Get More Information on Robotic Arm Market - Request Sample Report

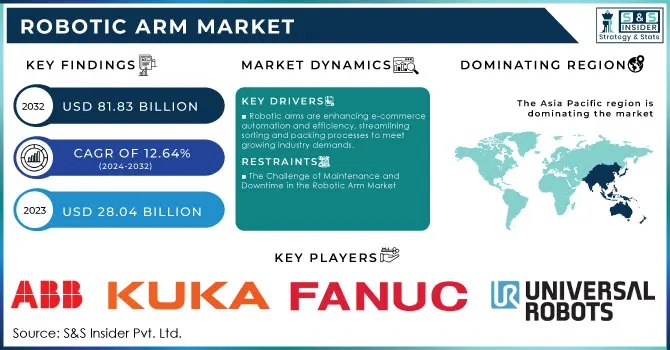

The Robotic Arm Market size was valued at USD 28.04 Billion in 2023 and is expected to reach USD 81.83 Billion by 2032 and grow at a CAGR of 12.64% over the forecast period 2024-2032.

The robotic arm market is set for considerable expansion, fueled by advancements in Industry 4.0 and the growing integration of Internet of Things (IoT) technologies within manufacturing. Notably, the number of active industrial robots worldwide is increasing at an impressive rate of approximately 14% per year. The GermX Initiative is at the forefront of this industrial transformation, promoting the creation of "data spaces" that enhance collaboration throughout the manufacturing sector. This initiative underscores the critical role of interoperability in unlocking the full potential of Industry 4.0. VDMA, the largest industrial association in Europe, is focused on establishing standardized machine communication via the OPC UA framework, which has already been adopted by over 700 companies globally. Robotic arms are particularly impactful in sectors such as automotive and electronics, where they are deployed for a variety of tasks, including assembly, welding, quality inspection, and precision surgery. Collaborative robots, or cobots, which are designed to work alongside human operators, are gaining popularity for their enhanced flexibility and efficiency, especially among small and medium-sized enterprises.

Moreover, the logistics and warehousing industries are undergoing a significant transformation, as robotic arms play a crucial role in sorting, packing, and transporting goods, thereby enabling businesses to efficiently meet the rising demands of e-commerce. Additionally, advancements in artificial intelligence and machine learning are further augmenting the capabilities of robotic arms, making them smarter and more adaptable, which solidifies their importance in the future of manufacturing. In summary, the robotic arm market is on the cusp of substantial growth, driven by Industry 4.0, and is establishing automation as a vital component of modern manufacturing strategies. The key statistics and trends highlight the necessity for businesses to embrace these technologies to maintain competitiveness in an ever-evolving industrial landscape.

Drivers

Robotic arms are enhancing e-commerce automation and efficiency, streamlining sorting and packing processes to meet growing industry demands.

The increasing demand for automation is one of the primary market drivers for the robotic arm industry, especially in sectors like e-commerce and logistics. As businesses seek to enhance operational efficiency and productivity, robotic arms are becoming essential tools for streamlining various processes, including sorting, packing, and inventory management. E-commerce companies, particularly those facing economic pressures, are increasingly adopting robotic solutions to automate resource-intensive tasks, which helps reduce labor costs and minimize human error. The rise of smart warehouses facilitated by the integration of advanced technologies such as artificial intelligence further amplifies the capabilities of robotic arms, positioning them as indispensable assets for meeting the challenges of high-volume order fulfillment. This trend toward automation not only optimizes supply chains but also significantly improves customer experiences. Additionally, technological advancements are making robotic arms more accessible and affordable for small and medium-sized enterprises, thus broadening their market reach.

Restraints

The Challenge of Maintenance and Downtime in the Robotic Arm Market

A major constraint on the robotic arm market is the challenge posed by maintenance and downtime, which can significantly disrupt operations and incur additional costs. Although robotic systems are engineered for high efficiency, they require consistent maintenance to maintain optimal functionality and extend their lifespan. This maintenance typically involves routine inspections, part replacements, and software updates, all of which demand dedicated personnel and resources. For instance, in surgical robotics utilized for procedures like colorectal cancer surgery, any downtime can hinder crucial operations, negatively affecting patient care and hospital efficiency. Companies such as Universal Robots are actively seeking partnerships to bolster the capabilities and reliability of their robotic arms, indicating that even cutting-edge systems face operational hurdles. When robotic arms malfunction or need servicing, it can lead to considerable interruptions in production lines, especially in manufacturing and logistics, where rapid task handling—like sorting, packing, and assembly—is essential. The financial repercussions of lost productivity during these downtimes can be significant, particularly for businesses striving to stay competitive. This risk is heightened in sectors like e-commerce, where prompt order fulfillment is vital for customer satisfaction. Thus, maintenance needs and potential downtime present notable challenges to widespread robotic arm adoption, particularly for smaller enterprises.

By Type

In 2023, articulated robotic arms became the leading segment in the robotic arm market, accounting for around 35% of total revenue. This significant market share is largely due to their versatility and applicability across diverse industries. Articulated robots feature multi-jointed structures that provide a wide range of motion, making them ideal for complex tasks such as welding, painting, assembly, and packaging. Their design allows them to replicate human arm movements, enabling operation in confined spaces and execution of intricate maneuvers, which is invaluable in manufacturing settings.The demand for articulated robotic arms is particularly strong in the automotive, electronics, and consumer goods sectors. For example, in automotive manufacturing, these robots play a crucial role in assembly lines for material handling and precision welding. Furthermore, ongoing advancements in technology, especially in AI and machine learning, have improved the precision and efficiency of articulated robots, facilitating their integration into existing workflows with enhanced programming interfaces. Increased investments from major industry players in automation solutions have also fueled their growth. As the push for automation continues globally, along with the rise of smart manufacturing and Industry 4.0 initiatives, the articulated robot segment is poised for sustained demand and market leadership.

By Application

In 2023, materials handling emerged as the leading application segment in the robotic arm market, accounting for around 47% of total revenue. This substantial share highlights the crucial role of robotic arms in enhancing logistics and supply chain efficiency across various industries. Robotic arms are particularly effective in automating repetitive and labor-intensive tasks such as picking, packing, sorting, and palletizing. Their capability to operate quickly and accurately significantly improves overall productivity, allowing businesses to manage larger volumes of goods more efficiently. By automating these processes, companies can lower labor costs associated with manual handling, a vital consideration for sectors like e-commerce and manufacturing, where operational expenses can be high. Furthermore, the integration of robotic arms with advanced technologies, including AI, machine learning, and IoT, enhances their effectiveness in materials handling, enabling real-time monitoring and predictive maintenance. Their flexibility and scalability allow for easy adaptation to various tasks and quick adjustments to changing market demands. The adoption of robotic arms in materials handling spans numerous sectors, including retail and logistics

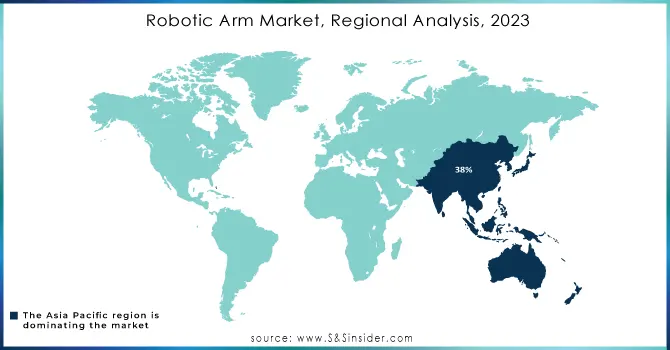

In 2023, the Asia Pacific region led the robotic arm market, securing around 38% of total revenue due to its strong manufacturing capabilities and rapid technological progress. This region hosts major manufacturing economies, including China, Japan, and South Korea. China, as the largest manufacturing hub, has significantly invested in automation, driving demand for robotic arms across diverse industries. Japan is renowned for its advanced robotics research, with companies like Fanuc and Yaskawa Electric at the forefront of innovation. Additionally, South Korea is enhancing its automation efforts, increasingly utilizing robotic arms for assembly and welding tasks.

Technological advancements, particularly in artificial intelligence and machine learning, have further propelled the region's robotics sector. For example, SoftBank Robotics' Pepper robot exemplifies how AI enhances robotic functionality, appealing to manufacturers. Government initiatives also play a crucial role; China’s “Made in China 2025” and South Korea’s “Manufacturing Innovation 3.0” strategies promote robotics adoption. Rising labor costs in China compel manufacturers to seek automation to maintain profitability, while e-commerce growth in countries like China and India drives investments in robotic solutions for efficient order fulfillment. Overall, these factors position the Asia Pacific region as a powerhouse in the global robotic arm market.

In 2023, North America distinguished itself as the fastest-growing region in the robotic arm market, propelled by technological advancements, significant investments in automation, and an escalating demand for robotics across multiple sectors. The United States plays a pivotal role in this landscape, witnessing remarkable progress in automation technology, particularly in manufacturing, healthcare, and logistics. Leading companies such as ABB, KUKA, and Universal Robots are innovating robotic solutions that significantly improve operational efficiency and productivity. This growth aligns with the increasing adoption of Industry 4.0 principles, which emphasize the integration of smart technologies and data analytics into manufacturing workflows. Additionally, the surge in e-commerce has heightened the need for robotic arms to enhance order fulfillment processes, including sorting and packing. The growing emphasis on automation as a means to tackle labor shortages and rising operational costs further accelerates the region’s development. Supportive government initiatives and increased funding for robotics research and development have fostered an environment conducive to innovation. Consequently, North America is well-positioned for continued robust growth in the robotic arm market, showcasing its dedication to advancing automation technologies across various industries.

