Get more information on Remote Patient Monitoring Market - Request Sample Report

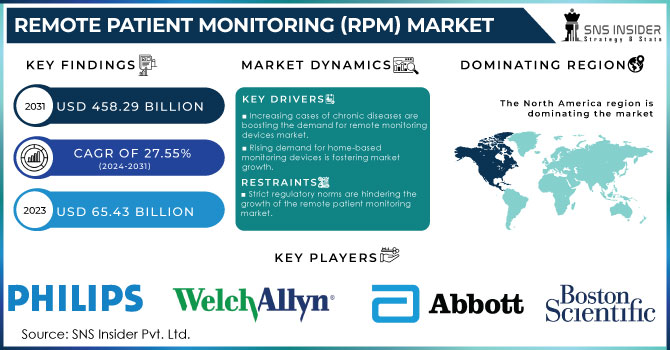

The Remote Patient Monitoring Market Size was valued at USD 65.43 billion in 2023 and is expected to reach USD 458.29 billion by 2031 and grow at a CAGR of 27.55% over the forecast period 2024-2031.

Post-pandemic, remote patient monitoring technology has become a critical component in healthcare, especially for managing chronic conditions by remotely monitoring vital signs such as body temperature, respiration rate heart rate along blood pressure. This transition has minimized the dependency on frequent hospital visits, enhancing patient convenience and reducing healthcare costs. Furthermore, with robust favorable regulatory norms from the USFDA, remote patient monitoring devices are now integrated into routine healthcare practices which has increased acceptance from both healthcare professionals as well as patients boosting the remote patient monitoring market growth.

The key factors driving the remote patient monitoring market are the rising burden of chronic diseases owing to lifestyle changes, and the rising demand for home-based monitoring devices & the surge in the geriatric population. Remote patient monitoring is ambulatory healthcare which assists patients to utilize a mobile medical device to perform a routine test and it also guides the test reports to a healthcare expert in real-time.

The increasing cases of Chronic diseases are boosting the demand for remote patient monitoring devices which is responsible for market growth. For instance, in 2022, as per the American Cancer Society's annual report data, the number of novel cancer cases in the United States reached approximately 1.9 million, and around half a million people died due to cancer in the country. Due to the higher incidence of cancer and the high mortality rate, there is rising usage of monitoring devices for tracking health among the affected population. Hence, the remote patient monitoring market studied is witnessing strong growth owing to the increasing burden of chronic diseases including cancer.

Additionally, remote patient monitoring devices are compact and portable also patients can wear them the whole day without feeling uneasy. The remote patient monitoring devices also make sure that the patient's condition is monitored continuously. Hence, demand for home-based monitoring devices also propels the remote patient monitoring market's growth. For instance, in 2021, As per the Center for Medicare and Medicaid Services, remote monitors assist various high-risk patients to avoid being readmitted to the hospital and make the most of their healthy days at home. For instance, in September 2023, as per the University of Pittsburgh Medical Center, the data states that the Patients who use remote monitoring devices report around 76% reduction in readmission rates which is an average of 89% patient satisfaction along with total medical cost savings of around USD 370 million.

Remote Patient Monitoring Market Dynamics:

KEY DRIVERS:

Increasing cases of chronic diseases are boosting the demand for remote monitoring devices market.

Rising demand for home-based monitoring devices is fostering market growth.

RESTRAINTS:

Strict regulatory norms are hindering the growth of the remote patient monitoring market.

Lack of Reimbursement policies is posing a major challenge for the adoption of remote patient monitoring devices among practitioners & patients.

OPPORTUNITY:

Technological Advancements in Remote Patient Monitoring (RPM) Devices are responsible for remote monitoring devices market growth during the forecast period.

Ongoing research and development (R&D) activities are paving a lucrative growth opportunity for remote monitoring devices.

Remote Patient Monitoring Market Segment Overview:

By Device

Multi-parameter monitors are expected to grow at the highest rate during the forecast period as these devices are portable, small as well as user-friendly. These multi-parameter remote monitoring devices are utilized by medical practitioners along with the health-conscious population for monitoring sleep & activity. The rising mortality rate owing to the rising chronic diseases across established economies, such as the United States & emerging countries, has generated awareness amongst the patient population for early and easy-to-monitor devices.

The majority of players have adopted numerous strategies including product developments, product launches, strategic collaborations, and expansions, to raise their market share. For example, in April 2022, Singapore-based company Fosun Trade Medical Device launched two novel medical devices that are BUZUD Multi-Parameter Monitor (MPM) which is designed to streamline the medical monitoring process and to assist healthcare practitioners in delivering a higher level of care to their patients, and the BUZUD PulseBit EX that is a personal electrocardiogram (ECG) tracker which made heart care affordable as well as convenient for heart patients. Such launches are witnessed to fuel the growth of the remote patient monitoring market segment.

Henceforth, the increasing emphasis on a healthy lifestyle, rising issues regarding the constant monitoring of patients' health parameters along the rising trend of self-monitoring and preventive medicine are witnessed to fuel the growth of the multi-parameter monitors segment boosting the remote monitoring market growth.

By Application

In 2023, The diabetes treatment segment was the leading application segment in 2023. Diabetes is one of the key causes of mortality, that requires continuous detection of blood glucose levels. The disease is also known to impact numerous functions of the body including vision, heart activity, renal activity as well as liver function. Continuous routine monitoring is necessary for diabetes; this can be easily achieved using remote patient monitoring devices. Hence, all these factors are driving the growth of the diabetes segment which is propelling the demand for remote patient monitoring devices.

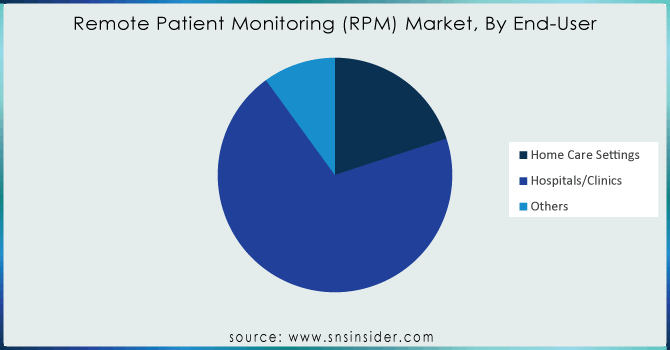

By End-User

The hospitals/ clinics segment was the leading end-use segment in the year 2023. Hospitals cater to a large pool of inpatients as well as outpatients. They deliver numerous diagnostic tests and have a larger technical staff for taking care of the needs of the patients. The large patient population and rising number of tests being performed are the major factors boosting the segmental growth.

Furthermore, homecare settings are witnessed to exhibit a sturdy CAGR during the upcoming years. The cost-efficiency of these settings as well as the availability of qualified resources is witnessed to assist the segmental growth. Investigating the rising strain on hospital resources and personnel, remote patient monitoring poses players with lucrative opportunities in terms of collaborating with hospitals & other healthcare settings and launching novel products to assist affordable care at a patient’s home. Additionally, the COVID crisis has increased the number of patients interacting with their doctors from home, fuelling the demand for the remote patient monitoring system.

Need any customization research on Remote Patient Monitoring Market - Enquiry Now

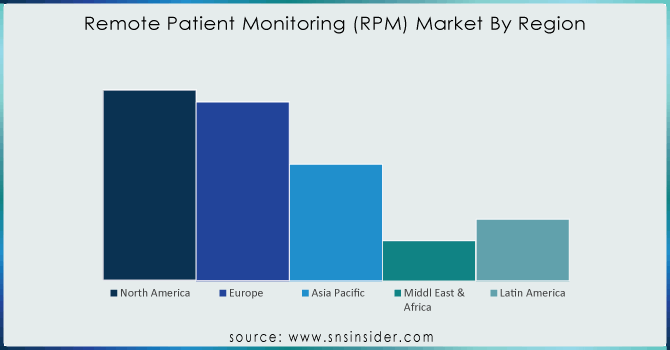

North America is witnessed to maintain its leading position during the forecast period. Novel product launches are a key factor contributing majorly to the remote patient monitoring market growth in the North American region. For example, in May 2022, Novant Health along with Health Recovery Solutions developed a remote patient monitoring system. The strategic alliance with a pilot program emphasizes bariatric patients, with plans to expand to other patient populations in the forthcoming years.

Additionally, the key players in the country have deployed various strategies including product developments, strategic collaborations, product launches, and expansions to increase their market share. For example, in October 2022, DocGo stated that through its pre-existing partnership with Gary and Mary West PACE, they are going to introduce a revolutionary remote patient monitoring (RPM) solution in the United States.

With all these factors combined, North America is well-positioned to maintain its leadership in the remote patient monitoring market for the upcoming years.

The remote patient monitoring (RPM) market is moderately competitive. Numerous medical device vendors along with specialized remote patient monitoring equipment vendors are operating in the market. There is a rising trend of strategic partnerships and alliances between industry participants as well as other medical device manufacturers to include remote patient monitoring functionalities. The key market players include Boston Scientific Corporation, Welch Allyn, Abbott, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Nihon Kohden Corporation, Smiths Medical, OSI Systems, Inc.., Omron Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and other players.

In August 2023, EPIC Health agreed to address health inequities as well as minimize heart attack and stroke risk in underserved Detroit communities. The program will feature VitalSight which is OMRON's first remote patient monitoring service developed for patients suffering from high blood pressure especially those having uncontrolled Stage 2 hypertension.

In August 2022, Medtronic plc collaborated with BioIntelliSense for the exclusive U.S. hospital as well as 30-day post-acute hospital-to-home distribution rights of the BioButton multi-parameter wearable for continuous & connected monitoring. The strategic alliance is responsible for the Medtronic Patient Monitoring business to provide access to a medical-grade device that delivers continuous vital sign measurements of general care patients in-hospital & after post-discharge.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 65.43 Billion |

| Market Size by 2031 | US$ 458.29 Billion |

| CAGR | CAGR of 27.55 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (Breath Monitors, Heart Monitors, Haematology Monitors, Multi-parameter Monitors & Others) • By Application (Cancer Treatment, Cardiovascular Diseases, Diabetes Treatment, Sleep Disorder, Weight Management and Fitness Monitoring & Others) • By End-User (Home Care Settings, Hospitals/Clinics & Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Welch Allyn, Abbott, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Nihon Kohden Corporation, Smiths Medical, OSI Systems, Inc., Omron Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and other players |

| Key Drivers | • Increasing cases of chronic diseases are boosting the demand for remote monitoring devices market. • Rising demand for home-based monitoring devices is fostering market growth. |

| RESTRAINTS | • Strict regulatory norms are hindering the growth of the remote patient monitoring market. • Lack of Reimbursement policies is posing a major challenge for the adoption of remote patient monitoring devices among practitioners & patients. |

Ans: The Remote Patient Monitoring (RPM) Market is to grow at a CAGR of 27.3% over the forecast period 2023-2030.

The challenges faced by Remote Patient Monitoring (RPM) is Behavioral hurdles, healthcare accessibility, and unawareness are all issues that need to be addressed.

The by Application is divided into ten sub segments is Bronchitis Cancer, Diabetes, Cardiovascular Diseases, Infections, Dehydration, Sleep Disorder, Weight management and Fitness Monitoring, Hypertension, and Virus.

Remote Patient Monitoring industry, North America overwhelmed the worldwide market.

Ans: The Remote Patient Monitoring (RPM) Market size is estimated to reach US$ 27.3% over the forecast period 2023-2030.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Remote Patient Monitoring (RPM) Market Segmentation, By Devices

7.1 Introduction

7.2 Breath Monitors

7.3 Heart Monitors

7.4 Haematology Monitors

7.5 Multi-parameter Monitors

7.6 Others

8. Remote Patient Monitoring (RPM) Market Segmentation, By Application

8.1 Introduction

8.2 Cancer Treatment

8.3 Cardiovascular diseases

8.4 Diabetes Treatment

8.5 Sleep Disorder

8.6 Weight Management and Fitness Monitoring

8.7 Others

9. Remote Patient Monitoring (RPM) Market Segmentation, By End-User

9.1 Introduction

9.2 Home Care Settings

9.3 Hospitals/Clinics

9.4 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Remote Patient Monitoring (RPM) Market by Country

10.2.3 North America Remote Patient Monitoring (RPM) Market By Devices

10.2.4 North America Remote Patient Monitoring (RPM) Market By Application

10.2.5 North America Remote Patient Monitoring (RPM) Market By End-User

10.2.6 USA

10.2.6.1 USA Remote Patient Monitoring (RPM) Market By Devices

10.2.6.2 USA Remote Patient Monitoring (RPM) Market By Application

10.2.6.3 USA Remote Patient Monitoring (RPM) Market By End-User

10.2.7 Canada

10.2.7.1 Canada Remote Patient Monitoring (RPM) Market By Devices

10.2.7.2 Canada Remote Patient Monitoring (RPM) Market By Application

10.2.7.3 Canada Remote Patient Monitoring (RPM) Market By End-User

10.2.8 Mexico

10.2.8.1 Mexico Remote Patient Monitoring (RPM) Market By Devices

10.2.8.2 Mexico Remote Patient Monitoring (RPM) Market By Application

10.2.8.3 Mexico Remote Patient Monitoring (RPM) Market By End-User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Remote Patient Monitoring (RPM) Market by Country

