Recycled Carbon Fiber Market Report Scope & Overview:

Get More Information on Recycled Carbon Fiber Market - Request Sample Report

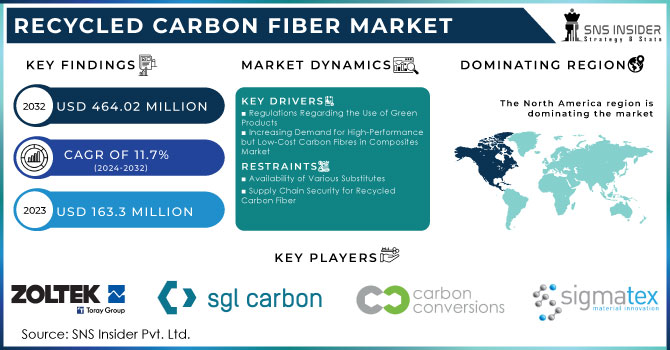

The Recycled Carbon Fiber Market was worth USD 163.3 million in 2023 and is expected to grow to USD 464.02 million by 2032, with a CAGR of 11.7% in the forecast period 2024-2032.

The Recycled Carbon Fiber Market has developed strongly due to environmental, economic, and technological changes. With industries tending toward sustainability, the demand for recycled carbon fiber recovered from carbon fiber composites—is surging due to increased environmental awareness and circular economy practices. These composites, applied in aerospace, automotive, and sports equipment for their high strength-to-weight ratio, are difficult to recycle, but new chemical and thermal processes have enhanced efficiency and feasibility.

Economically, it provides a cheaper route to virgin fiber, reducing the production cost while meeting environmental regulations. Companies like ELG Carbon Fiber and Carbicrete have been doing this in practice to reap the economic benefits of recycling, reprocessing, and using reclaimed fibers into new products. This technological innovation further upgrades the quality and properties of recycled carbon fiber, hence increasing its use in high-performance applications. For example, carmakers like BMW and Mercedes-Benz already use it in vehicles to prove sustainability while boosting performance. Many companies, among them a startup named Mallinda, have developed low-cost, closed-loop recycling processes that recover composite polymers and carbon fiber as well, using reversible chemistry to reduce waste.

These drivers are moreover powered by regulatory pressures and sustainability goals: governments enforce stricter environmental regulations and set ambitious targets for waste reduction. Policies such as the Circular Economy Action Plan by the EU and initiatives by the US EPA encourage the uptake of recycled materials, thereby increasing demand for recycled carbon fiber.

The aerospace industry is the first application that realizes real value from recycled carbon fiber by adding the material to aircraft components, meeting high-quality standards while reducing the associated environmental impacts. Firms like Airbus make it very clear that the material can stand up to some of the toughest industry specifications. As consumers become more environmentally conscious, they will opt for green purchasing of products that reduce waste.

The environmental consciousness, economic benefits, innovative technology, and regulatory pressures all contribute to the growth of the recycled carbon fiber market. Developments in recycling technologies have made it possible to efficiently reclaim carbon fibers, reducing waste and production costs. Aerospace and Automotive industries have pioneered the use of these materials, thereby remaining sustainable with high performance. With growing development in this market in the future, its integration will spread, hence powering a new circular economy.

Market Dynamics:

Drivers:

-

Regulations Regarding the Use of Green Products

The regulations regarding green product usage drive the Recycled Carbon Fiber Market, making industries embrace a more sustainable operation. From the government to other regulatory bodies across the world, strict environmental regulations have been framed to reduce carbon footprints and promote the usage of eco-friendly materials. For instance, the Circular Economy Action Plan by the European Union encourages greater recycling and reusing of materials for the benefit of industries that make use of recycled carbon fiber material. The United States Environmental Protection Agency implements source reduction and recycled material usage policies in the manufacturing industries. This set of policies strives not only to reduce harm to the environment but also to prompt new technological developments regarding recycling and clean methods of manufacture. Companies have enough reasons to comply: avoiding penalties and meeting consumer demand for "green" products. For example, Airbus uses recycled carbon fiber in parts of its aircraft to comply with strict European Union environmental standards, while BMW and Mercedes-Benz use them in their automobiles to serve regulations and demands from environment-conscious customers. Such regulatory pressures guarantee stable demand for recycled carbon fiber, stimulating market growth and further promoting the development of recycling technologies.

-

Increasing Demand for High-Performance but Low-Cost Carbon Fibres in Composites Market

Demand for low-cost and high-performance carbon fibers within the composites market is expected to be one of the primary drivers of the recycled carbon fiber market. The aerospace, automotive, and sports equipment sectors have been under immense pressure to find materials that allow very good strength and durability without huge prices similar to that of virgin carbon fibers. Recycled carbon fibers provide a rather attractive solution by delivering comparable performance at a fraction of the price. For example, car manufacturers like BMW and Ford are using recycled carbon fibers in car parts, which increase the strength, reduce the weight, but still remain at more affordable production prices. Such cost efficiencies would allow producers to come up with high-performance products but remain economically viable as well. More significantly, businesses have also developed processes through which carbon fibers can be reclaimed from end-of-use products—thereby driving down the costs significantly and making high-performance composites accessible. The fact that the fibers can be sold at a more reasonable price while reaching the targets set for sustainability makes them more attractive to consumers sensitive to the environment. This dual benefit of performance and affordability assures that recycled carbon fibers, with growing favor in the composites market, fuel demand and spur innovations in recycling technologies.

Restraints:

-

Availability of Various Substitutes

The ready availability of various alternatives is one major constraint to the Recycled Carbon Fiber Market. Materials such as fiberglass, natural fibers, and even advanced polymers have provided an alternative use for recycled carbon fibers with similar properties at varying prices. For example, the predominance of fiberglass in both the automotive and construction industries is due to its lower price, with adequate performance for some applications without the high strength-to-weight ratio of carbon fiber. Another fast-growing competition will come from natural fibers like hemp and flax. Renewable, and biodegradable, these seem especially in vogue among 'green' circles. Other alternatives come from advanced polymers—high-performance thermoplastics have several benefits connected with ease of processing and lower costs. For example, companies manufacturing sporting goods might be using substitute materials like fiberglass or advanced polymers to stay competitive in product pricing and yet meet the performance standards expected of them. This proclivity toward substitutes could result in some limitations in the use of these recycled carbon fibers, mainly in the cost-sensitive markets where such a premium price for a composite made of carbon fiber—recycled or not—could not be justified. Industries requiring less stringent performance may find these substitutes more than adequate, which further restrains the widespread acceptance of recycled carbon fiber. The market has to constantly innovate to improve the cost-effectiveness and performance characteristics of recycled carbon fibers so that it can effectively compete with these easily available alternates.

-

Supply Chain Security for Recycled Carbon Fiber

Opportunity:

-

Increased interest in lightweight and recyclable materials in the automotive and transport industry nowadays.

-

New demand from developing countries.

KEY MARKET SEGMENTS

By Source

Automotive scrap contributed to this majorly since the emphasis by the automotive industry on lightweight materials and sustainability secured a gigantic market share of 50% in 2023. Aeronautics plays a huge role in the market with their high requirement for high-performance materials. "Other" sources, including wind energy, marine, and construction, would make up a smaller but growing component of the market as the awareness raised in these industries results in the realization of the benefits of recycled carbon fiber. In summary, the source drives huge variations in the market size of recycled carbon fiber, where it realizes great placements in auto and aero scrap and the potential for growth in other sectors as sustainability considerations continue to drive adoption.

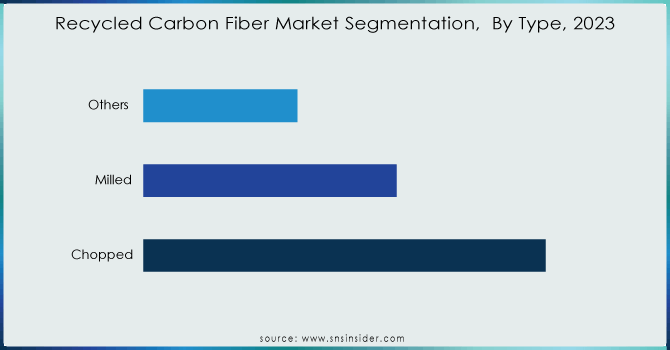

By Type

Chopped carbon fiber holds a share of around 45% in 2023 because it is versatile, strong, and broadly used to reinforce plastics or composites. Milled carbon fiber is preferred in fine, consistent reinforcement applications and hence enjoys a decent market share. Carbon fiber mat represents its segment because of its application in high-performance lightweight applications. The "others" category, including miscellaneous forms and applications, assumes a small but growing share. Globally, the market size of such products mirrors a diverse, changing industry that strives to meet the demand for low-cost, sustainable materials in the automotive, aerospace, and renewable energy industries.

Need any customization research on Recycled Carbon Fiber Market - Enquiry Now

By Recycling Method

The mechanical recycling segment dominated the recycled carbon fiber market in 2023 with a revenue share of 70%. Mechanical recycling is primarily based on shredding, milling, grinding, and crushing of composite parts into compact pieces that may again be powdered. After that, sieving of powdered products is usually done to achieve resin-rich and fiber-rich products. The recovery ratio of the mechanical recycling route for carbon fiber is greater than that of traditional thermolysis and two-step microwave methods. In the process, the epoxy resin of carbon fiber decays first, while char oxidation occurs in the second step. This step is utilized to produce virgin polymer and assists in diminishing greenhouse gases, plastic pollution, and waste. These factors help the segment grow.

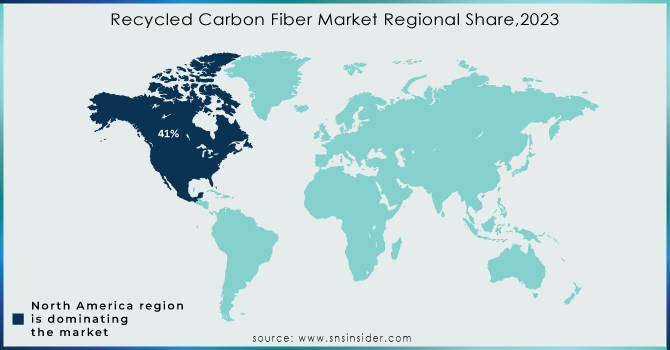

Regional Analysis

In 2023, North America dominated the recycled carbon fiber market with a revenue share of 41% in 2023 due to advanced manufacturing capabilities, a strong automotive and aerospace sector, and stringent yet progressively evolving regulatory frameworks. The United States, in particular, fuels the growth of this market with massive investments in recycling technologies and sustainability. For instance, leading vehicle companies like Ford and General Motors use carbon fiber recycled material for a number of automobile parts to increase performance without compromising the increasingly stringent environmental regulations. Aerospace industries, such as leaders Boeing and Airbus, with a large North American footprint, are utilizing recycled carbon fiber to hit demanding industry standards while lightening the impact on the environment. In addition, it has very good infrastructure for recycling and is supported by policies in the form of tax benefits for the use of recycled materials, or stringent emission regulations. With the presence of major recycling technology companies and leading research institutions in North America, the cycle of innovation and increasing efficiency in carbon fiber recycling is inevitable. The focus of industries, along with regulatory support and technological development, makes North America the continent leading in the recycled carbon fiber market.

The Asia-Pacific region, with a revenue share of 35%, is the fastest-growing region in the recycled carbon fiber market, as it is rapidly industrializing with growing industries of automobiles and aerospace, along with increasing environmental awareness. Huge investments in manufacturing and infrastructure development have made countries such as China and Japan front-runners in this growth. On environmental policy generally, China has always been quite at the forefront in terms of advocating for the use of recycled material. Japan, being a technologically inclined country itself, has recorded high growth in the use of recycled carbon fiber within its aerospace industry, especially firms like Mitsubishi Heavy Industries that manufacture aircraft parts. Besides, the reduced production cost and growing concern about the reduction of industrial wastes has also increased the rate of adoption of recycled carbon fibers within the region. Coupled with the rapid economic development in the region, enabling policies, and awareness raising on sustainability issues, Asia-Pacific shall turn into the fastest-growing market for recycled carbon fibers.

RECENT DEVELOPMENTS

-

February 2024: By using recycled carbon fiber, Thermolysis makes its debut of recyclable products at JEC World. Launches the RCF brand for zero-waste ambition and complete carbon fiber recycling. It helps in producing carbon fiber reuse and recycling of the carbon fibers in the production of bicycle accessories like fenders, light stands, cycling shoe boards, seats, pads, and bottle cages. Such produced products have excellent mechanical strength characteristics and are lightweight.

-

January 2024- Vartega, a specialist in carbon fiber material recycling, garnered $10 million with equity financing led by Diamond Edge Ventures. This helps in a sustainable future.

-

October 2023- Apply Carbon initiated a mass recycled carbon production facility. Apply Carbon has a capacity of 4000 metric tons and has completed the task of a fully automated production plant for recycled carbon fiber.

-

July 2023: The US Department of Energy announced a wind turbine materials recycling prize competition. Most of the materials used in wind turbines can be economically recycled, including fiberglass and carbon fiber.

Key Players:

Shocker composites LLC, ZOLTEK Corporation, Sigmatex, Carbon Fiber Recycling, SGL Carbon, Hadeg, Carbon Conversions, ELG Carbon Fibre Ltd, CFK Valley Stade Recycling GmbH & Co. KG, PROCOTEX CORPORATION,Teijin Limited, Vartega Inc, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 163.3 Million |

| Market Size by 2032 | US$ 464.0 Million |

| CAGR | CAGR of 11.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Aerospace scrap, Automotive scrap, Others) •By Type (Chopped, Milled, Others) •By Recycling Method (Mechanical Recycling, Chemical Recycling, Pyrolysis, Solvolysis, Others) •By End Use Industry (Automotive & Transportation, Consumer Goods, Industrial, Marine, Aerospace & Defense, Wind Energy, Sports & Leisure, Construction, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shocker composites LLC, ZOLTEK Corporation, Sigmatex, Carbon Fiber Recycling, SGL Carbon, Hadeg, Carbon Conversions, ELG Carbon Fibre Ltd, CFK Valley Stade Recycling GmbH & Co. KG, PROCOTEX CORPORATION, Teijin Limited, Vartega Inc |

| Key Drivers | •Regulations Regarding the Use of Green Products •Increasing Demand for High-Performance but Low-Cost Carbon Fibres in Composites Market |

| Restraints | •Availability of Various Substitutes •Supply Chain Security for Recycled Carbon Fiber |