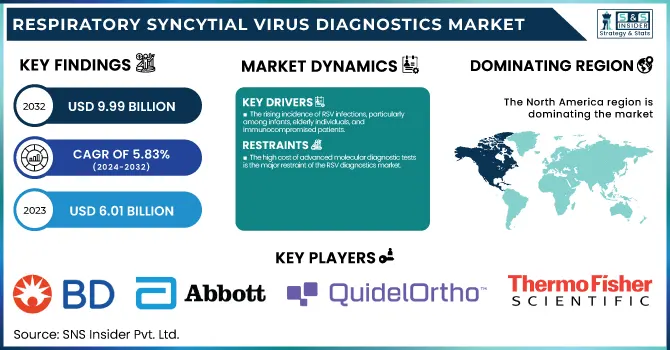

The Respiratory Syncytial Virus Diagnostics Market size was estimated at USD 6.01 Billion in 2023 and is expected to reach USD 9.99 Billion by 2032 and grow at a CAGR of 5.83% over the forecast period 2024-2032.

To Get more information on Respiratory Syncytial Virus Diagnostics Market - Request Free Sample Report

This report emphasizes the increasing incidence and prevalence of RSV, which is fueling demand for more effective diagnostic solutions. The research discusses diagnostic testing trends by region, highlighting gaps in accessibility and adoption rates. It also looks at technological advancements and innovations in RSV diagnostics, such as rapid antigen tests, molecular diagnostics, and point-of-care testing. The report also evaluates trends in RSV testing in healthcare environments, increasing towards early detection and combined diagnostic strategies. Additionally, it evaluates the regulatory and policy influence on RSV diagnostics, which guides market entry, product approvals, and compliance demands. Healthcare expenditures on RSV diagnostics are also analyzed, taking into account government programs, commercial investments, private healthcare contributions, and out-of-pocket payments for various regions.

Drivers

The rising incidence of RSV infections, particularly among infants, elderly individuals, and immunocompromised patients.

Based on the CDC, RSV accounts for around 58,000 hospitalizations a year in children below five in the U.S. and is responsible for huge morbidity globally. The rise in the usage of molecular diagnostic methods, including RT-PCR and nucleic acid amplification tests (NAATs), has further accelerated the market based on their sensitivity and quick reporting. Also, the increasing trend of point-of-care (POC) testing solutions is fueling demand for rapid antigen detection tests (RADT), allowing for early and fast diagnosis. Government programs for early RSV screening and vaccination initiatives have also boosted market growth. The COVID-19 pandemic has raised awareness and investment in respiratory virus testing, resulting in technology development and healthcare expenditure on infectious disease testing. In addition, the growing incidence of co-infections (RSV with influenza or COVID-19) has raised the need for multiplex respiratory panels, enabling the simultaneous detection of several viruses. All these factors combined boost market growth, making RSV diagnostics a high-priority segment in the global healthcare market.

Restraints

The high cost of advanced molecular diagnostic tests is the major restraint of the RSV diagnostics market

Although RT-PCR and NAAT-based tests are highly accurate, they are much more expensive than conventional rapid antigen tests, making them less accessible in low- and middle-income nations. Moreover, the absence of standardized diagnostic protocols for RSV testing has resulted in variability in diagnosis and reporting, impacting market adoption. Most healthcare centers, especially in developing countries, continue to use clinical symptom-based diagnosis instead of laboratory-based testing, which is a restraint on market growth. Another significant constraint is the limited supply of RSV-specific therapeutics since treatment is largely supportive care and not targeted antiviral therapy. In addition, cross-reactivity problems in antigen-based diagnostic tests can cause false positives or negatives, making them less reliable and deterring broad use. Regulatory barriers also present challenges, since rigorous FDA and CE approval procedures for new RSV diagnostic products tend to slow market entry. Finally, low awareness among adults about RSV leads to delayed treatment and diagnosis, even though it has a severe effect on high-risk groups, also limiting market penetration.

Opportunities

The RSV diagnostics market presents significant growth opportunities, particularly with the development of multiplex diagnostic panels capable of detecting RSV, and influenza.

As respiratory infections continue to rise in prevalence, high-throughput and automated diagnostic technology is in higher demand. Technological advances in artificial intelligence and machine learning in diagnostic interpretation have additional potential to provide quicker and more precise detection. Home-based and decentralized testing is another huge opportunity, as point-of-care molecular diagnostic test kits are on the rise for home use for RSV detection. The increasing use of next-generation sequencing in the diagnosis of infectious diseases also creates opportunities for accurate pathogen identification and strain discrimination. Moreover, growing public-private collaborations and RSV research investments stimulate market growth. For instance, large healthcare firms are teaming up with research institutions to create new RSV testing techniques with enhanced sensitivity. Telemedicine and online healthcare platforms are also likely to improve RSV diagnostics through the incorporation of remote monitoring and AI-based diagnostic solutions. The market will also gain from enhanced RSV vaccine development, which will spur greater demand for companion diagnostics to track vaccine efficacy and RSV trend prevalence.

Challenges

One of the key challenges in the RSV diagnostics market is the seasonal nature of RSV outbreaks, leading to fluctuating demand and testing capacity constraints.

In contrast to year-round respiratory illnesses like RSV, cases have a peak in the fall and winter months, posing supply chain and inventory management challenges for diagnostic firms. The other challenge lies in the fact that it is hard to differentiate between RSV and other respiratory viruses since symptoms overlap with influenza. This poses a risk of misdiagnosis and antibiotic misuse, affecting patient management. Furthermore, sparse diagnostic infrastructure in developing countries constrains access to sophisticated RSV testing, with most hospitals not having molecular testing capacity. Difficulty in regulations and reimbursement also impairs market growth, as most countries do not have definitive reimbursement guidelines for RSV diagnostic tests, hence inhibiting access to the tests by patients. Another hindrance comes in the form of a requirement for highly trained professionals to use molecular diagnostic devices, where deficiencies of skilled personnel in virology and infectious disease diagnosis slow its broad implementation. Last but not least, RSV awareness remains low among the public, especially adults and elderly adults, contributing to late diagnosis and underreporting of cases. These problems must be met by increased expenditure in healthcare facilities, better training in diagnostics, and streamlined approvals.

By Product

The chromatographic immunoassay market segment held the largest share of the RSV diagnostics market in 2023, at 25.3% of the overall market share. Its cost-effectiveness, simplicity of use, and short turnaround time make it a first choice in both point-of-care and laboratory settings. The high sensitivity and specificity of the method for detecting RSV have also made it widely accepted across diagnostic labs and hospitals.

The gel microdroplets category is anticipated to be the fastest-growing product line during the forecast period. It is fueled by the high precision of the technology, low viral load detection capacity, and potential for multiplex testing. As RSV testing evolves, gel microdroplets are increasingly finding applications in research and clinical work because they provide better accuracy and automation.

By End-use

The hospital segment was the highest end-use category in 2023, holding 39.09% market share. Hospitals are the biggest testing hubs for RSV diagnostics due to the high patient traffic, the presence of sophisticated diagnostic infrastructure, and government-sponsored testing programs. The increased incidence of severe RSV infection among infants, geriatric patients, and immunocompromised patients has fueled the demand for hospital-based diagnosis.

The homecare market is expected to see the highest growth in the coming years. Growth in point-of-care RSV diagnostic kits, heightened awareness for in-home testing, and advances in rapid antigen and molecular diagnostic solutions are major drivers for this trend. The decentralized healthcare movement and the desire for simple, non-invasive diagnostic products are further fueling homecare-based RSV testing uptake.

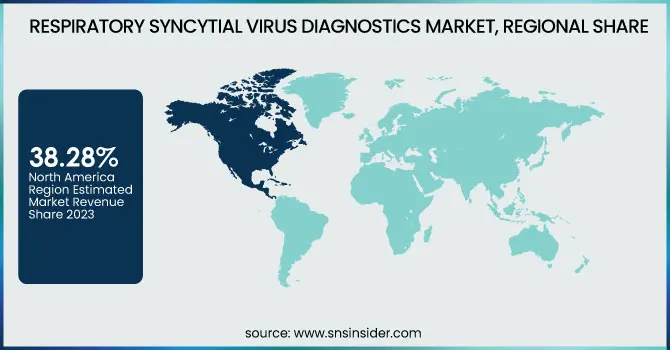

North America dominated the RSV diagnostics market in 2023, with the highest revenue share of 38.28%. The region's leadership is attributable mainly to increased RSV infection rates, strong healthcare infrastructure, and robust government support for diagnosis testing. A large share of this market belongs to the United States, taking advantage of rampant access to state-of-the-art molecular diagnostic tools, growing demand for point-of-care (POC) testing, and favorable reimbursement policies. Furthermore, recurring RSV outbreaks in peak seasons and the presence of industry leaders like Abbott, BD, and Quidel also help drive sustained market growth. Canada is also experiencing growing RSV test adoption, especially in hospital and laboratory settings, further reinforcing North America's dominance in the market.

The Asia-Pacific is projected to be the region with the most rapidly expanding RSV diagnostics market in the forecasting period. Its growth is underpinned by enhanced rates of RSV infection, expanded numbers of neonatal and pediatric patient bases, as well as accelerating levels of knowledge concerning the necessity for early diagnosis of diseases. RSV hospitalization waves in countries like China, India, and Japan are being matched with growing requirements for rapid antigen and molecular-based tests. Government efforts towards increasing healthcare availability, enhancing diagnostic facilities, and boosting RSV testing in remote locations also add to market growth. Moreover, the growing private diagnostic lab penetration, increased healthcare spending, and RSV diagnostics technology advancements help drive the growth of the region. As it moves towards budget-friendly and POC testing approaches, Asia-Pacific is likely to become a central figure in global RSV diagnostics.

Get Customized Report as per Your Business Requirement - Enquiry Now

BD (Becton, Dickinson, and Company): BD MAX Respiratory Viral Panel

Abbott: BinaxNOW RSV Test

QuidelOrtho Corporation: Sofia RSV FIA

Thermo Fisher Scientific Inc.: TaqPath Respiratory Viral Select Panel

F. Hoffmann-La Roche Ltd.: cobas Liat SARS-CoV-2 & Influenza A/B Test

QIAGEN: QIAstat-Dx Respiratory Panel

Hologic Inc.: Panther Fusion SARS-CoV-2/Flu A/B/RSV Assay

Cepheid: Xpert Xpress SARS-CoV-2/Flu/RSV

bioMérieux: BioFire Respiratory Panel

Bio-Rad Laboratories, Inc.: BioPlex 2200 Respiratory Panel

DiaSorin S.p.A.: Simplexa Flu A/B & RSV Direct

Merck KGaA: LightMix Modular Respiratory Virus Panel

Coris BioConcept: RSV Respi-Strip

Siemens Healthineers: FTD Respiratory Pathogens 21

Quest Diagnostics Incorporated: RSV RNA Real-Time PCR Test

In Oct 2024, HaystackAnalytics introduced a new diagnostic test designed to detect bacterial, fungal, and respiratory RNA viruses. This innovation enhances comprehensive pathogen detection, contributing to improved infectious disease diagnostics in the market.

In Sept 2024, Roche launched the Cobas Respiratory Flex test, the first to feature its proprietary TAGS (Temperature-Activated Generation of Signal) technology. This innovation enhances high-throughput multiplex PCR testing, enabling simultaneous detection of up to 15 respiratory pathogens—a significant advancement over conventional PCR tests. The test is designed for cobas 5800, 6800, and 8800 molecular diagnostic analyzers, improving syndromic panel testing efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.01 billion |

| Market Size by 2032 | USD 9.99 billion |

| CAGR | CAGR of 5.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Direct Fluorescent Antibody (DFA) Method, Rapid Antigen Diagnostic Test (RADT), Molecular Diagnostics, Chromatographic Immunoassay (Gravity Driven Test, Oligo chromatography (OC)), Diagnostic Imaging, Gel Microdroplets, Flow Cytometry, Others] • By End-use [Hospitals, Laboratory, Clinics, Homecare] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BD (Becton, Dickinson, and Company), Novartis AG, Abbott, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., bioMérieux, DiaSorin S.p.A., Merck KGaA, Coris BioConcept, Siemens Healthcare S.A., Quest Diagnostics Incorporated. |

Ans: The Respiratory Syncytial Virus Diagnostics market is projected to grow at a CAGR of 5.83% during the forecast period.

Ans: By 2032, the Respiratory Syncytial Virus Diagnostics market is expected to reach USD 9.99 billion, up from USD 6.01 billion in 2023.

Ans: The rising incidence of RSV infections, particularly among infants, elderly individuals, and immunocompromised patients.

Ans: The high cost of advanced molecular diagnostic tests is the major restraint of the RSV diagnostics market.

Ans: North America is the dominant region in the Respiratory Syncytial Virus Diagnostics market.

Table of content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of RSV (2023)

5.2 Diagnostic Testing Trends, (2023), by Region

5.3 Technological Advancements and Innovations in RSV Diagnostics

5.4 RSV Testing in Healthcare Settings (2023 Trends)

5.5 Regulatory and Policy Impact on RSV Diagnostics

5.6 Healthcare Spending on RSV Diagnostics, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Respiratory Syncytial Virus Diagnostics Market Segmentation, by Type

7.1 Chapter Overview

7.2 Direct Fluorescent Antibody (DFA) Method

7.2.1 Direct Fluorescent Antibody (DFA) Method Market Trends Analysis (2020-2032)

7.2.2 Direct Fluorescent Antibody (DFA) Method Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Rapid Antigen Diagnostic Test (RADT)

7.3.1 Rapid Antigen Diagnostic Test (RADT) Market Trends Analysis (2020-2032)

7.3.2 Rapid Antigen Diagnostic Test (RADT) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Molecular Diagnostics

7.4.1 Molecular Diagnostics Market Trends Analysis (2020-2032)

7.4.2 Molecular Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Chromatographic Immunoassay

7.5.1 Chromatographic Immunoassay Market Trends Analysis (2020-2032)

7.5.2 Chromatographic Immunoassay Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5.3 Gravity Driven Test

7.5.3.1 Gravity Driven Test Market Trends Analysis (2020-2032)

7.5.3.2 Gravity-Driven Test Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5.4 Oligo chromatography (OC)

7.5.4.1 Oligo chromatography (OC) Market Trends Analysis (2020-2032)

7.5.4.2 Oligo Chromatography (OC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Diagnostic Imaging

7.6.1 Diagnostic Imaging Market Trends Analysis (2020-2032)

7.6.2 Diagnostic Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Gel Microdroplets

7.7.1 Gel Microdroplets Market Trends Analysis (2020-2032)

7.7.2 Gel Microdroplets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Flow Cytometry

7.8.1 Flow Cytometry Market Trends Analysis (2020-2032)

7.8.2 Flow Cytometry Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Respiratory Syncytial Virus Diagnostics Market Segmentation, by End-use

8.1 Chapter Overview

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Laboratory

8.3.1 Laboratory Market Trends Analysis (2020-2032)

8.3.2 Laboratory Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Clinics

8.4.1 Clinics Market Trends Analysis (2020-2032)

8.4.2 Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Homecare

8.5.1 Homecare Market Trends Analysis (2020-2032)

8.5.2 Homecare Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Respiratory Syncytial Virus Diagnostics Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10. Company Profiles

10.1 BD (Becton, Dickinson, and Company)

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Novartis AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 QuidelOrtho Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Abbott

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Thermo Fisher Scientific Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Bio-Rad Laboratories, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 F. Hoffmann-La Roche Ltd.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 bioMérieux

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 DiaSorin S.p.A.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Merck KGaA

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Direct Fluorescent Antibody (DFA) Method

Rapid Antigen Diagnostic Test (RADT)

Molecular Diagnostics

Chromatographic Immunoassay

Gravity Driven Test

Oligo chromatography (OC)

Diagnostic Imaging

Gel Microdroplets

Flow Cytometry

Others

By End-use

Hospitals

Laboratory

Clinics

Homecare

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Diabetic Nephropathy Market size was valued at USD 2.33 Billion in 2023 and is expected to reach USD 3.72 Billion By 2031 and grow at a CAGR of 6.04% over the forecast period of 2024-2031.

The Smart Healthcare Market size was USD 166 Billion in 2023 and is expected to Reach USD 441.30 Billion by 2031 and grow at a CAGR of 13% over the forecast period of 2024-2031.

The MicroRNA Market Size, valued at USD 1.3 Billon in 2023, is expected to reach USD 7.7 Billon by 2032, growing at a 21.1% CAGR.

The Immunology Market Size was valued at USD 97.58 Billion in 2023, and is expected to reach USD 254.23 Billion by 2032, and grow at a CAGR of 11.8%.

The Muscle Stimulator Market size was valued at USD 783.8 million in 2023 and is expected to reach USD 1077.56 million by 2032 and grow at a CAGR of 3.6% over the forecast period 2024-2032.

Transport Chairs Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.26 billion by 2032, growing at a CAGR of 7.28% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone