Recombinant Proteins Market Size & Overview:

To Get More Information on Recombinant Proteins Market - Request Sample Report

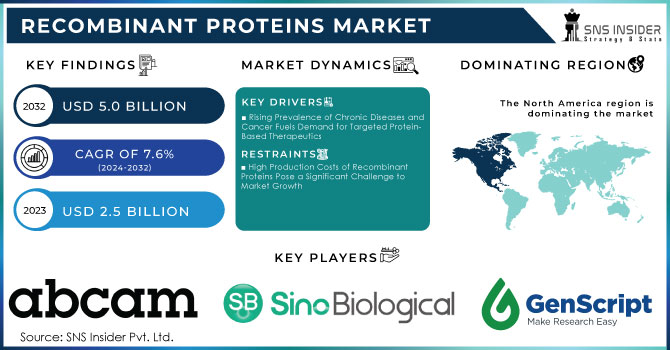

The Recombinant Proteins Market size was estimated at USD 2.5 billion in 2023 and is expected to reach USD 5.0 billion by 2032 with a growing CAGR of 7.6% during the forecast period of 2024-2032.

Driven primarily by the increasing prevalence of chronic diseases such as granulomatous disease, hemophilia, sclerosis, and cancer, the global recombinant proteins market is growing very rapidly. Advancements in biologics and biosimilars, and better products being designed and manufactured for recombinant proteins, will remain catalysts for growth. Research and development has accelerated, especially during the COVID-19 pandemic, in developing recombinant protein-based vaccines and therapeutics. This boom in innovation ended up changing the landscape of biopharmaceuticals as companies rushed to create safe and effective treatments. The increased demand for large-scale production of vaccines and therapeutic drugs during the pandemic also increased biologics research, which supports the interests of recombinant protein industries positively.

According to Global Genes, more than 400 million people around the globe suffer from rare genetic diseases, and there is a serious need for advanced treatments, coupled with better clinical settings. This has fostered the development of biobanks and cohort studies, ensuring quality samples for the scientists, and thus aiding research into significant drug development. More interest in biomarkers and personalized medicine, particularly in advanced diseases such as systemic mastocytosis, facilitated the entry of new therapies. For instance, in August 2022, the U.S. The FDA approved Ayvakit, the first drug targeting the KIT D816V mutation responsible for almost all cases of Systemic Mastocytosis (SM).

Increasing R&D investments also further support the market. As of 2021, nearly half of the respondents' R&D professionals have witnessed budget growth compared to the previous year 2020, and expect it to expand in 2022. R&D spend leaders in this market are increasing R&D investments to realize innovation and increase product lines. In this category, R&D investment for 2021 by Merck KGaA amounts to USD 2.44 billion, much of which went into healthcare and life sciences. The growing investment in biopharmaceutical research will be the main engine for the growth of recombinant proteins and will continue to accelerate the industry's growth shortly.

Cancer is one of the most common chronic conditions present worldwide, and the product line of recombinant protein therapeutics is in the process of establishing itself in this space. According to the American Cancer Society, new cancer cases diagnosed in the U.S. were estimated to be 1.9 million in 2022, with approximately 609,360 cancer deaths. The China report also indicates that in 2022, the new cancer cases were 4.8 million, and deaths due to cancer were 3.21 million. In India, the reports of 2023 point to cervical cancer reaching 340,000, with breast cancer remaining the most common. This is the ground on which the demand for recombinant protein-based therapies is increasing as it is more accurate and precise, especially in oncology.

New spending in R&D on research for auto-immunity and other chronic diseases is also fast-tracking the development of new recombinant protein drugs. In the year 2021, the NIH spent USD 1,021 million on autoimmunity which is expected to reach USD 1,061 million by 2022. Growth in funding will trigger the development of recombinant protein drugs, setting the pace for the market.

Briefly, the recombinant protein market will continue to grow. Some points that will drive their growth include increased investments in R&D, an increase in chronic cases, a rise in demand for biopharmaceuticals, and the successful development of new personalized medicines and cancer treatments.

Recombinant Proteins Market Dynamics

Drivers

- Rising Prevalence of Chronic Diseases and Cancer Fuels Demand for Targeted Protein-Based Therapeutics

The increasing prevalence of chronic diseases is significantly driving the demand for precise and effective protein-based therapeutic interventions. Cancer, in particular, remains a major contributor to this demand. According to estimates from the American Cancer Society, common cancer types such as lung, breast, colorectal, prostate, and skin cancers continue to pose substantial health challenges. Several risk factors, including tobacco use, poor dietary habits, physical inactivity, excessive sun exposure, and exposure to harmful chemicals and pollutants, contribute to cancer development.

In the United States, nearly 50% of all new cancer cases are comprised of breast, lung, bronchus, prostate, and colorectal cancers. Similarly, cancers of the lung, bronchus, colorectal, pancreas, and breast account for almost 50% of all cancer-related deaths. In 2022 alone, around 1.9 million new cancer cases were diagnosed in the U.S., with 609,360 individuals succumbing to the disease. Cancer remains the second leading cause of death in the country. Additionally, an estimated 89,010 new cases of lymphoma were reported in the U.S. in the same year. These alarming statistics underscore the critical need for advanced and targeted therapeutic solutions, fueling the growth of the recombinant protein market.

Restraints

- High Production Costs of Recombinant Proteins Pose a Significant Challenge to Market Growth

Recombinant Proteins Market Segmentation Analysis

By Product & Services

The product segment led the global market in 2023, accounting for over 65.7% of total revenue. This segment is expected to continue growing at the second-fastest rate while maintaining its leading position throughout the forecast period. Its growth is primarily driven by the widespread use of recombinant protein products in areas such as cancer, HIV/AIDS, COVID-19, immunology, and neuroscience. Growth factors and cytokines, in particular, play a crucial role in cancer research, with studies on their application in cancer treatment leading to new chemotherapy targets. Additionally, the rising demand for recombinant protein products in regenerative medicine, coupled with increased funding for cancer research and development, is further boosting global demand. Meanwhile, the services segment is projected to experience the fastest growth during the forecast period.

By Application

The therapeutics segment led the global market in 2023, capturing over 33.9% of the total revenue. This segment is also projected to register the fastest growth rate during the forecast period. The rising prevalence of diseases such as metabolic disorders, cancer, genetic conditions, and immune diseases is expected to drive demand for protein-based treatments. Cancer, in particular, remains a leading cause of mortality worldwide, and the World Health Organization (WHO) anticipates a significant increase in cancer cases in the coming years. Consequently, the therapeutics market is poised for growth.

Protein therapeutics are proving to be highly effective in treating a range of conditions, including diabetes, cancer, infectious diseases, hemophilia, and anemia. For instance, the International Diabetes Federation estimated that 537 million adults (aged 20-79) were living with diabetes in 2021, with projections indicating this number could rise to 643 million by 2030 and 783 million by 2045. Given the growing diabetic population, the demand for recombinant proteins within the therapeutics segment is expected to see substantial growth in the coming years.

By End-user

The pharma and biotech companies segment held the largest revenue share in 2023 and is projected to continue growing at the fastest CAGR over the forecast period, maintaining its dominant market position. The increasing focus on biologics and biosimilars has led to substantial multi-million-dollar investments by bio-manufacturers in research and development. These investments aim to expand product pipelines, develop new technologies, and enhance bioprocessing tools. The rising demand, intensifying competition among industry players, and diverse applications by end-users have further driven advancements in recombinant protein products.

Moreover, the R&D sector has seen a surge in investments through collaborations and partnerships between academia and industry. For instance, Pfizer's Center for Therapeutic Innovation (CTI) serves as a collaborative platform within the healthcare ecosystem. CTI partners with academic institutions and researchers to address challenges using Pfizer's expertise, promoting drug development research and potential therapies. Such collaborations are instrumental in advancing drug development and fostering industry growth.

By Host-cells

The global industry is further segmented by host cells into categories such as mammalian systems, insect cells, yeast & fungi, bacterial cells, and others. In 2023, the mammalian host cell segment led the market, capturing over 41.7% of the total revenue. This segment is expected to continue expanding at the fastest growth rate, maintaining its dominant position throughout the forecast period. The increasing popularity of mammalian protein expression is largely driven by the growing market for proteomics and biologics. These protein expression systems are easily accessible and can be integrated into high-throughput systems, facilitating efficient biologics and proteomics research.

Additionally, the focus on biopharmaceutical production has intensified, spurred by factors such as the rising incidence and prevalence of cancer and increased research and development (R&D) initiatives. These factors are contributing to the overall industry growth. Meanwhile, the bacterial cell segment is projected to experience the second-fastest growth rate during the forecast period.

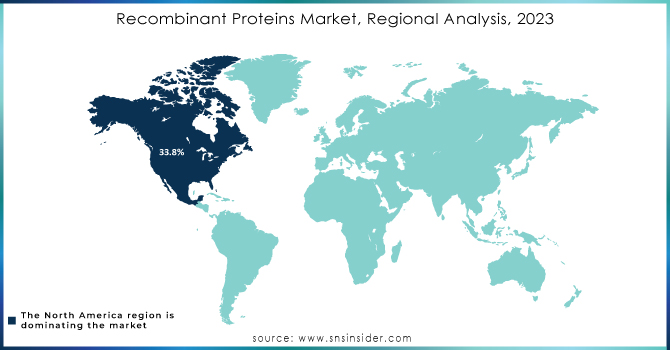

Recombinant Proteins Market Regional Outlook

In 2023, North America led the global recombinant protein market, capturing over 33.8% of the total share, driven by increased research funding, robust healthcare infrastructure, and the presence of numerous industry players. The rising prevalence of chronic diseases in the region has significantly boosted the demand for recombinant protein therapies, as these treatments are widely recognized for addressing various medical conditions. For instance, according to GLOBOCAN, Mexico reported 90,222 cancer-related deaths and 195,499 newly diagnosed cancer cases in 2020, underscoring the urgent need for advanced therapeutic solutions. In response to the COVID-19 pandemic, key pharmaceutical companies in the U.S., such as Sanofi and GSK, invested in recombinant DNA technology to develop vaccines. In April 2020, the two companies collaborated, combining GSK's additive technique with Sanofi's recombinant S-protein COVID-19 antigens.

Meanwhile, the Asia Pacific region is experiencing rapid growth, fueled by increased public and private investments in recombinant protein research, favorable government regulations, and a rising incidence of target diseases due to an aging population. The region’s growth is further supported by advancements in proteomic and genomic research, which are accelerating the development of innovative recombinant protein products. These factors position Asia Pacific as a key player in the global recombinant protein market expansion.

Do You Need any Customization Research on Recombinant Proteins Market - Enquire Now

Key Players

-

Abcam plc.

-

Sino Biological, Inc.

-

R&D Systems, Inc.

-

GenScript

-

BPS Bioscience, Inc.

-

Bio-Rad Laboratories, Inc.

-

Merck KGaA

-

Thermo Fisher Scientific

-

Proteintech Group, Inc.

-

Enzo Life Sciences, Inc.

-

Abnova Corp.

-

RayBiotech Life Inc.

-

STEMCELL Technologies Inc.

-

Bio-Techne

-

BioLegend Inc

-

Enzo Biochem Inc.

-

StressMarq Biosciences Inc.

-

Sartorius CellGenix GmbH and others.

Recent Developments

-

In February 2023, Bio-Techne and Cell Signaling announced a partnership aimed at facilitating the validation of simple Western antibodies for researchers.

- In May 2023, Thermo Fisher Scientific Inc. and the National Research and Innovation Agency of Indonesia (BRIN) signed a Memorandum of Understanding (MOU) to bolster and advance Indonesia's national research and innovation infrastructure and capabilities.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 2.5 billion |

|

Market Size by 2032 |

US$ 5.0 billion |

|

CAGR |

CAGR of 7.6% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Product & Services (Product, Production Services), By Host Cell (Mammalian Systems, Insect Cells, Yeast & Fungi, Bacterial Cells, Others), By Application (Drug Discovery & Development, Therapeutics, Research, Others), By End User (Pharma & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Abcam plc., Sino Biological, Inc., R&D Systems, Inc., GenScript, BPS Bioscience, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Thermo Fisher Scientific and Others |

|

Market Drivers |

•Rising Prevalence of Chronic Diseases and Cancer Fuels Demand for Targeted Protein-Based Therapeutics |

|

Market Restraints |

•High Production Costs of Recombinant Proteins Pose a Significant Challenge to Market Growth |