Real-Time PCR (qPCR) Market Size & Trends:

Get more information on Real-Time PCR (qPCR) Market - Request Sample Report

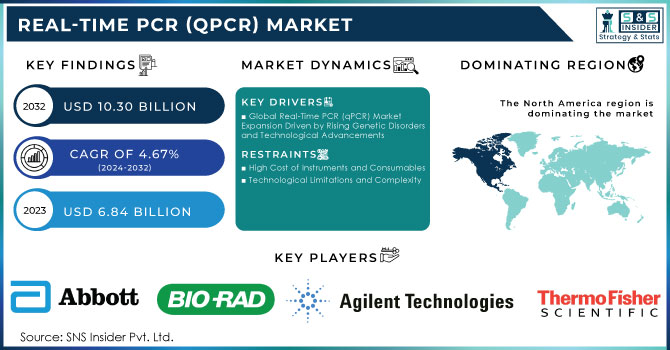

The Real-Time PCR (qPCR) Market Size was valued at USD 6.84 billion in 2023 and is expected to reach USD 10.30 billion by 2032 and grow at a CAGR of 4.67% over the forecast period 2024-2032.

The real-time PCR (qPCR) market is promising with the growing incidence of genetic disorders, infectious diseases, as well as chronic diseases. According to the CDC, congenital heart defects occur in approximately 1 percent of U.S. births yearly, thus a big demand for early detection and intervention through advanced diagnostics like qPCR. The critical need for PCR techniques applied to detect genetic variations for prenatal testing as well as diagnosis and prevention of diseases such as HIV, HPV, Alzheimer's, and Parkinson's disease is expanding the market. For instance, many European countries experienced an increase in invasive group A streptococcal (GAS) infections in children during the season of 2022-2023, leading to an increased demand for PCR-based diagnostics.

Other advantages of Real-Time PCR (qPCR) include precision, automation, accuracy, and real-time quantification, which have contributed to its rising adoption in various fields. This global trend is reflected in the substantial investments and initiatives aimed at enhancing qPCR capabilities in multiple countries. For instance, in 2023, the World Health Organization (WHO) launched a global initiative aimed at improving molecular diagnostics, specifically qPCR testing, in low- and middle-income countries. The program, funded by a USD 50 million investment, seeks to bolster healthcare infrastructure and increase testing capacities for infectious diseases like tuberculosis, HIV, and COVID-19. This initiative underscores the critical role that qPCR plays in public health surveillance and response. Additionally, in the United States, the Centers for Disease Control and Prevention (CDC) has allocated over USD 100 million to support the development and implementation of advanced qPCR technologies for various infectious diseases. This funding aims to enhance the country’s testing capabilities, especially in the context of emerging health threats.

Despite these advantages, other comparable technologies would exist to challenge its market. Technologies like immunoassays and next-generation sequencing will offer cheaper options with quick turnaround, thus competing with dPCR. Regulation is also a challenge for the industry, as the FDA U.S. has planned for regulation on laboratory-developed tests, LDTs. High-priced reagents and instruments for PCR, with some automated dPCR instruments reaching USD 100,000 also act as points of competition that prevent the adoption in the lower-budget research areas of regions.

However, high-tech innovations, such as ultrafast PCR technology that can run assays within 5 minutes, and strategic partnerships, such as the one between BD and CerTest Biotec for PCR assays, will continue to drive market growth. The qPCR market will grow steadily with the increasing trend of progress in PCR technology and explosive growth in POC testing requirements.

Market Dynamics

Drivers

-

Global Real-Time PCR (qPCR) Market Expansion Driven by Rising Genetic Disorders and Technological Advancements

One of the major contributors to the growth of the real-time PCR (qPCR) market is the increasing incidence of genetic disorders and life-threatening infectious diseases. Some of the other factors that continue to fuel this expansion are the growing incidence of genetic disorders, the increasing use of biomarker profiling in diagnostics, and the successful completion of the Human Genome Project. With advanced technology in PCR and investments, funding, and grants, the adoption of dPCR and qPCR will increase. These technologies prove very effective in diagnosing and evaluating disease-causing microbes, especially those that target.

Another critical driver of the market growth is the shift of focus towards genome-based drug discovery and away from plant-based treatments. This is notable in emerging markets with rising market penetration and consumer acceptance of genome-driven diagnostics and therapeutics. This is going to form a massive market for the technology. Technological limitations and the high cost of PCR instruments can turn out to be constraints on further expansion of the market.

Regulatory support has been the driving force in the advancement of PCR technologies. For instance, the U.S. FDA approved Bio-Rad's SARS-CoV-2 ddPCR Kit Emergency Use Authorization in 2020, while underlining PCR as an essential tool in fighting the COVID-19 pandemic. Moreover, Governments, as well as federal agencies of all countries, target qPCR and dPCR technologies within genomics research; this is backed by financial initiatives in both the public and private sectors. Due to this wide support, the growth of the global real-time PCR (qPCR) market is anticipated to accelerate.

Restraint

-

High Cost of Instruments and Consumables

-

Technological Limitations and Complexity

Key Segmentation

By Product

Reagents & Consumables were the leading product area in 2023 and more than 55.0% of the overall market share. The leading position of this product area is due to regular and repeat use of consumables during qPCR. These reagents and consumables have become indispensable for routine tests at diagnostic and research levels, hence ensuring continuous demand. Increased usage in disease diagnosis, particularly with infectious diseases, further accelerated the leading position of this segment. As far as the near future is concerned, the Software & Services segment is expected to be the most promising one. This growth would be a result of increased requirements for high-performance data analytics, PCR workflow automation, and improved in-lab operational efficiency. Therefore, the increased adoption of advanced PCR technologies in laboratories will be bound to accelerate the demand for integrated software solutions and maintenance services.

By Application

As of 2023, over 60.0% of market share in clinical applications was represented by the qPCR. The increasing prevalence of infectious diseases, genetic disorders, and cancer has also spurred the utilization of qPCR technology in clinical diagnostics. Its high accuracy, sensitivity, and speed in detecting and quantifying pathogens and genetic mutations make it an important tool for healthcare providers in making diagnoses and management decisions in clinical settings.

The fastest growth in this forecast period will be seen in the application segment of forensics. This growth can be due to increased dependence upon the use of qPCR for DNA sample analysis in criminal investigations, paternity testing, and disaster victim identification. Given the sensitivity and specificity of PCR in even minute and degraded samples, it has thus become an essential tool in forensic science and has witnessed rapid adoption.

By End-User

The Hospitals & Diagnostic Centers dominated the market in 2023, with a market share above 40.0%. Enhanced demand for accurate and rapid diagnostic solutions, especially during the ongoing management of infectious diseases and chronic illnesses, has furthered the cause of qPCR in these settings. Such ubiquity in hospitals and diagnostic labs worldwide is well facilitated by their seamless integration within routine diagnostic workflows. Pharmaceutical & Biotechnology Companies are the largest and fastest-growing end-user segment, primarily due to higher adoption of qPCR in drug discovery, development, and clinical trials. The trend towards personalized medicine and genome-based drug research has, of late, resulted in increasing adoption of qPCR technologies for evaluating genetic markers and developing targeted therapies. This trend is likely to persist since the pharmaceutical sector integrates genomics in most of its research and development work.

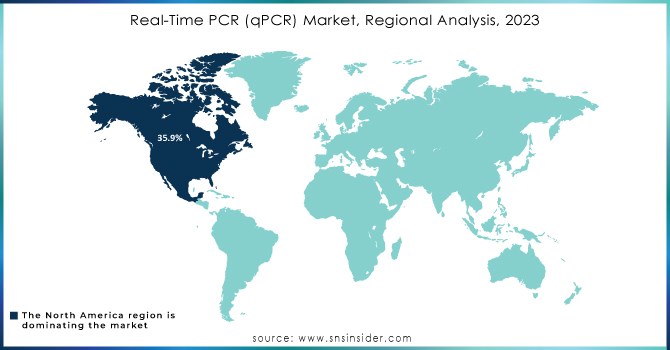

Regional Analysis

North America was the market leader in real-time PCR (qPCR) globally in 2023, holding more than 35.9% share of total revenue share. Growth in the region is attributed to increasing chronic disease incidences, genetic disorders, and infectious diseases, along with high demand for rapid diagnostic tests and a rising aging population. U.S. According to the Census Bureau, over 16.9 percent of the population of the United States, which sums up to as much as 56 million people, have aged above 65 years. As a result, this demographic trend tends to enhance the demand for diagnostics because older populations also appear to be at a higher risk of age-related and chronic conditions. North America also boasts of investments going into gene-based research. The presence of major market players such as Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., and Agilent Technologies, which is trying to shape the market with innovative solutions, further strengthens the market.

Asia Pacific is the most promising and lucrative market for qPCR. The growth in this region is valued by high unmet clinical needs, untapped market opportunities, and increasing health expenditure. Furthering the support for market expansion is the rising demand for advanced healthcare solutions, as well as governmental initiatives in the public health infrastructure. Such factors as target diseases, including both infectious and chronic conditions, and increased investments in health technologies, have led to the adoption of real-time, digital, and end-point PCR technologies.

Europe also holds a substantial market share in the qPCR market and is likely to do so in the future based on increasing diagnostics that are gene-based, infectious diseases are relatively common, and there is a very robust regulatory framework to support diagnostics technology development. Large countries like the U.K., Germany, and France are investing heavily in innovation in health care, which drives the regional market even further.

Need Any Customization Research On Real-Time PCR (qPCR) Market - Inquiry Now

Key Players

Reagents & Consumables

-

Abbott

-

Agilent Technologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

GE Healthcare

-

bioMérieux

-

F. Hoffmann-La Roche Ltd

-

Fluidigm Corporation

-

Takara Bio Inc.

-

TOYOBO Inc.

Instruments

-

Abbott

-

Bio-Rad Laboratories Inc.

-

Agilent Technologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

GE Healthcare

-

Fluidigm Corporation

-

F. Hoffmann-La Roche Ltd

-

Lumex Instruments

-

Analytik Jena AG

Software & Services

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories Inc.

-

Thermo Fisher Scientific, Inc.

-

QIAGEN

-

Fluidigm Corporation

-

Primerdesign Ltd

-

B.D.

-

F. Hoffmann-La Roche Ltd

Recent Developments

-

In December 2023, Walgreens launched flu and COVID-19 testing services across the U.S., targeting the peak respiratory illness season.

-

In October 2023, MAWD Laboratories received Emergency Use Authorization (EUA) from the U.S. FDA for its COVID-19 PCR test.

-

In May 2023, Standard BioTools introduced the X9 High-Throughput Genomics System, enabling users to perform RT-PCR and NGS-based applications on a single benchtop system.

-

In April 2023, Curative, Inc. spun off Sensible Diagnostics, a company focused on commercializing a novel point-of-care (POC) PCR testing platform that delivers results within 10 minutes with high accuracy.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.84 billion |

| Market Size by 2032 | US$ 10.30 billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents & Consumables, Instruments, Software & Services) • By Application (Clinical, Research, Forensics) • By End-User (Hospitals &Diagnostic Centers, Research Laboratories & Academic Institutes, Pharmaceutical & Biotechnology Companies, Clinical Research Organizations, Forensic Laboratories) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott, QIAGEN, Bio-Rad Laboratories Inc., Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., GE Healthcare, bioMérieux, F. Hoffmann-La Roche Ltd, Fluidigm Corporation, Takara Bio Inc., TOYOBO Inc., Lumex Instruments , Analytik Jena AG, Primerdesign Ltd , B.D. and other players |

| Key Drivers | • Global Real-Time PCR (qPCR) Market Expansion Driven by Rising Genetic Disorders and Technological Advancements |

| Market Restraints | • High Cost of Instruments and Consumables • Technological Limitations and Complexity |