Get More Information on Rigid Plastic Packaging Market - Request Sample Report

The Rigid Plastic Packaging Market size was USD 147282.50 million in 2023 and is expected to Reach USD 224324.15 million by 2031 and grow at a CAGR of 5.4% over the forecast period of 2024-2031.

The country's high proportion of organized retail has also significantly increased the use of plastic packaging. The packaged food and beverage sector has experienced rapid growth on a global level over the last few years. A number of macroeconomic factors, such as changing lifestyles, an increase in the urban population, increased economic activity in emerging markets, and greater penetration of e-retail globally, are driving the global packaged food sector. Additionally, the projected increase in the global population from 7.1 billion in 2015 to 9.5 billion in 2050 will lead to a rise in food demand, which is predicted to lead to an increase in the demand for plastic packaging materials.

Additionally, more opportunities for plastic packaging are anticipated in the coming years as innovative packaging solutions like active packaging, modified environment packaging, edible packaging, and bioplastic packaging continue to be introduced. However, it is anticipated that increased sustainability awareness and a strict ban on single-use plastic to reduce plastic pollution will endanger the sector's future.

Due to its durability and high aesthetic appeal, the rigid segment dominated the plastic packaging market and generated the most revenue, amounting to 60.2% of total sales, in 2021. In addition, rigid packaging's high barrier to light, moisture, and oxygen played a role in the segment's higher market share in 2021. The growth of rigid plastic products is likely to be aided by their reusability as industrial packaging materials like pallets, and other rigid packaging are reused repeatedly.

KEY DRIVERS:

Reusing and recycling rigid packaging materials.

The demand for rigid plastic packaging across various industries

Many industries benefit from rigid plastic packaging's durability, lightweight, and flexibility. Extrusion, injection molding, blow molding, thermoforming, and other processes are just a few of the methods used to create these packing components. To keep the products safe for a longer period of time, stiff plastic packaging made of substances like polyethylene, expanded polystyrene, and others is used. In addition, one of the key elements driving the expansion of the rigid plastic packaging market is the rise in packaged goods sales, which is a result of changing lifestyles.

RESTRAIN:

Increased competition from other plastic packaging companies.

An increase in the demand for alternative packaging.

Alternative packaging materials that are friendlier to the environment are gaining popularity among consumers. Due to their favorable environmental effects and high recyclability, aluminum and glass are widely accepted. People are consequently growing more skeptical of plastic. Also encouraging people to use biodegradable films rather than plastic is increased consumer awareness of good health and green packaging materials. The expansion of the global plastic packaging market is anticipated to be constrained by this during the forecast period.

OPPORTUNITY:

Rise of markets in emerging regions.

Innovation and consumer awareness

Manufacturers of rigid plastic packaging can spend money on research and development to produce cutting-edge materials like bio-based plastics, recyclable plastics, or biodegradable substitutes. These advancements can not only address environmental issues but also satisfy the evolving needs of consumers who care about the environment.

CHALLENGES:

Increasing environmental concerns.

Recycling of the plastic waste

Sustainable plastic packaging waste is a challenging process that requires high quality infrastructure. It takes a lot of time and requires staff expertise. However, recycling facilities are lacking in some parts of the world. The issue of insufficient recycling infrastructure exists even in wealthy nations like the US. Over USD 10 billion in recyclable containers are thrown away annually in the United States alone due to a lack of recycling facilities.

Russia's and Ukraine's ongoing conflict decreased exports of plastics to nations including resin, plastics machinery, plastics molds, and plastic goods. Exports of plastics to Russia fell from $100.1 million to $37.8 million, a 61.4% decrease, and exports to Ukraine fell from $20.3 million to $9.4 million, a 50.4% decline. So far, 2022 has been the last year for Russia and Ukraine to receive any exports of plastic machinery or molds.

Polytetrafluoroethylene (PTFE) and other fluoropolymers are two of the top ten sources from Russia. A total of 0.95 million kg of PTFE and other fluoropolymers were produced in Russia; this is a decrease from 1.16 million kg during the same time period in 2021.

As people become more prudent with their money, consumer spending tends to decline. This could lead to a decrease in the demand for goods that are packaged in rigid plastic containers, which would decrease sales for the companies that make the packaging.

Manufacturers may reduce their output in response to declining market demand. For businesses that manufacture rigid plastic packaging, this may mean decreased output and earnings. In order to mitigate the effects of the recession, it may also result in cost-cutting measures like layoffs or shortened workweeks.

The COVID-19 epidemic severely disrupted the supply chain, which had a negative impact on the rigid packaging industry. The shutdown in China, one of the major producers of plastic with more than 40% of the global market share, in the first quarter of 2020, has impacted manufacturers of plastic packaging globally. Due to the dearth of plastics produced by Chinese manufacturers, there is an imbalance between supply and demand. But the demand-supply imbalance was most prominent in the first quarter of 2020.

Covid 19 had a significant impact on the production and use of plastics in 2020-21. Plastic production, use, and waste were significantly impacted in 2020 by the COVID-19 pandemic and lockdown measures. Most industries saw a decrease in the use of plastics in tandem with a decrease in output and demand, particularly those that use large amounts of plastics, like the construction, trade, and automotive industries. 9.8 million tons (Mt) or a 2.1% decrease in global plastics consumption is projected for 2020, which is 4.3% less than the pre-COVID forecast.

By Raw Material

Bioplastics

Polypropylene

Polyethylene

Polystyrene

Polyvinyl Chloride

Expanded Polystyrene

Others

By Product type:

Bottle & Jars

Trays

Rigid Bulk Products

Others

By Production Process:

Thermoforming

Extrusion

Blow Molding

Others

By Application:

Food & Beverages

Household

Healthcare

Personal Care

Others

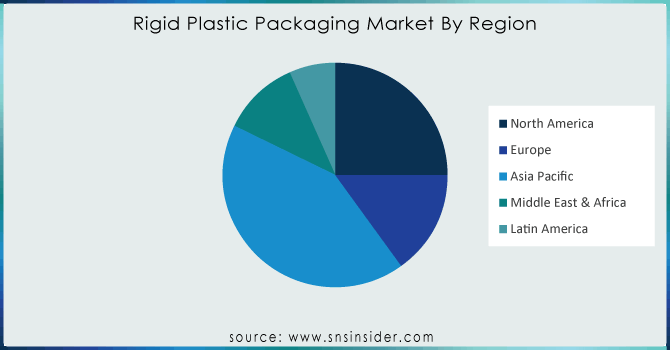

Asia Pacific dominated the plastic packaging industry. Rapidly developing application sectors in significant economies like China, and India, are expected to increase regional demand throughout the projection period.

Despite surpassing Asia Pacific as the second-largest regional market for plastic packaging, Europe is predicted to grow slowly over the course of the projected period. Slow market growth in the region is primarily attributed to stringent restrictions on the use of plastic packaging and high consumer concern for sustainability.

China’s rigid plastic packaging market is holding the largest market share and India’s rigid plastic packaging market is an emerging and rapidly growing market in the Asia Pacific region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin American

Lidl GB to incorporate Prevented Ocean Plastic into its water bottles.

Since opening its PET Recovery Plant in Washington in 2022, waste management company Biffa claims to have recycled 1,600 tons of previously wasted plastic.

Some of the major key players in the Rigid Plastic Packaging Market are Silgan Holdings, Berry Plastics Corporation, Amcor Limited, Consolidated Container Company, Pactiv Evergreen Inc, Al Jabri Plastic Factory, Sonoco Products Company, SABIC, Mauser Packaging Solutions, Ball Corporation, and other players.

| Report Attributes | Details |

| Market Size in 2023 | US$ 147282.50 Mn |

| Market Size by 2031 | US$ 224324.15 Mn |

| CAGR | CAGR of 5.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Bioplastics, Polyethylene Terephthalate, Polypropylene, Polyethylene, Polystyrene, Polyvinyl Chloride, Expanded Polystyrene, Others) • By Product Type (Bottle & Jars, Trays, Rigid Bulk Products, Others) • By Production Process (Thermoforming, Injection Molding, Extrusion, Blow Molding, Others) • By Application (Food & Beverages, Household, Healthcare, Personal Care, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Silgan Holdings, Berry Plastics Corporation, Amcor Limited, Consolidated Container Company, Pactiv Evergreen Inc, Al Jabri Plastic Factory, Sonoco Products Company, SABIC, Mauser Packaging Solutions, Ball Corporation |

| Key Drivers | • Reusing and recycling rigid packaging materials. • The demand for rigid plastic packaging across various industries |

| Market Opportunities | • Rise of markets in emerging regions. • Innovation and consumer awareness |

Ans: Rigid Plastic Packaging Market is expected to grow at a CAGR of 5.4 % over the forecast period of 2023-2030.

Ans: The Rigid Plastic Packaging Market size was USD 147282.50 million in 2023 and is expected to Reach USD 224324.15 million by 2031.

Ans: Reusing and recycling rigid packaging materials and the demand for rigid plastic packaging across various industries is the major key driver for the growth of Rigid Plastic Packaging Market.

Ans: Increased competition from other plastic packaging companies and an increase in the demand for alternative packaging is a major restrain for the market.

Ans: Asia Pacific is dominating the plastic packaging industry due to rapidly developing application sectors in emerging economies like China, and India, are expected to increase regional demand throughout the projection period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.3 Impact of Covid-19

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Rigid Plastic Packaging Market Segmentation, By Raw Material

8.1 Bioplastics

8.2 Polyethylene Terephthalate

8.3 Polypropylene

8.4 Polyethylene

8.5 Polystyrene

8.6 Polyvinyl Chloride

8.7 Expanded Polystyrene

8.8 Others

9. Rigid Plastic Packaging Market Segmentation, By Product Type

9.1 Bottle & Jars

9.2 Trays

9.3 Rigid Bulk Products

9.4 Others

10. Rigid Plastic Packaging Market Segmentation, By Production Process

10.1 Thermoforming

10.2 Injection Molding

10.3 Extrusion

10.4 Blow Molding

10.5 Others

11. Rigid Plastic Packaging Market by Application

11.1 Food & Beverages

11.2 Household

11.3 Healthcare

11.4 Personal Care

11.5 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Rigid Plastic Packaging Market by Country

12.2.2North America Rigid Plastic Packaging Market By Raw Material

12.2.3 North America Rigid Plastic Packaging Market By Product Type

12.2.4 North America Rigid Plastic Packaging Market by Production Process

12.2.5 North America Rigid Plastic Packaging Market by Application

12.2.6 USA

12.2.6.1 USA Rigid Plastic Packaging Market By Raw Material

12.2.6.2 USA Rigid Plastic Packaging Market By Product Type

12.2.6.3 USA Rigid Plastic Packaging Market by Production Process

12.2.6.4 USA Rigid Plastic Packaging Market by Application

12.2.7 Canada

12.2.7.1 Canada Rigid Plastic Packaging Market By Raw Material

12.2.7.2 Canada Rigid Plastic Packaging Market By Product Type

12.2.7.3 Canada Rigid Plastic Packaging Market by Production Process

12.2.7.4 Canada Rigid Plastic Packaging Market by Application

12.2.8 Mexico

12.2.8.1 Mexico Rigid Plastic Packaging Market By Raw Material

12.2.8.2 Mexico Rigid Plastic Packaging Market By Product Type

12.2.8.3 Mexico Rigid Plastic Packaging Market by Production Process

12.2.8.4 Mexico Rigid Plastic Packaging Market by Application

12.3 Europe

12.3.1 Europe Rigid Plastic Packaging Market by Country

12.3.2 Europe Rigid Plastic Packaging Market By Raw Material

12.3.3 Europe Rigid Plastic Packaging Market By Product Type

12.3.4 Europe Rigid Plastic Packaging Market by Production Process

12.3.5 Europe Rigid Plastic Packaging Market by Application

12.3.6 Germany

12.3.6.1 Germany Rigid Plastic Packaging Market By Raw Material

12.3.6.2 Germany Rigid Plastic Packaging Market By Product Type

12.3.6.3 Germany Rigid Plastic Packaging Market by Production Process

12.3.6.4 Germany Rigid Plastic Packaging Market by Application

12.3.7 UK

12.3.7.1 UK Rigid Plastic Packaging Market By Raw Material

12.3.7.2 UK Rigid Plastic Packaging Market By Product Type

12.3.7.3 UK Rigid Plastic Packaging Market by Production Process

12.3.7.4 UK Rigid Plastic Packaging Market by Application

12.3.8 France

12.3.8.1 France Rigid Plastic Packaging Market By Raw Material

12.3.8.2 France Rigid Plastic Packaging Market By Product Type

12.3.8.3 France Rigid Plastic Packaging Market by Production Process

12.3.8.4 France Rigid Plastic Packaging Market by Application

12.3.9 Italy

12.3.9.1 Italy Rigid Plastic Packaging Market By Raw Material

12.3.9.2 Italy Rigid Plastic Packaging Market By Product Type

12.3.9.3 Italy Rigid Plastic Packaging Market by Production Process

12.3.9.4 Italy Rigid Plastic Packaging Market by Application

12.3.10 Spain

12.3.10.1 Spain Rigid Plastic Packaging Market By Raw Material

12.3.10.2 Spain Rigid Plastic Packaging Market By Product Type

12.3.10.3 Spain Rigid Plastic Packaging Market by Production Process

12.3.10.4 Spain Rigid Plastic Packaging Market by Application

12.3.11 The Netherlands

12.3.11.1 Netherlands Rigid Plastic Packaging Market By Raw Material

12.3.11.2 Netherlands Rigid Plastic Packaging Market By Product Type

12.3.11.3 Netherlands Rigid Plastic Packaging Market by Production Process

12.3.11.4 Netherlands Rigid Plastic Packaging Market by Application

12.3.12 Rest of Europe

12.3.12.1 Rest of Europe Rigid Plastic Packaging Market By Raw Material

12.3.12.2 Rest of Europe Rigid Plastic Packaging Market By Product Type

12.3.12.3 Rest of Europe Rigid Plastic Packaging Market by Production Process

12.3.12.4 Rest of Europe Rigid Plastic Packaging Market by Application

12.4 Asia-Pacific

12.4.1 Asia Pacific Rigid Plastic Packaging Market by Country

12.4.2 Asia Pacific Rigid Plastic Packaging Market By Raw Material

12.4.3 Asia Pacific Rigid Plastic Packaging Market By Product Type

12.4.4 Asia Pacific Rigid Plastic Packaging Market by Production Process

12.4.5 Asia Pacific Rigid Plastic Packaging Market by Application

12.4.6 Japan

12.4.6.1 Japan Rigid Plastic Packaging Market By Raw Material

12.4.6.2 Japan Rigid Plastic Packaging Market By Product Type

12.4.6.3 Japan Rigid Plastic Packaging Market by Production Process

12.4.6.4 Japan Rigid Plastic Packaging Market by Application

12.4.7 South Korea

12.4.7.1 South Korea Rigid Plastic Packaging Market By Raw Material

12.4.7.2 South Korea Rigid Plastic Packaging Market By Product Type

12.4.7.3 South Korea Rigid Plastic Packaging Market by Production Process

12.4.7.4 South Korea Rigid Plastic Packaging Market by Application

12.4.8 China

12.4.8.1 China Rigid Plastic Packaging Market By Raw Material

12.4.8.2 China Rigid Plastic Packaging Market By Product Type

12.4.8.3 China Rigid Plastic Packaging Market by Production Process

12.4.8.4 China Rigid Plastic Packaging Market by Application

12.4.9 India

12.4.9.1 India Rigid Plastic Packaging Market By Raw Material

12.4.9.2 India Rigid Plastic Packaging Market By Product Type

12.4.9.3 India Rigid Plastic Packaging Market by Production Process

12.4.9.4 India Rigid Plastic Packaging Market by Application

12.4.10 Australia

12.4.10.1 Australia Rigid Plastic Packaging Market By Raw Material

12.4.10.2 Australia Rigid Plastic Packaging Market By Product Type

12.4.10.3 Australia Rigid Plastic Packaging Market by Production Process

12.4.10.4 Australia Rigid Plastic Packaging Market by Application

12.4.11 Rest of Asia-Pacific

12.4.11.1 APAC Rigid Plastic Packaging Market By Raw Material

12.4.11.2 APAC Rigid Plastic Packaging Market By Product Type

12.4.11.3 APAC Rigid Plastic Packaging Market by Production Process

12.4.11.4 APAC Rigid Plastic Packaging Market by Application

12.5 The Middle East & Africa

12.5.1 The Middle East & Africa Rigid Plastic Packaging Market by Country

12.5.2 The Middle East & Africa Rigid Plastic Packaging Market By Raw Material

12.5.3 The Middle East & Africa Rigid Plastic Packaging Market By Product Type

12.5.4 The Middle East & Africa Rigid Plastic Packaging Market by Production Process

12.5.5 The Middle East & Africa Rigid Plastic Packaging Market by Application

12.5.6 Israel

12.5.6.1 Israel Rigid Plastic Packaging Market By Raw Material

12.5.6.2 Israel Rigid Plastic Packaging Market By Product Type

12.5.6.3 Israel Rigid Plastic Packaging Market by Production Process

12.5.6.3 Israel Rigid Plastic Packaging Market by Application

12.5.7 UAE

12.5.7.1 UAE Rigid Plastic Packaging Market By Raw Material

12.5.7.2 UAE Rigid Plastic Packaging Market By Product Type

12.5.7.3 UAE Rigid Plastic Packaging Market by Production Process

12.5.7.4 UAE Rigid Plastic Packaging Market by Application

12.5.8 South Africa

12.5.8.1 South Africa Rigid Plastic Packaging Market By Raw Material

12.5.8.2 South Africa Rigid Plastic Packaging Market By Product Type

12.5.8.3 South Africa Rigid Plastic Packaging Market by Production Process

12.5.8.4 South Africa Rigid Plastic Packaging Market by Application

12.5.9 Rest of Middle East & Africa

12.5.9.1 Rest of Middle East & Asia Rigid Plastic Packaging Market By Raw Material

12.5.9.2 Rest of Middle East & Asia Rigid Plastic Packaging Market By Product Type

12.5.9.3 Rest of Middle East & Asia Rigid Plastic Packaging Market Production Process

12.5.9.4 Rest of Middle East & Asia Rigid Plastic Packaging Market by Application

12.6 Latin America

12.6.1 Latin America Rigid Plastic Packaging Market by Country

12.6.2 Latin America Rigid Plastic Packaging Market By Raw Material

12.6.3 Latin America Rigid Plastic Packaging Market By Product Type

12.6.4 Latin America Rigid Plastic Packaging Market by Production Process

12.6.5 Latin America Rigid Plastic Packaging Market by Application

12.6.6 Brazil

12.6.6.1 Brazil Rigid Plastic Packaging Market By Raw Material

12.6.6.2 Brazil Africa Rigid Plastic Packaging Market By Product Type

12.6.6.3 Brazil Rigid Plastic Packaging Market by Production Process

12.6.6.4 Brazil Rigid Plastic Packaging Market by Application

12.6.7 Argentina

12.6.7.1 Argentina Rigid Plastic Packaging Market By Raw Material

12.6.7.2 Argentina Rigid Plastic Packaging Market By Product Type

12.6.7.3 Argentina Rigid Plastic Packaging Market by Production Process

12.6.7.4 Argentina Rigid Plastic Packaging Market by Application

12.6.8 Rest of Latin America

12.6.8.1 Rest of Latin America Rigid Plastic Packaging Market By Raw Material

12.6.8.2 Rest of Latin America Rigid Plastic Packaging Market By Product Type

12.6.8.3 Rest of Latin America Rigid Plastic Packaging Market by Production Process

12.6.8.4 Rest of Latin America Rigid Plastic Packaging Market by Application

13 Company Profile

13.1 Amcor Ltd

13.1.1 Market Overview

13.1.2 Financials

13.1.3 Products/Services/Offerings

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Berry Global Group Inc

13.2.1 Market Overview

13.2.2 Financials

13.2.3 Products/Services/Offerings

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 , Sonoco Products Company

13.3.1 Market Overview

13.3.2 Financials

13.3.3 Products/Services/Offerings

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Sealed Air Corporation

13.4.1 Market Overview

13.4.2 Financials

13.4.3 Products/Services/Offerings

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 DS Smith

13.5.1 Market Overview

13.5.2 Financials

13.5.3 Products/Services/Offerings

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Constantia Flexibles

13.6.1 Market Overview

13.6.2 Financials

13.6.3 Products/Services/Offerings

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Transcontinental Inc

13.7.1 Market Overview

13.7.2 Financials

13.7.3 Products/Services/Offerings

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Mondi Group

13.8.1 Market Overview

13.8.2 Financials

13.8.3 Products/Services/Offerings

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Huhtamaki Oyj

13.9.1 Market Overview

13.9.2 Financials

13.9.3 Product/Services/Offerings

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Westrock Company

13.10.1 Market Overview

13.10.2 Financials

13.10.3 Product/Services/Offerings

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Protective Packaging Market Size was valued at USD 32.31 billion in 2022, and is expected to reach USD 49.96 billion by 2030, and grow at a CAGR of 5.6% over the forecast period 2023-2030.

The Pharmaceutical Packaging Market size was valued at USD 137.80 billion in 2023 and is expected to Reach USD 311.87 billion by 2032 and grow at a CAGR of 9.5% over the forecast period of 2024-2032.

The Anti-counterfeit Packaging Market size was USD 161 billion in 2023 and is expected to reach USD 237.87 billion by 2031 and grow at a CAGR of 5 % over the forecast period of 2024-2031.

The Paper Straw Market size was USD 2 billion in 2023 and is expected to Reach USD 10.99 billion by 2031 and grow at a CAGR of 20.85% over the forecast period of 2024-2031.

The Antimicrobial Packaging Market size was valued at USD 9.75 billion in 2023 and is expected to Reach USD 14.24 billion by 2031 and grow at a CAGR of 4.85 % over the forecast period of 2024-2031.

The Modified Atmosphere Packaging market size was USD 16.5 billion in 2023 and is expected to Reach USD 23.73 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone