Rigid Foam Market Report Scope & Overview:

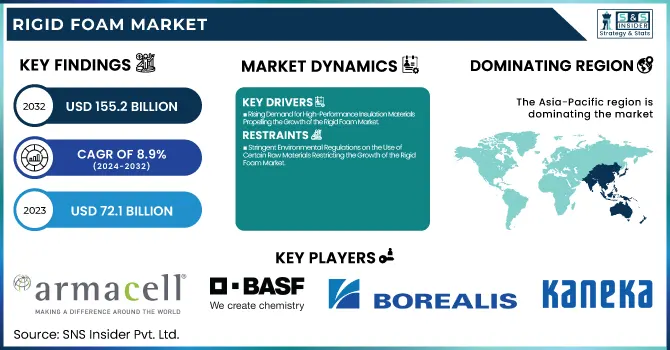

The Rigid Foam Market Size was valued at USD 72.1 Billion in 2023 and is expected to reach USD 155.2 Billion by 2032, growing at a CAGR of 8.9% over the forecast period of 2024-2032.

To Get more information on Rigid Foam Market - Request Free Sample Report

The growth of the rigid foam market can be attributed to increasing demand from the construction and automotive industries, as well as the packaging industry. Pricing analysis, including regional variations and regulatory impact, are included in this report, respectively addressing sustainability and compliance. Technological Advancement and R&D investments provide insight into the innovations that are propelling efficiency. The market entry, supply chain bottlenecks, and funding trends are scrutinized to discover growth opportunities, funding patterns, and disruptions envisaging the future of the market.

Rigid Foam Market Dynamics

Drivers

-

Rising Demand for High-Performance Insulation Materials Propelling the Growth of the Rigid Foam Market

Increasing focus on energy saving in buildings and industrial applications has been positively impacting demand for high-performance insulation materials, which is a key driving factor boosting consumption of rigid Foam over the last few years. Among the most utilized insulation is rigid foams, mainly made of polyurethane and polystyrene, which natively present impressive thermal resistance, low density, and good durability. In the wake of stricter energy efficiency regulations coming from governments around the world, such as the European Union's Energy Performance of Buildings Directive (EPBD) and the efficiency standards coming from the U.S. Department of Energy, the construction industry is increasingly turning to improved insulation solutions. Moreover, sectors including refrigeration, aerospace, and automotive are using rigid foam for better thermal management and energy efficiency. It is anticipated that the increasing investments in infrastructure development can be an added advantage to boost the growth of rigid foam insulation, and the growing emphasis on green buildings will further accelerate the growth of this market. Additionally, various enhancements in material formulation and production methods are further enhancing the economic and functional properties of rigid foams, thus reinforcing their dominance in the market.

Restraints

-

Stringent Environmental Regulations on the Use of Certain Raw Materials Restricting the Growth of the Rigid Foam Market

Stringent environmental regulations regarding the usage of certain raw materials and chemicals are one of the crucial factors influencing the overall rigid foam market. Many traditional rigid foams use hydrofluorocarbon (HFC) as well as hydrochlorofluorocarbon (HCFC) blowing agents, which play a role in global warming as well as ozone depletion. Regulatory agencies including the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have established stringent regulations to gradually eliminate these chemicals, impacting their production and raising compliance costs for manufacturers. Also in Europe, regulations such as (REACH) restrict the use of some hazardous materials in foams. As a result, manufacturers have to spend on R&D to manufacture eco-friendly substitutes for these hazardous substances and it is creating a burden of high production cost as well as market volatility. While the transition towards sustainable materials has begun, the ever-evolving environmental laws & compliance are the few constraints to market growth.

Opportunities

-

Growing Infrastructure Development in Emerging Economies Boosting Demand for Rigid Foam Products

With rapid urbanization and industrialization in emerging economies, infrastructure development is tremendously increasing, which in turn, is a preamble for robust demand for rigid foam products. Asia-pacific, Latin America and middle east are undergoing enormous construction especially in residential, commercial and industrial. The demand for rigid foam insulation has become increasingly strong as the adoption of energy-efficient building materials increases, coupled with government initiatives and smart city projects. Moreover, there are massive transportation networks that consist of railways, highways, and airports that also make use of rigid foams in structural applications. Increasing disposable income, the increasing population of the middle-class class, and the government initiative of affordable housing projects are some other factors that will bring you more demand for high-performance thermal insulation materials. This presents an opportunity for market participants to intensify their ground presence in these regions by forming strategic collaborations or by having small manufacturing units in these regions to establish their strong footing in the emerging markets.

Challenge

-

Difficulty in Recycling and Waste Management of Rigid Foam Materials Posing Environmental Challenges

The recycling and waste management of foam products is one of the most important challenges in the rigid foam market. The recycling process for most rigid foams, particularly polystyrene and polyurethane, is complicated and costly. Wide-scale recycling of rigid foams is a huge challenge, their structure is specific which makes them difficult to recycle on a micro-scale, hence working on either several material categories or the ability to recycle them when crusted, a textile-like recovery still requires sophisticated laboratory facilities and high-end technologies. But, in many countries, rigid foams are not recycled, which results in more rubbish and is detrimental to the environment. The situation becomes worse because flame retardants and other chemical additives complicate recycling. Chemical recycling and biodegradable foam formulations are some of the other solutions, but they have not been able to scale up yet, while companies are looking for alternative solutions. Industry-related waste issues are expected to remain a major environmental and regulatory challenge until effective recycling solutions are developed and become economically attractive.

Rigid Foam Market Segmental Analysis

By Type

Polyurethane (PU/PIR) dominated and accounted for the largest share with more than 50% of the market share in 2023. The dominance is due to their superior thermal insulation properties which makes them the material of choice in the building & construction industry. The Energy Performance of Buildings Directive by the European Union, for example, has driven the uptake of various energy-saving products, in which PU/PIR foams have been largely applied to comply with these strict regulations. Thirdly, entities such as the Polyurethane Manufacturers Association have demonstrated the application features and energy-efficient operations, which is strengthening its market-leading position.

By Density

The Low-Density Foam segment dominated the rigid foam market, accounting for 30% market share in 2023. Low-density foams are advantageous due to their lightweight and economical nature, making them suitable for usage in packaging and cushioning. The growth of e-commerce and an increase in demand for protective packaging will fuel demand for low-density foams in packaging applications as these foams are widely used for the protection of products while traveling. Also, the U.S. Environmental Protection Agency and other government agencies are excited about low-density foams for their material usage and waste reduction impacts and have so far promoted the material in many different industries.

By Application

The Thermal Insulation application segment dominated the rigid foam market accounting for nearly 40% of the rigid foam market in 2023. The growing focus on energy buttressing in the household, as well as commercial structures, has invigorated the requirement for quality warmth insulation materials. For this application, rigid foams such as polyurethane and polystyrene provide excellent thermal resistance. The ongoing government initiatives for instance the Weatherization Assistance Program by the US Department of Energy that promote the use of rigid foam insulation to increase energy efficiency in low-income homes– have contributed positively to this end-use company’s market.

By End-use Industry

The Building & Construction segment dominated the rigid form market and contributed approximately 39% to the overall rigid foam market in 2023. Rising urbanization along with infrastructure development, particularly in developing countries, has increased construction works which is further propelling the market for rigid foams to be used in insulation and structural applications. High-performance insulation materials such as rigid foams have pushed their way into construction by building standards organizations such as the International Code Council, which is changing building codes to place a larger emphasis on energy efficiency. In addition to that their wide range of applications in other industries has been maintained with the help of government programs encouraging sustainable construction practices which also provides an opportunity for the growth of usage of rigid foams in the building and construction industry.

Rigid Foam Market Regional Analysis

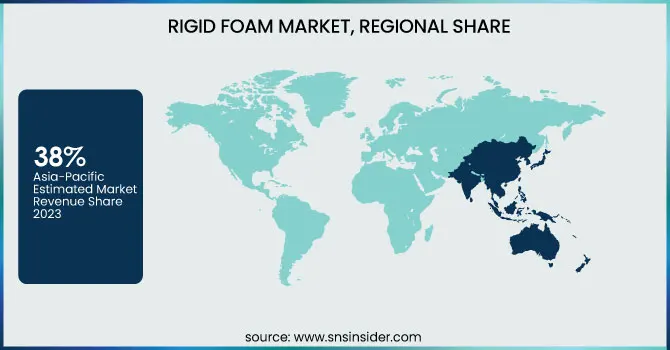

Asia Pacific dominated the rigid foam market in 2023, accounting for around 38% of the overall market share. This dominance is mainly propelled by fast industrialization and urbanization in China, India, and Japan, which results in increased demand in the construction, automotive, and packaging industries. In China, for instance, the construction sector to have grown by 7% in 2023, according to the National Bureau of Statistics. A lot of foam is needed since this increase requires an enormous amount of foam to be used for insulation. Likewise, the provision of housing for all initiatives by India is expected to build millions of affordable homes, thereby, driving the demand for rigid foam insulation materials in India. Additionally, Japan's automotive industry is one of the significant contributing sectors, as indicated by the Japan Automobile Manufacturers Association, with vehicle production in 2023 increasing by 5% due to the use of rigid foam for lightweight and energy absorption. All of these factors contribute to the market leadership of the region in the rigid foam market.

On the other hand, Europe emerged as the fastest growing region in the rigid foam market with a substantial growth rate. The growth is driven by strict environmental regulations and a focus on energy efficiency and emission control. The European Union has ordered to reduce carbon emissions which is boosting the adoption of energy-efficient building materials such as rigid foam insulation. Germany is leading the pack with 4% growth in energy efficiency-focused building projects measured by the Federal Statistical Office in 2023 causing a boom in rigid foam. The impetus is partly from the government for promoting sustainable construction practices, which are also part of the growth of France. Moreover, the ban on single-use plastics in the U.K. has been a catalyst for developing recyclable rigid foam products, boosting the market progression. These developments emphasize the impressive progress being made by Europe in the field of rigid foams.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Armacell International S.A. (ArmaFlex, ArmaPET)

-

BASF SE (Styropor, Elastopor)

-

Borealis AG (BorECO, BorSafe)

-

Covestro AG (Baytherm, Bayfoam)

-

Elliott Co. of Indianapolis, Inc. (Polyurethane Foam, Polyisocyanurate Foam)

-

Foamcraft, Inc. (Polyurethane Foam, Polystyrene Foam)

-

Future Foam, Inc. (Flexible Polyurethane Foam, Rigid Polyurethane Foam)

-

Huntsman Corporation (Insulfoam, Polyurethane Foam)

-

Kaneka Corporation (Kaneka Foam, Kaneka Polyurethane Foam)

-

Nitto Denko Corporation (Nitto Thermal Insulation Foam, Nitto Rigid Foam)

-

Recticel S.A. (Europur, Eurothane)

-

Rogers Corporation (Rogers Foam, PORON)

-

Sealed Air Corporation (Instapak, Bubble Wrap)

-

Sekisui Chemical Co., Ltd. (Styrofoam, Ekoflex)

-

Saint-Gobain S.A. (Isover, Placo)

-

Trelleborg AG (Trelleborg Foam, Trelleborg Insulation Foam)

-

The Dow Chemical Company (Styrofoam, Great Stuff)

-

Wanhua Chemical Group Co., Ltd. (Polyurethane Foam, Isocyanate Foam)

-

Woodbridge Foam Corporation (Polyurethane Foam, Rigid Foam)

-

Zotefoams Plc (Zotefoam, Zotek)

Recent Highlights

-

April 2024: BASF revealed a new product line on produces high-performance insulation based on rigid foam. The initiative is required to improve energy efficiency in building construction and achieve sustainability goals by reducing carbon emissions in the building industry.

-

March 2023: Owens Corning announced that it would build a new plant for rigid foam insulation in Arkansas. The facility will increase the company's overall production capacity, which should help meet the growing demand for energy-efficient insulation products in the North American market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 72.1 Billion |

| Market Size by 2032 | USD 155.2 Billion |

| CAGR | CAGR of 8.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polyurethane (PU/PIR), Polystyrene (PS), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Others) •By Density (Low-Density Foam, High-Density Foam, Medium-Density Foam) •By Application (Thermal Insulation, Sound Insulation, Structural Insulation, Others) •By End-use Industry (Building & construction, Appliances, Packaging, Automobile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, Huntsman Corporation, Covestro AG, JSP Corporation, Borealis AG, Sealed Air Corporation, Armacell International S.A., Kaneka Corporation, Woodbridge Foam Corporation and other key players |