Recruitment Process Outsourcing (RPO) Market Size & Overview:

Get more information on Recruitment Process Outsourcing (RPO) Market - Request Free Sample Report

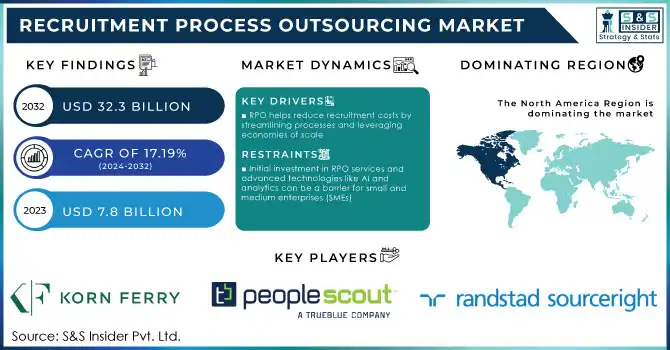

Recruitment Process Outsourcing Market was valued at USD 7.8 billion in 2023 and is expected to reach USD 32.3 Billion by 2032, growing at a CAGR of 17.19% from 2024-2032.

The Recruitment Process Outsourcing (RPO) market is undergoing significant growth, driven by technological advancements, an increasingly interconnected global workforce, and a heightened focus on cost-effective recruitment solutions. Critical factors contributing to this growth include streamlined hiring processes, scalability, and access to niche talent pools, enabling organizations to address skill gaps and enhance recruitment efficiency. Technological innovation serves as a cornerstone for market expansion. AI and data analytics are transforming recruitment, with tools that automate candidate sourcing and screening. Companies like Cielo exemplify this trend, leveraging AI to boost efficiency in talent acquisition. The rise of virtual recruitment platforms has also facilitated remote hiring, reflecting broader trends like hybrid work models, which in 2023 saw 12.7% of employees working fully remotely—a figure expected to grow. These shifts highlight the increasing reliance on technology to meet modern recruitment demands. Regional trends underscore the market's dynamics. North America leads in market size, driven by early adoption of advanced recruitment technologies and a focus on optimizing workforce management. Conversely, the Asia-Pacific region is the fastest-growing market, spurred by robust economic development, technology investments, and demand for skilled labor in sectors like IT and healthcare.

Additionally, ATS (Applicant Tracking System) recruitment software has been gaining traction due to its ability to streamline the hiring process, particularly in industries like IT, healthcare, and retail. This growth is fueled by factors such as the increasing demand for skilled workers, automation in recruitment, and the need to reduce hiring costs. AIDC technologies like AI-driven tools are helping companies improve efficiency in tracking candidates, managing resumes, and speeding up the hiring process.

Strategic initiatives reflect the sector’s adaptability. Kelly Services' launch of innovative RPO solutions and Tele performance's USD 300 million acquisition of PSG Global Solutions underscore efforts to enhance digital recruitment capabilities. Such moves highlight how RPO providers tailor their services to evolving client requirements, emphasizing agility and tech-driven innovation. In summary, the RPO market is poised for transformative growth as businesses prioritize efficiency, cost savings, and competitive recruitment strategies to navigate a dynamic labor landscape

Market Dynamics

Drivers

-

RPO helps reduce recruitment costs by streamlining processes and leveraging economies of scale

-

Integration of AI and data analytics enhances efficiency in candidate screening and sourcing