Need Any Customization Research On Robotic Arm market - Inquiry Now

Some of the major key players in Robotic Arm market with product:

ABB Ltd. (IRB Series Robots)

KUKA AG (LBR iiwa Collaborative Robots)

FANUC Corporation (M-20iA Series)

Yaskawa Electric Corporation (MOTOMAN Series)

Universal Robots (UR3, UR5, UR10)

NACHI-FUJIKOSHI Corp. (MC Series Robots)

Siemens AG (Simatic Robot)

Omron Corporation (LD Series Autonomous Mobile Robots)

Mitsubishi Electric Corporation (RV Series Robots)

Epson Robots (Epson C4 Series)

Denso Corporation (VS-Series Robots)

Rethink Robotics (Baxter and Sawyer Robots)

Kawasaki Heavy Industries (K-Series Robots)

Robot System Products AB (RSX and RSP Robotic Arms)

Schunk GmbH & Co. KG (PGS and PGS Plus Grippers)

Stäubli Robotics (TX Series Robots)

Cyberdyne Inc. (HAL Exoskeleton)

Festo AG & Co. KG (BionicSoftHand)

Adept Technology (Adept Viper Series)

Kinova Robotics (J2 Robot Arm)

List key raw material suppliers for robotic arms, which provide essential components and materials used in manufacturing robotic systems:

BASF SE

DuPont de Nemours, Inc.

Aluminum Corporation of China Limited (CHALCO)

Thyssenkrupp AG

3M Company

Hitachi Metals, Ltd.

CeramTec GmbH

Mitsubishi Materials Corporation

Ferro Corporation

Siemens AG (Digital Industries)

Parker Hannifin Corporation

SKF Group

SABIC (Saudi Basic Industries Corporation)

Toray Industries, Inc.

Eaton Corporation

Emerson Electric Co.

Nippon Steel Corporation

Kukdong Industrial Co., Ltd.

Huntsman Corporation

Northrop Grumman Corporation

On October 24, 2024, [FABRI Creator] unveiled a tutorial for building a mini robotic arm, enabling enthusiasts to automate small, repeatable tasks at a low cost. This DIY project is designed for beginners, making robotics more accessible without the need for expensive industrial systems.

On October 24, 2024, GITAI USA Inc. announced that its Inchworm-type Robotic Arm achieved Technology Readiness Level 6 (TRL6) after successfully completing tests in a thermal vacuum chamber simulating lunar conditions. This advancement underscores GITAI's commitment to reducing space operation costs through innovative robotic technologies, including lunar rovers and robotic satellites.

On October 24, 2024, McMaster University researcher Andrew Gadsden announced a collaboration with the developer of the Canadarm to enhance the reliability and accuracy of robotic arms used in space. Gadsden plans to build a highly complex robotic arm in the lab to predict and address malfunctions during space missions.

On October 9, 2024, Amazon showcased its latest robotics innovations at its new fulfillment center in Shreveport, Louisiana, highlighting the integration of over 750,000 robots into its operations. This initiative aims to enhance employee safety and productivity while accelerating package delivery times for customers.

On October 19, 2024, engineering students at the Four Rivers Career Center received a robotic arm donated by Parker Hannifin - Sporlan Division, aimed at enhancing their robotics skills. The donation will enable students to integrate the technology into projects focused on developing independent robotic systems for HVAC and refrigeration manufacturing.

On October 12, 2024, Indian Creek High School introduced FANUC robotic arms into its curriculum, providing students with advanced tools for hands-on training. This initiative aims to better prepare students for future careers in robotics and automation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.04 Billion |

| Market Size by 2032 | USD81.83 Billion |

| CAGR | CAGR of 12.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated, Cartesian, SCARA, Spherical or Polar, Cylindrical, Others), • By Application (Materials Handling, Cutting and Processing, Soldering and Welding, Assembling and Disassembling, Others), • By End User (Automotive, Electrical and Electronics, Metals and Machinery, Plastics and Chemicals, Food and Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots, NACHI-FUJIKOSHI Corp., Siemens AG, Omron Corporation, Mitsubishi Electric Corporation, Epson Robots, Denso Corporation, Rethink Robotics, Kawasaki Heavy Industries, Robot System Products AB, Schunk GmbH & Co. KG, Stäubli Robotics, Cyberdyne Inc., Festo AG & Co. KG, Adept Technology, and Kinova Robotics. |

| Key Drivers | • Robotic arms are enhancing e-commerce automation and efficiency, streamlining sorting and packing processes to meet growing industry demands. |

| RESTRAINTS | • The Challenge of Maintenance and Downtime in the Robotic Arm Market |

Ans: The Robotic Arm Market size was valued at USD 28.04 Billion in 2023 and is expected to reach USD 81.83 Billion by 2032

Ans: North America is dominating the Robotic Arm Market.

