Research Antibodies Market Size Analysis:

To Get More Information on Research Antibodies Market - Request Sample Report

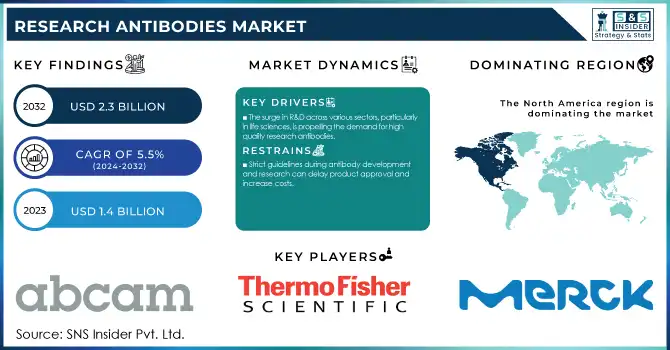

The Research Antibodies Market Size was valued at USD 1.4 billion in 2023 and is expected to reach USD 2.3 billion by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The increasing governmental investments in biotechnology and healthcare research to develop novel antibodies are expected to drive the growth of the research antibodies market over the forecast period. In 2023, the U.S. government spent more than $47 billion on biomedical research and development (R&D), according to the U.S. National Institutes of Health (NIH). Most of these funds go towards research antibodies, which are the main tools for diagnostic, therapeutic, and pharmaceutical research. In addition, the European Union's Horizon Europe program (2021-2027) has an overall budget of more than €95 billion, including life sciences and biotechnology-driven use of antibodies for cancer, infectious disease, and immunology.

One of the other major drivers is the nationwide push for biopharmaceutical development, especially in aim across such applications as oncology and immunotherapy. Research antibodies are indispensable for understanding disease mechanisms, validating biomarkers, and developing targeted therapies. In many nations including India, China, and Japan, governments have also increased investments in their biotech, and antibodies could be one of the biotechnologies that change health. Meanwhile, 2023 saw the Indian government announce an increase in funding for biotech R&D of 25%, in conjunction with targeted initiatives to help prioritize the advancement of monoclonal antibodies and other biologics. We anticipate this additional government assistance to expedite the use of research antibodies in the clinical and pre-clinical arenas. Moreover, the increasing emphasis on precision therapy has contributed to the rising demand for antibodies. As more public-private partnerships emerge, researchers have access to more antibodies to facilitate drug discovery and personalized treatment development. Based on the increasing application of high-quality synthetic research antibodies and the rising demand for personalized therapies the research antibody market is also expected to expand. These trends underscore the critical role of research antibodies in the broader scope of scientific innovation and medical breakthroughs.

Market Dynamics

Drivers

-

The surge in R&D across various sectors, particularly in life sciences, is propelling the demand for high-quality research antibodies.

-

The growing use of antibodies in therapeutic treatments, including oncology and autoimmune diseases, is expanding the market.

-

Progress in antibody engineering and production technologies is enhancing the specificity and efficacy of antibodies, driving market growth.

-

Increased government investments in biomedical research and personalized medicine are fostering market expansion.

A major factor driving the Research Antibodies market is the increasing focus on research and development (R&D) activities such as in life sciences and biotechnology. Increasing annual budgets for years, coupled with an expansion of drug discovery, disease research, and personalized medicine, R&D spending has grown considerably with the world. Worldwide R&D spending in the pharma industry reached USD 230 billion in 2023 up around 4–5% per year. The increase in investments is creating the demand for very specific and dependable antibodies, which in turn fosters research into such antibodies for areas like immunology, oncology, and neuroscience.

For example, in oncology research, monoclonal antibodies have been studied as potential therapeutic agents due to their specificity for certain cancer cells that spare surrounding normal tissue. One of the best examples nowadays is the production of antibodies, such as trastuzumab (Herceptin) which represents a major breakthrough in the treatment of breast cancer. Antibodies also play a crucial in diagnostic research for instance, antibodies are the central component of enzyme-linked immunosorbent assays (ELISA) and Western blot and are used in assessing significant biomarkers associated with diseases such as HIV, Alzheimer's, and other infectious disease-driven illnesses. In addition, the continued trend towards personalized medicine, with treatment focused on the individual patient as determined by genetic and molecular profiles, is driving antibody research. This can be applied in engineering antibodies for specific populations of patients and further enhance their therapeutic use of them. Such R&D advancements will remain instrumental in driving the demand for research antibodies, further propelling market development and innovation

Restraints:

-

Strict guidelines during antibody development and research can delay product approval and increase costs.

-

The complex and expensive process of developing antibodies may limit market growth, especially for smaller entities.

-

Ensuring consistent quality and reproducibility of antibodies remains a significant challenge, potentially affecting research outcomes.

High development costs involved in manufacturing of antibodies film the major restraint in the research antibodies market. A high-quality antibody development process for research and therapeutic application is a complicated, costly procedure. Researchers must undergo rigorous procedures such as antibody generation, validation, and optimization, all of which require specialized equipment, highly skilled personnel, and considerable time investment. Another consideration is that most research applications utilize monoclonal antibodies that are more costly to produce, requiring complex technologies such as hybridoma technology or recombinant DNA methods. The huge price tags associated with these can place a financial strain on the small biotech companies and academic institutions that rely on them, and in turn, restrict access to these new antibodies to cash-strapped scientists. This has the potential to limit the implementation of new antibody-based tools and thus stifle innovation and slow down the general pace of research in this area.

Research Antibodies Market Segmentation Analysis

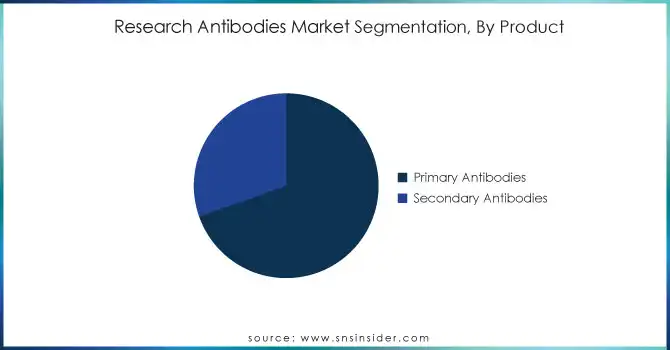

By Product

The primary antibodies segment dominated the global research antibodies market, contributing to 73% in revenue in 2023. Factors such as the demand for primary antibodies for use in diagnostics, therapeutic development, and the study of disease mechanisms contribute to this dominance. Primary antibodies are directly involved in the detection of antigens and are key components used in various laboratory techniques including immunohistochemistry, Western blotting, and enzyme-linked immunosorbent assays (ELISA). Leading to vitally important developments in the extension of primary antibody usage, the large financial commitment of the U.S. government toward the promotion of medical research has played an integral part. Over 15% of NIH funding is for basic research, which typically employs primary antibodies to dissect Molecular and Cellular Mechanisms. Furthermore, primary antibodies are very crucial in the development of vaccines and the study of the immune system studies, their role has become even more critical in the wake of the COVID-19 pandemic. Innovative developments in cancer immunotherapy include the application of primary antibodies to discover cancer biomarkers and to validate new drug targets, which will further fuel the growth of this market.

By Type

In 2023, the research antibodies market was dominated by the monoclonal antibodies (mAb) segment, which accounted for the largest revenue share. The era of monoclonal antibodies (mAbs) has profoundly impacted both biotechnology and pharmaceutical sciences, allowing the targeted treatment of conditions including cancer, autoimmune disease, and infection. These properties render them a unique tool in research studies, their role has become even more critical in the wake of the COVID-19 pandemic. As well as therapeutic applications, due to their specificity, and ability to bind single epitopes. Monoclonal antibody research has received strong government support. The investment represents a burgeoning portion of the monoclonal antibody marketplace that is quickly being identified as an essential element in medical research. Moreover, a wide variety of therapeutic monoclonal antibodies that have been approved by the U.S. Food and Drug Administration and/or are in clinical trials have been developed, which is another factor responsible for the rising demand for mAb research. High demand for therapeutics such as monoclonal antibodies owing to the global trend to develop advanced therapeutics with a hotspot in oncology as these are widely implemented in the development of immunotherapy for cancers.

The high specificity of monoclonal antibodies to antigens also makes them suitable for developing new diagnostic tools. This proliferation supports their prominence in the marketplace with continued use in the management of chronic diseases, such as rheumatoid arthritis and inflammatory bowel disease. Demand for monoclonal antibodies worldwide could keep rising as new manufacturing processes make production more efficient and less expensive.

By Application

In 2023, research antibodies for oncology held the largest share of the research antibodies market. The dominance of this segment is majorly due to the vital role of antibodies in cancer research, diagnosis, and therapeutics. Cancer continues to be among the top causes of death worldwide, with an estimated 9.6 million cancer deaths in 2023, according to the American Cancer Society. This has led to increased research efforts and funding from governments and private sectors to develop effective cancer treatments.

In 2023, the NIH spent around $6.2 billion on cancer research in the USA, much of this being input on antibody-based treatments. More specifically, monoclonal antibodies play a critical role in immunotherapy, presenting new hope for cancer patients through targeted cancer therapies that reduce the risk of side effects. In addition, research antibodies are also used widely in the detection of cancer biomarkers which aids in the enhancement of cancer diagnosis and development of personalized treatment plans for the patients. An increasing focus on immuno-oncology, in which antibodies are central to devoting the immune system to fight cancer by the body, has driven additional demand for the use of antibodies in cancer research.

By End Use

In 2023, academic and research institutes dominated the market with the highest revenue share in the research antibodies market. These institutions rely heavily on research antibodies for fundamental studies in molecular biology, immunology, and biotechnology. The rising trend of scientific discovery and innovation that leads to growing funding for academic research is expected to fuel the market for research antibodies over the forecast period.

The U.S. government has consistently supported academic research, with the NIH earmarking over $9 billion for basic and applied biomedical research in 2023. This funding supports a broad range of research initiatives at universities, medical institutions, and government laboratories. Antibodies are essential tools in these research efforts, particularly in areas such as disease diagnosis, gene editing, and biomarker discovery. With the growing focus on precision medicine, where research antibodies are used to develop individualized treatments, academic institutions remain the largest consumers of these products.

Regional Insights

North America held the largest research antibodies market share 38% in 2023, driven by established pharmaceutical companies, government funding, and a robust healthcare system. One factor that's placed this region at the forefront of the market is the considerable investments in biomedical research by the U.S. government, especially from the National Institute of Health (NIH). Growth in the number of clinical trials, regulatory approvals of new antibody-based therapeutics, and continuing R&D for oncology, immunology, and infectious diseases have also contributed to the expressed region's profile.

On the other hand, the Asia Pacific region will record the fastest CAGR over the forecast period of 2024-2032. The growth is driven by the increasing government spending on biotechnology, specifically in some economies including China, Japan, and India. The Chinese government will direct huge funds to its biopharma sector, with a target of 30% annual increases in R&D spending over five years. Also, Asia Pacific has become a focal point for clinical research, with significant multinational pharmaceutical companies moving research to the region due to the dollar values of doing business there and the growing experience of associated academic institutions. Due to this, Asia Pacific is gaining rapidly in the research antibodies market share and is anticipated to witness the highest growth in the coming years.

Do You Need any Customization Research on Research Antibodies Market - Enquire Now

Recent News & Developments

-

In April 2024, Genentech, part of the Roche Group, secured FDA approval for a monoclonal antibody therapy targeting metastatic lung cancer, boosting the monoclonal antibodies market.

-

Agilent Technologies launched an Integrated Biology Center in August 2023 at Monash University, Malaysia focused on life sciences research and development.

Key Players

Key Service Providers/Manufacturers

-

Abcam Plc (Anti-GAPDH Antibody, Anti-CD3 Antibody)

-

Thermo Fisher Scientific, Inc. (Anti-Histone H3 Antibody, Alexa Fluor 488 Secondary Antibody)

-

Merck KGaA (Anti-β-Actin Antibody, Anti-IL-6 Antibody)

-

Cell Signaling Technology, Inc. (Phospho-Akt Antibody, Anti-p53 Antibody)

-

Bio-Rad Laboratories, Inc. (Anti-GFP Antibody, Anti-Flag M2 Antibody)

-

R&D Systems, Inc. (a Bio-Techne brand) (Anti-TNF-alpha Antibody, Anti-BDNF Antibody)

-

GenScript Biotech Corporation (Anti-His Tag Antibody, Anti-Mouse IgG Antibody)

-

Rockland Immunochemicals, Inc. (Anti-VEGF Antibody, Anti-Human IgG Antibody)

-

PerkinElmer, Inc. (LanthaScreen Antibodies, AlphaLISA Detection Antibodies)

-

Santa Cruz Biotechnology, Inc. (Anti-CXCR4 Antibody, Anti-Bcl-2 Antibody)

Key Users

-

Pfizer Inc.

-

Novartis AG

-

Roche Holding AG

-

Johnson & Johnson

-

AstraZeneca Plc

-

GlaxoSmithKline Plc (GSK)

-

Amgen Inc.

-

Sanofi S.A.

-

Eli Lilly and Company

-

Bayer AG

| Report Attributes | Details |

| Market Size in 2023 | USD 1.4 Billion |

| Market Size by 2032 | USD 2.3 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Monoclonal Antibodies, Polyclonal Antibodies) • By Product (Primary Antibodies, Secondary Antibodies) • By Source (Mouse, Rabbit, Goat, Others) • By Technology (Immunohistochemistry, Immunofluorescence, Western Blotting, Flow Cytometry, Immunoprecipitation, ELISA, Others) • By Application (Infectious Diseases, Immunology, Oncology, Stem Cells, Neurobiology, Others) • By End Use (Academic & Research Institutes, Contract Research Organizations, Pharmaceutical & Biotechnology Companies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Abcam Plc, Thermo Fisher Scientific, Inc., Merck KGaA, Cell Signaling Technology, Inc., Bio-Rad Laboratories, Inc., R&D Systems, Inc. (a Bio-Techne brand), GenScript Biotech Corporation, Rockland Immunochemicals, Inc., PerkinElmer, Inc., Santa Cruz Biotechnology, Inc. |

| Key Drivers | • The surge in R&D across various sectors, particularly in life sciences, is propelling the demand for high-quality research antibodies. • The growing use of antibodies in therapeutic treatments, including oncology and autoimmune diseases, is expanding the market. |

| Market Challenges | • Strict guidelines during antibody development and research can delay product approval and increase costs. • The complex and expensive process of developing antibodies may limit market growth, especially for smaller entities. |