To get more information on Rehabilitation Robots Market - Request Free Sample Report

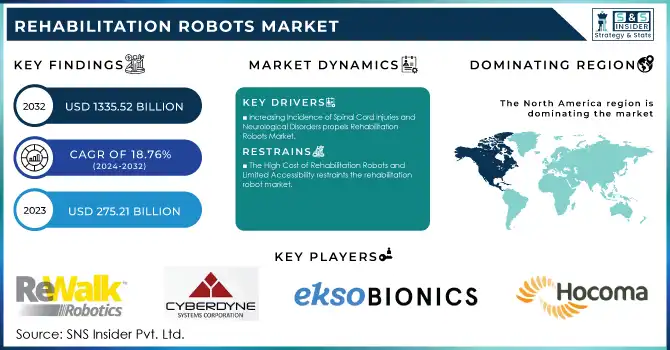

The Rehabilitation Robots Market was valued at USD 275.21 million in 2023 and is expected to reach USD 1335.52 million by 2032, growing at a CAGR of 18.76% from 2024-2032.

The Rehabilitation Robots market is growing rapidly due to breakthroughs in robotics, artificial intelligence, and an increasing need for more effective rehabilitation solutions. The rise in the aging population across the world, accompanied by a higher incidence of neurological, musculoskeletal, and spinal cord injuries, is creating a demand for new rehabilitation methods. Rehabilitation robots, like robotic exoskeletons and therapy robots, have become some of the most important tools for aiding recovery by providing accurate, repeatable movements that diminish dependence on manual therapy and therefore make rehabilitation more efficient.

High and frequent incidents of conditions such as stroke, cerebral palsy, and spinal cord injuries mean more patients need long-term rehabilitation. Increasing patient inflows are posing substantial pressure on healthcare systems, prompting greater adoption of efficient technologies for rehabilitation. Rehabilitation robots tackle the problem by providing the very required high frequency, quality, and tailored therapy; this means better outputs at the end.

The advancements in technology, especially by incorporating AI and machine learning capabilities, are making rehabilitation robots better. The systems developed using AI can analyze the feedback in real time to allow robots to adjust their movements accordingly for individual patients. In this way, customization to meet patient needs optimizes recovery while also reducing rehabilitation time. Innovations by companies like ReWalk Robotics and German Bionic have led to more sophisticated robotic exoskeletons, demonstrating the growing potential of rehabilitation robots for a wide range of conditions.

Increased investment in healthcare automation and robotics further supports the development of advanced rehabilitation robots, contributing to the market’s rapid expansion. As healthcare providers adapt these technologies in hospitals, rehabilitation centers, and senior care facilities, the demand for robotic rehabilitation solutions keeps surging. Moreover, an FDA-approved process is a major contribution to market growth by facilitating safety and efficacy in those devices, which boosts the level of confidence in the market to expand adoption.

Drivers

Increasing Incidence of Spinal Cord Injuries and Neurological Disorders propels Rehabilitation Robots Market

A significant factor contributing to the growth of the rehabilitation robot market is the rising incidence of spinal cord injuries and neurological disorders such as stroke, cerebral palsy, and Parkinson’s disease. The World Health Organization estimates that 250,000 to 500,000 people around the globe suffer spinal cord injuries each year. Furthermore, according to the Centers for Disease Control and Prevention, around 795,000 people in the United States suffer a stroke each year, with many needing post-stroke rehabilitation to recover lost motor functions.

Robotics will be an effective innovation meant to go beyond the traditional capabilities that therapy has in offering precise and repeated movements, even with simple robots on board, allowing scaling the therapy sessions up to 100 times. Robotic systems will help regain lost strength, mobility, and functionality for thousands of people worldwide in rehabilitation centers, ultimately leading to higher adoption rates.

Technological Advancements and Investment in AI-Driven Rehabilitation Robotics for Enhanced Patient Outcomes

Continual advancements in robotics, artificial intelligence and machine learning are key for the rehabilitation robot market to continue evolving towards higher levels of precision, adaptability, and user interaction. These innovations broaden the capabilities of rehabilitation robots, enabling them to provide more personalized, efficient treatment. With AI integration, therapy sessions can be adjusted in real-time based on patient feedback, thereby allowing healthcare professionals to devise tailored treatment plans that accelerate recovery and improve outcomes. The growth in robotic rehabilitation systems is being driven as the healthcare industry increasingly invests in automation and high-tech solutions to improve care and outcomes for patients. In 2024, Ekso Bionics’ EksoNR was released with new degrees of freedom to allow for more versatility and the restoration of function for patients with neurological and musculoskeletal conditions. The Robotic Rehabilitative Exoskeleton recently developed by Acoris Robotics is also attracting a hefty amount of investment from healthcare institutions for its ability to use AI to monitor rehabilitation sessions and modify them in real-time based on the patient's individualized needs.

