Get more information on Refrigeration Coolers Market - Request Sample Report

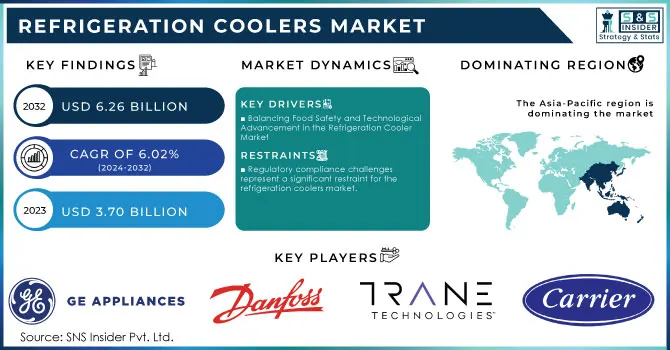

The Refrigeration Coolers Market Size was valued at USD 3.70 Billion in 2023 and is expected to reach USD 6.26 Billion by the end of 2032 at CAGR about 6.02% during the forecast period of 2024-2032.

The refrigeration coolers market is poised for significant growth, primarily fueled by the rising demand for processed foods and the necessity for efficient cold storage solutions. Recent developments, such as the Greater Boston Food Bank's expansion of its refrigeration capacity, underscore the increasing community needs. This expansion aligns with a broader trend of a 4% rise in demand for refrigerated storage across the food supply chain, highlighting the crucial role of refrigeration in food distribution and safety. Additionally, approximately 58% of the American diet now consists of ultra-processed foods, increasing the demand for reliable refrigeration systems to ensure food safety and prevent spoilage, especially as households increasingly choose frozen and pre-packaged meals. A report by Beko emphasizes the importance of refrigeration in maintaining the quality of processed foods, further driving the demand for advanced refrigeration solutions. The BBC also notes that the global shift toward plant-based diets and convenience foods is heightening the need for effective refrigeration to preserve food quality. As sustainability gains traction, the refrigeration sector is witnessing a shift toward energy-efficient technologies, with anticipated increases in investments. In summary, the refrigeration coolers market is well-positioned for rapid growth, driven by evolving consumer preferences, stricter food safety regulations, and technological advancements.

A trend in the refrigeration coolers market is the growing consumer demand for energy-efficient systems, capable of reducing energy consumption by 20-50%. This focus is crucial for both homeowners and businesses aiming to lower operational costs while minimizing their environmental impact. Approximately 47% of consumers are willing to pay a premium for products stored in eco-friendly refrigeration units, signaling a shift toward sustainability. In the retail sector, around 75% of grocery stores are investing in advanced refrigeration technologies to enhance food safety and quality. This increasing emphasis on energy efficiency and compliance with stricter regulations is expected to drive innovation and significant market growth in the coming years.

Drivers

Balancing Food Safety and Technological Advancement in the Refrigeration Cooler Market

As food safety regulations tighten, businesses are compelled to invest in advanced refrigeration systems to prevent food spoilage and ensure the safe distribution of perishable goods. According to the U.S. Food and Drug Administration (FDA), proper refrigeration is essential for maintaining food safety, as improper storage can lead to bacterial growth and foodborne illnesses. The FDA states that keeping food at a safe temperature is vital, as the temperature danger zone between 40°F and 140°F allows bacteria to thrive. Reports indicate that maintaining optimal temperature conditions has led to a surge in demand for innovative refrigeration technologies that can effectively monitor and manage food storage environments. A recent article highlights that approximately 20% of food is wasted due to spoilage, emphasizing the need for effective refrigeration solutions to preserve food quality. Companies are increasingly recognizing the importance of walk-in coolers, which play a crucial role in food safety, with studies showing that proper maintenance can prevent contamination and extend the shelf life of products. The USDA emphasizes the necessity of keeping food at safe temperatures during emergencies, further highlighting the reliance on robust refrigeration systems. As consumer awareness of food safety rises, many consumers are willing to pay a premium for products stored in eco-friendly refrigeration units. This trend is supported by articles discussing the maintenance of walk-in coolers as essential for food safety and quality assurance. The increased focus on food safety, alongside the alarming statistic that approximately 48 million people get sick from foodborne illnesses each year in the U.S., drives significant demand for advanced refrigeration solutions. This compelling need for effective refrigeration systems ultimately positions the refrigeration coolers market for substantial growth.

Restraints

Regulatory compliance challenges represent a significant restraint for the refrigeration coolers market.

The industry is confronted with stringent regulations concerning energy efficiency and refrigerant usage, leading to substantial costs for businesses striving to meet these standards. Smaller companies often find navigating this complex regulatory landscape particularly burdensome, as they may lack the specialized knowledge and resources needed to manage compliance effectively. Reports indicate that these additional operational costs can severely influence profitability and competitive positioning for smaller enterprises. Furthermore, regulatory frameworks are subject to frequent updates, creating ongoing compliance challenges for companies that must stay current with evolving standards. Industry analyses reveal that the financial burden of adhering to these regulations can escalate, especially as businesses are increasingly pressured to invest in eco-friendly technologies aimed at reducing environmental impact. The growing focus on sustainability practices necessitates that companies allocate significant resources toward compliance initiatives, further increasing operational expenses. As regulations continue to tighten, the refrigeration sector faces heightened pressure to balance compliance with operational efficiency, which could hinder growth, particularly for small to medium enterprises that may not possess the infrastructure to adapt swiftly. These challenges highlight the necessity of developing robust compliance strategies to effectively navigate the regulatory landscape.

by Component

In 2023, the refrigeration coolers market saw a significant contribution from various components, with condensers leading, capturing around 57% of the market share. This prominence stems from the crucial function condensers serve in the refrigeration cycle, facilitating the heat exchange process that allows refrigerants to release heat and transition from gas to liquid. Condensers are essential for the efficiency and performance of refrigeration systems, and their design significantly affects energy consumption. With a growing emphasis on energy efficiency and sustainability, manufacturers are innovating to create more efficient condenser designs, fueling market growth. Notable companies like Carrier Global Corporation and Daikin Industries are spearheading advancements in condenser technologies that enhance energy efficiency while minimizing environmental impact. The segment's expansion is further driven by the increasing demand for advanced refrigeration technologies, especially in the food and beverage sector, where optimal storage conditions are critical. For instance, Thermo King, a subsidiary of Ingersoll Rand, has improved its refrigeration solutions through IoT integration and smart technologies for real-time temperature monitoring. Additionally, Blue Star Limited has rolled out eco-friendly refrigerant solutions and innovative condenser designs that adhere to stringent environmental regulations, highlighting the industry's shift toward sustainability.

by Application

In 2023, the refrigeration coolers market saw substantial growth from the commercial application segment, which captured approximately 62% of total revenue. This prominence is largely attributed to the widespread deployment of refrigeration coolers in various commercial environments, such as supermarkets, restaurants, and convenience stores, where optimal temperature control for perishable goods is critical. The expansion of the commercial sector is closely linked to the rising consumer demand for fresh and frozen food products, coupled with an increased emphasis on food safety and quality. Supermarkets and grocery chains are heavily investing in advanced refrigeration technologies to enhance product storage and display, ensuring freshness for consumers. Additionally, the shift toward healthier eating and organic options has heightened the need for efficient refrigeration solutions, prompting retailers to offer a diverse selection of fresh produce and dairy items. Companies like Linde and Emerson Electric Co. have acknowledged this trend and are innovating refrigeration solutions tailored for commercial use. Linde has upgraded its cooling systems with eco-friendly refrigerants and energy-efficient designs, helping businesses reduce their carbon footprints and improve operational efficiency. Meanwhile, Emerson Electric Co. has launched its E2 system, integrating IoT capabilities for real-time monitoring and analytics, which allows retailers to optimize their refrigeration practices and uphold food safety standards.

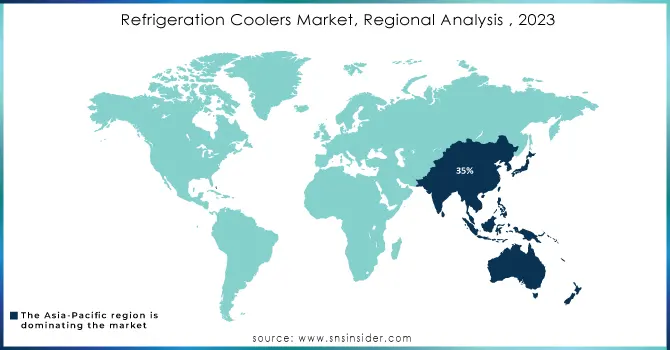

In 2023, the Asia-Pacific region solidified its position as the leading market for refrigeration coolers, capturing around 35% of the total revenue. This dominance is driven by rapid urbanization, increasing disposable incomes, and a growing demand for refrigerated products across sectors such as food and beverage, pharmaceuticals, and logistics. The burgeoning population and evolving consumer preferences have heightened the need for fresh and frozen foods, prompting supermarkets, convenience stores, and restaurants to expand their refrigeration capabilities. Additionally, the rise of e-commerce in the grocery sector has intensified the demand for efficient cold chain logistics, ensuring safe delivery of perishables. Countries like China and India are at the forefront of this growth. In China, rapid industrialization and a shift toward modern retail formats have spurred significant investments in advanced refrigeration technologies. Meanwhile, India is projected to offer the highest salary increases among Asia-Pacific countries, with specific sectors, including food processing and logistics, driving demand for commercial refrigeration. The expanding food processing and cold storage industries in India are crucial for meeting the rising need for efficient refrigeration. Furthermore, the region's focus on sustainability and energy efficiency is becoming increasingly prominent. Companies are investing in innovative refrigeration solutions, such as cold room coolers and condensers that minimize environmental impact.

In 2023, North America emerged as the fastest-growing region in the refrigeration coolers market, driven by several key factors that emphasize innovation, technological advancements, and a shift toward sustainability. The region's focus on energy-efficient solutions has led to significant investments in modern refrigeration technologies, particularly in commercial and industrial applications. As consumers increasingly demand fresher and higher-quality food products, retailers, supermarkets, and food service providers are upgrading their refrigeration systems to meet these expectations. The rising awareness of food safety regulations further bolsters the demand for reliable refrigeration solutions. Regulatory bodies in the U.S. and Canada have implemented stringent guidelines to ensure proper food handling and storage, prompting businesses to invest in advanced refrigeration coolers that comply with these standards. Additionally, the e-commerce boom has fueled the need for efficient cold chain logistics, driving growth in the demand for refrigeration coolers that maintain optimal temperatures during the transportation and storage of perishable goods.

Need Any Customization Research On Refrigeration Coolers Market - Inquiry Now

Key Players

Some of the major key players in Refrigeration Coolers Market with product:

Carrier Global Corporation (Commercial refrigeration units, chillers)

Trane Technologies (Refrigerated display cases, air conditioning systems)

Danfoss A/S (Compressors, valves, and electronic controls)

Emerson Electric Co. (Refrigeration controls, compressors, transcritical systems)

Johnson Controls International (HVAC systems, chillers, refrigeration solutions)

GE Appliances (Refrigerators, freezers, cooling units)

Whirlpool Corporation (Refrigerators, ice makers, cooling appliances)

LG Electronics (Commercial refrigerators, freezer solutions)

Samsung Electronics (Refrigerators, freezers, smart cooling solutions)

Hitachi, Ltd. (Air conditioning systems, commercial refrigeration)

Daikin Industries, Ltd. (Air conditioning units, chillers, heat pumps)

Mitsubishi Electric Corporation (VRF systems, commercial refrigeration solutions)

Frigidaire (Refrigerators, freezers, cooling appliances)

Sub-Zero Group, Inc. (Luxury refrigerators, wine coolers)

Blue Star Limited (Commercial refrigeration, air conditioning systems)

Panasonic Corporation (Refrigerators, cooling systems, compressors)

Electrolux AB (Refrigerators, freezers, cooling appliances)

AHT Cooling Systems GmbH (Commercial refrigerators, freezers)

Beverage-Air Corporation (Refrigerated display cases, ice cream freezers)

Kigali Refrigeration (Custom refrigeration solutions, display cases)

List of suppliers in the refrigeration coolers market:

Carrier Global Corporation

Trane Technologies

Danfoss A/S

Emerson Electric Co.

Johnson Controls International

GE Appliances

Whirlpool Corporation

LG Electronics

Daikin Industries, Ltd.

Mitsubishi Electric Corporation

Recent Development

In April 2024, Electrolux Announces New Eco-Friendly Refrigeration Technology, Electrolux, a major appliance manufacturer, announced the development of a new, more environmentally friendly refrigeration technology that utilizes a natural refrigerant with lower global warming potential. This technology is expected to be incorporated into their future refrigerator models.

In March 2024, Samsung and LG Collaborate on Smart Refrigerator Standards, Industry giants Samsung and LG announced a collaboration to develop common standards for smart refrigerator features. This collaboration aims to improve interoperability between smart refrigerators and other smart home devices, regardless of brand.

In January 2024, Carrier Acquires a global provider of heating, ventilation, and air conditioning (HVAC) solutions, announced the acquisition of a leading cold chain logistics provider. This move strengthens Carrier's position in the cold chain market and expands its offerings for temperature-controlled storage and transportation solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.70 Billion |

| Market Size by 2032 | USD 6.26 Billion |

| CAGR | CAGR of 6.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Evaporators and Air Coolers, Condensers) • By Applications (Commercial, Industrial) • By Refrigerant (HFC/HFO, NH3, CO2, Glycol, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrier Global Corporation, Trane Technologies, Danfoss A/S, Emerson Electric Co., Johnson Controls International, GE Appliances, Whirlpool Corporation, LG Electronics, Samsung Electronics, Hitachi, Ltd., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Frigidaire, Sub-Zero Group, Inc., Blue Star Limited, Panasonic Corporation, Electrolux AB, AHT Cooling Systems GmbH, Beverage-Air Corporation, Kigali Refrigeration. |

| Key Drivers | • Balancing Food Safety and Technological Advancement in the Refrigeration Cooler Market |

| RESTRAINTS | • Regulatory compliance challenges represent a significant restraint for the refrigeration coolers market. |

Ans: Refrigeration Coolers Market size was USD 3.6 billion in 2023 and is expected to Reach USD 6.26 billion by 2032.

Ans: The market has been segmented with respect to Component, Application and Refrigerant.

Ans. Rising Investments in refrigerated warehouses and cold storage facilities, Refrigeration coolers that are both innovative and compact are in high demand; Natural refrigerant-based systems are becoming increasingly popular in a variety of commercial and industrial applications.

Ans: Asia-Pacific is dominating in Refrigeration Coolers Market in 2023

Ans: The Refrigeration Coolers Market is expected to grow at a CAGR of 6.02 %.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Refrigeration Coolers Market Segmentation, by Component

7.1 Chapter Overview

7.2 Evaporators and Air coolers

7.2.1 Evaporators and Air coolers Market Trends Analysis (2020-2032)

7.2.2 Evaporators and Air coolers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Air Units

7.2.3.1 Air Units Market Trends Analysis (2020-2032)

7.2.3.2 Air Units Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Dry Coolers

7.2.4.1 Dry Coolers Market Trends Analysis (2020-2032)

7.2.4.2 Dry Coolers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Brine Coolers

7.2.5.1 Brine Coolers Market Trends Analysis (2020-2032)

7.2.5.2 Brine Coolers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Blast/Tunnel Unit cooler

7.2.6.1 Blast/Tunnel Unit cooler Market Trends Analysis (2020-2032)

7.2.6.2 Blast/Tunnel Unit cooler Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Condenser

7.3.1 Condenser Market Trends Analysis (2020-2032)

7.3.2 Condenser Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Air-Cooled & Water-cooled

7.3.3.1 Air-Cooled & Water-cooled Market Trends Analysis (2020-2032)

7.3.3.2 Air-Cooled & Water-cooled Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Evaporative

7.3.4.1 Evaporative Market Trends Analysis (2020-2032)

7.3.4.2 Evaporative Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Refrigeration Coolers Market Segmentation, by Application

8.1 Chapter Overview

8.2 Commercial

8.2.1 Commercial Market Trends Analysis (2020-2032)

8.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Supermarkets and Hypermarkets

8.2.3.1 Supermarkets and Hypermarkets Market Trends Analysis (2020-2032)

8.2.3.2 Supermarkets and Hypermarkets Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Convenience Stores and Mini Markets

8.2.4.1 Convenience Stores and Mini Markets Market Trends Analysis (2020-2032)

8.2.4.2 Convenience Stores and Mini Markets Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Hospitality

8.2.5.1 Hospitality Market Trends Analysis (2020-2032)

8.2.5.2 Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Industrial

8.3.1 Industrial Market Trends Analysis (2020-2032)

8.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.3 Refrigerated Warehouses

8.3.3.1 Refrigerated Warehouses Market Trends Analysis (2020-2032)

8.3.3.2 Refrigerated Warehouses Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.4 Fruit & Vegetable Processing

8.3.4.1 Fruit & Vegetable Processing Market Trends Analysis (2020-2032)

8.3.4.2 Fruit & Vegetable Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.5 Beverage Processing

8.3.5.1 Beverage Processing Market Trends Analysis (2020-2032)

8.3.5.2 Beverage Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.6 Dairy & Ice-cream Processing

8.3.6.1 Dairy & Ice-cream Processing Market Trends Analysis (2020-2032)

8.3.6.2 Dairy & Ice-cream Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.7 Meat, Poultry, & Fish Processing

8.3.7.1Meat, Poultry, & Fish Processing Market Trends Analysis (2020-2032)

8.3.7.2 Meat, Poultry, & Fish Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.8 Special Applications

8.3.8.1 Special Applications Market Trends Analysis (2020-2032)

8.3.8.2 Special Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Refrigeration Coolers Market Segmentation, by Refrigerant

9.1 Chapter Overview

9.2HFC/HFO

9.2.1 HFC/HFO Market Trends Analysis (2020-2032)

9.2.2HFC/HFO Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 NH3

9.3.1 NH3Market Trends Analysis (2020-2032)

9.3.2 NH3 Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 CO2

9.4.1 CO2 Market Trends Analysis (2020-2032)

9.4.2 CO2 Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Glycol

9.5.1 Glycol Market Trends Analysis (2020-2032)

9.5.2 Glycol Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.4 North America Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.6.2 USA Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.7.2 Canada Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.7.2 France Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.6.2 China Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.7.2 India Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.8.2 Japan Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.12.2 Australia Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.4 Africa Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Refrigeration Coolers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.4 Latin America Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Refrigeration Coolers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Refrigeration Coolers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Refrigeration Coolers Market Estimates and Forecasts, by Refrigerant (2020-2032) (USD Billion)

11. Company Profiles

11.1 Carrier Global Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Trane Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Danfoss A/S

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Emerson Electric Co.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Johnson Controls International

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 GE Appliances

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Whirlpool Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 LG Electronics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Samsung Electronics

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Hitachi, Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Evaporators and Air coolers

Air Units

Dry Coolers

Brine Coolers

Blast/Tunnel Unit cooler

Condenser

Air-Cooled & Water-cooled

Evaporative

By Application

Commercial

Supermarkets and Hypermarkets

Convenience Stores and Mini Markets

Hospitality

Industrial

Refrigerated Warehouses

Fruit & Vegetable Processing

Beverage Processing

Dairy & Ice-cream Processing

Meat, Poultry, & Fish Processing

Special Applications

By Refrigerant

HFC/HFO

NH3

CO2

Glycol

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Photolithography Equipment Market Size was valued at USD 13.46 Billion in 2023 and is expected to reach USD 26.42 Billion by 2032 and grow at a CAGR of 7.82% over the forecast period 2024-2032.

The Flexible Electronics Market Size was valued at USD 32.65 Billion in 2023 and is expected to grow at a CAGR of 9.72% to reach USD 75.04 Billion by 2032.

The Land Mobile Radio Market was valued at USD 25.24 billion in 2023 and is projected to reach USD 69.11 billion by 2032, growing at a CAGR of 11.84% from 2024 to 2032.

The Hermetic Packaging Market was valued at USD 3.84 billion in 2023 and is projected to reach USD 7.36 billion by 2032, growing at a CAGR of 7.49% from 2024 to 2032.

The ASEAN Semiconductor Market size was valued at $31.32 Billion in 2023 and is expected to grow to $52.9 Billion at a CAGR Of 5.98% By forecasts 2024-2032

The Parking Sensors Market Size was valued at USD 7.42 Billion in 2023 and is expected to reach USD 26.28 Billion by 2032 and grow at a CAGR of 15.13% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone