Get More Information on Recycled Plastics Market - Request Sample Report

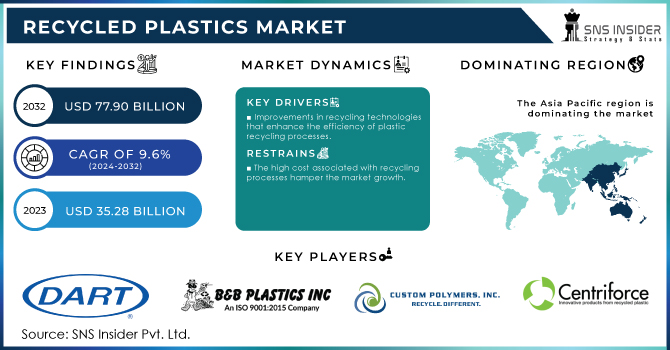

The Recycled Plastics Market Size was valued at USD 35.28 Billion in 2023 and is expected to reach USD 77.90 billion by 2032 and grow at a CAGR of 9.6% over the forecast period 2024-2032.

Increasing awareness about environmental issues, particularly plastic pollution and its impact on marine life, is a significant driver of the recycled plastics market. Every year, millions of tons of plastic waste end up in the heaps, ocean causing severe harm to marine life. Marine animals ingest plastics, which can lead to starvation, poisoning, and death. Public awareness campaigns by organizations such as the Ocean Conservancy and WWF highlight the devastating impact of plastic pollution, effectively raising public consciousness and pushing for changes in both consumer behavior and corporate practices.

For instance, the European Union implemented a ban on single-use plastics like straws, cutlery, and plates starting in 2021. The EU's Single-Use Plastics Directive aims to reduce plastic waste and promote recycling

As consumers become more environmentally conscious, they are increasingly seeking eco-friendly and sustainably sourced products. This shift in consumer behavior compels businesses to adopt recycled plastic in their products and packaging to meet the growing demand for sustainable practices. The combination of heightened awareness and changing consumer preferences is significantly boosting the adoption of recycled plastics across various industries.

Moreover, in California, U.S. California's SB 54, passed in 2022, requires all plastic packaging in the state to be recyclable or compostable by 2032. It also mandates a 25% reduction in plastic packaging waste.

Furthermore, advancements in recycling technologies are improving the quality and efficiency of plastic recycling processes. Innovations such as chemical recycling and improved sorting technologies are making it easier to recycle a wider range of plastic types.

Market Dynamics:

Drivers

Improvements in recycling technologies that enhance the efficiency of plastic recycling processes.

Improvements in recycling technologies have significantly enhanced the quality and efficiency of plastic recycling processes, leading to increased recycling rates and better-quality recycled materials. For instance, advanced sorting technologies like Near-Infrared spectroscopy and robotic sorting systems have improved the accuracy and speed of sorting different types of plastics, reduced contamination, and increasing the purity of recycled products.

Moreover, chemical recycling methods, such as depolymerization and pyrolysis, have enabled the breakdown of hard-to-recycle plastics into their basic monomers or fuels, contributing to a circular economy by creating high-quality recycled plastics that can be reused in manufacturing. For example, companies like Carbios have developed enzymatic recycling processes that can depolymerize PET plastics, achieving a recycling efficiency of over 90%. These technological advancements not only enhance the overall efficiency of recycling processes but also help meet regulatory targets and consumer demand for sustainable products, driving the growth of the recycled plastics market.

Restrain

The high cost associated with recycling processes hamper the market growth.

High costs associated with recycling processes, including collection, sorting, and processing, can make recycled plastics more expensive than virgin plastics, discouraging widespread adoption. Additionally, contamination in plastic waste streams often reduces the quality of recycled materials, limiting their applicability in high-grade applications. Inconsistent and inadequate recycling infrastructure, especially in developing regions, further exacerbates these challenges. Regulatory barriers and lack of standardized practices across different regions also create difficulties for global market expansion. These factors collectively restrain the market, necessitating continued innovation and policy support to overcome these obstacles.

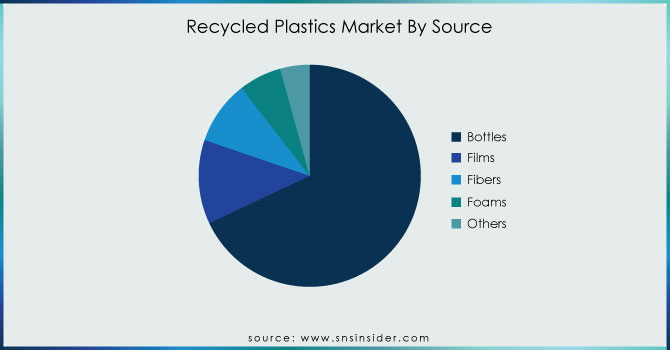

By Source

The bottles segment held the largest market share in the source segment around 68.00% in 2023. Bottles especially PET bottles are very recyclable and are collected in large quantities via curbside recycling programs and well-established deposit-return programs. Compared to other sources, the infrastructure for recycling bottles is more advanced, guaranteeing a consistent supply of premium recycled PET. The production of new bottles, food-grade containers, and other consumer items is in high demand for this rPET due to legal regulations as well as business sustainability objectives. The recycling rate for PET bottles in the US reached 27.9% in 2020, according to the National Association for PET Container Resources, demonstrating effective mechanisms for collecting and processing. Furthermore, recycled PET made from bottles has high clarity and quality, which makes it ideal for a variety of uses and solidifies its market-leading position in recycled plastics.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Type

The polyethylene segment held a significant market share around 27.22% of the total volume in 2023. The increased need for packaging materials in consumer goods, food and beverage, industrial, and other industries is the reason for this high share. Among many other places, it is also frequently utilized in the packaging of laundry detergents, milk cartons, chopping boards, and trash cans.

Moreover, because of its exceptional chemical and mechanical qualities, polypropylene is widely utilized in the production of medical devices, laboratory equipment, automobile components, packaging, and labels, among many other products. It has outstanding mechanical strength and is resistant to a variety of chemical solvents, acids, and bases. Additionally, it is one of the world's best-formulated polymers.

By Application

In the application segment, packaging held the largest market share around 38.42% of the total volume in 2023. The demand is growing because they account for a large amount of plastic usage, and packaging materials such as bottles, films, and containers are a primary focus of recycling initiatives. Recycle facilities are receiving a growing amount of the large amount of plastic trash produced by packaging instead of landfills, where it is converted into high-grade recycled products. The usage of recycled content in packaging is being driven by pressure on businesses to meet legal requirements and lessen their environmental impact.

Regional Analysis:

Asia Pacific dominated the recycled plastics market with the highest revenue share of about 48.57% in 2023. This is because the number of small enterprises is increasing, as is their relevance in the market. Furthermore, the region imports and recycles waste plastic, as well as converting it for important applications. The availability of low-cost labor and significant industrial locations in nations such as China are seen as major drivers of the region's plastic recycling industry growth. The Asia-Pacific region's overall growth of the plastic recycling sector is being influenced by the region's heavy use of automobile industries and industrialization

European countries, on the other hand, are experiencing a faster development rate in the plastic recycling business as a result of the constraints and rigorous regulations governing plastic waste. According to figures from European countries, about 4.4 million tonnes of plastic garbage is generated each year in Europe, with landfills becoming landfills over time. As a result of these charges, the European government has increased its recycling efforts and increased awareness among industrial sectors.

Dart Container Corporation, B & B Plastics Inc., Plasgran Ltd., Custom Polymer, Inc., Viridor Waste Management Ltd., KW Plastics, Dart Container Corporation, Kuusakoski Recycling Ltd., Centrifore Products Ltd., CarbonLite Industries LLC, Dart Container Corporation, and other players.

Recent Development:

In 2023, Carbios continued to advance its enzymatic recycling technology for PET plastics, aiming to achieve industrial-scale production. The company partnered with major brands like L'Oreal and Nestle to further develop and commercialize this technology, demonstrating its commitment to sustainability and innovation.

In 2023, Plastic Energy expanded its global footprint by opening new pyrolysis facilities in Europe and Asia. These facilities convert plastic waste into synthetic oils, which can be used to produce new plastics, thereby contributing to a circular economy.

In 2022, Eastman Chemical Company introduced its molecular recycling technology, which breaks down polyester waste into its basic building blocks for reuse in producing new plastics. The company announced significant investments in new facilities to scale up this technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.28 Billion |

| Market Size by 2032 | US$ 77.90 Billion |

| CAGR | CAGR of 9.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Bottles, Films, Fibers, Foams, Others) • By Type (PET, PE, PVC, PP, PS, Others) • By End-use Industry (Packaging, Building & Construction, Textile, Automotive, Electrical & Electronics, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Dart Container Corporation, B & B Plastics Inc., Plasgran Ltd., Custom Polymer, Inc., Viridor Waste Management Ltd., KW Plastics, Dart Container Corporation, Kuusakoski Recycling Ltd., Centrifore Products Ltd., CarbonLite Industries LLC, Dart Container Corporation, and other players. |

| DRIVERS | • Improvements in recycling technologies that enhance the efficiency of plastic recycling processes. |

| Restraints | • The high cost associated with recycling processes hamper the market growth. |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Dart Container Corporation, B & B Plastics Inc., Plasgran Ltd., Custom Polymer, Inc., Viridor Waste Management Ltd., KW Plastics, Dart Container Corporation, Kuusakoski Recycling Ltd., Centrifore Products Ltd., CarbonLite Industries LLC and Dart Container Corporation.

Ans: Packaging, Building & Construction, Textile, Automotive, Electrical & Electronics and Others are the sub-segments of by end user segment.

Ans: Recycled plastic is being used more frequently, Manufacturers' demands have increased and Techniques for reprocessing and recycling have changed are the opportunity for Recycled Plastics Market.

Ans: Recycled Plastics Market Size was valued at USD 35.28 Billion in 2023 and is expected to reach USD 77.90 billion by 2032 and grow at a CAGR of 9.60% over the forecast period 2024-2032.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Recycled Plastics Market Segmentation, By Source

7.1 Introduction

7.2 Bottles

7.3 Films

7.4 Fibers

7.5 Foams

7.6 Others

8. Recycled Plastics Market Segmentation, By Type

8.1 Introduction

8.2 Polyethylene Terephthalate (PET)

8.4 Polyvinyl Chloride (PVC)

8.5 Polypropylene (PP)

8.6 Polystyrene (PS)

8.7 Others

9. Recycled Plastics Market Segmentation, By End-Use

9.1 Introduction

9.2 Packaging

9.3 Building & Construction

9.4 Textile

9.5 Automotive

9.6 Electrical & Electronics

9.7 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Recycled Plastics Market by Country

10.2.3 North America Recycled Plastics Market By Source

10.2.4 North America Recycled Plastics Market By Type

10.2.5 North America Recycled Plastics Market By End-Use

10.2.6 USA

10.2.6.1 USA Recycled Plastics Market By Source

10.2.6.2 USA Recycled Plastics Market By Type

10.2.6.3 USA Recycled Plastics Market By End-Use

10.2.7 Canada

10.2.7.1 Canada Recycled Plastics Market By Source

10.2.7.2 Canada Recycled Plastics Market By Type

10.2.7.3 Canada Recycled Plastics Market By End-Use

10.2.8 Mexico

10.2.8.1 Mexico Recycled Plastics Market By Source

10.2.8.2 Mexico Recycled Plastics Market By Type

10.2.8.3 Mexico Recycled Plastics Market By End-Use

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Recycled Plastics Market by Country

10.3.2.2 Eastern Europe Recycled Plastics Market By Source

10.3.2.3 Eastern Europe Recycled Plastics Market By Type

10.3.2.4 Eastern Europe Recycled Plastics Market By End-Use

10.3.2.5 Poland

10.3.2.5.1 Poland Recycled Plastics Market By Source

10.3.2.5.2 Poland Recycled Plastics Market By Type

10.3.2.5.3 Poland Recycled Plastics Market By End-Use

10.3.2.6 Romania

10.3.2.6.1 Romania Recycled Plastics Market By Source

10.3.2.6.2 Romania Recycled Plastics Market By Type

10.3.2.6.4 Romania Recycled Plastics Market By End-Use

10.3.2.7 Hungary

10.3.2.7.1 Hungary Recycled Plastics Market By Source

10.3.2.7.2 Hungary Recycled Plastics Market By Type

10.3.2.7.3 Hungary Recycled Plastics Market By End-Use

10.3.2.8 Turkey

10.3.2.8.1 Turkey Recycled Plastics Market By Source

10.3.2.8.2 Turkey Recycled Plastics Market By Type

10.3.2.8.3 Turkey Recycled Plastics Market By End-Use

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Recycled Plastics Market By Source

10.3.2.9.2 Rest of Eastern Europe Recycled Plastics Market By Type

10.3.2.9.3 Rest of Eastern Europe Recycled Plastics Market By End-Use

10.3.3 Western Europe

10.3.3.1 Western Europe Recycled Plastics Market by Country

10.3.3.2 Western Europe Recycled Plastics Market By Source

10.3.3.3 Western Europe Recycled Plastics Market By Type

10.3.3.4 Western Europe Recycled Plastics Market By End-Use

10.3.3.5 Germany

10.3.3.5.1 Germany Recycled Plastics Market By Source

10.3.3.5.2 Germany Recycled Plastics Market By Type

10.3.3.5.3 Germany Recycled Plastics Market By End-Use

10.3.3.6 France

10.3.3.6.1 France Recycled Plastics Market By Source

10.3.3.6.2 France Recycled Plastics Market By Type

10.3.3.6.3 France Recycled Plastics Market By End-Use

10.3.3.7 UK

10.3.3.7.1 UK Recycled Plastics Market By Source

10.3.3.7.2 UK Recycled Plastics Market By Type

10.3.3.7.3 UK Recycled Plastics Market By End-Use

10.3.3.8 Italy

10.3.3.8.1 Italy Recycled Plastics Market By Source

10.3.3.8.2 Italy Recycled Plastics Market By Type

10.3.3.8.3 Italy Recycled Plastics Market By End-Use

10.3.3.9 Spain

10.3.3.9.1 Spain Recycled Plastics Market By Source

10.3.3.9.2 Spain Recycled Plastics Market By Type

10.3.3.9.3 Spain Recycled Plastics Market By End-Use

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Recycled Plastics Market By Source

10.3.3.10.2 Netherlands Recycled Plastics Market By Type

10.3.3.10.3 Netherlands Recycled Plastics Market By End-Use

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Recycled Plastics Market By Source

10.3.3.11.2 Switzerland Recycled Plastics Market By Type

10.3.3.11.3 Switzerland Recycled Plastics Market By End-Use

10.3.3.12 Austria

10.3.3.12.1 Austria Recycled Plastics Market By Source

10.3.3.12.2 Austria Recycled Plastics Market By Type

10.3.3.12.3 Austria Recycled Plastics Market By End-Use

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Recycled Plastics Market By Source

10.3.3.13.2 Rest of Western Europe Recycled Plastics Market By Type

10.3.3.13.3 Rest of Western Europe Recycled Plastics Market By End-Use

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Recycled Plastics Market by Country

10.4.3 Asia-Pacific Recycled Plastics Market By Source

10.4.4 Asia-Pacific Recycled Plastics Market By Type

10.4.5 Asia-Pacific Recycled Plastics Market By End-Use

10.4.6 China

10.4.6.1 China Recycled Plastics Market By Source

10.4.6.2 China Recycled Plastics Market By Type

10.4.6.3 China Recycled Plastics Market By End-Use

10.4.7 India

10.4.7.1 India Recycled Plastics Market By Source

10.4.7.2 India Recycled Plastics Market By Type

10.4.7.3 India Recycled Plastics Market By End-Use

10.4.8 Japan

10.4.8.1 Japan Recycled Plastics Market By Source

10.4.8.2 Japan Recycled Plastics Market By Type

10.4.8.3 Japan Recycled Plastics Market By End-Use

10.4.9 South Korea

10.4.9.1 South Korea Recycled Plastics Market By Source

10.4.9.2 South Korea Recycled Plastics Market By Type

10.4.9.3 South Korea Recycled Plastics Market By End-Use

10.4.10 Vietnam

10.4.10.1 Vietnam Recycled Plastics Market By Source

10.4.10.2 Vietnam Recycled Plastics Market By Type

10.4.10.3 Vietnam Recycled Plastics Market By End-Use

10.4.11 Singapore

10.4.11.1 Singapore Recycled Plastics Market By Source

10.4.11.2 Singapore Recycled Plastics Market By Type

10.4.11.3 Singapore Recycled Plastics Market By End-Use

10.4.12 Australia

10.4.12.1 Australia Recycled Plastics Market By Source

10.4.12.2 Australia Recycled Plastics Market By Type

10.4.12.3 Australia Recycled Plastics Market By End-Use

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Recycled Plastics Market By Source

10.4.13.2 Rest of Asia-Pacific Recycled Plastics Market By Type

10.4.13.3 Rest of Asia-Pacific Recycled Plastics Market By End-Use

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Recycled Plastics Market by Country

10.5.2.2 Middle East Recycled Plastics Market By Source

10.5.2.3 Middle East Recycled Plastics Market By Type

10.5.2.4 Middle East Recycled Plastics Market By End-Use

10.5.2.5 UAE

10.5.2.5.1 UAE Recycled Plastics Market By Source

10.5.2.5.2 UAE Recycled Plastics Market By Type

10.5.2.5.3 UAE Recycled Plastics Market By End-Use

10.5.2.6 Egypt

10.5.2.6.1 Egypt Recycled Plastics Market By Source

10.5.2.6.2 Egypt Recycled Plastics Market By Type

10.5.2.6.3 Egypt Recycled Plastics Market By End-Use

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Recycled Plastics Market By Source

10.5.2.7.2 Saudi Arabia Recycled Plastics Market By Type

10.5.2.7.3 Saudi Arabia Recycled Plastics Market By End-Use

10.5.2.8 Qatar

10.5.2.8.1 Qatar Recycled Plastics Market By Source

10.5.2.8.2 Qatar Recycled Plastics Market By Type

10.5.2.8.3 Qatar Recycled Plastics Market By End-Use

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Recycled Plastics Market By Source

10.5.2.9.2 Rest of Middle East Recycled Plastics Market By Type

10.5.2.9.3 Rest of Middle East Recycled Plastics Market By End-Use

10.5.3 Africa

10.5.3.1 Africa Recycled Plastics Market by Country

10.5.3.2 Africa Recycled Plastics Market By Source

10.5.3.3 Africa Recycled Plastics Market By Type

10.5.3.4 Africa Recycled Plastics Market By End-Use

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Recycled Plastics Market By Source

10.5.3.5.2 Nigeria Recycled Plastics Market By Type

10.5.3.5.3 Nigeria Recycled Plastics Market By End-Use

10.5.3.6 South Africa

10.5.3.6.1 South Africa Recycled Plastics Market By Source

10.5.3.6.2 South Africa Recycled Plastics Market By Type

10.5.3.6.3 South Africa Recycled Plastics Market By End-Use

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Recycled Plastics Market By Source

10.5.3.7.2 Rest of Africa Recycled Plastics Market By Type

10.5.3.7.3 Rest of Africa Recycled Plastics Market By End-Use

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Recycled Plastics Market by country

10.6.3 Latin America Recycled Plastics Market By Source

10.6.4 Latin America Recycled Plastics Market By Type

10.6.5 Latin America Recycled Plastics Market By End-Use

10.6.6 Brazil

10.6.6.1 Brazil Recycled Plastics Market By Source

10.6.6.2 Brazil Recycled Plastics Market By Type

10.6.6.3 Brazil Recycled Plastics Market By End-Use

10.6.7 Argentina

10.6.7.1 Argentina Recycled Plastics Market By Source

10.6.7.2 Argentina Recycled Plastics Market By Type

10.6.7.3 Argentina Recycled Plastics Market By End-Use

10.6.8 Colombia

10.6.8.1 Colombia Recycled Plastics Market By Source

10.6.8.2 Colombia Recycled Plastics Market By Type

10.6.8.3 Colombia Recycled Plastics Market By End-Use

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Recycled Plastics Market By Source

10.6.9.2 Rest of Latin America Recycled Plastics Market By Type

10.6.9.3 Rest of Latin America Recycled Plastics Market By End-Use

11. Company Profiles

11.1 Dart Container Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 B & B Plastics Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Plasgran Ltd.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Custom Polymer, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Viridor Waste Management Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 KW Plastics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Dart Container Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Centrifore Products Ltd

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 CarbonLite Industries LLC

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Dart Container Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Bottles

Films

Fibers

Foams

Others

By Type

Polyethylene Terephthalate (PET)

Polyethylene (PE)

Polyvinyl Chloride (PVC)

Polypropylene (PP)

Polystyrene (PS)

Others

By End-Use

Packaging

Building & Construction

Textile

Automotive

Electrical & Electronics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Coating Equipment Market Size was USD 18.5 billion in 2023 and is expected to reach USD 30.4 billion by 2032 and grow at a CAGR of 5.7% by 2024-2032.

Elastomers Market size was USD 97.80 billion in 2023 and is expected to reach USD 147.35 billion by 2032, growing at a CAGR of 4.23% from 2024 to 2032.

The Proppants Market size was USD 9.27 Billion in 2023 and is expected to reach USD 20.10 Billion by 2032, growing at a CAGR of 8.89% from 2024 to 2032.

Rare Earth Metals Market size was valued at USD 7.66 billion in 2023 and is expected to reach USD 16.26 billion by 2032, at a CAGR of 8.75% from 2024-2032.

Propanol Market size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 6.34 Billion by 2032, growing at a CAGR of 5.70% from 2024-2032.

The Lignin Market Size was valued at USD 1.10 billion in 2023, and is expected to reach USD 1.60 billion by 2032, and grow at a CAGR of 4.3% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone