Get more information on Recycled PET Market - Request Sample Report

The Recycled PET Market Size was valued at USD 8.9 billion in 2023 and is expected to reach USD 17.2 billion by 2032 and grow at a CAGR of 7.6% over the forecast period 2024-2032.

The Recycled PET market has been experiencing tremendous growth due to the increasing awareness of sustainability and the requirement for circular economy practices. This encompasses several dynamics driving the market, one of the most important factors being growing regulatory pressure and consumer demand for environmentally friendly products. The influence of imposing regulations by governments and organizations to decrease plastic waste has resulted in pressure on manufacturers to invest in recycling technologies. Apart from these methods, companies are also using newer processes that make PET recycling even easier, thus making the material a viable option for many applications in packaging, textiles, and automotive industries. For instance, as recently as in September 2024, scientists broke the technology in the recycling of PET when they developed a method that was easy to break down waste PET into its basic components, thus making recycling and reuse easier. It is this momentum that may increase the recycling rate of PET even more and lead to another step towards proper, more environmentally safe waste plastic management.

The recent information circulating in the industry has shown that all parties concerned may go the extra mile to curb low rates of recycling PET. For example, in July 2024, scientific studies conducted by experts at a research institution revealed that, at the moment, plastic waste collection and processing need to be enhanced by better recycling structures. The research discovered that the rate of recycling of plastics would be directly benefited if the existing recycling infrastructure is improved to half the current rate. In August 2024, new data was posted by a coalition focused on PET bottle and packaging recycling focusing on how far it has gone in the recycling industry. From the data, the discovery reveals that a set goal for recycling with ambitious targets requires the collaboration of both manufacturers and waste management companies.

South Africa is also gaining momentum in the Recycled PET market, according to a September 2024 report. The country plans to significantly enhance its rPET capacities, which reflects a forward-looking approach towards plastic waste issues. In addition to this, investments in local recycling facilities and among business partnerships are giving an additional push for the enhancement of the collection and processing of PET materials. This development will help the local economies as well as decrease carbon while transporting the raw materials required to be used; thus, this development meets the criteria of sustainability worldwide.

The second innovation was done in April 2024 when scientists came forward disclosing that including fluorine in the recycling process can make the whole recycling procedure of PET plastic wastes simple. This innovation enhances the recyclability of PET, which leads to high material yield. Such developments are quite critical in catering to the increasing demand for recycled materials from industries. While the Recycled PET market continues to advance, such developments point toward a hopeful future driven by several technological breakthroughs and teamwork toward creating an environment with better sustainability.

Drivers:

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Recycled PET Market Growth

Demand in the Recycled PET market is witnessing a spurt due to the general thrust towards sustainability by industries such as packaging, textiles, and automobiles. Consumers, increasingly concerned about environmental issues, are on the lookout for green products. This has prompted manufacturers to attempt to add recycled material to their products so that their products meet consumer expectations. For example, beverage packaging is one area that has received significant attention, as large corporations promise to use rPET in their bottles in a bid to reduce the carbon footprint and plastic waste. Additionally, regulatory frameworks force businesses to perform sustainable activities since they set aggressive recycling targets and encourage the input of recycled material. For example, the initiatives to ban single-use plastics and promote a circular economy have contributed to an overall friendly environment for the growth of the Recycled PET market. Increased investment in recycling technology and infrastructure also supports the change in the direction of more sustainable activities and further opens up space for market growth.

Regulatory Pressure and Initiatives Fuel Investment in Recycling Technologies

Regulatory frameworks and measures to cut plastic waste are paramount in investments in recycling technologies in the Recycled PET market. More stringent regulations, including extended producer responsibility policies, are increasingly being imposed by governments around the world. This implies that manufacturers are obliged to cover the entire lifecycle of their products, which in turn compels them to invest in more efficient recycling processes and recycling technologies to ensure compliance with the new regulations. Many countries are encouraging companies that manufacture products that consist of recycled materials through incentives, and such encouragement leads to sustainability. For instance, due to European Union directives that dictate that a certain percentage of recycling capacity should be put into the packaging material, manufacturers are compelled to invest heavily in recycling capacity. Coupled with this, cooperation between governments, NGOs, and private enterprises is furthering the development of recycling technologies. In this case, cooperation is enhancing not only the recycling rate but also innovative solutions for tackling plastic waste, thus serving to help the Recycled PET market.

Restraint:

High Costs Associated with Recycling Processes Restraint Recycled PET Market Growth

The high cost of recycling processes represents one of the critical constraints that hinder the Recycled PET market. PET recycling processes are rather complex and require specialized technologies and infrastructures, which are prohibitively expensive for most companies. High capital expenditure in establishing recycling facilities and high operating and maintenance costs for these plants can keep out smaller companies. Furthermore, processing used PET materials into high-quality rPET requires significant investment in automation and technology, as well as labor costs for collection, sorting, and processing. Such costs may make the recycled products more expensive than those from virgin PET. In addition, price volatility in virgin PET adds even more complexity to the economics of recycling operations. This will also limit the availability of recycled products and hinder innovation in recycling technologies for the growth of the Recycled PET market as a whole.

Opportunity:

Increasing Focus on Circular Economy Initiatives Presents Significant Opportunities for Recycled PET Market

The upsurge in circular economy activities creates enormous scope for the Recycled PET market to expand and grow. Circular economies are essentially catalyzed to ensure the exhaustive use of resources through recycling processes, reusing, and repurposing items. Since firms and governments continue realizing environmental and economic benefits by embracing circular approaches, they become enthusiastic about integrating recycled materials into their value chain. This trend, in turn, stimulates significant demand for rPET in such sectors as packaging, textiles, and consumer goods. Companies that have incorporated recycled PET into their line successfully comply not only with legislation but also satisfy the ecological preferences of consumers, giving a boost to their brand image and competitive position on the market. There are also collaborative initiatives between businesses, governments, and non-profit organizations to encourage investment in recycling infrastructure and technology that improves the quality and quantity of recycling. As circular economy initiatives gain momentum worldwide, the Recycled PET market will benefit significantly from increased investments and demand for sustainable products.

Challenge:

Competition from Alternative Materials and Technologies Challenges Recycled PET Market Growth

High competition from alternative materials and technologies in the market is a gigantic challenge for Recycled PET. Since demand for sustainability is on the rise, the scope of industries like packaging and containers seek and implement alternatives to traditionally used plastics in the forms of biodegradable matter, bioplastics, and other eco-friendly alternatives. Therefore, most of these materials compete with the advantages of a lower environmental impact than traditional plastics; hence, pose a competitive threat to recycled PET products. New alternative recycling technologies of PET could also be considered as competitive challenges; among these is chemical recycling, which offers yields potentially higher than mechanical recycling processes and also much flexibility in handling different kinds of plastics. Maintaining a share of the market and relevance in a fast-changing material scene is critical for the Recycled PET market, with business goals being met not only on sustainability but also to meet consumer preference. For this, innovation and adaptation must be continuous so that recycled PET stands as the preferred choice both for manufacturers and consumers.

By Source

In 2023, the post-consumer PET segment dominated and accounted for approximately 75% of the Recycled PET market. This huge chunk of dominance in the market is primarily attributed to an increased consumer consciousness regarding sustainability and also higher regulatory pressures towards decreasing plastic waste. Recycling from post-consumer PET is a significant source of recyclable material available at the consumers' disposal, such as plastic bottles, containers, and packing materials. For example, a PET post-consumer is the leader in the market along with Coca-Cola and PepsiCo who have accelerated their collection and recyclability of plastic bottles. They set ambitious targets in using recycled material in their packaging, however, comply with consumer demand and regulatory obligations to enhance their footing on the market. Moreover, the enhanced coverage of recycling infrastructure and collection programs have successively made post-consumer PET available in the market and consequently increased its market share.

By Type

In 2023, the RPET Flakes segment dominated the Recycled PET market, estimated at a share of about 55%. It will dominate the Recycled PET market due to its flexibility. RPET flakes are highly used across a wide variety of applications, from packaging and textiles to automotive components. "Post-consumer PET bottle collection and processing results in flakes which can be easily reconverted into virtually any product desired.". For instance, companies like Unifi and Repreve have been successful in incorporating RPET flakes into their fabric manufacturers without a hitch and thus coming up with high-quality fibers for garments and other textile products. Besides, the growing consumer preference for sustainable packaging solutions has nudged companies such as Nestlé and Unilever to take more RPET flakes in bottles and containers. This, in turn, will help in consolidating its market leadership position. An increase in demand for sustainable and recycled materials across various industries is expected to drive growth in RPET flakes in the near future.

By Application

The packaging segment dominated the Recycled PET market share in 2023, accounting for about 65%. This can be particularly attributed to the increased demand for sustainable packaging solutions since the awareness of environmental sensitivity is increasingly being embraced by more consumers as well as businesses. Recycled PET is used greatly for bottles, containers, and other packaging materials, thus making it an indispensable element in many industries. For example, leading beverage companies like Coca-Cola and PepsiCo made major commitments on recycling content in packaging, pledging to use 50% recycled content in bottles by 2030. E-commerce also saw a growing requirement for eco-friendly packaging-most especially because brands want to reduce the carbon footprint associated with products while still keeping their integrity intact. The industry has witnessed the increasing significance of sustainability from the packaging industry, combined with regulatory pressures to decrease plastic waste, which will continue to keep its leadership in the Recycled PET market while driving innovation and investment in recycled packaging solutions.

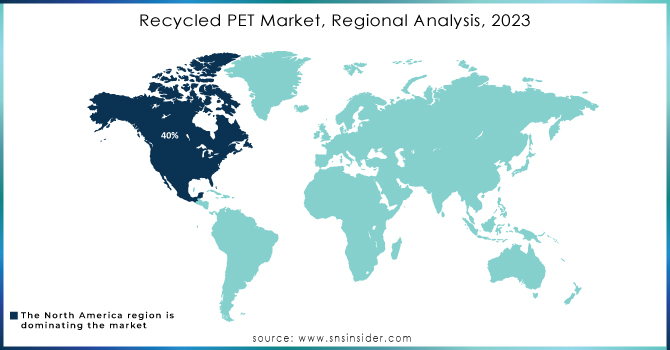

North America dominated the Recycled PET market in 2023, holding an estimated market share of about 40%. This is because of the robust recycling infrastructure, the stringent environmental regulations, and growing consumer awareness about sustainability in the region. Major companies in the United States and Canada have invested heavily in their recycling technologies as well as initiatives to enhance post-consumer PET collection and processing. For instance, Coca-Cola and PepsiCo have established high-scale recycling programs emphasizing a higher usage of recycled material in packaging. State-specific legislation, such as the bottle deposit law in California, has significantly increased recycling volumes, driving North America to lead the Recycled PET market.

Moreover, Asia-Pacific emerged as the fastest growing region in 2023, with the highest CAGR of around 8% for the year 2023. Growth is driven by rapid urbanization, increased plastic consumption, and a growing focus on sustainability initiatives being pursued by governments and industries across the region. Countries like China and India are seeing a growing demand for PET or recycled because of wide manufacturing capacity building and increasing the consciousness of consumers about environmental issues. For example, multinationals setting up recycling operations in Asia-Pacific to achieve sustainability both locally and globally have added further momentum to the rapid growth within the region. The latest import ban on plastic wastes from China led to the growth of local recycling facilities in this country, considerably increasing the domestic market of Recycled PET.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

ALPLA Werke Alwin Lehner GmbH & Co KG (rPET bottles, rPET containers)

Berry Global Inc. (rPET packaging, rPET bottles)

Clean Tech (rPET flakes, rPET pellets)

Coca-Cola Company (PlantBottle, rPET beverage bottles)

Eastman Chemical Company (Tritan Renew, rPET resin)

Green Dot Holdings LLC (rPET resin, rPET pellets)

Indorama Ventures Public Company Limited (rPET pellets, EcoCircle rPET)

Kreussler Inc. (rPET fiber, rPET yarn)

Loop Industries (Loop PET, Loop branded rPET)

M&G Chemicals (rPET pellets, rPET resins)

Nampak (rPET bottles, rPET food containers)

PepsiCo (rPET bottles, Eco-Friendly Packaging)

Plastic Energy Limited (rPET granules, rPET pellets)

Plastipak Packaging (rPET bottles, rPET containers)

PureCycle Technologies (PureCycle rPET, recycled PET resin)

REPREVE (Unifi, Inc.) (REPREVE recycled fiber, rPET yarn)

SABIC (rPET resin, Eco-Therm rPET)

Sealed Air Corporation (rPET packaging, rPET film)

Wellman Advanced Materials (rPET fiber, rPET pellets)

WestRock Company (rPET containers, rPET packaging solutions)

Recycling Companies

PureCycle Technologies

Loop Industries

Plastipak Packaging

REPREVE (Unifi, Inc.)

Green Dot Holdings

Chemical and Material Suppliers

Eastman Chemical Company

LyondellBasell Industries

Invista

BASF SE

Recent Developments

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 8.9 Billion |

|

Market Size by 2032 |

US$ 17.2 Billion |

|

CAGR |

CAGR of 7.6% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Source (Post-consumer PET, Post-industrial PET) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Indorama Ventures Public Company Limited, M&G Chemicals, Clean Tech, ALPLA Werke Alwin Lehner GmbH & Co KG, Plastic Energy Limited, SABIC, Green Dot Holdings LLC, Wellman Advanced Materials, Kreussler Inc., Coca-Cola Company and other key players |

| Key Drivers |

• Growing Demand for Eco-Friendly Products in Various Industries Boosts the Recycled PET Market Growth |

| RESTRAINTS |

• High Costs Associated with Recycling Processes Restraint Recycled PET Market Growth |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Far Eastern New Century Corporation, Biffa, Indorama Ventures Public Limited, Plastipak Holdings Inc, Alpek, and other players are the major key players of Recycled PET Market.

Ans: The prices of recycled plastics are high are the challenges faced by the Recycled PET Market.

Ans: Lack of the Right Structure for Collecting and Sorting Plastic Waste and There are fewer treatment plants and not enough people who know how to recycle pet waste are the restraints for Recycled PET Market.

Recycled PET Market Size was valued at USD 9.54 billion in 2022, and is expected to reach USD 15.20 billion by 2030, and grow at a CAGR of 6.0% over the forecast period 2023-2030.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Recycled PET Market Segmentation, by Source

7.1 Chapter Overview

7.2 Post-consumer PET

7.2.1 Post-consumer PET Market Trends Analysis (2020-2032)

7.2.2 Post-consumer PET Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Post-industrial PET

7.3.1 Post-industrial PET Market Trends Analysis (2020-2032)

7.3.2 Post-industrial PET Market Size Estimates and Forecasts to 2032 (USD Million)

8. Recycled PET Market Segmentation, by Type

8.1 Chapter Overview

8.2 RPET Flakes

8.2.1 RPET Flakes Market Trends Analysis (2020-2032)

8.2.2 RPET Flakes Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 RPET Chips

8.3.1 RPET Chips Market Trends Analysis (2020-2032)

8.3.2 RPET Chips Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 RPET Fibers

8.4.1 RPET Fibers Market Trends Analysis (2020-2032)

8.4.2 RPET Fibers Market Size Estimates and Forecasts to 2032 (USD Million)

9. Recycled PET Market Segmentation, by Application

9.1 Chapter Overview

9.2 Packaging

9.2.1 Packaging Market Trends Analysis (2020-2032)

9.2.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Fiber and Textiles

9.3.1 Fiber and Textiles Market Trends Analysis (2020-2032)

9.3.2 Fiber and Textiles Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Sheets and Thermoforming

9.4.1 Sheets and Thermoforming Market Trends Analysis (2020-2032)

9.4.2 Sheets and Thermoforming Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Construction Materials

9.5.1 Construction Materials Market Trends Analysis (2020-2032)

9.5.2 Construction Materials Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Automotive Parts

9.6.1 Automotive Parts Market Trends Analysis (2020-2032)

9.6.2 Automotive Parts Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Automotive Parts

9.7.1 Automotive Parts Market Trends Analysis (2020-2032)

9.7.2 Automotive Parts Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.4 North America Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.6.2 USA Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.7.2 Canada Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.8.2 Mexico Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.3 Mexico Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.6.2 Poland Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.7.2 Romania Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.8.2 Hungary Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.9.2 Turkey Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.4 Western Europe Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.6.2 Germany Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.7.2 France Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.3 France Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.8.2 UK Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.3 UK Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.9.2 Italy Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.10.2 Spain Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.13.2 Austria Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.4 Asia Pacific Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.6.2 China Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.3 China Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.7.2 India Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.3 India Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.8.2 Japan Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.3 Japan Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.9.2 South Korea Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.3 South Korea Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.10.2 Vietnam Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.11.2 Singapore Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.3 Singapore Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.12.2 Australia Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.3 Australia Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.4 Middle East Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.5 Middle East Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.6.2 UAE Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.7.2 Egypt Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.9.2 Qatar Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.4 Africa Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.5 Africa Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.6.2 South Africa Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Recycled PET Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.4 Latin America Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.5 Latin America Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.6.2 Brazil Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.3 Brazil Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.7.2 Argentina Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.3 Argentina Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.8.2 Colombia Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.3 Colombia Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Recycled PET Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Recycled PET Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Recycled PET Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 Indorama Ventures Public Company Limited

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 M&G Chemicals

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Clean Tech

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 ALPLA Werke Alwin Lehner GmbH & Co KG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Plastic Energy Limited

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 SABIC

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Green Dot Holdings LLC

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Wellman Advanced Materials

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Kreussler Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Coca-Cola Company

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Post-consumer PET

Post-industrial PET

By Type

RPET Flakes

RPET Chips

RPET Fibers

By Application

Packaging

Fiber and Textiles

Sheets and Thermoforming

Construction Materials

Automotive Parts

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Fly Ash Market size was USD 13.42 Billion in 2023 and is expected to reach USD 23.30 Billion by 2032, growing at a CAGR of 5.67% from 2024 to 2032.

The Aliphatic Hydrocarbon Market size was USD 3.95 billion in 2023 and is expected to reach USD 6.02 billion by 2032 and grow at a CAGR of 4.81% over the forecast period of 2024-2032.

The Automotive Adhesives Market size was USD 4.8 Billion in 2023 and is expected to reach USD 7.9 Billion by 2032 and grow at a CAGR of 5.8% by 2024-2032.

Optic Adhesives Market was valued at USD 1.44 Billion in 2023 and is expected to reach USD 2.80 Billion by 2032, growing at a CAGR of 7.64% from 2024 to 2032.

The Activated Carbon Market Size was valued at USD 4.9 billion in 2023 and is expected to reach USD 9.2 billion by 2032 and grow at a CAGR of 7.3% over the forecast period 2024-2032.

Structural Steel Market size was valued at USD 110.04 billion in 2023 and is expected to reach USD 169.60 billion by 2032, at a CAGR of 4.95% from 2024-2032.

Hi! Click one of our member below to chat on Phone