Recycled Textiles Market Report Scope & Overview:

The Recycled Textiles Market size was valued at USD 6.03 billion in 2024 and is expected to reach USD 8.69 billion by 2032, at a CAGR of 4.70% from 2025-2032.

The recycled textiles market is experiencing significant growth driven by increasing consumer demand for sustainable products, rising environmental concerns, and the growing emphasis on reducing textile waste. Key market dynamics include adopting circular economy principles, advancing recycling technologies, and stringent regulations surrounding waste management. Companies in the sector are forging partnerships and investing in innovations to enhance the efficiency of recycling processes. In November 2024, the Odisha government in India approved 15 projects to establish textile waste recycling units, which are expected to bolster local economies and reduce textile waste. The same month, the Textile Ministry of India launched an initiative to recycle used clothes, underscoring the government's commitment to addressing the textile waste problem and promoting sustainability.

Market Size and Forecast:

-

Market Size in 2024 USD 6.03 Billion

-

Market Size by 2032 USD 8.69 Billion

-

CAGR of 4.70% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

To get more information on Recycled Textiles Market - Request Free Sample Report

Recycled Textiles Market Trends:

• Increasing adoption of recycled textiles by fashion brands to meet consumer demand for sustainable and circular products.

• Expansion of recycled textile use into automotive interiors, upholstery, and seating components for eco-friendly manufacturing.

• Growth in sustainable fashion driving investment in recycling technologies and supply chain circularity.

• Rising consumer preference for brands embracing circular economy practices, influencing product offerings and marketing strategies.

• Diversification of recycled textile applications into furniture, home décor, and other non-fashion industries.

Recycled Textiles Market Growth Drivers:

-

Increasing Consumer Awareness about Sustainability and Environmental Impact Drives Recycled Textiles Market Expansion

The growing popularity of sustainable fashion and circular economy models is driving demand for recycled textiles. Fashion brands and retailers are increasingly turning to recycled materials to meet the rising demand for sustainable products. Circular economy models emphasize the reuse and recycling of materials to extend product life cycles and reduce waste. This shift towards sustainability is influencing supply chains and encouraging companies to use more recycled fibers in their manufacturing processes. As a result, the adoption of recycled textiles is increasing across various segments of the fashion industry, from clothing to accessories and footwear. Consumers are more inclined to buy from brands that embrace circularity and sustainable practices, which is pushing brands to invest in sustainable materials and recycling technologies. The growth of the sustainable fashion sector is helping the recycled textiles market gain significant traction, as more companies recognize the benefits of incorporating recycled textiles into their product offerings.

Recycled Textiles Market Restraints:

-

High Cost of Recycling Technologies and Infrastructure Limits Large-Scale Adoption of Recycled Textiles

While the demand for recycled textiles is growing, the high initial investment required for recycling technologies and infrastructure remains a significant challenge. Setting up advanced recycling facilities that can handle large volumes of textile waste and convert it into high-quality fibers requires substantial capital. The technological processes involved in textile recycling, such as the extraction of fibers from used garments or the breakdown of synthetic fibers, can be complex and costly. Additionally, maintaining and operating these facilities can be expensive, which limits the ability of smaller businesses to enter the recycled textiles market. Despite the long-term environmental and economic benefits, the financial barriers associated with the adoption of recycling technologies can hinder widespread market penetration, particularly in regions with limited access to funding or where textile recycling infrastructure is underdeveloped.

Recycled Textiles Market Opportunities:

-

Collaboration with Fashion Industry to Promote Use of Recycled Textiles Offers Market Growth Opportunities

The automotive and upholstery industries are emerging as key opportunities for recycled textiles, as these sectors seek sustainable materials for manufacturing. The use of recycled textiles in car interiors, upholstery, and seating components is gaining traction due to the demand for more eco-friendly materials in these industries. Automakers are exploring the use of recycled fibers in seat covers, carpets, and interior linings, which could lead to a new market for recycled textiles. Similarly, the furniture and home decor industries are also turning to recycled textiles for upholstery and soft furnishings. By tapping into these new industries, recycled textiles can diversify their market reach and establish a strong presence in sectors beyond fashion and apparel.

| Impact Area | Description | Examples |

|---|---|---|

| Reduction in Textile Waste | Recycling textiles helps divert significant amounts of waste from landfills. | Global brands implementing garment take-back programs. |

| Lower Carbon Footprint | The process of recycling textiles generally emits fewer greenhouse gases. | Use of recycled polyester in clothing reduces carbon emissions. |

| Conservation of Natural Resources | Using recycled textiles reduces the need for virgin raw materials like cotton. | Recycling polyester and cotton fibers reduces water and land use. |

| Economic Value Creation | Circular economy models from textile recycling create new business opportunities. | Brands generating revenue by reselling upcycled textiles. |

| Promotion of Sustainable Manufacturing | Incorporating recycled materials into textile production promotes sustainable practices. | Fashion companies using 100% recycled fabrics for product lines. |