-

Expands hiring reach, especially with the rise of remote work and hybrid models

In the Recruitment Process Outsourcing (RPO) market, the demand for hiring across different geographical locations has risen considerably as remote work and hybrid work models have virtually extended the hiring range as organizations do not need to restrict themselves to the local workforce anymore. The pandemic push for flexible work arrangements has accelerated this trend, which businesses are capitalizing on to tap into a wider, more diverse talent pool. For instance, in 2023, approximately 12.7% of full-time employees worked entirely remotely, with hybrid models encompassing 28.2%. This trend is projected to continue growing, with 32.6 million individuals expected to work remotely by 2025. RPO service providers utilize the latest technology such as virtual hiring portals and tools and artificial intelligence (AI) and ML to assist hiring across borders with ease. These tools allow companies to assess and make a decision on candidates without an in-person interview thereby reducing the time to hire and the cost of physical infrastructure. Moreover, virtual recruitment resonates with the desires of modern job applicants, especially millennials and Gen Z applicants, who demand flexibility and remote work. For enterprises, this strategy also expands the pool of available resources and aids in workforce diversity by permitting hiring through skill-based hiring from qualified individuals in various geographical locations or communities. Domains such as IT, healthcare, and financial services have significantly thrived with this trend because more often than not, these domains require niche skills that are not easily available within the local boundary. RPO services enable these sectors to access skilled talent worldwide, thereby bridging the gap where skills are lacking and help in remaining competitive in the changing landscape.

|

Aspect |

Impact on RPO Market |

|---|---|

|

Talent Accessibility |

Access to global talent pools, enhancing diversity and skill availability. |

|

Cost Efficiency |

Reduced need for physical recruitment infrastructure and relocation costs. |

|

Technological Integration |

Increased adoption of virtual recruitment tools and AI for efficiency. |

|

Workforce Trends |

Supports hybrid and fully remote workforce models, aligning with global trends. |

Restraints

-

Initial investment in RPO services and advanced technologies like AI and analytics can be a barrier for small and medium enterprises (SMEs)

-

Outsourcing recruitment processes increases the risk of data breaches and non-compliance with regional privacy regulations

-

Difficulty in aligning standardized RPO solutions with unique organizational needs can limit adoption

The Recruitment Process Outsourcing (RPO) market encounters a key challenge in adapting standardized solutions to meet the unique demands of individual organizations. To ensure scalability and cost efficiency, RPO providers often structure their services around general industry norms and predefined workflows. However, this generalized approach may fail to address specific business needs, such as distinctive corporate cultures, region-specific hiring regulations, niche skill requirements, or sector-specific recruitment practices. For instance, while a manufacturing company may emphasize recruiting for on-site roles within local regions, a tech firm might prioritize sourcing specialized global talent for remote positions. Standardized RPO models often fall short of meeting such diverse priorities, potentially resulting in slower recruitment processes, mismatched candidates, and lost opportunities to attract top-tier talent aligned with organizational objectives.

Moreover, achieving customization in RPO services can escalate operational costs and complexity for both the provider and the client. This can discourage adoption among small and medium enterprises (SMEs) with limited budgets. Additionally, integrating RPO systems with existing organizational HR technologies and workflows often presents logistical and technical hurdles, further complicating the process.

Despite these challenges, the RPO market is gradually evolving to address these concerns. Many providers are adopting tailored approaches, such as modular RPO models that allow organizations to selectively outsource specific recruitment functions—like sourcing, screening, or onboarding—while retaining control over other aspects. This hybrid model offers greater flexibility, enabling businesses to align outsourced processes more effectively with their unique goals and operational needs.

While the difficulty of aligning standardized RPO solutions to specific business requirements remains a restraint, it also underscores the growing demand for flexible, client-focused services. Providers that emphasize customization, industry-specific expertise, and adaptive models are better positioned to overcome these barriers and cater to their clients' diverse requirements.

Segment Analysis

By Type

In 2023, The enterprise-based segment dominated the market and represented a significant revenue share of 54.3%. Enterprise engagement RPO, or full-scale or end-to-end recruitment process outsourcing — A comprehensive outsourced recruitment solution typically awarded for multi-year contracts. A comprehensive solution, it encompasses a range of services including sourcing, screening, scheduling interviews, onboarding, tracking, and interviewing candidates. It lightens the load of working on talent pooling and enables the organization to pay attention to other activities of its core business. The appetite for hiring targeted competencies through a full-scale RPO model is fueled among Fortune 500 companies in the developed economies of the U.S. and U.K.

