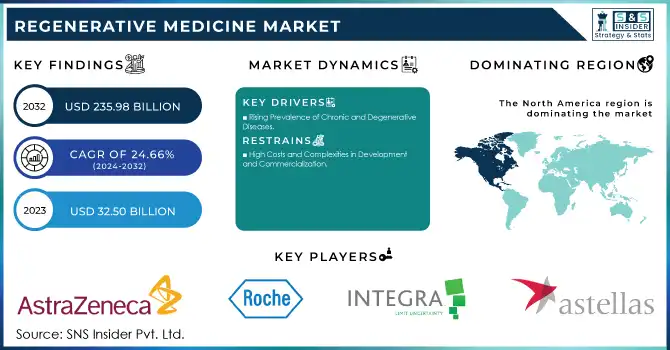

The Regenerative Medicine Market size was estimated at USD 32.50 billion in 2023 and expected to reach USD 235.98 billion in 2032, and grow at a CAGR of 24.66% for the forecast period of 2024-2032.

Get More Information on Regenerative Medicine Market - Request Sample Report

The Regenerative Medicine Market is rapidly transforming healthcare by introducing groundbreaking solutions to repair, regenerate, and replace damaged tissues and organs. This innovative field leverages stem cell therapy, gene therapy, tissue engineering, and biomaterials to address chronic and degenerative conditions, including cardiovascular diseases, neurodegenerative disorders, musculoskeletal injuries, and genetic abnormalities. With over 1.13 million people globally requiring organ transplants annually but only a fraction receiving them due to donor shortages, regenerative medicine offers a promising alternative through lab-grown organs and bioengineered tissues.

Scientific advancements have been a driving force in this market. For instance, induced pluripotent stem cells (iPSCs) have revolutionized regenerative therapies by enabling the generation of patient-specific cells. In 2022, studies demonstrated the successful transplantation of bioengineered corneas derived from iPSCs, restoring sight to individuals with corneal blindness. Similarly, CRISPR gene-editing technology has shown potential in curing inherited blood disorders such as sickle cell anemia and beta-thalassemia, with multiple clinical trials reporting successful outcomes.

The increasing prevalence of chronic diseases further supports the market's growth. For example, the World Health Organization (WHO) estimates that over 17.9 million people die annually from cardiovascular diseases, many of which could benefit from regenerative solutions like myocardial cell regeneration. In neurodegenerative conditions, stem cell-based therapies for Parkinson’s disease have shown promise, with clinical trials reporting improved motor functions and reduced symptoms.

Regulatory support and funding also play a critical role. The U.S. FDA has granted over 170 Regenerative Medicine Advanced Therapy (RMAT) designations since 2017. This facilitates faster approval for therapies like Luxturna, the first gene therapy approved for a rare form of inherited blindness. Furthermore, investments in regenerative medicine R&D exceeded USD 14 billion globally in 2021, fueling innovations like 3D bioprinted skin for burn victims and cartilage for joint repair.

Drivers

Rising Prevalence of Chronic and Degenerative Diseases

The increasing burden of chronic conditions like diabetes, cardiovascular diseases, and neurodegenerative disorders is a significant driver for the regenerative medicine market. Traditional treatments often address symptoms rather than underlying damage, creating a demand for innovative therapies. For instance, stem cell-based treatments for Type 1 diabetes are advancing, with clinical trials showing the potential to regenerate insulin-producing beta cells. Similarly, cartilage repair therapies for osteoarthritis are gaining traction as non-surgical alternatives for pain management and mobility restoration.

Technological Advancements in Regenerative Solutions

Innovations in 3D bioprinting, gene-editing tools like CRISPR, and biomaterials have revolutionized the field of regenerative medicine. These technologies allow for precise tissue engineering and personalized therapeutic solutions. For example, 3D bioprinted tissues are being developed to replace damaged organs, while hydrogels are improving cell delivery for wound healing applications. Such advancements significantly enhance treatment efficacy and broaden the scope of regenerative medicine.

Government Initiatives and Increased Funding

Supportive regulatory frameworks and substantial funding are accelerating market growth. Policies like Japan's Act on the Safety of Regenerative Medicine and the U.S. FDA’s RMAT designation streamline clinical trials and approvals, fostering innovation. Simultaneously, global R&D investments in regenerative medicine exceeded USD 14 billion in recent years, enabling breakthroughs such as lab-grown skin for burn victims and gene therapies for rare diseases. These efforts not only drive innovation but also improve accessibility to advanced treatments worldwide.

Restraints

High Costs and Complexities in Development and Commercialization

One of the primary restraints for the regenerative medicine market is the high cost and complexity associated with developing and commercializing advanced therapies. Processes like stem cell harvesting, tissue engineering, and gene editing require sophisticated technologies, skilled expertise, and extensive R&D investments, driving up production costs. For instance, CAR-T cell therapies, though highly effective for certain cancers, can cost upwards of USD 373,000 per patient. Additionally, navigating the stringent regulatory pathways for approval, which demand extensive clinical trials and long-term safety evaluations, can delay market entry and inflate expenses. The scalability of personalized therapies also presents challenges, as each treatment often requires customization to individual patient needs, further complicating manufacturing processes. These factors limit the accessibility of regenerative treatments, particularly in low- and middle-income countries, posing a significant barrier to the widespread adoption of these transformative medical solutions.

By Product

In 2023, cell therapy was the dominant product segment in the regenerative medicine market, accounting for 35% of the total market share. Cell therapy’s dominance is driven by its broad applicability across various therapeutic areas, including oncology, musculoskeletal disorders, and neurological diseases. One of the most notable innovations in this segment is CAR-T cell therapy (Chimeric Antigen Receptor T-cell therapy), which has revolutionized the treatment of certain cancers, particularly blood cancers such as leukemia and lymphoma. Additionally, stem cells used in regenerative treatments for bone, cartilage, and nerve regeneration further enhance the reach and effectiveness of cell therapy. Cell therapy has become a cornerstone of regenerative medicine with the growing prevalence of chronic diseases, degenerative conditions, and the need for personalized therapies.

Stem cell therapy emerged as the fastest-growing segment throughout the forecast period, within the broader cell therapy category. Stem cells have garnered attention due to their remarkable ability to regenerate and repair damaged tissues, making them a promising option for treating a wide range of conditions. Stem cell therapies are now being investigated and applied to diseases such as osteoarthritis, heart disease, neurodegenerative diseases, and even spinal cord injuries. These therapies are not only helping to regenerate tissue but also providing a potential alternative to organ transplants, a major challenge in modern healthcare.

By Therapeutic Area

Oncology was the leading therapeutic area for regenerative medicine in 2023, dominating the market with 40% of the total share. The field of oncology is one of the largest and most crucial for regenerative medicine due to the significant burden that cancer places on global healthcare systems. The growth of innovative cell therapies, particularly CAR-T cell therapy, has dramatically improved treatment outcomes for certain types of cancer, such as blood cancers including leukemia, lymphoma, and myeloma. The ability of CAR-T cells to be engineered to target specific cancer cells and induce long-term remission has garnered substantial attention and investment. Additionally, gene therapy approaches, including the modification of immune cells to enhance their cancer-fighting capabilities, are further accelerating the use of regenerative medicine in oncology. With the increasing number of cancer cases worldwide and the growing demand for more effective and targeted treatments, regenerative therapies in oncology are seen as a groundbreaking advancement.

Cardiovascular Diseases are anticipated to be the fastest-growing segment over the forecast period. This segment is rapidly advancing due to its potential to revolutionize the treatment of heart conditions, particularly those resulting from myocardial infarctions (heart attacks) and heart failure. Stem cell therapies are being developed to regenerate damaged heart tissues, improve heart function, and reduce scarring, offering a promising alternative to traditional treatments like heart transplants and surgeries.

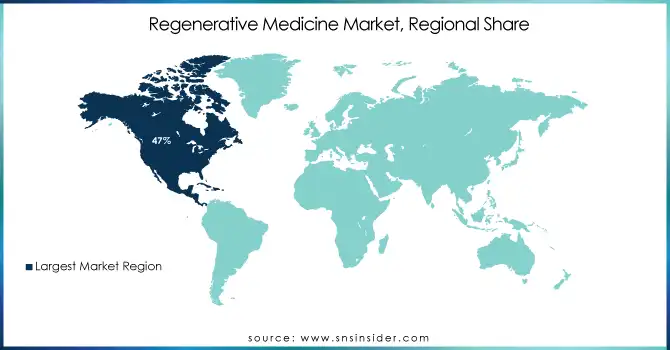

North America is the dominant region in 2023 with a 47% share, particularly the U.S., which held the largest market share due to its advanced healthcare infrastructure, significant investments in research and development, and a high number of clinical trials. Leading companies such as Astellas Pharma, Pfizer, and Merck are based in this region, further boosting the market. The U.S. Food and Drug Administration (FDA) has been instrumental in approving regenerative therapies, accelerating the market's growth. Additionally, the increasing prevalence of chronic conditions like cardiovascular diseases, neurological disorders, and musculoskeletal issues is driving the demand for regenerative medicine.

In Europe, countries like the UK, Germany, and France are making strides in stem cell-based therapies and tissue engineering technologies. The region benefits from growing collaborations between biotech firms and research institutions. The European Medicines Agency (EMA) has also facilitated the approval of various regenerative medicine products, supporting the sector’s growth.

Meanwhile, the Asia-Pacific region is the fastest-growing, driven by expanding healthcare investments, an aging population, and a rise in clinical trial activity. Countries such as Japan, China, and South Korea are advancing in stem cell research and gene therapy, with government-backed funding programs further fostering innovation. As healthcare access improves in these regions, the regenerative medicine market in Asia-Pacific is expected to grow rapidly in the coming years.

Need any customization research on Regenerative Medicine Market - Enquiry Now

Stem cell-based therapies (in preclinical stages).

F. Hoffmann-La Roche Ltd.

SPARC-related treatments.

Integra Lifesciences Corp.

OASIS Wound Matrix.

RPE cell therapy.

Cook Biotech, Inc.

OASIS Wound Matrix.

BlueRock Therapeutics (Stem cell-derived therapies).

Pfizer, Inc.

Pfizer-BioNTech collaborations.

Merck KGaA

Bioinks, Stem cell cultivation technologies.

Abbott

HeartMate 3 LVAD.

Vericel Corp.

MACI (Matrix-Induced Autologous Chondrocyte Implantation).

Novartis AG

Luxturna, Zolgensma.

GlaxoSmithKline (GSK)

Strimvelis.

Biogen, Inc.

Anti-inflammatory gene therapy research.

Sarepta Therapeutics, Inc.

SRP-9001.

Gilead Sciences, Inc.

Yescarta, Tecartus.

Amgen Inc.

Prolia, Evenity.

Smith+Nephew

PICO Negative Pressure Wound Therapy, Regeneten.

MEDIPOST Co., Ltd.

CARTISTEM.

JCR Pharmaceuticals Co., Ltd.

TEMCELL.

Takeda Pharmaceutical Company Limited

Hemophilia gene therapies.

CORESTEM, Inc.

NeuroNata-R

In Jan 2025, Zhongzhi Pharmaceutical Holdings Ltd. invested USD 3 million in Gabaeron Inc.'s Series A financing round on December 21, aiming to advance Gabaeron's preclinical Alzheimer’s disease (AD) stem cell therapy candidate into phase I testing.

In Nov 2024, Intellia Therapeutics announced that the U.S. Food and Drug Administration (FDA) has granted Regenerative Medicine Advanced Therapy (RMAT) designation to nexiguran ziclumeran (nex-z, also known as NTLA-2001). This CRISPR-based investigational therapy is designed to treat hereditary transthyretin (ATTR) amyloidosis with polyneuropathy by inactivating the TTR gene, preventing the production of TTR protein. Intellia is leading its development and commercialization in collaboration with Regeneron.

In Oct 2024, The U.S. Department of Commerce’s National Institute of Standards and Technology (NIST) awarded two organizations cooperative agreements of up to USD 1.5 million to develop curricula and training programs to enhance regenerative medicine workforce skills in standards implementation. The awardees were selected through a competitive process earlier this year.

In Sept 2024, Poseida Therapeutics announced that the U.S. Food and Drug Administration (FDA) granted Regenerative Medicine Advanced Therapy (RMAT) designation to its investigational stem cell memory T cell (TSCM)-based allogeneic CAR-T cell therapy, P-BCMA-ALLO1. The therapy is in Phase 1/1b clinical trials for treating relapsed/refractory multiple myeloma.

| Report Attributes | Details |

| Market Size in 2023 | USD 32.50 billion |

| Market Size by 2032 | USD 235.98 billion |

| CAGR | CAGR of 24.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Cell therapy, Stem cell therapy (Cell transplantations, Stem cell therapy products, {Autologous therapy, Allogenic therapy}, Cell-based immunotherapy products, Gene therapy, Tissue engineering] • By Therapeutic Area [Oncology, Musculoskeletal disorders, Dermatology & wound care, Cardiovascular diseases, Ophthalmology, Neurology, Other applications] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AstraZeneca plc, F. Hoffmann-La Roche Ltd., Integra Lifesciences Corp., Astellas Pharma, Inc., Cook Biotech, Inc., Bayer AG, Pfizer, Inc., Merck KGaA, Abbott, Vericel Corp., Novartis AG, GlaxoSmithKline, Biogen, Inc., Sarepta Therapeutics, Inc., Gilead Sciences, Inc., Amgen Inc., Smith+Nephew, MEDIPOST Co., Ltd., JCR Pharmaceuticals Co., Ltd., Takeda Pharmaceutical Company Limited, CORESTEM, Inc. |

| Key Drivers | • Rising Prevalence of Chronic and Degenerative Diseases • Technological Advancements in Regenerative Solutions • Government Initiatives and Increased Funding |

| Restraints | • High Costs and Complexities in Development and Commercialization |

Ans: The Regenerative Medicine Market was estimated at USD 32.50 billion in 2023 and is poised to reach USD 235.98 billion in 2032.

Ans: The CAGR Growth rate of Regenerative medicine market is approx. at a CAGR of 24.66% from 2024 to 2032.

Ans: The major Key players are AstraZeneca plc, F. Hoffmann-La Roche Ltd., Integra Lifesciences Corp, Astellas Pharma, Inc., Cook Biotech, Inc, Bayer AG, Pfizer, Inc., Merck KGaA, Abbott, Vericel Corp, Novartis AG and others.

Ans: A powerful pipeline portfolio, a large number of clinical trials, the significant economic impact of regenerative medicine, and technical advancements in regenerative medicine are important market growth drivers.

Ans: In 2023, North America held a 47% market share for regenerative medicine. This is due to the region's accessibility to cutting-edge technology and the existence of research institutions engaged in the creation of innovative therapies.

Table of contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Regenerative Medicine Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Regenerative Medicine Market Segmentation, by Product

7.1 Chapter Overview

7.2 Cell therapy

7.2.1 Cell Therapy Market Trends Analysis (2020-2032)

7.2.2 Cell Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Stem cell therapy

7.3.1 Stem Cell Therapy Market Trends Analysis (2020-2032)

7.3.2 Stem Cell Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Cell transplantations

7.3.3.1 Cell Transplantations Market Trends Analysis (2020-2032)

7.3.3.2 Cell Transplantations Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Stem Cell Therapy Products

7.3.4.1 Stem Cell Therapy Products Market Trends Analysis (2020-2032)

7.3.4.2 Stem Cell Therapy Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4.3 Autologous therapy

7.3.4.3.1 Autologous Therapy Market Trends Analysis (2020-2032)

7.3.4.3.2 Autologous Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4.4 Allogenic therapy

7.3.4.4.1 Allogenic Therapy Market Trends Analysis (2020-2032)

7.3.4.4.2 Allogenic Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cell-based immunotherapy products

7.4.1 Cell-based immunotherapy products Market Trends Analysis (2020-2032)

7.4.2 Cell-based Immunotherapy Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Gene therapy

7.5.1 Gene Therapy Market Trends Analysis (2020-2032)

7.5.2 Gene Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Tissue Engineering

7.6.1 Tissue Engineering Market Trends Analysis (2020-2032)

7.6.2 Tissue Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Regenerative Medicine Market Segmentation, by Therapeutic Area

8.2 Oncology

8.2.1 Oncology Market Trends Analysis (2020-2032)

8.2.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Musculoskeletal disorders

8.3.1 Musculoskeletal Disorders Market Trends Analysis (2020-2032)

8.3.2 Musculoskeletal Disorders Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Dermatology & wound care

8.4.1 Dermatology & wound care Market Trends Analysis (2020-2032)

8.4.2 Dermatology & wound care Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cardiovascular diseases

8.5.1 Cardiovascular Diseases Market Trends Analysis (2020-2032)

8.5.2 Cardiovascular Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Ophthalmology

8.6.1 Ophthalmology Market Trends Analysis (2020-2032)

8.6.2 Ophthalmology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Neurology

8.7.1 Neurology Market Trends Analysis (2020-2032)

8.7.2 Neurology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Other applications

8.8.1 Other Applications Market Trends Analysis (2020-2032)

8.8.2 Other Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Regenerative Medicine Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Regenerative Medicine Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Regenerative Medicine Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

10. Company Profiles

10.1 AstraZeneca plc

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 F. Hoffmann-La Roche Ltd.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Integra Lifesciences Corp.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Astellas Pharma, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Cook Biotech, Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Bayer AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Pfizer, Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Merck KGaA

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Abbott

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Vericel Corp.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Cell therapy

Stem cell therapy

Cell transplantations

Stem cell therapy products

Autologous therapy

Allogenic therapy

Cell-based immunotherapy products

Gene therapy

Tissue engineering

By Therapeutic Area

Oncology

Musculoskeletal disorders

Dermatology & wound care

Cardiovascular diseases

Ophthalmology

Neurology

Other applications

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Heating Pad Market size was valued at USD 51.78 billion in 2023 and is expected to grow to USD 81.52 billion by 2032 and grow at a CAGR of 5.19% from 2024-2032.

The Psoriasis Treatment Market size was valued at USD 22.38 billion in 2023 and is projected to reach USD 54.40 billion by 2032, growing at a CAGR of 10.4%.

The Bariatric Surgery Market size was valued at USD 1.70 Bn in 2023 and is expected to reach USD 3.34 Bn by 2032 and grow at a CAGR of 7.85% by 2024-2032.

The Topical Drug Delivery Market Size was valued at USD 210.03 Billion in 2023 and is expected to reach USD 499.39 Billion by 2032 and grow at a CAGR of 10.62% over the forecast period 2024-2032.

Pediatric Hospitals Market was valued at USD 159.3 billion in 2023 and is expected to reach USD 257.3 billion by 2032, growing at a CAGR of 5.5% over the forecast period 2024-2032.

The Healthcare Asset Management Market size was valued at USD 25.7 billion in 2023, and is expected to reach USD 166.82 billion by 2032 and grow at a CAGR of 23.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone