Get more information on the Road Safety System Market - Request a Free Sample Report.

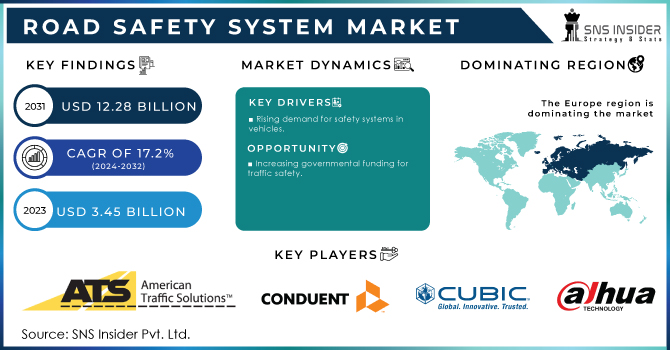

The Road Safety System Market size was recorded at USD 3.45 Billion in 2023 and is expected to reach USD 12.28 Billion by 2031 and grow at a CAGR of 17.2% over the forecast period of 2024-2031.

There has been an increase in the number of road accidents and fatalities which are driving the Road safety system market. The rising demand for public safety and investments in road infrastructure is likely to support market expansion prospects. Furthermore, many governments of the land owned overseas are busy to making a tensile traffic accident as well by various programs & initiatives. To reduce the number of road accidents and deaths, authorities worldwide are concentrating on maintaining traffic civility for safe driving.

Globally, the rise in road deaths has been a major factor driving sales for improved technology on roads. According to the World Health Organization (WHO), every year 1.3 million people die, and a range of between 20 - 50 million more are injured due to road accidents, WHO estimates on reading for health in traffic dataset from- kilometers, committed by drivers around the world who spend all day together at work or socializing with each other. As a result, road safety has become an increasing focus with many government initiatives from around the world dedicated to reducing these numbers. In addition, the expanding focus on public safety has directed authorities to contribute towards road infrastructure. For instance, the Smart Mobility 2030 strategic proposal released by the Intelligent Transportation Society Singapore (ITSS) in partnership with the Land Transport Authority, Singapore Government Initiative is focused on implementing intelligent transport services to provide sustainable smart mobility solutions for the benefit of commuters.

Positive steps taken to enforce road safety systems including policies and traffic monitoring devices will further propel the market growth through 2021. The Road to Zero initiative, by the U.S. federal government is an epic example of this where there will be no traffic fatalities by 2050. Zero fatalities in traffic should be the goal, says the National Safety Council initiative In India, the Ministry of Road Transport and Highways has been making efforts for better road safety standards to bring down accidents on National Highways.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Solution Type (Red Light & Speed Enforcement, Incident Detection & Response, Automatic Number, Others), • by Service Type (Professional Services, Managed Services) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | American Traffic Solutions, Conduent, Cubic Corporation, Dahua Technology, FLIR Services, IDEMIA, Siemens, Swarco, Vitronic |

Driver:

Rising demand for safety systems in vehicles.

The importance of vehicle safety has become more known by the public as a whole. Safety systems are a big marketing angle for automakers, as more and more consumers know what they want in terms of safety specifications. This is precisely why car insurance providers often offer discounts to policyholders who drive models equipped with state-of-the-art safety features. This has led more customers to opt for cars with safety functions. The rapid advancement of technology has helped to bring highly sophisticated safety systems into the reach of all. Features such as lane-keeping assistance, adaptive cruise control systems, and collision avoidance are more common now.

Restrain:

The requirement of high investments.

Opportunity

Increasing governmental funding for traffic safety

Safety on the road is becoming more and more important to governments globally. This is hardly surprising since traffic accidents are not only costly in money but also take many human lives. Governments have been investing in road safety systems among many other road safety initiatives. Road safety systems technology evolution: Innovation in road safety systems has grown rapidly over the years. ITS (Intelligent Transportation System) is one of the technologies that are being developed to improve traffic control and reduce accident rates. These are the technological advancements necessitating road safety systems.

