Get PDF Sample Copy of Retail Point-Of-Sale Terminals Market - Request Sample Report

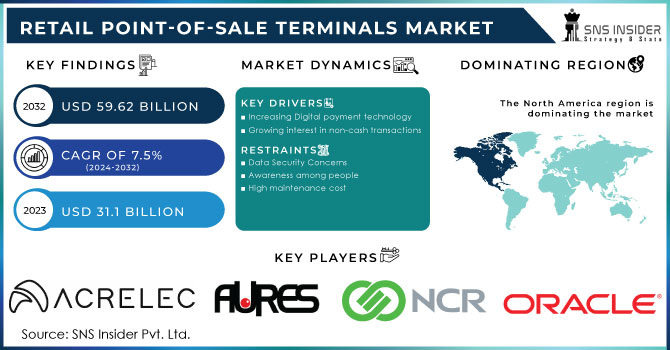

The Retail Point-of-Sale Terminals Market size was valued at USD 31.1 Billion in 2023 and is expected to grow to USD 59.62 Billion by 2032 and grow at a CAGR of 7.5% over the forecast period of 2024-2032.

The retail POS terminals market has seen substantial growth due to the fast adoption of new technologies and changing consumer preferences. As more and more businesses switch from basic cash registers to advanced POS systems, the market is seeing a move towards integrated solutions with combined hardware and software to improve functionality. These terminals currently have functions like processing mobile payments, managing inventory, maintaining customer relationships, and analyzing data, giving retailers a complete set of tools to enhance operational effectiveness and interact with customers. The increase in e-commerce and omnichannel retailing has increased demand, as merchants aim to streamline their sales processes across different platforms. Moreover, the pandemic has sped up the implementation of contactless payment choices, resulting in a rise in the usage of POS terminals that are compatible with NFC and mobile wallet payments. The increasing focus on improving customer interactions and the popularity of POS systems among small and medium-sized businesses are driving the market's growth. With increasing competition, POS terminals makers are concentrating on innovation and creating customized solutions to address retailers' various requirements, guaranteeing a strong growth path for the market in the future.

The retail payments landscape is rapidly evolving, driven by the increasing adoption of digital wallets, Buy Now, Pay Later (BNPL) services, and advanced point-of-sale (POS) systems. Digital wallets are projected to exceed a staggering global transaction value of over USD 16 trillion by 2028, reflecting a significant shift in consumer spending habits and preferences for convenient, secure payment methods. In the Euro area, non-cash payment transactions surged by 10.1% in the first half of 2023, with contactless card payments alone increasing by 24.3%. This trend highlights consumers' growing preference for fast and efficient payment solutions. Furthermore, BNPL services are reshaping consumer credit, especially among younger demographics who appreciate the flexibility these offerings provide, particularly during economic uncertainty. The integration of innovative POS technologies, including cloud-based systems and mobile POS solutions, is enhancing the retail checkout experience by enabling seamless, real-time transactions anywhere in the store. As retailers embrace these advancements, they not only improve operational efficiency but also elevate customer satisfaction by providing personalized experiences. Enhanced loyalty programs, driven by real-time data, further reinforce customer retention and engagement, making innovative payment solutions essential to retail success. Overall, the ongoing transformation in the retail POS terminals market underscores the necessity for retailers to adapt to emerging trends in payment technologies, ensuring they meet the evolving expectations of today's consumers.

Drivers

Increase in NFC and contactless payment methods leading to expansion of retail POS terminals.

The POS terminals market in retail is growing due to the rise in NFC and contactless payment usage. In Europe, there was a 24.3% increase in contactless card payments in 2023, highlighting consumers' favor for quick and safe transactions. The European Central Bank announced a 15.6% rise in card payments, as contactless options gain popularity among consumers looking for ease and speed. Governments are also backing this movement by taking steps to improve payment systems and encourage the use of digital transactions. For example, the UK government's dedication to updating payment systems has motivated retailers to enhance their POS terminals for contactless technologies, guaranteeing smooth customer interactions. Moreover, the increasing demand for mobile wallets has also boosted the prominence of NFC-enabled devices, enabling customers to easily make payments straight from their mobile phones. by investing in advanced POS solutions that incorporate contactless payment options, retailers are meeting consumer demand and improving operational efficiency. The move towards contactless payments is predicted to influence the future of retail transactions, with NFC technology playing a vital role in driving growth in the POS terminals market.

Restraints

Obstacles in infrastructure are impeding the expansion of the retail POS terminals market.

The retail POS terminals market encounters major obstacles because of the unreliable and outdated infrastructure, hindering the uptake of contemporary payment technologies. A lot of areas continue to use old payment systems that are not able to handle advanced POS features, causing inefficiencies and dissatisfaction among customers. A recent report from the Office for National Statistics (ONS) in the UK stated that around 20% of retail businesses faced challenges in updating their payment systems because of infrastructure constraints. In the same way, the European Central Bank reported that approximately 55% of businesses in the European Union had transitioned to completely digital payment platforms by 2022. This gap shows that numerous retailers do not have the necessary tools to provide smooth and effective payment options, which hinders their ability to compete in a constantly changing market. Government efforts focused on enhancing payment infrastructure are vital in tackling these issues. As an illustration, the UK government has put more than £2 billion into the digital infrastructure industry as part of its "Digital Strategy" to encourage businesses, such as retail, to embrace technology. Lack of significant infrastructure investments could prevent the retail POS terminals market from growing due to the untapped potential benefits of advanced POS terminals such as improved transaction speed, security, and customer satisfaction.

by Product

In 2023, the Fixed POS terminals segment maintained a significant market share of 63.67% in the retail point-of-sale (POS) terminals market, strengthening its position as the top choice due to the common use of traditional checkout systems in retail settings. Fixed POS terminals, valued for their durability and dependability, are crucial in industries like supermarkets, restaurants, and retail stores, enabling efficient processing of large numbers of transactions. Prominent corporations such as NCR Corporation and Verifone have introduced innovative stationary POS systems with capabilities like cloud connection, integrated payment processing, and improved security measures to address changing customer needs. An example is NCR's newest product, the NCR Silver, which merges hardware with advanced software functions, enabling retailers to effectively oversee sales, inventory, and customer information. Additionally, Square, known for its mobile solutions, unveiled a new series of stationary terminals designed for small to medium-sized businesses, improving accessibility and user-friendliness. The advancements in the Fixed POS sector enhance both operational efficiency and customer experience, allowing retailers to keep up with omnichannel retailing while maintaining strong in-store transaction capabilities. With technology advancements, Fixed POS terminals are expected to maintain a strong presence in the market despite facing growing competition from mobile options.

by Component

The retail POS terminals market was led by the hardware segment in 2023, which accounted for 55.44% of total revenue, mainly due to the rising need for effective transaction solutions in different retail settings. Major companies such as Ingenico, NCR Corporation, and Verifone are at the forefront, introducing new hardware solutions to improve transaction speed and security. An example is the Lane/3000 series by Ingenico, which integrates cutting-edge payment technology with a simple interface, enabling retailers to smoothly conduct transactions. The newest product from NCR, the NCR Secure Pay, comes with advanced security capabilities to safeguard businesses and customers from the growing threat of fraud in the digital world. Additionally, the worldwide trend towards intelligent retail systems has led countries such as the US and Japan to make significant investments in enhancing their POS infrastructure, which in turn boosts the hardware segment growth. The Japanese government's push for cashless transactions has boosted the need for updated POS systems, leading local manufacturers to enhance and broaden their product range. This increase in hardware focus indicates a shift towards better operational efficiency and necessary adjustment to evolving consumer payment preferences in retail.

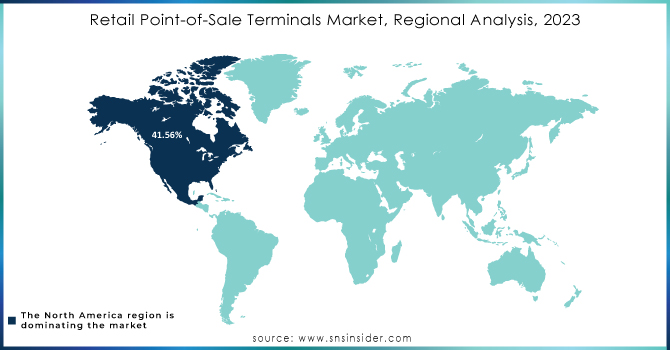

In the retail point-of-sale (POS) terminals market in 2023, North America had a significant revenue share of 41.56% due to its strong retail infrastructure and widespread use of advanced payment technologies by consumers. Square and Clover, companies recognized for their creative point-of-sale solutions, have shown great progress in this area with the introduction of easy-to-use terminals tailored for small and medium-sized businesses. Square's newest product, the Square Register, combines both hardware and software to allow for smooth payment processing, inventory tracking, and customer interaction, ultimately improving the retail experience as a whole. In the meantime, Clover launched the Clover Mini, a small and adaptable point-of-sale terminal created to meet various business requirements and provide advanced analytics capabilities. The U.S. government's efforts to encourage cashless transactions are increasing the need for modern POS systems, making it easier to transition from handling cash to using digital payments. Moreover, the swift growth of online shopping has pushed retailers to incorporate omnichannel tactics, underlining the need for advanced POS systems that can effectively handle in-person and internet transactions. The combination of technology, regulations, and consumer habits highlights North America's strong presence in the retail POS terminal market, establishing it as a pioneer in new ideas and acceptance.

In 2023, the Asia-Pacific region saw a notable rise as the quickest developing market for retail point-of-sale (POS) terminals, driven by fast urbanization and an increase in the amount of retail businesses, ranging from big department stores to little convenience shops. This growth has led to a strong demand for advanced POS systems to efficiently oversee activities and meet the varying requirements of customers. Development in the retail sector in the area has seen a notable increase, fueled by shifting consumer behaviors, higher incomes, and a boost in consumer expenditures. Therefore, retailers are making significant investments in enhancing their POS systems to improve operational efficiency and customer experiences. Additionally, Europe has seized a significant portion of the worldwide retail POS terminal market due to a strong retail industry and strict regulations requiring safe transactions. The region's dedication to improving transaction security is evident in the extensive use of advanced POS technologies like contactless payment methods and EMV compliance. Moreover, there is an increasing investment in POS systems in different retail industries, demonstrating a significant focus on enhancing customer satisfaction and operational productivity. This ever-changing setting emphasizes the crucial importance of sophisticated POS systems in addressing the changing needs of the retail market.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

Some the key players in the retail point-of-sale (POS) terminals market along with their products and services:

Acrelec (self-service kiosks and digital signage)

AURES Group (multifunctional POS systems and peripherals)

HM Electronics (wireless communication solutions for POS systems)

Hewlett Packard Development LP (POS hardware and software solutions)

NCR Corp. (integrated retail solutions and omnichannel POS systems)

Oracle (cloud-based POS and enterprise resource planning solutions)

Presto Group (self-service ordering systems for restaurants)

Quail Digital (mobile and fixed POS solutions)

Revel Systems (cloud-based POS and business management software)

Toast, Inc. (restaurant management platform with integrated POS)

Toshiba Corp. (POS terminals and retail technology solutions)

TouchBistro (iPad-based restaurant POS system)

Xenial, Inc. (cloud POS solutions for the restaurant industry)

Diebold Nixdorf (automated teller machines and retail POS solutions)

Epicor Software Corporation (ERP solutions with integrated POS)

Ingenico Group (payment solutions and terminals)

NEC Corporation (POS hardware and software solutions)

Panasonic Corporation (POS systems and peripherals)

PAX Technology (payment terminals)

Samsung Electronic Co. Ltd (smart POS systems)

Square, Inc. (mobile payment solutions)

VeriFone Systems (secure payment terminals and solutions)

Others

Recent Development

In India, Zoho Corporation introduced Zakya, a new brand, providing a contemporary retail POS solution in February 2024. Zakya's POS solution, which is based on the cloud, is simple to set up and user-friendly, enabling small and medium-sized retailers to get up and running and begin billing within one hour.

In January 2023.A new point of sale (POS) solution for retailers was introduced by VMware, Inc. in January 2023. In partnership with Stratodesk, the VMware Retail POS modernization solution was created to prolong the lifespan of existing POS systems, resulting in increased ROI, decreased security vulnerabilities, enhanced store performance, and better customer satisfaction.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.1 Billion |

| Market Size by 2032 | USD 59.62 Billion |

| CAGR | CAGR of 7.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fixed, Mobile), By Component (Hardware, Software, Services) • By End User (Supermarkets/Hypermarkets, Grocery Stores, Specialty Stores, Convenience Stores, Gas Stations, Discount Stores, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acrelec, AURES Group, HM Electronics, Hewlett Packard Development LP, NCR Corp., Oracle, Presto Group, Quail Digital, Revel Systems, Toast, Inc., Toshiba Corp., TouchBistro, Xenial, Inc., Diebold Nixdorf, Epicor Software Corporation, Ingenico Group, NEC Corporation, Panasonic Corporation, PAX Technology, Samsung Electronic Co. Ltd, Square, Inc., and VeriFone Systems. & Others |

| Key Drivers | • Increase in NFC and contactless payment methods leading to expansion of retail POS terminals. |

| Restraints | • Obstacles in infrastructure are impeding the expansion of the retail POS terminals market. |

Ans: The Retail Point-of-Sale Terminals Market size was valued at USD 31.1 billion in 2023 and is expected to grow to USD 59.62 billion by 2032 and grow at a CAGR of 7.5% over the forecast period of 2024-2032.

Ans: The major growth factor of the Retail Point-of-Sale Terminals market is the increasing demand for advanced packaging solutions in electronics, driven by the proliferation of IoT devices and smart technologies.

Ans: The Retail Point-of-Sale Terminals Market grow at a CAGR of 7.5% over the forecast period of 2024-2032.

Ans: The Fixed segment dominated the Retail Point-of-Sale Terminals Market.

Ans: North America dominated the Retail Point-of-Sale Terminals Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Retail Point-Of-Sale Terminals Market Segmentation, by Product

7.1 Chapter Overview

7.2 Fixed

7.2.1 Fixed Market Trends Analysis (2020-2032)

7.2.2 Fixed Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Mobile

7.3.1 Mobile Market Trends Analysis (2020-2032)

7.3.2 Mobile Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Retail Point-Of-Sale Terminals Market Segmentation, by Component

8.1 Chapter Overview

8.2 Hardware

8.2.1 Hardware Market Trends Analysis (2020-2032)

8.2.2 Hardware Guidance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Software

8.3.1 Software Market Trends Analysis (2020-2032)

8.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Services

8.4.1 Services Market Trends Analysis (2020-2032)

8.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Retail Point-Of-Sale Terminals Market Segmentation, by End User

9.1 Chapter Overview

9.2 Supermarkets/Hypermarkets

9.2.1 Supermarkets/Hypermarkets Market Trends Analysis (2020-2032)

9.2.2 Supermarkets/Hypermarkets Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Grocery Stores

9.3.1 Grocery Stores Market Trends Analysis (2020-2032)

9.3.2 Grocery Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Specialty Stores

9.4.1 Specialty Stores Market Trends Analysis (2020-2032)

9.4.2 Specialty Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Convenience Stores

9.5.1 Convenience Stores Market Trends Analysis (2020-2032)

9.5.2 Convenience Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Gas Stations

9.6.1 Gas Stations Market Trends Analysis (2020-2032)

9.6.2 Gas Stations Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Discount Stores

9.7.1 Discount Stores Market Trends Analysis (2020-2032)

9.7.2 Discount Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.5 North America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.6.3 USA Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.7.3 Canada Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.8.3 Mexico Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.6.3 Poland Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.7.3 Romania Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.5 Western Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.6.3 Germany Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.7.3 France Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.8.3 UK Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.9.3 Italy Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.10.3 Spain Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.13.3 Austria Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.6.3 China Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.7.3 India Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.8.3 Japan Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.9.3 South Korea Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.10.3 Vietnam Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.11.3 Singapore Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.12.3 Australia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.5 Middle East Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.6.3 UAE Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.5 Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.5 Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.6.3 Brazil Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.7.3 Argentina Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.8.3 Colombia Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Retail Point-Of-Sale Terminals Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Acrelec

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 AURES Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 HM Electronics

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Hewlett Packard Development LP

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 NCR Corp.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Oracle

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Presto Group

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Quail Digital

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Revel Systems

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Toast, Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Fixed

Mobile

By Component

Hardware

Software

Services

By End User

Supermarkets/Hypermarkets

Grocery Stores

Specialty Stores

Convenience Stores

Gas Stations

Discount Stores

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Specialty Lighting Market Size was USD 6.5 Billion in 2023 and is expected to reach USD 11.73 Billion by 2032 and grow at a CAGR of 6.82% by 2024-2032.

The Integrated Circuit Market Size will be valued at USD 1846.29 billion by 2032, and it accounted for USD 619.52 billion in 2023, and grow at a CAGR of 12.9% over the forecast period 2024-2032.

The Human Machine Interface Market Size was USD 5.59 Billion in 2023 and will reach USD 12.49 Billion by 2032 and grow at a CAGR of 9.54% by 2024-2032.

The Battery Materials Market size was valued at USD 43.63 billion in 2023 and is expected to reach USD 89.27 billion by 2032, with growing at a CAGR of 8.31% over the forecast period 2024-2032.

The Infrared Detector Market size was valued at USD 538 million in 2023 and is expected to reach USD 980.80 million by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.The Infrared Detector Market size was valued at USD 538 million in 20

The Paralleling Switchgear (PSG) Market Size was valued at USD 1.66 Billion in 2023 and is expected to grow at a CAGR of 7.36% to reach USD 3.13 Billion by 2032.

Hi! Click one of our member below to chat on Phone