Retort Packaging Market Key Insights:

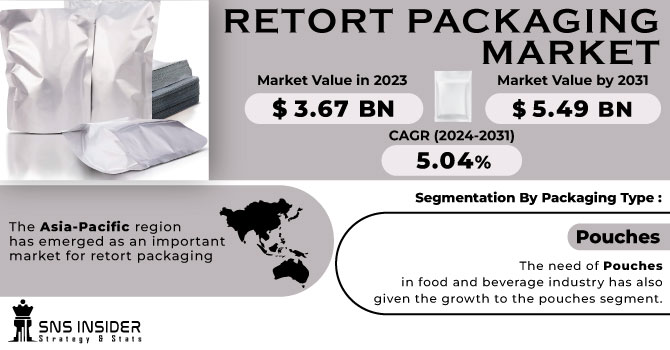

The Retort Packaging Market size was USD 3.67 billion in 2023 and is expected to Reach USD 5.49 billion by 2031 and grow at a CAGR of 5.04% over the forecast period of 2024-2031.

The retort packaging market has experienced significant growth and development in recent years. Retort packaging can withstand high temperatures and pressures, making it suitable for sterilizing and preserving organic food and beverages. This form of packaging is gaining in popularity as it can extend product shelf life while maintaining nutritional value and taste.

Get More Information on Retort Packaging Market - Request Sample Report

One of the main drivers behind the growth of the retort packaging market is the increasing demand for convenient, ready-to-eat food. With changing lifestyles and busy schedules, consumers are demanding quick and easy meal solutions that don't compromise on quality. Retort packaging has the advantage of long shelf life without the need for refrigeration and is preferred for a variety of food products such as soups, sauces, instant meals and pet foods.

The growing awareness of food safety and hygiene has also contributed to the introduction of retort packaging. The sterilization process used in retort packaging ensures that the product is free of harmful bacteria and microorganisms, reducing the risk of foodborne illness. This aspect has become especially important following various food contamination incidents, making safe packaging solutions a priority for manufacturers and consumers.

Additionally, the retort packaging market has seen advances in materials and technology, resulting in improved product performance and sustainability. Innovations such as the use of high-barrier films and lightweight materials have made retort packaging more durable and flexible while reducing its environmental impact. This eliminated concerns about packaging waste and contributed to the growth of the overall market.

In summary, the retort packaging market is experiencing significant growth due to increasing demand for convenience, food safety testing and sustainability. As consumers continue to seek efficient and flexible packaging solutions, the industry will see further advances in technology and materials, opening up new opportunities for manufacturers and contributing to the expansion of the overall market.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing Demand for preservative-free products

Retort shall be performed if the non-sterilized products are hermetically sealed, meaning their packaging is not sterile Packaging shall be loaded into a retort vessel, and subjected to pressurized steam. For a much longer period of time than the heated filling, the product is also subject to temperature extremes. The quality of the product as well as its nutritional content may be significantly affected by this additional time.

Demand for retort packaging has increased as a result of rising demand for products that do not contain preservatives.

-

In order to prevent food waste, the demand for intelligent packaging is growing.

RESTRAIN:

-

A high cost for research and development activities.

-

The availability of alternatives in the market

OPPORTUNITY:

-

Ban on single-use plastic packaging products in the global market is an opportunity for the growth of retort packaging

The government has taken firm steps to ban single-use plastics and non-biodegradable packaging goods in the market with increasing environmental concerns in a number of regions. It is because plastics are more difficult to decompose and they pose a risk to marine life as well as land animals.

The use of different types of packaging for different applications leads to waste generation and is extremely harmful to the environment. Plastic packaging is used to package consumer goods, creating non-biodegradable plastic packaging waste, releasing harmful gases into the soil, and posing a hazard to animals and groundwater. Therefore, steps have been taken to ban the packaging of plastic bags as harmful to the environment.

-

Continuous innovation in the market for retort packaging.

CHALLENGES:

-

There may be limited recycling infrastructure for retort packaging, which could lead to problems with waste management and the environment.

IMPACT OF RUSSIA-UKRAINE WAR

Russia and Ukraine are major players in the global packaging industry, and any disruption to production or transportation capacity could lead to shortages or delays in obtaining critical materials and equipment needed to manufacture retort pouches. Major companies are suffering from a loss of 13% in overall business due to less demand and increased prices of raw materials. Plastic polymers prices rose by 15 % due to an increase in crude oil prices. Production costs rose by 7 % due to an increase in energy prices in the European region.

Asia Pacific region suffered significant losses due to trade disruptions and an increase in raw material prices. However, losses were 3% less as compared to the European region which was majorly impacted by the war.

IMPACT OF ONGOING RECESSION

In recessions, consumer spending tends to decline as people become more cautious about their finances. This could reduce demand for packaged food and beverages, including retort products. According to a report by Packaging Forum, food and beverage may suffer losses of an average of 10-12% during the recession. This may affect the retort packaging market since the food and beverage sector accounts for the largest market share in the retort packaging end-user segment.

New innovation and research will be postponed or stopped during the recession period, this will be done to avoid capital expenditure during the recession. On an average businesses spend 5-10 % on research and development to develop new products. Due to less investment in research, no new product will be launched in the market which can generate more demand.

KEY MARKET SEGMENTATION

By Raw Material

-

PET

-

Aluminium Foil

-

Polypropylene

-

Polyester

-

Others

By Packaging Type

-

Cartons

-

Pouches

-

Trays

-

Others

Based on Packaging Type, Pouches hold the largest market. This is because of its durability. The need of pouches in food and beverage industry has also given the growth to the pouches segment. Retort pouches hold various properties such as they are lightweight, and also consume less space due to which they can also replace tin cans.

By Application

-

Food & Beverages

-

Pharmaceuticals

-

Others

Based on the Application, Food, and Beverages segment accounts for the largest market share. This segment has given growth for the retort packaging. Retort packaging has developed the food industry in such a way that any seasonal food product can be made available all year.

REGIONAL ANALYSIS

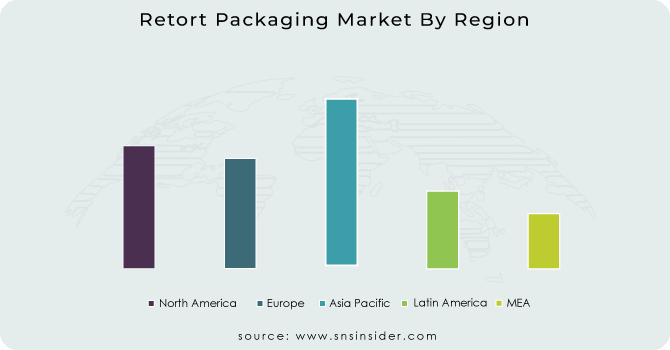

From a regional perspective, the Asia-Pacific region has emerged as an important market for retort packaging, owing to the rapid expansion of the food and beverage industries such as China, India, and Japan. Population growth, urbanization and changing consumption habits in the region create a favorable environment for the introduction of retort packaging solutions.

However, North America and Europe are also gaining significant market share due to the demand for prepared foods and the presence of established food processing companies.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are Sonoco Products Company, Amcor PLC, Clondalkin Group, ProAmpac, Mondi, Sealed Air Corporation, Coveris Group, Constantia Flexibles, Winpak Limited, Clifton Packaging Group Limited and other players.

Clondalkin Group-Company Financial Analysis

RECENT DEVELOPMENTS

-

Toppan expands its all-PP GL line of Barriers with retortible packaging and introduces PE barrier packaging for boiling sterilization.

-

ProAmpac, Launches High-Performance Retort Pouches Made with Post-Consumer Recycled Material.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.67 Bn |

| Market Size by 2031 | US$ 5.49 Bn |

| CAGR | CAGR of 5.04% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (PET, Paper & Paperboards, Aluminium Foil, Polypropylene, Polyester, Others) • By Packaging Type (Cartons, Pouches, Trays, Others) • By Application (Food & Beverages, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sonoco Products Company, Amcor PLC, Clondalkin Group, ProAmpac, Mondi, Sealed Air Corporation, Coveris Group, Constantia Flexibles, Winpak Limited, Clifton Packaging Group Limited |

| Key Drivers | • Increasing Demand for preservative-free products • In order to prevent food waste, the demand for intelligent packaging is growing. |

| Market Restraints | • A high cost for research and development activities. • The availability of alternatives in the market |