The on-demand segment is projected to register the highest CAGR of 16.8% between 2023 and 2032. As the RPO providers bring various benefits to recruitment process outsourcing, SMEs have understood what the providers are capable of and have accepted the service for their recruitment needs. Rental recruitment models are more cost-effective and are therefore the preferred choice of SMEs due to budget restrictions. On-demand RPO fills this gap by offering flexible, scalable, and low-cost services that can be tapped into on an as-needed basis. With this model, the organization can ramp up its recruiting capacity depending on the demand from the business. This has led to the increasing demand for the on-demand segment, which is expected to witness strong growth over the forecast period.

By Service

In 2023, the off-site segment held the largest revenue share at 68.7%. Although it adds an off-site angle to the previously discussed recruitment process outsourcing, it centralizes the hiring approach for a client across several geographies as well. The company partners with clients in some of the industry's best talent globally. Recruitment firms implement best practices and personalized approaches during this process so that it can yield the best results while also motivating more circle-based hiring. Different nations have distinct employment legislation and recruitment culture limits to marvel in recruitment. Due to their expertise in the local market along with their insights into labor standards and laws, RPO firms make the international hiring process seamless. These companies will adhere to accurate record keeping, compliance laws, and processes and methods that can be verified and enforced by audits. Consequently, multinational organizations are opting for RPO services to manage their global-level recruitment programs.

The on-site segment is projected to expand at the highest CAGR of 17.8% during the forecast period. The platform's existing HR department branches out with on-site service. Hiring solution from recruitment service provider The Recruitment service provider works in association with the HR team of the company to provide a complete hiring solution. On-site services are most commonly adopted across several end-use industries as they develop a productive working relationship between recruiter and RPO firm, streamline the hiring process by offering a single point of contact, and enhance the efficiency of the services. The on-site service model provides the customer visibility over the recruitment fees and number of agencies placed on assignment.

By Organization Size

In terms of revenue, the largest enterprise segment led the market in 2023 and accounted for 69.8% of the market. In the large enterprises of areas such as manufacturing, financial services, and pharmaceuticals it creates a tremendous demand for outsourced recruitment services. A majority of this demand stems from Greenfield projects, where companies are required to have fully functioning HR departments and are seeking staffing partners who can provide end-to-end recruitment solutions. In addition to that, we can also see that big companies have more allocation and need for complex services such as recruitment or other HR functions, 360-degree interviews, recruitment audits, and application-related.

Small and Medium Segment is expected to witness the highest growth over the forecast period, at the highest CAGR of 16.6%. Smaller companies frequently feature an HR group that successfully deals with employment and recruitment responsibilities as nicely as different jobs like payroll, education, and managing employee relations. Such companies require a higher budget and quicker TAT to hire candidates. However, SMEs struggle with continuous changes in the hiring process. This is why SMEs tend to adopt RPO more than large enterprises, since their focus rides the minimizing the total recruiting cost, making recruiting as easy a process for the potential candidates as possible.

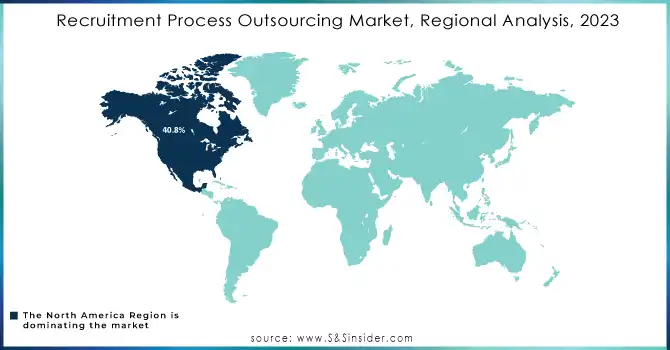

Regional Analysis

North America dominated the market and represented the largest revenue share of 40.8% in 2023. In the same year, the region was led by the United States and is anticipated to continue through the forecast period. With employment back on track and greater demand for degrees in higher education and upskilling in new sectors in order, the US economy is getting back to business. Moreover, the healthcare and manufacturing sectors including healthcare, one of the fastest-growing fields, are opening up new employment opportunities nationwide. Various Government Actions and Environment Like That Revived the Industrial Sector of the United States.

Asia Pacific is expected to witness the highest CAGR of 17.6% during the forecast period. There is also a rise in RPO service providers entering fast-growing regional markets such as Asia Pacific. The growth is directly fueled by the heightened investments by various international corporations in a vast array of sectors as the companies seek new ways to gain a competitive edge in the market. These include recruitment outsourcing transactions emerging in the region due to the expanding labor markets in countries like India and China, gaining significant traction.

Asia Pacific is likely to register a considerable increase in terms of the area due to the growing number of small and medium enterprises and large-scale enterprise companies. In addition, the continued growth of multinational corporations should fuel the regional market. India is projected to grow drastically over the next years, owing to robust expansion in industrial segments such as healthcare, information technology, and manufacturing.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key player along with one service each

-

Randstad Sourceright – Integrated Talent Solutions

-

Cielo– High-Volume Hiring

-

PeopleScout – Total Workforce Solutions

-

Korn Ferry– Project RPO

-

ManpowerGroup Solutions – Recruitment Process Outsourcing

-

Allegis Global Solutions – Contingent Workforce Management

-

Alexander Mann Solutions (AMS) – Contingent Workforce Solutions

-

Hudson RPO – Employer Branding

-

Pontoon Solutions – Managed Service Provider (MSP)

-

KellyOCG– Recruitment Process Outsourcing

-

Yoh – Enterprise Recruitment Solutions

-

WilsonHCG – Talent Acquisition

-

ADP RPO – Recruitment Process Outsourcing

-

IBM Talent Acquisition Optimization – Recruitment Process Outsourcing

-

Sevenstep– Enterprise RPO

-

Orion Talent – Military Hiring Solutions

-

Hays Talent Solutions – Recruitment Process Outsourcing

-

Resource Solutions– Recruitment Process Outsourcing

-

Futurestep (a Korn Ferry company) – Recruitment Process Outsourcing

-

Lucas Group – Executive Search

Recent Developments

July 2023: Randstad made significant strides with its AI-powered recruitment solutions, focusing on improving the candidate experience and reducing time-to-hire. Their efforts emphasize the growing trend of using AI for smarter and more efficient recruitment strategies.

August 2023: Pontoon Solutions expanded its RPO services, targeting large enterprises and integrating more sophisticated analytics into their recruitment process. This move responds to the growing demand for data-driven recruitment insights.

| Report Attributes | Details |

| Market Size in 2023 | USD 7.8 billion |

| Market Size by 2032 | USD 32.3 Billion |

| CAGR | CAGR of 17.19% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (On-demand RPO, Function-based RPO, Enterprise RPO) • By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises) • By Service (On-site, Off-site) • By End-use (BFSI, Healthcare, Manufacturing, IT & Telecom, Retail and E-Commerce, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM Corporation, Randstad N.V, ADP, Inc., Hudson Global Inc., Alexander Mann Solutions, Manpower Group, Pontoon Solutions, Korn Ferry, PeopleScout, WilsonHCG, Allegis Group, Inc., Sevenstep, Cielo, Inc. |

| Key Drivers | •RPO helps reduce recruitment costs by streamlining processes and leveraging economies of scale •Integration of AI and data analytics enhances efficiency in candidate screening and sourcing •Expands hiring reach, especially with the rise of remote work and hybrid models |

| Market Restraints | •Initial investment in RPO services and advanced technologies like AI and analytics can be a barrier for small and medium enterprises (SMEs) •Outsourcing recruitment processes increases the risk of data breaches and non-compliance with regional privacy regulations •Difficulty in aligning standardized RPO solutions with unique organizational needs can limit adoption |