Ans: Robotic Arm Market is to expand by 12.64% from 2024 to 2032.

Ans: Articulated segment is dominating in Robotic Arm Market

Ans: Increasing demand for automation in manufacturing processes to enhance efficiency and reduce labor costs.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Robotic Arm Production and Sales Volumes, 2020-2032, by Region

5.2 Compliance with Industry Standards and Regulations, by Region

5.3 Robotic Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on robotic arm maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Robotic Arm Market Segmentation, by Type

7.1 Chapter Overview

7.2 Articulated

7.2.1 Articulated Market Trends Analysis (2020-2032)

7.2.2 Articulated Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Cartesian

7.3.1 Cartesian Market Trends Analysis (2020-2032)

7.3.2 Cartesian Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 SCARA

7.4.1 SCARA Market Trends Analysis (2020-2032)

7.4.2 SCARA Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Spherical or Polar

7.5.1 Spherical or Polar Market Trends Analysis (2020-2032)

7.5.2 Spherical or Polar Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Cylindrical

7.5.1 Cylindrical Market Trends Analysis (2020-2032)

7.5.2 Cylindrical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Robotic Arm Market Segmentation, by Application

8.1 Chapter Overview

8.2 Materials Handling

8.2.1 Materials Handling Market Trends Analysis (2020-2032)

8.2.2 Materials Handling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cutting and Processing

8.3.1 Cutting and Processing Market Trends Analysis (2020-2032)

8.3.2 Cutting and Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Soldering and Welding

8.4.1 Soldering and Welding Market Trends Analysis (2020-2032)

8.4.2 Soldering and Welding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5Assembling and Disassembling

8.5.1Assembling and Disassembling Market Trends Analysis (2020-2032)

8.5.2Assembling and Disassembling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Robotic Arm Market Segmentation, by End User

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Electrical and Electronics

9.3.1 Electrical and Electronics Market Trends Analysis (2020-2032)

9.3.2 Electrical and Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Metals and Machinery

9.4.1 Metals and Machinery Market Trends Analysis (2020-2032)

9.4.2 Metals and Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Plastics and Chemicals

9.5.1 Plastics and Chemicals Market Trends Analysis (2020-2032)

9.5.2 Plastics and Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Food and Beverages

9.6.1 Food and Beverages Market Trends Analysis (2020-2032)

9.6.2 Food and Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Robotic Arm Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Robotic Arm Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Robotic Arm Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Robotic Arm Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 ABB Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 KUKA AG

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 FANUC Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Yaskawa Electric Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Universal Robots

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 NACHI-FUJIKOSHI Corp.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Siemens AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Omron Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Mitsubishi Electric Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Epson Robots

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Articulated

Cartesian

SCARA

Spherical or Polar

Cylindrical

Others

By Application

Materials Handling

Cutting and Processing

Soldering and Welding

Assembling and Disassembling

Others

By End User

Automotive

Electrical and Electronics

Metals and Machinery

Plastics and Chemicals

Food and Beverages

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Inline Metrology Market Size was valued at USD 0.60 billion in 2023 and is expected to reach USD 1.45 billion by 2032 and grow at a CAGR of 10.29% over the forecast period 2024-2032.

The Interactive Kiosk Market Size was valued at $32.18 Billion in 2023 and is expected to reach $64.51 Billion by 2032, at a CAGR of 8.05% During 2024-2032

The Consumer Drones Market size was valued at USD 5.20 Billion in 2023. It is estimated to reach USD 15.78 Billion by 2032, at a CAGR of 13.15% by 2024-2032

The Semiconductor Intellectual Property Market Size was valued at USD 7.04 Billion in 2023 and is expected to reach USD 15.68 Billion by 2032 and grow at a CAGR of 9.77% over the forecast period 2024-2032.

The X-Ray Security Screening Market Size was USD 5.85 Billion in 2023 and will reach USD 11.76 Billion by 2032 and grow at a CAGR of 8.09% by 2024-2032.

The Rugged Display Market Size was valued at USD 10.63 Billion in 2023 and is expected to grow at a CAGR of 6.08% to reach USD 18.02 Billion by 2032.

Hi! Click one of our member below to chat on Phone