Restraint

The High Cost of Rehabilitation Robots and Limited Accessibility restraints the rehabilitation robot market

High development, manufacturing, and integration costs of rehabilitation robots are among the significant restraints for the rehabilitation robotics market Robotics, artificial intelligence, machine learning, etc — all of this advanced tech require a lot of money to invest in research, engineering, and infrastructure. Consequently, initial purchase and maintenance costs for rehabilitation robots are often excessive for many healthcare facilities, especially in low- and middle-income locations. As a result, these technologies are not accessible to a wider population outside of well-funded hospitals, clinics, and rehabilitation centers. The expense also represents a barrier to insurance companies and healthcare systems who might be reluctant to pay for patients' robotic rehabilitation devices.

By Type

In 2023, the exoskeletons segment dominated the rehabilitation robot market by holding the largest market share. The growth is also mainly fueled by the growing older population, which is said to raise the usage of exoskeletons. The European Commission has projected that, by 2050, nearly 500,000 people in the EU-27 will be aged 100 or older. In addition, the increasing prevalence of cerebral palsy, the most common childhood disability, will also propel the demand for exoskeleton robots further. The market is also getting a fillip from an increase in product launches and approvals. For example, German Bionic, a leader in active exoskeleton technology, launched its new Apogee+ power suit for the healthcare sector in October 2024. The Apogee+ exosuit offers considerable gains in strength and intelligence to help healthcare professionals reduce the risks of fatigue and injury while improving efficiency in operational tasks in medical and residential care settings.

The therapy robots segment is likely to expand at the fastest growth rate during the period of the forecast, with a CAGR of 16%. This growth is further fueled by the increasing adoption of therapy robots in healthcare, increased investment in research and development to create advanced technologies and greater awareness of the benefits of therapy robots. The rising incidence of conditions like paralysis, spinal cord injuries, and strokes is a major factor driving this segment's expansion.

By End-use

In 2023, the hospitals and clinics segment dominated the market, capturing the largest market share of 45%. The growth is mainly driven by increased healthcare spending and the rapid adoption of advanced technologies in healthcare settings. In addition, a large number of people with spinal cord injuries, musculoskeletal disorders, and other conditions require rehabilitation services in hospitals, which further boosts the sector. Moreover, awareness regarding technologically advanced systems, and the rising number of FDA approvals for medical exoskeletons, is also enhancing the growth of the market.

The senior care facilities segment is likely to experience the fastest growth during the forecast period due to the increase in the elderly population. Global expansion of government programs for the construction of senior care facilities, coupled with growing demand for enhanced healthcare services for elderly people, also contributes to this segment's growth.

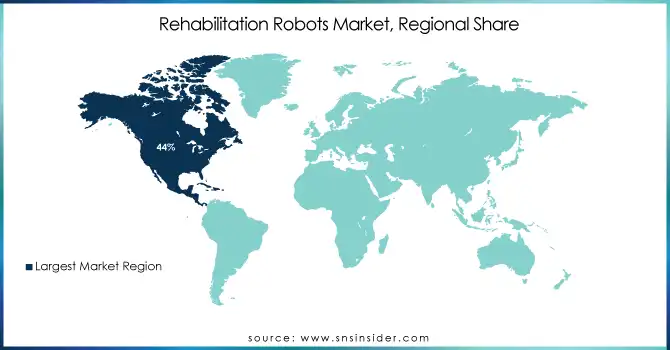

In 2023, North America dominated the rehabilitation robot market with a market share of 44%. The increasing prevalence of spinal cord injuries is a major power for the market along with the growing disabled and old populations. As of 2023, around 42.5 million people—13% of the civilian noninstitutionalized population, experienced disabilities in the U.S., according to the U.S. Census Bureau. These factors are playing a major role in the growth of the industry.

Asia Pacific is expected to show the fastest growth during the forecast period. Increasing healthcare expenditure and cognizance of newer technologies in rehabilitation are propelling the Asia Pacific to emerge as the largest market for rehabilitation robots in the forecast period. Additionally, the increasing population of elderly in this region necessitates the availability of efficient rehabilitation solutions specifically aimed toward age-related conditions and injuries. China was the largest contributor to the regional market, owing to the presence of advanced robotic systems in 2024. SYREBO, a pioneer in the rehabilitation solutions industry, made waves at MEDICA 2023 by launching two revolutionary products — the Hand Rehabilitation Robot (BCI) and the Upper Limb Rehabilitation Robot in November 2023.