10.3.2.2 Eastern Europe Remote Patient Monitoring (RPM) Market By Devices

10.3.2.3 Eastern Europe Remote Patient Monitoring (RPM) Market By Application

10.3.2.4 Eastern Europe Remote Patient Monitoring (RPM) Market By End-User

10.3.2.5 Poland

10.3.2.5.1 Poland Remote Patient Monitoring (RPM) Market By Devices

10.3.2.5.2 Poland Remote Patient Monitoring (RPM) Market By Application

10.3.2.5.3 Poland Remote Patient Monitoring (RPM) Market By End-User

10.3.2.6 Romania

10.3.2.6.1 Romania Remote Patient Monitoring (RPM) Market By Devices

10.3.2.6.2 Romania Remote Patient Monitoring (RPM) Market By Application

10.3.2.6.4 Romania Remote Patient Monitoring (RPM) Market By End-User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Remote Patient Monitoring (RPM) Market By Devices

10.3.2.7.2 Hungary Remote Patient Monitoring (RPM) Market By Application

10.3.2.7.3 Hungary Remote Patient Monitoring (RPM) Market By End-User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Remote Patient Monitoring (RPM) Market By Devices

10.3.2.8.2 Turkey Remote Patient Monitoring (RPM) Market By Application

10.3.2.8.3 Turkey Remote Patient Monitoring (RPM) Market By End-User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Remote Patient Monitoring (RPM) Market By Devices

10.3.2.9.2 Rest of Eastern Europe Remote Patient Monitoring (RPM) Market By Application

10.3.2.9.3 Rest of Eastern Europe Remote Patient Monitoring (RPM) Market By End-User

10.3.3 Western Europe

10.3.3.1 Western Europe Remote Patient Monitoring (RPM) Market by Country

10.3.3.2 Western Europe Remote Patient Monitoring (RPM) Market By Devices

10.3.3.3 Western Europe Remote Patient Monitoring (RPM) Market By Application

10.3.3.4 Western Europe Remote Patient Monitoring (RPM) Market By End-User

10.3.3.5 Germany

10.3.3.5.1 Germany Remote Patient Monitoring (RPM) Market By Devices

10.3.3.5.2 Germany Remote Patient Monitoring (RPM) Market By Application

10.3.3.5.3 Germany Remote Patient Monitoring (RPM) Market By End-User

10.3.3.6 France

10.3.3.6.1 France Remote Patient Monitoring (RPM) Market By Devices

10.3.3.6.2 France Remote Patient Monitoring (RPM) Market By Application

10.3.3.6.3 France Remote Patient Monitoring (RPM) Market By End-User

10.3.3.7 UK

10.3.3.7.1 UK Remote Patient Monitoring (RPM) Market By Devices

10.3.3.7.2 UK Remote Patient Monitoring (RPM) Market By Application

10.3.3.7.3 UK Remote Patient Monitoring (RPM) Market By End-User

10.3.3.8 Italy

10.3.3.8.1 Italy Remote Patient Monitoring (RPM) Market By Devices

10.3.3.8.2 Italy Remote Patient Monitoring (RPM) Market By Application

10.3.3.8.3 Italy Remote Patient Monitoring (RPM) Market By End-User

10.3.3.9 Spain

10.3.3.9.1 Spain Remote Patient Monitoring (RPM) Market By Devices

10.3.3.9.2 Spain Remote Patient Monitoring (RPM) Market By Application

10.3.3.9.3 Spain Remote Patient Monitoring (RPM) Market By End-User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Remote Patient Monitoring (RPM) Market By Devices

10.3.3.10.2 Netherlands Remote Patient Monitoring (RPM) Market By Application

10.3.3.10.3 Netherlands Remote Patient Monitoring (RPM) Market By End-User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Remote Patient Monitoring (RPM) Market By Devices

10.3.3.11.2 Switzerland Remote Patient Monitoring (RPM) Market By Application

10.3.3.11.3 Switzerland Remote Patient Monitoring (RPM) Market By End-User

10.3.3.12 Austria

10.3.3.12.1 Austria Remote Patient Monitoring (RPM) Market By Devices

10.3.3.12.2 Austria Remote Patient Monitoring (RPM) Market By Application

10.3.3.12.3 Austria Remote Patient Monitoring (RPM) Market By End-User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Remote Patient Monitoring (RPM) Market By Devices

10.3.3.13.2 Rest of Western Europe Remote Patient Monitoring (RPM) Market By Application

10.3.3.13.3 Rest of Western Europe Remote Patient Monitoring (RPM) Market By End-User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Remote Patient Monitoring (RPM) Market by Country

10.4.3 Asia-Pacific Remote Patient Monitoring (RPM) Market By Devices

10.4.4 Asia-Pacific Remote Patient Monitoring (RPM) Market By Application

10.4.5 Asia-Pacific Remote Patient Monitoring (RPM) Market By End-User

10.4.6 China

10.4.6.1 China Remote Patient Monitoring (RPM) Market By Devices

10.4.6.2 China Remote Patient Monitoring (RPM) Market By Application

10.4.6.3 China Remote Patient Monitoring (RPM) Market By End-User

10.4.7 India

10.4.7.1 India Remote Patient Monitoring (RPM) Market By Devices

10.4.7.2 India Remote Patient Monitoring (RPM) Market By Application

10.4.7.3 India Remote Patient Monitoring (RPM) Market By End-User

10.4.8 Japan

10.4.8.1 Japan Remote Patient Monitoring (RPM) Market By Devices

10.4.8.2 Japan Remote Patient Monitoring (RPM) Market By Application

10.4.8.3 Japan Remote Patient Monitoring (RPM) Market By End-User

10.4.9 South Korea

10.4.9.1 South Korea Remote Patient Monitoring (RPM) Market By Devices

10.4.9.2 South Korea Remote Patient Monitoring (RPM) Market By Application

10.4.9.3 South Korea Remote Patient Monitoring (RPM) Market By End-User

10.4.10 Vietnam

10.4.10.1 Vietnam Remote Patient Monitoring (RPM) Market By Devices

10.4.10.2 Vietnam Remote Patient Monitoring (RPM) Market By Application

10.4.10.3 Vietnam Remote Patient Monitoring (RPM) Market By End-User

10.4.11 Singapore

10.4.11.1 Singapore Remote Patient Monitoring (RPM) Market By Devices

10.4.11.2 Singapore Remote Patient Monitoring (RPM) Market By Application

10.4.11.3 Singapore Remote Patient Monitoring (RPM) Market By End-User

10.4.12 Australia

10.4.12.1 Australia Remote Patient Monitoring (RPM) Market By Devices

10.4.12.2 Australia Remote Patient Monitoring (RPM) Market By Application

10.4.12.3 Australia Remote Patient Monitoring (RPM) Market By End-User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Remote Patient Monitoring (RPM) Market By Devices

10.4.13.2 Rest of Asia-Pacific Remote Patient Monitoring (RPM) Market By Application

10.4.13.3 Rest of Asia-Pacific Remote Patient Monitoring (RPM) Market By End-User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Remote Patient Monitoring (RPM) Market by Country

10.5.2.2 Middle East Remote Patient Monitoring (RPM) Market By Devices

10.5.2.3 Middle East Remote Patient Monitoring (RPM) Market By Application

10.5.2.4 Middle East Remote Patient Monitoring (RPM) Market By End-User

10.5.2.5 UAE

10.5.2.5.1 UAE Remote Patient Monitoring (RPM) Market By Devices

10.5.2.5.2 UAE Remote Patient Monitoring (RPM) Market By Application

10.5.2.5.3 UAE Remote Patient Monitoring (RPM) Market By End-User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Remote Patient Monitoring (RPM) Market By Devices

10.5.2.6.2 Egypt Remote Patient Monitoring (RPM) Market By Application

10.5.2.6.3 Egypt Remote Patient Monitoring (RPM) Market By End-User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Remote Patient Monitoring (RPM) Market By Devices

10.5.2.7.2 Saudi Arabia Remote Patient Monitoring (RPM) Market By Application

10.5.2.7.3 Saudi Arabia Remote Patient Monitoring (RPM) Market By End-User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Remote Patient Monitoring (RPM) Market By Devices

10.5.2.8.2 Qatar Remote Patient Monitoring (RPM) Market By Application

10.5.2.8.3 Qatar Remote Patient Monitoring (RPM) Market By End-User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Remote Patient Monitoring (RPM) Market By Devices

10.5.2.9.2 Rest of Middle East Remote Patient Monitoring (RPM) Market By Application

10.5.2.9.3 Rest of Middle East Remote Patient Monitoring (RPM) Market By End-User

10.5.3 Africa

10.5.3.1 Africa Remote Patient Monitoring (RPM) Market by Country

10.5.3.2 Africa Remote Patient Monitoring (RPM) Market By Devices

10.5.3.3 Africa Remote Patient Monitoring (RPM) Market By Application

10.5.3.4 Africa Remote Patient Monitoring (RPM) Market By End-User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Remote Patient Monitoring (RPM) Market By Devices

10.5.3.5.2 Nigeria Remote Patient Monitoring (RPM) Market By Application

10.5.3.5.3 Nigeria Remote Patient Monitoring (RPM) Market By End-User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Remote Patient Monitoring (RPM) Market By Devices

10.5.3.6.2 South Africa Remote Patient Monitoring (RPM) Market By Application

10.5.3.6.3 South Africa Remote Patient Monitoring (RPM) Market By End-User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Remote Patient Monitoring (RPM) Market By Devices

10.5.3.7.2 Rest of Africa Remote Patient Monitoring (RPM) Market By Application

10.5.3.7.3 Rest of Africa Remote Patient Monitoring (RPM) Market By End-User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Remote Patient Monitoring (RPM) Market by country

10.6.3 Latin America Remote Patient Monitoring (RPM) Market By Devices

10.6.4 Latin America Remote Patient Monitoring (RPM) Market By Application

10.6.5 Latin America Remote Patient Monitoring (RPM) Market By End-User

10.6.6 Brazil

10.6.6.1 Brazil Remote Patient Monitoring (RPM) Market By Devices

10.6.6.2 Brazil Remote Patient Monitoring (RPM) Market By Application

10.6.6.3 Brazil Remote Patient Monitoring (RPM) Market By End-User

10.6.7 Argentina

10.6.7.1 Argentina Remote Patient Monitoring (RPM) Market By Devices

10.6.7.2 Argentina Remote Patient Monitoring (RPM) Market By Application

10.6.7.3 Argentina Remote Patient Monitoring (RPM) Market By End-User

10.6.8 Colombia

10.6.8.1 Colombia Remote Patient Monitoring (RPM) Market By Devices

10.6.8.2 Colombia Remote Patient Monitoring (RPM) Market By Application

10.6.8.3 Colombia Remote Patient Monitoring (RPM) Market By End-User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Remote Patient Monitoring (RPM) Market By Devices

10.6.9.2 Rest of Latin America Remote Patient Monitoring (RPM) Market By Application

10.6.9.3 Rest of Latin America Remote Patient Monitoring (RPM) Market By End-User

11. Company Profiles

11.1 Boston Scientific Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Welch Allyn

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Abbott

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Koninklijke Philips N.V.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 F. Hoffmann-La Roche Ltd

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Nihon Kohden Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Smiths Medical

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 OSI Systems, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Omron Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Device

Breath Monitors

Heart Monitors

Haematology Monitors

Multi-parameter Monitors

Others

By Application

Cancer Treatment

Cardiovascular Diseases

Diabetes Treatment

Sleep Disorder

Weight Management and Fitness Monitoring

Others

By End-User

Home Care Settings

Hospitals/Clinics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The BOTOX market size was valued at USD 5.58 billion in 2023 and is projected to reach USD 13.74 billion by 2032, growing at a CAGR of 10.55% from 2024-2032.

The Cardiac Rhythm Management Devices Market was valued at USD 18.51 billion in 2023, projected to reach USD 32.35 billion by 2032, growing at a CAGR of 6.40%.

The Human Insulin Market size was valued at USD 18.1 billion in 2023 and will reach USD 24.6 billion by 2032 and grow at a CAGR of 3.4% by 2024-2032.

The Compression Therapy Market size was valued at USD 4.06 Billion in 2023 & is estimated to reach USD 7.86 Billion by 2032 with a growing CAGR of 7.63% over the forecast period of 2024-2032.

Demand for Portable and Point-of-Care Imaging Devices is on the rise, driven by advances in medical imaging technology and the growing demand for effective healthcare services.

The Monkeypox Testing Market Size was valued at USD 1.73 billion in 2023 and is expected to reach USD 2.58 billion by 2032 and grow at a CAGR of 4.55% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone