

Predictive Maintenance |

IoT-enabled robots facilitate early detection of issues. |

|

Cost Reduction |

Minimizes labor costs and reduces waste and rework. |

Robotic Welding Market Restraints:

Attributing to its innovative technological advancements, the Robotic Welding Market is witnessing unprecedented progress; however, it will witness stiff competition from other welding strategies especially manual welding. Despite the undeniable benefits of robotic welding such as efficiency, precision and repeatability, manual welding can still be a great choice for many applications, particularly in smaller or more specialised projects. There is competition within which it can stifle the growth of robotic solutions for multiple reasons. There are a number of reasons for this, first manual welding typically involves lower initial costs, thus making it accessible to small and medium enterprises (SMEs) with limited budgets. Such businesses might value initial investment instead of the long-term benefits of automation. Manual welding is also more versatile; a skilled welder can adapt to different workpieces or changes in the project without the need for extensive programming and reconfiguration that robotic systems require. The ability to do this can make it attractive when designs change often in an industry. And, another great thing is the skilled labor force for manual welding itself. While welders with years and years of experience can produce high quality outputs, it becomes difficult for a robotic system to entirely replace human labor in many situations. Human welders might be favored over robots in industries that involve precision and artistry.

|

Feature |

Robotic Welding |

Manual Welding |

|---|---|---|

|

Initial Cost |

High |

Low |

|

Flexibility |

Limited (requires programming) |

High (adaptable to designs) |

|

Skill Requirement |

Specialized training needed |

Skilled labor widely available |

|

Skill Requirement |

High (continuous operation) |

Variable (depends on labor) |

|

Quality Consistency |

High (precise repeatability) |

Variable (depends on skill) |

|

Maintenance Needs |

Requires regular upkeep |

Variable (depends on skill) |

Robotic Welding Market Segment Analysis:

By Payload Capacity

In 2024, medium (30-60 kg) payload capacity accounted for a high market share as they are employed in various applications under heavy working conditions, especially across the automotive industry. Robots for welding arcPerfect for continuous operation with low maintenance and operating costs, these specialized robots from Kuka AG and FANUC Corporation are offered in a variety of designs.

On the other hand, due to growing demand for electric vehicles high (80-300kg) payload capacity is expected to witness highest CAGR during the forecast period . This segment is further aided by the convenience of the loading and unloading operations. On the other hand, the low payload capacity segment is expected to witness continuous growth owing to large-scale usage of spot and arc welding used by various industries.

By Industry

The automotive segment of the Robotic Welding Market is poised for significant growth, driven by several key factors. Firstly, the increasing demand for electric vehicles (EVs) is propelling automakers to adopt advanced robotic welding solutions to enhance production efficiency and precision. Additionally, the need for lightweight materials in vehicle manufacturing is further driving the adoption of robotic welding, as these systems can effectively join different materials, including metals and composites. Furthermore, the push towards smart manufacturing and Industry 4.0 initiatives is leading automotive companies to integrate automation and robotics into their production processes, improving overall productivity. The growing emphasis on safety and quality control in vehicle manufacturing also supports the expansion of robotic welding solutions. As a result, the automotive segment is expected to witness robust growth, reflecting the broader trends in the manufacturing industry toward automation and efficiency.

Robotic Welding Market Regional Analysis:

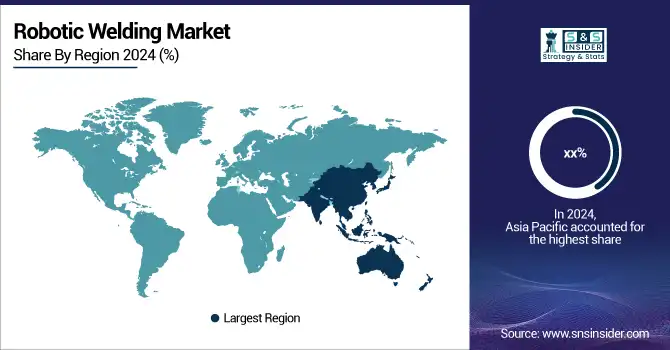

Asia Pacific Robotic Welding Market Insights

The Asia Pacific dominated the market and represented significant revenue share in 2024, due to growing industrial automation along with a robust manufacturing hub are supplanting in Japan, China, South Korea and India. Furthermore, the robotic welding market outlook is driven by being an integral part of Industry 4.0 techniques. However, the region boasts a topnotch presence of its existing companies along with various registered and unregulated manufacturers which is further aiding in capturing the market.

Technological development is improving variety of robotic welders in the automotive transportation, shipbuilding, and electrical and electronics sectors, leading to a rise in demand for robotic welding in India. Electric vehicles and other automotive products, as well as electrical component manufacturing facilities development. For instance, In March 2023, Tesla announced a collaboration with KUKA to enhance its automated manufacturing processes at its Gigafactory in Texas. This partnership focuses on integrating advanced robotic welding systems to streamline production lines for electric vehicles. KUKA’s robots will be utilized for tasks such as body assembly and battery integration, aiming to improve efficiency and reduce manufacturing times. This initiative reflects the growing trend of deploying robotic welding systems across the automotive industry, further driving innovation and productivity in the sector.

Need Any Customization Research On Robotic Welding Market - Inquiry Now

North America Robotic Welding Market Insights

The North American market is driven by the rapid adoption of Industry 4.0 technologies and advanced manufacturing solutions. Automotive and aerospace sectors are key end-users, demanding high precision and efficiency. Strong industrial infrastructure, technological innovation, and investments in smart factories are fueling the growth of robotic welding systems across the region.

Europe Robotic Welding Market Insights

Europe’s market growth is supported by the automotive, aerospace, and heavy machinery industries focusing on automation and quality. Government initiatives promoting Industry 4.0 and smart manufacturing adoption, along with technological advancements in collaborative robots, are accelerating robotic welding integration. The region emphasizes efficiency, safety, and precision in production processes.

Latin America (LATAM) and Middle East & Africa (MEA) Robotic Welding Market Insights

The LATAM and MEA markets are emerging as key growth regions due to industrial modernization and increasing automotive and construction activities. Investments in smart factories and automation solutions are rising. However, slower adoption rates and infrastructure challenges slightly limit growth, while demand for improved productivity, quality, and reduced labor dependency is driving interest in robotic welding systems.

Robotic Welding Market Key Players:

Some of the Robotic Welding Market Companies are

- KUKA AG - KUKA KR AGILUS

- FANUC Corporation - FANUC ARC Mate 100iD

- ABB Ltd. - ABB IRB 6700

- Yaskawa Electric Corporation - Yaskawa MOTOMAN MA2010

- MOTOMAN Robotics - Yaskawa MOTOMAN-MH24

- COMAU S.p.A. - COMAU Racer3

- Panasonic Corporation - Panasonic TA1800

- CLOOS GmbH - QINEO PULSE

- EWM AG - EWM Taktis

- Lincoln Electric Company - Lincoln Electric Robotic Welding Systems

- Hyundai Robotics - Hyundai HSR Series

- Stäubli Robotics - Stäubli TX2 Series

- ESAB Corporation - ESAB Rebel EMP 215IC

- Universal Robots A/S - UR10e

- Daihen Corporation - Daihen HLR Series

- TriStar Automation - TriStar Robot Welding Cell

- Kawasaki Heavy Industries, Ltd. - Kawasaki K-Rex

- Nachi-Fujikoshi Corp. - Nachi MZ Series

- Toshiba Machine Co., Ltd. - Toshiba Machine Robot Series

- SABER Technologies - SABER Robotic Welding Solutions

Competitive Landscape for Robotic Welding Market:

Yaskawa Electric Corporation is a leading provider of robotic welding solutions, offering advanced automation systems for automotive, aerospace, and industrial applications. Known for its MOTOMAN series, the company delivers high-precision, efficient, and flexible robotic welding technologies that enhance productivity, quality, and operational efficiency in smart manufacturing environments.

-

October 2023: Yaskawa unveiled a new series of robotic arms designed for heavy-duty welding tasks, providing increased payload capacity and improved flexibility.

KUKA AG is a global leader in robotic welding solutions, providing innovative automation systems for automotive, aerospace, and industrial sectors. Its KR AGILUS and other robotic platforms deliver high-precision, efficient, and flexible welding capabilities, enabling manufacturers to improve productivity, maintain quality standards, and advance smart manufacturing initiatives.

-

August 2023: KUKA launched its new welding robots equipped with AI technology, enhancing precision and efficiency in welding operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.51 Billion |

| Market Size by 2032 | USD 13.2 Billion |

| CAGR | CAGR of 7.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload Capacity (Low (6-22 kg), Medium (30-60 kg), High (80-300kg)) • By Type (Arc, Spot, MIG/TIG, Laser, Others) • By Industry (Automotive,Aerospace & Defense, Construction, Mining, Oil & Gas, Railway & Shipbuilding, Electrical & Electronics, Others (Steel Plant, Wind Turbines, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | KUKA AG, FANUC Corporation, ABB Ltd., Yaskawa Electric Corporation, MOTOMAN Robotics, COMAU S.p.A., Panasonic Corporation, CLOOS GmbH, EWM AG, Lincoln Electric Company, Hyundai Robotics |