Reverse Logistics Market Report Scope & Oveview:

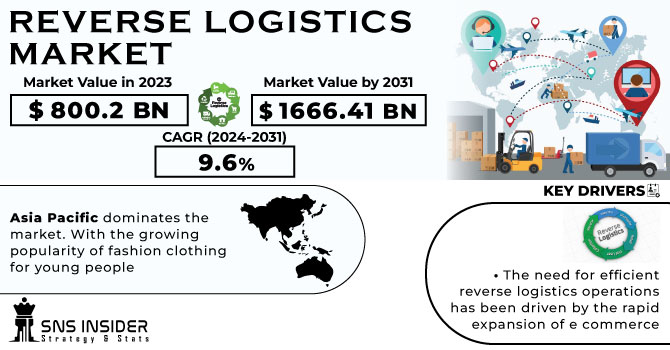

The Reverse Logistics Market was valued at USD 692.62 billion in 2023 and is projected to reach USD 1042.65 by 2032, growing at a robust CAGR of 4.70% during the forecast period from 2024 to 2032.

The demand for reverse logistics services has been driven by the worldwide growth of e commerce firms, as well as an increasing volume of product returns and replacements. The growth in the market should be driven by increased product recall, due to strict government regulations and quality standards. With the expansion of e-commerce businesses around the world, there is a need for a competent backward logistics solution. As the e commerce industry is rapidly growing, demand for return of goods has increased in a simpler way.

Get More Information on Reverse Logistics Market - Request Sample Report

With some customers requiring a physical examination of the ordered product before deciding whether it should be retained, E-commerce logistics Service Providers emphasise reverse logistics. With the help of reverse logistics, customers can return products if they are not worth buying. Due to the global growth in e commerce businesses, there is an increased frequency of returns and replacement items requiring a reverse logistics service. With customers purchasing on the Internet, they are more likely to return products because it is easy to add them to a virtual shopping cart and only by physical verification can you check their appearance or fit.

E commerce companies have been able to achieve efficiency and reachability through the growing use of modern technologies, e.g. automation, robotics or Augmented Reality A.R. Because of advantages like convenience, waiting time, cost, and variety of options, a growing number of consumers are becoming accustomed to buying on the Internet rather than in stores. In order to move products from retailers or production units to end users in a shortened period of time, e-commerce undertakings are much dependent on shipping and warehousing capabilities.

The automated system could route customer requests for refunds, produce packaging and labelling material, shorten the waiting times for returns in retail stores or enable customers to pick up their orders by mail amongst other things. Once a return request has been filed or when the returns process is completed and all operations are audited in an effective manner, companies may use automated processes to contact consumers. In order to make sure that customers continue to be kept up to date as soon as they request a refund, exchange or claim for warranty, automation may give them transparency in the return process. It shall also help to fight fraud in the return process.

MARKET DYNAMICS

KEY DRIVERS:

-

The need for efficient reverse logistics operations has been driven by the rapid expansion of e commerce

Online shoppers expect hassle-free return processes, which has prompted retailers to invest in effective reverse logistics systems to manage returns, exchanges, and refunds efficiently.

-

Reversible logistics, when properly managed, are likely to reduce costs.

RESTRAIN:

-

Managing reverse logistics operations can be expensive

Costs include transportation, handling, inspection, sorting, repair, and disposition of returned goods. Optimizing these processes to reduce costs while maintaining quality can be a challenge.

OPPORTUNITY:

-

Growing need for efficient and customer-friendly reverse logistics solutions

Companies that develop user-friendly returns, offer flexible options, and use technology to streamline return processing can gain a competitive edge.

-

Creating secondary markets for refurbished or repurposed products can lead to additional revenue streams

CHALLENGES:

-

High Operational Costs

Reverse logistics operations can incur substantial costs due to transportation, inspection, testing, refurbishment, and disposal activities. Balancing these costs while delivering value can be demanding.

IMPACT OF RUSSIAN UKRAINE WAR

The cost of reverse logistics has increased by 20-30% since the beginning of the war. This is due to a number of factors including higher transportation costs, higher insurance premiums and the need to use more expensive routes. The availability of reverse logistics services has decreased. Indeed, many companies have ceased operations in Russia and Ukraine, and those that are still operating are facing problems such as staff shortages and supply chain disruptions. The demand for reverse logistics services has increased. Indeed, companies are returning more goods due to war-related disruptions, and they are also finding ways to recycle and reuse materials to reduce their impact on the environment. In addition, the cost of shipping returns from Europe to China has increased by 50%. This is due to the closure of the airspace to Russia and Ukraine, which has forced shippers to take longer and more expensive routes. The cost of plastic recycling in Ukraine has increased by 25%. This is due to a lack of raw materials, as well as increased transportation and labor costs. Demand for reverse logistics services in the automotive industry increased by 15%. This is due to a shortage of new cars, as well as the need to recycle parts from damaged vehicles.

The impact of the Russian-Ukrainian war on the reverse logistics market is expected to continue for the foreseeable future. Businesses that depend on reverse logistics should be prepared for higher costs, reduced availability, and increased demand.

IMPACT OF ONGOING RECESSION

Reverse logistics costs are expected to increase by 10-15% by 2023. This is due to a number of factors including higher transportation costs, higher labor costs and the need to comply with new regulations. about environment. The availability of reverse logistics services is expected to decrease. This is because businesses are cutting costs and reducing their workforce, which is leading to a decrease in the number of reverse logistics providers. Demand for reverse logistics services is expected to increase. Indeed, companies are returning more goods as consumers become more frugal, and they are also finding ways to recycle and reuse materials to reduce their environmental impact. Return shipping costs from the United States to China have increased by 10%. This is due to an increase in fuel prices, as well as a decrease in the availability of shipping containers. The cost of recycling electronics in the United States has increased by 5%. This is due to decreased demand for electronics, as well as increased labor and transportation costs. Retail demand for reverse logistics services increased by 15%. This is due to an increase in online shopping, as well as the return of more goods due to the economic downturn.

Businesses are increasingly focusing on efficiency and cost savings. This has led to a need for reverse logistics providers that can provide value-added services, such as repair and refurbishment. There is a growing need for sustainable reverse logistics solutions. Companies are looking to reduce their environmental impact and are turning to reverse logistics providers that offer recycling and reuse services.

KEY MARKET SEGMENTS

By Return Type

-

Repairable Returns

-

Recall Returns

-

B2B & Commercial Returns

-

End of Life Returns

-

End of Use Returns

By Services

-

Transportation

-

Reselling

-

Refund Management

-

Warehousing

-

Replacement Management

-

Others

By End User

-

E-commerce

-

Pharmaceutical

-

Retail

-

Automotive

-

Luxury Goods

-

Consumer Electronics

-

Reusable Packaging

REGIONAL ANALYSIS

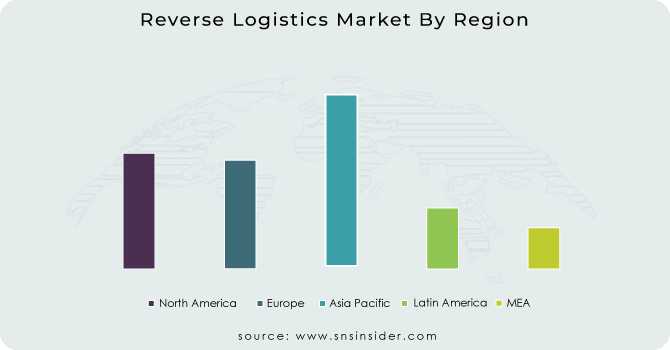

With the highest market share, Asia Pacific dominates the market. With the growing popularity of fashion clothing for young people, it is expected that this region will retain its dominant position over the forecast period. The increased proliferation of the e commerce industry, as well as rapid growth in online shopping activity in countries such as India and China, are also contributing to this growth. The growing trend towards online shopping will lead to higher returns which are likely to support market growth in the region. In addition, the expansion of the market is expected to be driven by the increasing growth of the manufacturing sector in developing countries and the growing demand for reverse logistics for electric vehicles.

During the forecast period, the Middle East and Africa are expected to experience significant growth. In the Middle East & Africa, reversing logistics is projected to grow at a second-fastest annual growth rate during the forecast period. A number of strategic initiatives are being taken by leading players in order to improve their competitiveness. Moreover, the Middle East is seeing increasing investments in order to become a logistics hub. These factors and a rise in disposable incomes provide favourable prospects for the region's reverse logistics sector.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Reverse Logistics market are Safexpress Pvt Ltd, DB SCHENKER, FedEx Corporation, Yusen Logistics Co. Ltd, Deutsche Post AG, RLG Systems AG, Kintetsu World Express, Inc, Core Logistic Private Limited, United Parcel Service, Inc, CCR Logistics Systems AG and other players.

FedEx Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

In order to consolidate its market leading experience in reverse operations and invest in future returns, repairs and refurbishments of electronic equipment, DB Schenker is launching a new line of Circular Economy Logistics products.

-

Two new Express services are announced by AJEX Logistics Services, a specialist of express shipping and distribution solutions to the Middle East based in Saudi Arabia: AJEX Same Day Domestic and AJEX pick up services in Dammam, Riyadh and Jeddah.

| Report Attributes | Details |

| Market Size in 2023 | US$ 692.62 Bn |

| Market Size by 2032 | US$ 1042.65 Bn |

| CAGR | CAGR of 4.70 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Return Type (Repairable Returns, Recall Returns, B2B & Commercial Returns, End of Life Returns, End of Use Returns) • by Services (Transportation, Reselling, Refund Management, Warehousing, Replacement Management, Others) • by End User (E-commerce, Pharmaceutical, Retail, Automotive, Luxury Goods, Consumer Electronics, Reusable Packaging) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Safexpress Pvt Ltd, DB SCHENKER, FedEx Corporation, Yusen Logistics Co. Ltd, Deutsche Post AG, RLG Systems AG, Kintetsu World Express, Inc, Core Logistic Private Limited, United Parcel Service, Inc, CCR Logistics Systems AG |

| Key Drivers | • The need for efficient reverse logistics operations has been driven by the rapid expansion of e commerce • Reversible logistics, when properly managed, are likely to reduce costs. |

| Market Restraints | • Managing reverse logistics operations can be expensive |