Japan, is another major country that would likely see a surge in rehabilitation robots in the upcoming years. It has an aging population that is growing as a result of potentially related problems like stroke and degenerative diseases. Statistics from the National Institute of Population and Social Security Research estimate that by 2040, 34.8% of the Japanese population will be over 65 years old.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Hocoma AG (Lokomat Gait Training Robot, Armeo Arm Therapy Robot)

Ekso Bionics Holdings, Inc. (EksoNR Neurorehabilitation Exoskeleton, EksoVest Upper Body Exoskeleton)

ReWalk Robotics (ReWalk Personal Exoskeleton, ReStore Stroke Therapy Exosuit)

Cyberdyne Inc. (HAL Hybrid Assistive Limb, HAL Single Joint Type)

Bionik Laboratories Corp. (InMotion Arm Stroke Rehabilitation Robot, InMotion Hand Therapy Robot)

Myomo, Inc. (MyoPro Powered Arm Brace, MyoPro Motion G Pediatric Arm Device)

Parker Hannifin Corporation (Indego Personal Mobility Exoskeleton, Indego

Therapy Gait Training Device)

Aretech, LLC (ZeroG Body Weight Support System, Ovation Treadmill Rehabilitation System)

Kinova Robotics (Kinova Gen3 Assistive Robotic Arm, KINARM Neurological Assessment Exoskeleton)

Tyromotion GmbH (Amadeo Finger Therapy Robot, Diego Arm and Shoulder Therapy Robot)

AlterG, Inc. (Anti-Gravity Treadmill, Bionic Leg Lower Limb Rehabilitation Device)

Hocoma Valedo (ValedoMotion Back Therapy Robot, ValedoShape Posture Analysis Device)

Fourier Intelligence (ArmMotus Upper Limb Rehabilitation Robot, ExoMotus Lower Limb Exoskeleton)

Rex Bionics Ltd. (REX Standing and Walking Exoskeleton, REX P Therapy Center Exoskeleton)

Honda Motor Co., Ltd. (Walking Assist Device, Stride Management Assist)

Hocoma C-Mill (C-Mill Gait Therapy Treadmill, BalanceTutor Dynamic Balance Training System)

Yaskawa Electric Corporation (SmartPal Rehabilitation Robot, Motoman Robotic Arm)

Focal Meditech BV (iARM Interactive Arm Support, Liftup Raizer Rehabilitation Lifting Chair)

Mazor Robotics (Mazor X Robotic Spine Assistant, Renaissance Guidance Rehabilitation Device)

Ottobock SE & Co. KGaA (C-Brace Lower Limb Orthotic Device, Dynamic Arm Powered Orthosis)

Recent Developments

November 29, 2024 – Honda Research Institute Japan Co., Ltd. (HRI-JP), a subsidiary of Honda R&D focused on advanced technology research, announced the launch of its AI-powered social robot, “Haru.” The innovative robot has been deployed at the Virgen del Rocío University Hospital (HUVR) in Seville, Spain, to support and improve the well-being of children during their hospital stays.

March 2024: Cyberdyne unveiled its advanced Hybrid Assistive Limb (HAL), a powered exoskeleton suit developed in collaboration with Japan’s Tsukuba University. HAL is designed to support voluntary control of knee and hip joint movements by detecting bioelectric signals from muscle activities or force-pressure signals caused by weight shifts, providing enhanced mobility assistance to users.

December 2023: ReWalk Robotics, Ltd., a leading innovator in mobility and wellness technologies for individuals with neurological conditions, announced the successful demonstration of its next-generation exoskeleton as a proof-of-concept, showcasing its commitment to advancing rehabilitation and daily life solutions.

September 2023: Bionik Laboratories secured a patent from the U.S. Patent and Trademark Office (USPTO) for its cutting-edge rehabilitation technology. The innovation includes a novel device and technique aimed at providing improved positioning and guidance for patients during upper-extremity rehabilitation, further enhancing therapeutic outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 275.21 million |

| Market Size by 2032 | US$ 1355.52 million |

| CAGR | CAGR of 18.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Therapy robots, Exoskeletons) • By Extremity (Upper body, Lower body) •By End-use (Hospitals & clinics, Senior care facilities, Homecare settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hocoma AG, Ekso Bionics Holdings, Inc., ReWalk Robotics, Cyberdyne Inc., Bionik Laboratories Corp., Myomo, Inc., Parker Hannifin Corporation, Aretech, LLC, Kinova Robotics, Tyromotion GmbH, AlterG, Inc., Hocoma Valedo, Fourier Intelligence, Rex Bionics Ltd., Honda Motor Co., Ltd., Hocoma C-Mill, Yaskawa Electric Corporation, Focal Meditech BV, Mazor Robotics, Ottobock SE & Co. KGaA, and other players. |

| Key Drivers | •Increasing Incidence of Spinal Cord Injuries and Neurological Disorders propels Rehabilitation Robots Market •Technological Advancements and Investment in AI-Driven Rehabilitation Robotics for Enhanced Patient Outcomes |

| Restraints | •The High Cost of Rehabilitation Robots and Limited Accessibility restraints the rehabilitation robot market |

Ans- The Rehabilitation Robots Market was valued at USD 275.21 million in 2023 and is expected to reach USD 1335.52 million by 2032.

Ans – The CAGR rate of the Rehabilitation Robots Market during 2024-2032 is 18.76%.

Ans- The hospitals and clinics segment dominated the market by 45%

Ans- North America held the largest revenue share by 44% in 2023.

Ans- Asia Pacific is the fastest-growing region in the Rehabilitation Robots Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Healthcare Integration Statistics

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Customer Satisfaction Rates

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Rehabilitation Robots Market Segmentation, by Type

7.1 Chapter Overview

7.2 Therapy robots

7.2.1 Therapy Robots Market Trends Analysis (2020-2032)

7.2.2 Therapy Robots Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Exoskeletons

7.3.1 Exoskeletons Market Trends Analysis (2020-2032)

7.3.2 Exoskeletons Market Size Estimates and Forecasts to 2032 (USD Million)

8. Rehabilitation Robots Market Segmentation, by Application

8.1 Chapter Overview

8.2 Upper body

8.2.1 Upper Body Market Trends Analysis (2020-2032)

8.2.2 Upper Body Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Lower body

8.3.1 Lower Body Market Trends Analysis (2020-2032)

8.3.2 Lower Body Market Size Estimates and Forecasts to 2032 (USD Million)

9. Rehabilitation Robots Market Segmentation, by End User

9.1 Chapter Overview

9.2 Hospitals & clinics

9.2.1 Hospitals & clinics Market Trends Analysis (2020-2032)

9.2.2 Hospitals & clinics Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Senior care facilities

9.3.1 Senior care facilities Market Trends Analysis (2020-2032)

9.3.2 Senior care facilities Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Homecare settings

9.4.1 Homecare settings Market Trends Analysis (2020-2032)

9.4.2 Homecare settings Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Rehabilitation Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Rehabilitation Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Rehabilitation Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Rehabilitation Robots Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Hocoma AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Ekso Bionics Holdings, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 ReWalk Robotics

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Cyberdyne Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Bionik Laboratories Corp.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Myomo, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Parker Hannifin Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Aretech, LLC

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Kinova Robotics

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Tyromotion GmbH

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Therapy robots

Exoskeletons

By Extremity

Upper body

Lower body

By End Use

Hospitals & clinics

Senior care facilities

Homecare settings

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Bioequivalence Studies Market was valued at USD 742 Million in 2023 and is expected to reach USD 1484.5 million by 2032, growing at a CAGR of 8% over the forecast period 2024-2032.

The Pressure Monitoring Market was valued at USD 12.74 billion in 2023 and is expected to reach USD 27.07 billion by 2032, growing at a CAGR of 8.75% over the forecast period of 2024-2032.

The Pharmaceutical logistics Market was valued at USD 94.6 billion in 2023 and is expected to reach USD 210.18 billion by 2032, growing at a CAGR of 9.28% over the forecast period 2024-2032.

The Probe Reprocessing Market was valued at USD 752.42 million in 2023 and is expected to reach USD 1985.18 million by 2032, growing at a CAGR of 11.27% from 2024 to 2032.

The Single-Use Bioreactors Market Size was valued at USD 3872.40 million in 2023 and is expected to reach USD 13784.83 million by 2031 and grow at a CAGR of 17.2% over the forecast period 2024-2031.

Ruminant Methane Reduction Market Size was valued at USD 2.61 Billion in 2023 and is expected to reach USD 4.73 billion by 2032, growing at a CAGR of 6.8% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone