Recreational Vehicle Market Report Scope & Overview:

Get more information on Recreational Vehicle Market - Request Sample Report

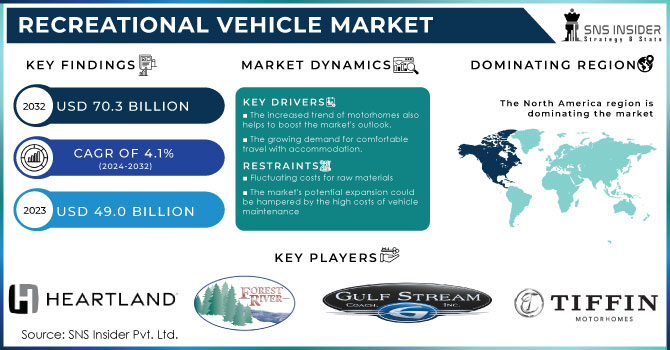

The Recreational Vehicle Market Size was valued at USD 49.0 billion in 2023 and is expected to reach USD 70.3 billion by 2032 and grow at a CAGR of 4.1 % over the forecast period 2024-2032.

The market growth is driven by the rising trend for equivalent tourism and increasingly increasing sustainability in travel around the world. This change highlights an increased understanding and demand by travelers for ecologically friendly alternatives in travel. Moreover, the desirability of green RVs goes beyond their lighter eco-footprint. In Addition, Leisure and recreational activities in parks and camping sites are gaining popularity owing to the increasing focus on healthier lifestyles. In countries such as the U.S., Germany, the UK, and Australia, demand for recreational vehicles is witnessing a surge due to the growing motorhome culture and the integration of campgrounds around and within national parks, hiking trails, and picturesque areas in a bid to boost footfall at local tourism spots. For Instance, the U.S. recorded more than 300 thousand wholesale shipments of vehicles in 2023.

The rising adoption of the electrification of recreational vehicles is creating new, profitable avenues in the market. On top of that, battery technology is offering electric RVs longer ranges and better performance, which should allow them to attract a wider range of customers. For instance, in August 2023 the company began a collaboration with Ricardo, an independent strategic and engineering consulting firm also classed as "a significant shareholder," to design & build the all-electric zero-emission vehicle called Winnebago eRV2 that will serve within its recreational vehicle market. In line with that, SEALVAN, a Turkish company has launched its outbreaking amphibious caravan, i.e., its van can be converted into a marine ship that is cost-effective and also helpful in minimizing air pollutants.

Minor products and better structures that are lightweight are boosting the Recreational vehicle market. These light, tough materials are the way vehicle manufacturers reduce weight while increasing durability. This translates into better fuel economy, more convenient towing, and greater availability for the consumer.

Moreover, the government is also taking the initiative to encourage recreational activities and boost the recreational vehicles market. The UK Govt. is taking steps like campaigns, providing incentives for eco-friendly vehicles, and promoting consumers' preference towards sustainability. For Instance, The Electric Vehicle Homecharge Scheme — EVHS will give people who apply for the fund free money up to USD 380 for Off-Street charging (Home). The Workplace Charging Scheme (WCS) can award businesses a grant of up to USD 15,202 for installing charging stations. The On-street Residential Charge Point Scheme (ORCS) encourages local authorities to install on-street chargers. Electric motorhomes enjoy not only first-year VED (but also standard vehicle tax), and the benefit-in-kind company car tax rate for electric vehicles is just 2% for that single year up to April 2024/25.

MARKET DYNAMICS:

Drivers

-

The increased trend of motorhomes also helps to boost the market's outlook.

-

The surge in spending by millennials on recreational vehicles is the driving force behind the market.

-

The growing demand for comfortable travel with accommodation.

This is one of the key elements that propels the demand for recreational vehicles (RVs) which offer comfortable travel, along with accommodation, and can ferry a large number of passengers on board. The growth in lifestyle is driven by the increasing demand for convenience and comfort among a set of consumers who are looking to immerse themselves deeper into travel experiences. In addition, the growing desire for outside gatherings including camping and road trips then multiplied by the numbers active in camping has increased with a whole new demographic of campers - one that desires size and luxury. According to SNS Insider, The average U.S. population engaged in recreational activities per day is around 21% including men& women.

In addition, the craze for motorhomes as compared to expensive hotels is increasing. Motorhome sales in China increased rapidly as a result of the government's backing of self-driving tourism and the country's growing middle class. This pattern is also seen in Germany, the United States, and the United Kingdom, where camping is very common and RVing is a major part of travel culture.

RESTRAINTS:

-

Fluctuating costs for raw materials

-

The market's potential expansion could be hampered by the high costs of vehicle maintenance

Market, By Application:

By application, the personal segment led the market with more than 62 % of the revenue share in 2023. The best traveling option is a comfortable, convenient, and easy-to-manage base camp for individuals who want to take part in different kinds of activities outdoors; camping, hiking fishing, etc., boost the recreational vehicle market in terms of expansion and technological advancement. Manufacturers have continuously endeavored to bring comfort and time savings for RVs through innovations. Modern luxury recreational vehicles feature fuel-efficient, high-end interiors; desirable entertainment systems, and smart home connections for the benefit of the homeowner. Then come green options. The technology developments that are appealing to personal buyers looking for a more refined and comfortable journey, also open up the aftermarket market growth by changing what potential customers perceive as essential elements of their vehicles.

Market, By Vehicle Type:

Based on vehicle type, the towable RVs segment led the market with more than 70 % of the market share in 2023. The towable RVs have been gaining immense popularity worldwide as the rising trend for experiential travel has led to a growing interest in the pursuit of freedom and flexibility that has encouraged more people to buy towable RVs. On top of that, the design accommodates a ton of flexibility with detachability which will give more transportation methods for users letting them use their towing vehicle separately. This makes the vehicle attractive to those who are looking for a multi-utility like this one. Therefore, the growth of factors is anticipated to boost the growth rate of the market during the forecast period

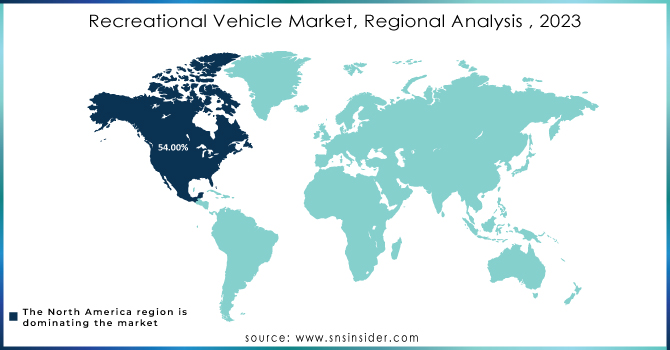

REGIONAL ANALYSIS:

North America led the recreational vehicle market with more than 54% of the market share in 2023. In North America, eco-friendly products have become more common because the country's government attempted to safeguard the environment. In response to the growing demand for these vehicles, the capital market has grown significantly, resulting in an increase in recreational vehicle Size In the market. To match the demand of the booming RV travel market, a vast camping infrastructure is required, with over 13,000 privately owned campgrounds in the United States. A record 11.2 million U.S. households now own an RV, as of 2024, up 26 percent from ten years ago. However, many of these campgrounds need modernization to today's standards, at least 60 feet long with extra hookups. That means that outdoor recreation including RVing generates $1.1 trillion in output and sustains millions of jobs. Increased interest in camping, impelled by the desire to experience the outdoors in new ways, further encourages investment in campground facilities to accommodate this trend.

Get Customized Report as per your Business Requirement - Ask For Customized Report

KEY PLAYERS:

The major key players are Thor Industries, Inc., Heartland Recreational Vehicles, LLC, Forest River, Inc., Gulf Stream Coach, Inc., Tiffin Motorhomes, Inc., Eclipse Recreational Vehicles, Inc., Trigona SA, Coachmen Recreational Vehicle Company, Starcraft RV, Inc., Triple E Recreational Vehicle, Monaco RV LLC, Jayco Inc., Winnebago Industries, Inc., Fleetwood RV, Inc. are some of the affluent competitors with significant market share in the Recreational Vehicle Market.

Recent Developments:

-

Airstream Partners with Forest River for 2024 In June, a new line of Airstream branded travel trailers was introduced in real time on CNBC's Fast Mo... The idea was, to mirror the spirit of both loyal RV'ers and new customers seeking alternatives in travel made achievable by pairing Forest River's renowned manufacturing expertise with Airstream's legendary designing heritage.

-

Thor Industries bought an impressive share of Trigano, a European RV maker in 2023 making it more discovered by people across the entire Europe. The merger is intended to utilize Trigano's familiar distribution networks and product lines to enhance Thor's reach around the world.

-

Winnebago Industries stepped up a notch in early 2024 when that company purchased luxury motorhome manufacturer Newmar Corporation. The partnership is expected to bolster Winnebago's presence in the premium RV space, and offer it diversification product-wise. The integration of Newmar's cutting-edge designs with Winnebago's manufacturing abilities is expected to bring new dimensions for expansion in the luxury market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 49.0 Billion |

| Market Size by 2032 | US$ 70.3 Billion |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Personal, Commercial) • by Vehicle Type [Motorhomes (Class A, Class B, Class C), Towable RVs (Fifth Wheel, Travel Trailer, Camping Trailer)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thor Industries, Inc., Heartland Recreational Vehicles, LLC, Gulf Stream Coach, Inc., Eclipse Recreational Vehicles, Inc., Trigona SA, Coachmen Recreational Vehicle Company, Starcraft RV, Inc., Monaco RV LLC, Jayco Inc., Fleetwood RV, Inc. |

| Key Drivers |

•The increased trend of motorhomes also helps to boost the market's outlook. • The surge in spending by millennials on recreational vehicles is the driving force behind the market. • The growing demand for comfortable travel with accommodation. |

| RESTRAINTS |

• Fluctuating costs for raw materials • The market's potential expansion could be hampered by the high costs of vehicle maintenance |