Challenges

The high cost and the adaptability issues are also the requirements of highly skilled professionals.

By Solution Type

Red Light & Speed Enforcement

Incident Detection & Response

Automatic Number

Others

In this segmentation, The red light & speed enforcement segment accounted for a market share of more than 55% in 2023. Additionally, these services were installed at road intersections or along roads to maintain traffic discipline. However, with advances in technology, companies began to focus on providing services that offer speed and red-light monitoring capability in a signal device. These advances in product design boost the market growth. For instance, TraffiStar and Jenoptik provide combined speed monitoring and red lights that use high-resolution cameras to record traffic offenses up to four lanes.

By Service Type

Professional Services

Managed Services

The professional service segment accounted for the largest market share of more than 80% in 2023. Service integration, installation, training, consulting, and support and maintenance are all included in the professional services section. A certain amount of calibration is needed for the equipment to be implemented, in addition to routine maintenance and observation. Consequently, industry growth over the past few years has been driven mostly by the demand for professional services, and this trend is expected to continue.

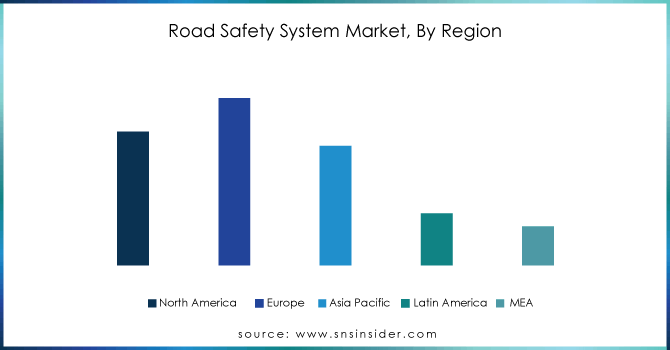

Europe accounted for a significant portion of the market more than 26% in 2023. Modern road infrastructure and a high level of technological adoption have increased sales in Europe. Due to the presence of multiple businesses that have a significant end-user base and a strong regional presence, the region will continue to contribute to the total market demand. Europe has developed an advanced approach to road safety that emphasizes preventative measures. While Europe has a lower road accident death rate than the world average, the rates differ primarily between nations. As a result, several nations are working to reduce the likelihood of these deaths by developing national road safety policies.

Over the projected period, Asia Pacific is expected to emerge as the regional market with the fastest pace of growth. Regional expansion is being encouraged by rising investments in the development of road infrastructure and the growing requirement of maintaining traffic discipline. Furthermore, nations like China and India have enormous geographical areas, as well as a vast network of roads and highways. Together, these nations' increasing road building and development are driving the Asia Pacific market's expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are American Traffic Solutions, Conduent, Cubic Corporation, Dahua Technology, FLIR Services, IDEMIA, Siemens, Swarco, Vitronic and others.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.45 Bn |

| Market Size by 2031 | US$ 12.28 Bn |

| CAGR | CAGR of 17.2 % From 2023 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Rising demand for safety systems in vehicles. |

| Market Restraints | • The requirement of high investments. |

Ans; GAGR of 17.2% over the forecast period of 2024-2031.

Ans: The Road Safety System Market size was recorded at USD 3.45 Bn in 2023 and is expected to reach USD 12.28 Bn by 2031.

Ans: Rising demand for safety systems in vehicles.

Ans: The high cost and the adaptability issues, also the requirement of highly skilled professionals.

Ans: North America is the largest market for road safety systems.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Road safety system Market Segmentation, By Solution Type

7.1 Introduction

7.2 Red Light & Speed Enforcement

7.3 Incident Detection & Response

7.4 Automatic Number

7.5 Others

8. Road safety system Market Segmentation, By Service Type

8.1 Introduction

8.2 Professional Services

8.3 Managed Services

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Road Safety System Market by Country

9.2.3 North America Road Safety System Market By Solution Type

9.2.4 North America Road Safety System Market By Service Type

9.2.5 USA

9.2.5.1 USA Road Safety System Market By Solution Type

9.2.5.2 USA Road Safety System Market By Service Type

9.2.6 Canada

9.2.6.1 Canada Road Safety System Market By Solution Type

9.2.6.2 Canada Road Safety System Market By Service Type

9.2.7 Mexico

9.2.7.1 Mexico Road Safety System Market By Solution Type

9.2.7.2 Mexico Road Safety System Market By Service Type

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Road Safety System Market by Country

9.3.2.2 Eastern Europe Road Safety System Market By Solution Type

9.3.2.3 Eastern Europe Road Safety System Market By Service Type

9.3.2.4 Poland

9.3.2.4.1 Poland Road Safety System Market By Solution Type

9.3.2.4.2 Poland Road Safety System Market By Service Type

9.3.2.5 Romania

9.3.2.5.1 Romania Road Safety System Market By Solution Type

9.3.2.5.2 Romania Road Safety System Market By Service Type

9.3.2.6 Hungary

9.3.2.6.1 Hungary Road Safety System Market By Solution Type

9.3.2.6.2 Hungary Road Safety System Market By Service Type

9.3.2.7 turkey

9.3.2.7.1 Turkey Road Safety System Market By Solution Type

9.3.2.7.2 Turkey Road Safety System Market By Service Type

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Road Safety System Market By Solution Type

9.3.2.8.2 Rest of Eastern Europe Road Safety System Market By Service Type

9.3.3 Western Europe

9.3.3.1 Western Europe Road Safety System Market by Country

9.3.3.2 Western Europe Road Safety System Market By Solution Type

9.3.3.3 Western Europe Road Safety System Market By Service Type

9.3.3.4 Germany

9.3.3.4.1 Germany Road Safety System Market By Solution Type

9.3.3.4.2 Germany Road Safety System Market By Service Type

9.3.3.5 France

9.3.3.5.1 France Road Safety System Market By Solution Type

9.3.3.5.2 France Road Safety System Market By Service Type

9.3.3.6 UK

9.3.3.6.1 UK Road Safety System Market By Solution Type

9.3.3.6.2 UK Road Safety System Market By Service Type

9.3.3.7 Italy

9.3.3.7.1 Italy Road Safety System Market By Solution Type

9.3.3.7.2 Italy Road Safety System Market By Service Type

9.3.3.8 Spain

9.3.3.8.1 Spain Road Safety System Market By Solution Type

9.3.3.8.2 Spain Road Safety System Market By Service Type

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Road Safety System Market By Solution Type

9.3.3.9.2 Netherlands Road Safety System Market By Service Type

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Road Safety System Market By Solution Type

9.3.3.10.2 Switzerland Road Safety System Market By Service Type

9.3.3.11 Austria

9.3.3.11.1 Austria Road Safety System Market By Solution Type

9.3.3.11.2 Austria Road Safety System Market By Service Type

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Road Safety System Market By Solution Type

9.3.2.12.2 Rest of Western Europe Road Safety System Market By Service Type

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Road Safety System Market by Country

9.4.3 Asia Pacific Road Safety System Market By Solution Type

9.4.4 Asia Pacific Road Safety System Market By Service Type

9.4.5 China

9.4.5.1 China Road Safety System Market By Solution Type

9.4.5.2 China Road Safety System Market By Service Type

9.4.6 India

9.4.6.1 India Road Safety System Market By Solution Type

9.4.6.2 India Road Safety System Market By Service Type

9.4.7 japan

9.4.7.1 Japan Road Safety System Market By Solution Type

9.4.7.2 Japan Road Safety System Market By Service Type

9.4.8 South Korea

9.4.8.1 South Korea Road Safety System Market By Solution Type

9.4.8.2 South Korea Road Safety System Market By Service Type

9.4.9 Vietnam

9.4.9.1 Vietnam Road Safety System Market By Solution Type

9.4.9.2 Vietnam Road Safety System Market By Service Type

9.4.10 Singapore

9.4.10.1 Singapore Road Safety System Market By Solution Type

9.4.10.2 Singapore Road Safety System Market By Service Type

9.4.11 Australia

9.4.11.1 Australia Road Safety System Market By Solution Type

9.4.11.2 Australia Road Safety System Market By Service Type

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Road Safety System Market By Solution Type

9.4.12.2 Rest of Asia-Pacific Road Safety System Market By Service Type

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Road Safety System Market by Country

9.5.2.2 Middle East Road Safety System Market By Solution Type

9.5.2.3 Middle East Road Safety System Market By Service Type

9.5.2.4 UAE

9.5.2.4.1 UAE Road Safety System Market By Solution Type

9.5.2.4.2 UAE Road Safety System Market By Service Type

9.5.2.5 Egypt

9.5.2.5.1 Egypt Road Safety System Market By Solution Type

9.5.2.5.2 Egypt Road Safety System Market By Service Type

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Road Safety System Market By Solution Type

9.5.2.6.2 Saudi Arabia Road Safety System Market By Service Type

9.5.2.7 Qatar

9.5.2.7.1 Qatar Road Safety System Market By Solution Type

9.5.2.7.2 Qatar Road Safety System Market By Service Type

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Road Safety System Market By Solution Type

9.5.2.8.2 Rest of Middle East Road Safety System Market By Service Type

9.5.3 Africa

9.5.3.1 Africa Road Safety System Market by Country

9.5.3.2 Africa Road Safety System Market By Solution Type

9.5.3.3 Africa Road Safety System Market By Service Type

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Road Safety System Market By Solution Type

9.5.2.4.2 Nigeria Road Safety System Market By Service Type

9.5.2.5 South Africa

9.5.2.5.1 South Africa Road Safety System Market By Solution Type

9.5.2.5.2 South Africa Road Safety System Market By Service Type

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Road Safety System Market By Solution Type

9.5.2.6.2 Rest of Africa Road Safety System Market By Service Type

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Road Safety System Market by Country

9.6.3 Latin America Road Safety System Market By Solution Type

9.6.4 Latin America Road Safety System Market By Service Type

9.6.5 brazil

9.6.5.1 Brazil Road Safety System Market By Solution Type

9.6.5.2 Brazil Road Safety System Market By Service Type

9.6.6 Argentina

9.6.6.1 Argentina Road Safety System Market By Solution Type

9.6.6.2 Argentina Road Safety System Market By Service Type

9.6.7 Colombia

9.6.7.1 Colombia Road Safety System Market By Solution Type

9.6.7.2 Colombia Road Safety System Market By Service Type

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Road Safety System Market By Solution Type

9.6.8.2 Rest of Latin America Road Safety System Market By Service Type

10. Company Profiles

10.1 American Traffic Solutions

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Conduent

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Cubic Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Dahua Technology

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 FLIR Services

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 ITEMS

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Siemens

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Swarco

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Vitronic

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Kapsch TraficCom

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Car Carburetors Market was valued at USD 1.93 billion in 2023 and is expected to reach USD 2.79 Billion by 2032, growing at a CAGR of 4.18% from 2024-2032.

Automotive Active Purge Pump Market Size was valued at USD 94.90 million in 2023 and is expected to reach USD 1910 million by 2031 and grow at a CAGR of 45.73% over the forecast period 2024-2031.

The Luxury Car Market Size was valued at USD 658.43 billion in 2023, and will reach to USD 1210.49 billion by 2032, and grow at a CAGR of 7% by 2024-2032.

The Off-highway Vehicle Lighting Market Size was valued at USD 1.18 billion in 2023 & will reach $2.22 billion by 2032 & grow at a CAGR of 7.3% by 2024-2032

The Automotive Solar Sunroof Market size was valued at USD 3.62 million in 2023 & is expected to reach USD 413.22 Mn by 2032, with a growing at CAGR of 69.33% over the forecast period of 2024-2032.

The Automated Parking System Market size was valued at USD 2.10 billion in 2023 & reach USD 7.78 billion by 2031 and grow at a CAGR of 17.8% by 2024-2031

Hi! Click one of our member below to chat on Phone