Recycling textiles plays a crucial role in advancing sustainability and the circular economy by minimizing textile waste, lowering carbon emissions, and conserving natural resources. By diverting textile waste from landfills, the industry helps reduce the environmental burden of disposal, contributing to the reduction of waste in urban areas. In addition, the carbon footprint associated with producing recycled textiles is significantly lower compared to using virgin materials, helping companies meet sustainability targets. Furthermore, the recycling process conserves essential natural resources, including water, land, and raw materials, by reducing the need for new fibers like cotton. The circular economy model in the textile industry also creates new economic opportunities, where businesses engage in upcycling and recycling processes to generate value from waste. This fosters innovation in sustainable manufacturing, with numerous companies shifting to 100% recycled materials in their product lines to promote eco-friendly fashion solutions.

Recycled Textiles Market Segment Analysis:

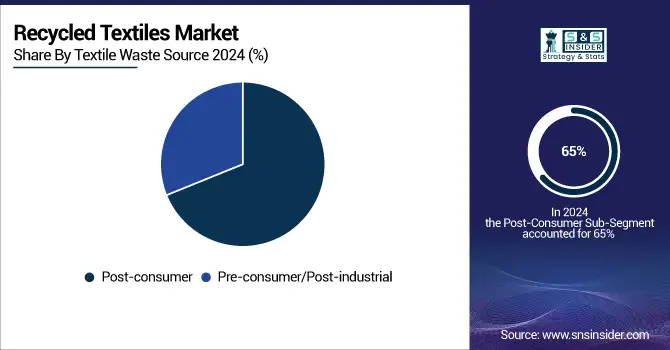

By Textile Waste Source

In 2024, the post-consumer segment dominated the recycled textiles market, accounting for a market share of 65%. This dominance is largely driven by an increasing consumer focus on sustainability and waste reduction. The post-consumer waste category consists of used clothing and textiles discarded by individuals, which are collected for recycling. This type of waste is the most significant contributor to the recycling stream, as consumers become more aware of the environmental impact of textile waste and actively seek ways to dispose of their used garments responsibly. Major retail companies, such as H&M and Patagonia, have launched garment collection programs, encouraging customers to recycle old clothes instead of discarding them. The global push towards circular fashion, where products are designed for reuse and recycling, has further accelerated the growth of this segment. This shift not only helps reduce landfill waste but also ensures that valuable materials are reused in new products, further driving the recycling economy. Post-consumer textiles, including used garments, shoes, and household textiles, represent a critical resource in the recycling process, making them the dominant segment in 2024.

By Type

Recycled polyester dominated the recycled textiles market in 2024, with a market share of 45%. Polyester, a synthetic fiber made from petroleum-based resources, is widely used in the textile and fashion industries, making it the most recycled fiber globally. Its high presence in the fashion industry, especially in fast fashion, results in a large quantity of polyester waste, which can be recycled and reused in new products. Major companies like Unifi and Indorama Ventures have invested significantly in technology to recycle post-consumer polyester waste into high-quality recycled fibers. These fibers are then used in a variety of applications, including clothing, home furnishings, and automotive parts. The growing awareness among consumers and businesses about the environmental impact of polyester production has led to an increased demand for recycled polyester. Recycled polyester is seen as a more sustainable alternative to virgin polyester, as it requires less energy and fewer resources to produce. This trend is expected to continue as sustainability becomes a key priority for both manufacturers and consumers.

By Material

Polyester dominated the material segment in the recycled textiles market in 2024, holding a market share of 50%. As one of the most widely used materials in the global textile industry, polyester accounts for a significant portion of textile waste that is suitable for recycling. The widespread use of polyester in various consumer products, particularly in the fashion and apparel sectors, has resulted in a large supply of post-consumer polyester waste, making it an essential material for recycling. Polyester can be effectively recycled through mechanical or chemical processes, turning old garments and textiles into new fibers and products. Companies like Unifi, which produces Repreve, have played a significant role in the growth of the recycled polyester market by offering high-quality fibers made from recycled plastic bottles and textile waste. The ability to recycle polyester multiple times without degrading its quality has further contributed to its dominance in the market. Additionally, recycled polyester is often used in combination with other materials, such as cotton, to create sustainable and durable fabrics for a wide range of applications, including activewear, home textiles, and automotive upholstery.

By End-use Industry

The apparel & fashion industry dominated the recycled textiles market in 2024, accounting for a market share of 60%. The growing demand for sustainable and eco-friendly products in fashion has been a driving factor in the increased adoption of recycled textiles. In recent years, many fashion brands, including global giants like H&M, Nike, and Adidas, have committed to using recycled materials in their products. Recycled polyester, cotton, and wool are commonly used in clothing, footwear, and accessories, reducing the need for virgin materials and lowering the environmental footprint of the industry. Additionally, fashion consumers are becoming more conscious of sustainability, pushing brands to incorporate circular economy principles into their product lines. These brands are actively participating in garment collection programs, where customers can return old garments for recycling. By doing so, the apparel sector plays a critical role in supporting the circular economy by extending the lifecycle of textiles and reducing the volume of textile waste sent to landfills. The apparel industry's continued push for sustainability ensures that recycled textiles remain in high demand.

By Distribution Channel

In 2024, retail stores dominated the distribution channels for recycled textiles, with a market share of 55%. This dominance can be attributed to the growing consumer awareness of the environmental impact of textile waste and the increasing availability of eco-friendly products in retail outlets. Major fashion brands and retailers have recognized the demand for sustainable products and have made recycled textiles a key part of their product offerings. Retail stores provide consumers with a direct way to purchase recycled textile products, such as clothing made from recycled polyester, cotton, and wool. Additionally, some retail stores offer garment collection programs, encouraging customers to return used clothes for recycling. This not only supports the circular economy but also creates an opportunity for brands to sell new items made from recycled materials. Retail stores are increasingly showcasing their sustainable collections, emphasizing their commitment to eco-friendly practices, which has led to the growth of recycled textiles in the retail sector. The retail channel remains the most accessible and popular distribution outlet for recycled textile products in 2024, as sustainability continues to shape consumer purchasing behavior.

Recycled Textiles Market Regional Analysis:

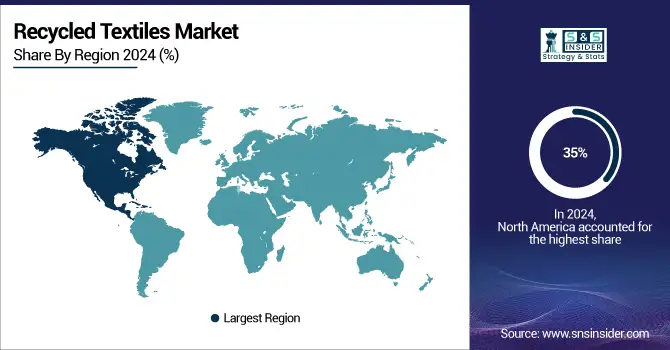

North America Recycled Textiles Market Insights

In 2024, North America dominated the recycled textiles market, holding a market share of 35%. This dominance is driven by robust consumer demand for sustainable fashion and textiles, combined with significant advancements in recycling technologies and infrastructure. Countries like the United States have made substantial investments in promoting textile recycling initiatives, and many major fashion brands, including Patagonia, Levi's, and Nike, have adopted circular economy principles, utilizing recycled fibers in their product lines. The region also benefits from a growing number of textile waste collection programs, where consumers are encouraged to recycle old clothing through in-store drop-offs and take-back schemes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Furthermore, regulations in North America have been increasingly supportive of sustainable practices, with many states implementing extended producer responsibility (EPR) programs for textiles. This encourages manufacturers to design products with recyclability in mind and take responsibility for their end-of-life disposal. The United States, as the largest market in North America, has seen a significant rise in the recycling of polyester and cotton, two major components of the textile waste stream. Canada is also actively involved in textile recycling, with initiatives like the Textile Recovery Program, which focuses on diverting textile waste from landfills. This commitment to sustainability in both the consumer and manufacturing sectors has positioned North America as the dominant region in the recycled textiles market.

Asia Pacific Recycled Textiles Market Insights

In 2024, the Asia-Pacific region emerged as the fastest-growing region in the recycled textiles market, with a CAGR of around 6.5%. The growth in this region is driven by the increasing focus on sustainability, coupled with the growing textile waste problem due to rapid industrialization and fast fashion trends. Key countries like China, India, and Japan are seeing significant growth in their textile recycling industries. In China, the largest textile producer globally, efforts to recycle textile waste are expanding as the country grapples with massive textile waste generated by its booming apparel industry. Government initiatives, such as the "Made in China 2025" plan, have promoted sustainable manufacturing practices, including recycling textiles. India, known for its large textile industry, has also seen a rise in demand for recycled textiles, with several startups focusing on innovative recycling technologies and sustainable fabric production.

Europe Recycled Textiles Market Insights

Europe’s recycled textiles market is growing rapidly due to rising demand for sustainable fashion, stringent environmental regulations, and strong circular economy initiatives. Governments and industry bodies are promoting textile recycling, eco-labeling, and sustainable production practices. Fashion brands and retailers are increasingly incorporating recycled fibers into apparel, footwear, and accessories. Additionally, expansion into automotive, furniture, and home décor sectors is creating new opportunities. Consumer awareness about sustainability and corporate responsibility further fuels market adoption across Western and Northern European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Recycled Textiles Market Insights

The recycled textiles market in LATAM and MEA is gaining momentum driven by growing environmental awareness, government sustainability initiatives, and increasing adoption by fashion and furniture industries. Countries like Brazil, Mexico, South Africa, and UAE are investing in recycling infrastructure and circular economy projects. Rising consumer preference for eco-friendly products, coupled with expansion of recycled textile applications in automotive interiors and home décor, is creating new market opportunities across both regions.

Recycled Textiles Market Key Players:

-

Anandi Enterprises (Recycled Cotton Yarn, Recycled Polyester Fabric)

-

Boer Group (Recycled Polyester Fiber, Recycled Wool Fiber)

-

Chindi (Recycled Cotton Rugs, Recycled Textile Handbags)

-

Gebrueder Otto GmbH & Co. KG (Recycled Cotton Yarns, Recycled PET Yarns)

-

Hyosung TNC Co. Ltd. (Recycled Nylon Fiber, Recycled Polyester Yarn)

-

Khaloom Textiles Pvt. Ltd. (Recycled Polyester Fabric, Recycled Cotton Yarn)

-

Kisco Group (Recycled Nylon, Recycled Polyester)

-

Kishco Group (Recycled Polyester Yarn, Recycled Cotton Fabric)

-

Leigh Fibers Inc. (Recycled Polyester Fiber, Recycled Cotton Fiber)

-

Lone Star Textiles (Recycled Cotton, Recycled Polyester)

-

Martex Fiber (Recycled Cotton Fiber, Recycled Polyester Fiber)

-

Martex Fiber Southern Corp. (Recycled Polyester Fiber, Recycled Cotton Fiber)

-

Otto Garne (Recycled Polyester Yarns, Recycled Cotton Yarns)

-

Prokotex (Recycled Polyester, Recycled Nylon)

-

Renewcell (Cellulose Fiber from Recycled Textiles, Recycled Cotton Fiber)

-

Renewcell AB (Textile-to-Textile Recycling Fiber, Recycled Cotton Pulp)

-

Santanderina Group (Recycled Polyester, Recycled Cotton Fabric)

-

Unifi (Repreve Recycled Polyester, Recycled Nylon Yarn)

-

Usha Yarns Ltd. (Recycled Cotton Yarns, Recycled Polyester Yarns)

-

Vishal Fabrics (Recycled Cotton, Recycled Polyester Fabrics)

Competitive Landscape for Recycled Textiles Market:

Boer Group is Europe‑based textile‑recycling leader with collection and sorting operations in the Netherlands, Belgium and Germany. The company sorts over 400 000 kg of used textiles daily into some 350 quality categories, and has established platforms (e.g., Boer Group Recycling Solutions) to innovate textile‑to‑textile recycling.

- In October 2025: “ReHubs’ closed‑loop recycling project” – Boer Group initiated a closed‑loop recycling value chain converting 24 tons of post‑consumer textiles into ~50,000 garments with 70% recycled content.

Gebrüder Otto GmbH & Co. KG is a German‐based, family‑owned textile manufacturer founded in 1901, specializing in high‑quality yarns and twists made in Germany, serving apparel, technical and medical textile markets. The company emphasizes sustainability through locally sourced natural fibers, its “recot²” recycling concept, and solar/hydropower plants while maintaining a strong niche positioning in Europe.

- In November 2024: Otto collaborates with Recycling Atelier (ITA Augsburg) on a project to develop cotton yarns containing 50% post‑consumer recycled fibre, particularly for towel applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.03 Billion |

| Market Size by 2032 | USD 8.69 Billion |

| CAGR | CAGR of 4.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Textile Waste Source (Post-consumer, Pre-consumer/Post-industrial) • By Type (Recycled Cotton, Recycled Wool, Recycled Polyester, Recycled Nylon, Others) • By Material (Polyester, Cotton, Nylon, Wool, Others) • By End-use Industry (Apparel & Fashion, Home Furnishings, Automotive, Industrial, Others) • By Distribution Channel (Online, Retail Stores, Specialty Stores, Department Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Anandi Enterprises, Boer Group, Chindi, Gebrueder Otto GmbH & Co. KG, Hyosung TNC Co. Ltd., Khaloom Textiles Pvt. Ltd., Kisco Group, Kishco Group, Leigh Fibers Inc., Lone Star Textiles, Martex Fiber, Martex Fiber Southern Corp., Otto Garne, Prokotex, Renewcell, Renewcell AB, Santanderina Group, Unifi, Usha Yarns Ltd., Vishal Fabrics. |