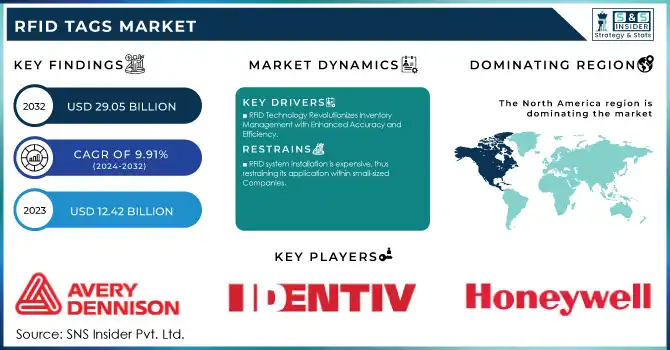

The RFID Tags Market Size was valued at USD 12.42 Billion in 2023 and is expected to reach USD 29.05 Billion by 2032 and grow at a CAGR of 9.91% over the forecast period 2024-2032.

The Radio Frequency Identification Tags Market is experiencing significant growth across the globe due to technological advancements, increasing adoption across industries, and supportive government policies. In 2023, governments worldwide emphasized digital transformation, opening up opportunities for RFID technologies in diverse sectors such as retail, logistics, healthcare, and manufacturing.

Get more information on RFID Tags Market - Request Sample Report

For instance, the U.S. Congress made RFID usage mandatory in pharmaceutical and food supply chains for traceability purposes while Europe's thrust to improve logistics efficiency fueled increased adoption. In Asia-Pacific, plans such as India's "Digital India" and China's "Made in China 2025" actively promoted the use of RFID technology, primarily in manufacturing and e-commerce.

The year 2023 witnessed thin-film flexible RFID tags, especially for wearable device applications, while other advancements included energy-harvesting, passive RFID tags with better data accuracy and networking with IoT systems. In that regard, RFID solutions are still getting more within reach and cost-effective. In November 2024, Phenix Label has launched a recyclable packaging design for liquid-filled bottles that includes a tear-off radio-frequency identification (RFID) label tab. The label above the fill levels incorporates a RAIN RFID inlay from Tageos within the packaging. By the year 2024, launches such as battery-less RFID sensors for industrial environments brought out the concern of the market toward sustainability and efficiency. These innovations are transforming operations in industries like automotive, where RFID is increasingly used for smart toll systems and vehicle tracking.

In the European Union, laws on combating counterfeiting and supply chain transparency have speeded up RFID usage in key industries. Similarly, in the United States, the government has initiatives to enhance traceability in health care and agriculture, thus widening the usage of RFID applications. Even the developing world has accepted RFID as an instrument to enhance the efficiency of public sectors; for example, the Southeast Asian countries have developed RFID-based public transport systems.

The agricultural department shall make optimum use of RFID technologies in livestock management and crop monitoring. The retail sector is expected to make a much deeper use of it in inventory and loss prevention. In the healthcare sector, it shall make much more use of RFID for the real-time tracking of equipment and medical supplies. As the world continues to push for automation and digitalization, RFID tags are poised to become an essential part of the industries that want efficiency, accuracy, and cost savings.

Key Drivers:

RFID Technology Revolutionizes Inventory Management with Enhanced Accuracy and Efficiency

Global industries increasingly rely on RFID tags for real-time inventory tracking, reducing losses by 30%. RFID in supply chain management has transformed the way inventory tracking and operational efficiency are carried out. In retail, RFID technology enabled brands like Walmart to achieve inventory accuracy rates exceeding 95% in 2023, according to research. Governments worldwide have also promoted RFID usage in food and pharmaceutical sectors for traceability, reducing counterfeit risks.

The report by the U.S. National Library of Medicine states that through RFID implementations in pharmaceuticals, recall efficiency increased by 40%. The demand is furthered due to cost-cutting and increased visibility in logistics ecosystems, ensuring proper delivery and optimizing warehouse operations.

IoT Integration with RFID Drives Automation and Expands Applications Across Industries

The integration of IoT with RFID fosters automation, enhances the operational efficiency. RFID technology has become an essential part of IoT ecosystems, where it facilitates seamless communication between devices.

Automotive industries use IoT-powered RFID for smart tolling and vehicle tracking. In addition, smart city projects in the Asia-Pacific region use RFID in traffic management and utility monitoring. The synergy between RFID and IoT drives innovation in automation, real-time monitoring, and predictive maintenance and therefore expands its application across various industries.

Restrains:

RFID system installation is expensive, thus restraining its application within small-sized companies.

While it has many benefits, the installation of an RFID system is cost-expensive to many firms, especially SMEs. It incurs a cost up to 20% more than that of traditional tracking. According to the International Trade Administration, a 2023 report indicated that small retailers in developing countries are not adopting RFID due to lack of budget. Furthermore, the cost of maintaining and replacing damaged tags increases the costs. This limitation prevents RFID adoption in areas where profit margins are thin, such as small-scale agriculture or low-cost retail. This barrier will be solved through subsidies, cost-sharing programs, or even cheaper solutions between governments and manufacturers for the widespread diffusion of RFID technology.

By Type

The Passive RFID tag segment held maximum market share, which in 2023 reached 73%. This is mainly because it does not require any battery, rather, it absorbs electromagnetic energy from the reader for its working, and it has wide applicability in applications like retail inventory tracking, supply chain management, and library systems, among others, which do not require high-range active tags.

Passive RFID tag segment is likely to grow strongly, with an expected fastest CAGR of 10.05% during the forecast period of 2024–2032, supported by growing industry demand and emphasis on sustainability. Recent advancements have made passive RFID tags more cost-effective and efficient. For instance, ultra-thin, flexible passive tags were recently introduced in 2023, designed for use in textiles and smart packaging.

By Frequency

In 2023, the Ultra-High Frequency (UHF) RFID tags accounted for 59% market share because of its intensive usage in inventory management, logistics industries, and automotive sectors. UHF RFID tags have a long range and faster data transfer, making them the first preference for real-time tracking. Advances in UHF technology, including improved anti-collision features and read accuracy, are expected to drive further adoption in 2024.

The Ultra-High Frequency (UHF) RFID tags segment is likely to grow with the fastest CAGR of 10.07% from 2024 to 2032, supported by increasing demand for efficient supply chain solutions and IoT integration. HF RFID tags, mostly used in access control and payment systems, and LF RFID tags, used for animal tagging, also contribute to the market but at a slower growth rate.

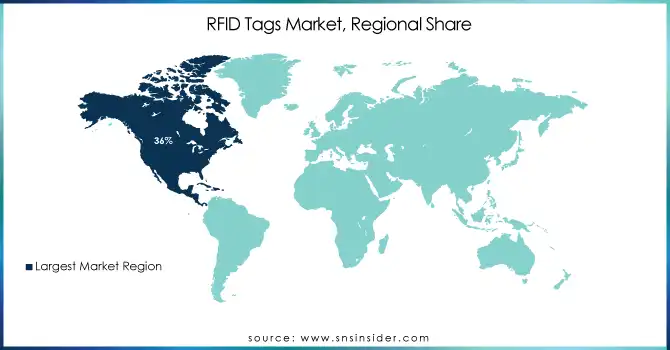

North America region dominated the RFID Tags Market in 2023 accounting for 36% of the share. The region's stronghold is due to high adoption levels in retail, healthcare, and logistics, backed by stringent government regulations for traceability and safety. Initiatives such as the FDA's drug supply chain security program and Walmart's RFID mandate in retail enhanced the market.

The Asia-Pacific region is expected to experience the fastest growth, with a CAGR of 10.38% during the period of 2024 to 2032. This is due to fast industrialization, increasing e-commerce penetration, and government-supported digitalization programs in countries like China and India. For example, India's "Digital India" initiative and China's "Made in China 2025" strategy focus heavily on RFID technology in manufacturing and logistics. It is also a great market in Europe, especially when considering transportation and public infrastructure, through smart city projects that integrate RFID.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major players in the RFID Tags Market are

Zebra Technologies (RFID printers, handheld readers)

Impinj, Inc. (RFID chips, RAIN RFID solutions)

Alien Technology (RFID inlays, tags)

Avery Dennison (RFID labels, tags)

NXP Semiconductors (RFID ICs, NFC chips)

HID Global (RFID cards, secure identity solutions)

Smartrac (RFID inlays, IoT solutions)

GEO RFID. (RFID readers, tags)

Omni-ID (RFID tags, asset management solutions)

Honeywell (RFID scanners, handheld devices)

Checkpoint Systems (RFID labels, inventory management solutions)

Invengo (RFID inlays, tags)

SATO Holdings (RFID printers, label solutions)

Confidex (RFID tags, industrial IoT solutions)

Idencia (asset tracking solutions, RFID tags)

RFID4U (RFID hardware, software)

Caen RFID (RFID readers, antennas)

ThingMagic (RFID modules, embedded readers)

Mojix (RFID middleware, IoT solutions)

Terso Solutions (RFID storage systems, asset tracking)

Major Suppliers (Components, Technologies)

Laird Connectivity (antennae, shielding materials)

3M (adhesives, conductive materials)

Dow Inc. (silicones, epoxies)

DuPont (high-performance polymers, conductive inks)

Rogers Corporation (dielectric materials, laminates)

Henkel (adhesives, conductive pastes)

BASF (polymers, specialty chemicals)

Murata Manufacturing Co. (electronic components, ceramic capacitors)

Texas Instruments (semiconductors, ICs)

TDK Corporation (inductors, ferrite cores)

Major Clients

Amazon

Walmart

FedEx

DHL

Siemens

BMW

GE Healthcare

Airbus

Nike

Target

March 2024: Zebra Technologies Corporation, a premier digital solution provider that allows companies to smartly connect data, assets, and individuals, today declared its sponsorship of the NFL Health & Safety Summit taking place from March 25-28, alongside the NFL Annual Meeting in Orlando, Florida. The Summit unites representatives from all 32 Clubs, the League office, NFL partner organizations, as well as experts from medical, athletic training, and sports performance sectors.

October 2024: Avery Dennison has introduced AD Dura 2.0, a durable reusable label solution that provides protection against water, heat, vibration, and impact. Tailored for demanding conditions, the AD Dura 2.0 is compatible with various Avery Dennison RFID UHF and HF/NFC inlay designs for both dry and wet label types, such as the AD Circus NTAG213 and AD Dogbone M730. The new product promotes extended product lifespans and decreases waste.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.42 Billion |

| Market Size by 2032 | USD 29.05 Billion |

| CAGR | CAGR of 9.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (RFID Tags, RFID Readers, Middleware), • By Type (Passive RFID Tags, Active RFID Tags), • By Frequency (Low Frequency, High Frequency, and Ultra-high frequency), • By Application (Retail, Financial Services, Healthcare, Industrial, Government, Transport & Logistics, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies, Impinj, Inc., Alien Technology, Avery Dennison, NXP Semiconductors, HID Global, Smartrac, GAO RFID Inc., Omni-ID, Honeywell International, Checkpoint Systems, Invengo, SATO Holdings, Confidex, Idencia, RFID4U, Caen RFID, ThingMagic, Mojix, Terso Solutions. |

| Key Drivers | • RFID Technology Revolutionizes Inventory Management with Enhanced Accuracy and Efficiency. • IoT Integration with RFID Drives Automation and Expands Applications Across Industries. |

| Restraints | • RFID system installation is expensive, thus restraining its application within small-sized companies. |

Ans: North America dominated the RFID Tags Market in 2023.

Ans: The RFID Tags Market is expected to grow at a CAGR of 9.91% during 2024-2032.

Ans: RFID Tags Market size was USD 12.42 Billion in 2023 and is expected to Reach USD 29.05 Billion by 2032.

Ans: The major growth factors of the RFID Tags Market are rely on RFID tags for real-time inventory tracking and integration of IoT with RFID tags.

Ans: The Passive RFID tag segment dominated the RFID Tags Market.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. RFID Tags Market Segmentation, By Product

7.1 Chapter Overview

7.2 RFID Tags

7.2.1 RFID Tags Market Trends Analysis (2020-2032)

7.2.2 RFID Tags Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 RFID Readers

7.3.1 RFID Readers Market Trends Analysis (2020-2032)

7.3.2 RFID Readers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Middleware

7.4.1 Middleware Market Trends Analysis (2020-2032)

7.4.2 Middleware Market Size Estimates and Forecasts to 2032 (USD Billion)

8. RFID Tags Market Segmentation, by Application

8.1 Chapter Overview

8.2 Retail

8.2.1 Retail Market Trends Analysis (2020-2032)

8.2.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Financial Services

8.3.1 Financial Services Market Trends Analysis (2020-2032)

8.3.2 Financial Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Healthcare

8.4.1 Healthcare Market Trends Analysis (2020-2032)

8.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Industrial

8.5.1 Industrial Market Trends Analysis (2020-2032)

8.5.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Government

8.6.1 Government Market Trends Analysis (2020-2032)

8.6.2 Government Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Transport & Logistics

8.7.1 Transport & Logistics Market Trends Analysis (2020-2032)

8.7.2 Transport & Logistics Market Size Estimates And Forecasts To 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. RFID Tags Market Segmentation, By Type

9.1 Chapter Overview

9.2 Passive RFID Tags

9.2.1 Passive RFID Tags Market Trends Analysis (2020-2032)

9.2.2 Passive RFID Tags Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Active RFID Tags

9.3.1 Active RFID Tags Market Trends Analysis (2020-2032)

9.3.2 Active RFID Tags Market Size Estimates and Forecasts to 2032 (USD Billion)

10. RFID Tags Market Segmentation, By Frequency

10.1 Chapter Overview

10.2 Low Frequency

10.2.1 Low Frequency Market Trends Analysis (2020-2032)

10.2.2 Low Frequency Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 High Frequency

10.3.1 High Frequency Market Trends Analysis (2020-2032)

10.3.2 High Frequency Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Ultra-high frequency

10.4.1 Ultra-high frequency Market Trends Analysis (2020-2032)

10.4.2 Ultra-high frequency Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.4 North America RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.6 North America RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.7.2 USA RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.4 USA RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.8.2 Canada RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.4 Canada RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.9.2 Mexico RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.4 Mexico RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.8.2 France RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.4 France RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.9.2 UK RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.4 UK RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.7.2 China RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.4 China RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.8.2 India RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.4 India RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.9.2 Japan RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.4 Japan RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.10.2 South Korea RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.4 South Korea RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.12.2 Singapore RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.4 Singapore RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.13.2 Australia RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.4 Australia RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.4 Middle East RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.6 Middle East RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.4 Africa RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.6 Africa RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America RFID Tags Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.4 Latin America RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.6 Latin America RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.7.2 Brazil RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.4 Brazil RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.8.2 Argentina RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.4 Argentina RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.9.2 Colombia RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.4 Colombia RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America RFID Tags Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America RFID Tags Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America RFID Tags Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America RFID Tags Market Estimates and Forecasts, By Frequency (2020-2032) (USD Billion)

12. Company Profiles

12.1 Zebra Technologies

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Impinj

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Alien Technology

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Avery Dennison

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 NXP Semiconductors

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 HID Global

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Smartrac

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 GAO RFID Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Omni-ID

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Honeywell International

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

BY PRODUCT

RFID Tags

RFID Readers

Middleware

BY TYPE

Passive RFID Tags

Active RFID Tags

BY FREQUENCY

Low Frequency

High Frequency

Ultra-high Frequency

BY APPLICATION

Retail

Financial Services

Healthcare

Industrial

Government

Transport & Logistics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The High-Integrity Pressure Protection System Market Size was valued at USD 473 Million in 2023 & is expected to grow at 6.7% CAGR During 2024-2032

The Device as a Service Market Size was valued at USD 105.27 billion in 2023 and is expected to grow at a CAGR of 36.18% to reach USD 1688.53 billion by 2032.

The P2P Antennas Market size was valued at USD 4.30 Billion in 2023. It is estimated to reach USD 7.06 Billion by 2032, at a CAGR of 5.70% during 2024-2032.

The Lithium-Ion Battery Recycling Market Size was valued at USD 9.17 Billion in 2023 and is expected to grow at 18.5% CAGR to reach USD 42.09 Billion by 2032.

The Interactive Tables Market was valued at USD 1.43 Billion in 2023 and is expected to reach USD 3.01 Billion by 2032 and grow at a CAGR of 8.66% over the forecast period 2024-2032.

The Semiconductor Memory Market Size was valued at USD 122.35 Billion in 2023 and is expected to reach USD 273.03 Billion by 2032 and grow at a CAGR of 9.4% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone