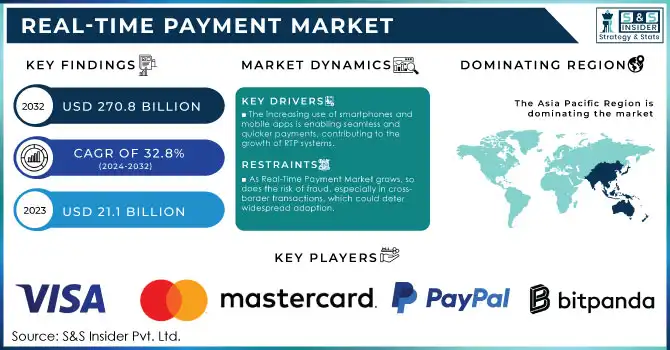

Real-Time Payment Market Size & Overview:

Real-Time Payment Market was valued at USD 159.30 billion in 2024 and is expected to reach USD 1541.05 billion by 2032, growing at a CAGR of 32.8% over 2025-2032.

Get more information on Real-Time Payment Market - Request Free Sample Report

The RTP (Real_Time Payments) market has been growing rapidly primarily due to the need for systems that can process transactions quickly and effectively. The government has played a vital role in encouraging the evolution as well as the adoption of real-time payment infrastructures acts as a key market driver. The governments and central banks of many countries are designing new policies and monetary systems to enable rapid, easy payment methods. According to the latest statistics from the Federal Reserve, real-time payment systems have become a priority for financial institutions and government bodies, with the U.S. seeing a 30% increase in RTP transactions from 2022 to 2023.

Moreover, governments around the world are establishing national-level programs to encourage real-time payment adoption, as illustrated by the India's launch of the Unified Payments Interface (UPI), and the UK's Faster Payments Service, both of which have transformed the domestic space for consumers and enterprises. Compared to now instant payment has become the need of the hour due to the rise in the trend of mobile banking, e-wallets, and digital wallets along with the increasing online shopping and e-commerce. Moreover, according to India's government data, real-time payments are projected to exceed $1 trillion in use and economic value by the year 2025, which underlines their transformative impact in driving digital transformation. In light of these developments, several regulatory bodies are also focusing on ensuring that these systems are secure and compliant with international standards, fostering trust and encouraging further adoption. The continued government push for RTGS and technology evolution is expected to fuel the growth of the real-time payment market and increase its penetration across the developed and developing markets.

Market Size and Forecast:

-

Market Size in 2024 USD 159.30 Billion

-

Market Size by 2032 USD 1541.05 Billion

-

CAGR of 32.8% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Real-Time Payment Market Trends:

-

Rising smartphone penetration is creating a strong foundation for real-time payment adoption worldwide.

-

Mobile-first payment platforms are increasingly driving consumer preference for instant financial transactions.

-

National payment systems in emerging markets are showcasing rapid scalability of real-time payment solutions.

-

Developed markets are experiencing strong adoption of RTP networks across banks and fintech providers.

-

Consumers are shifting toward instant, convenient, and branchless transactions, making real-time payments the global standard.

Real-Time Payment Market Growth Drivers:

Increase in smartphone penetration and mobile payment adoption is a key driver for the Real-Time Payment Market growth. With smartphones becoming ubiquitous, consumers and businesses are increasingly relying on mobile apps for their financial transactions. In 2024 the global smartphone penetration hit over 80% of the world population, paving the way for a ripe mobile payment landscape. Notably, the widespread use of apps like Google Pay, Apple Pay, and PayPal has made Real-Time Payment a convenient option for consumers looking for instant transactions. For example, in India, the Unified Payments Interface (UPI), a Real-Time Payment platform, recorded over 15 billion transactions in 2023, marking a significant jump from previous years. This growth is mainly driven by mobile-first, in which users initiate a transfer anytime without any delays and the need to visit a branch. Likewise, it is the story in the U.S., where RTP networks such as The Clearing House's RTP system and the Zelle network have been growing impressively, with Zelle reportedly processing over $90 billion in transactions in 2023 alone.

As consumers increasingly expect more convenient ways to get their finances done quickly, immediate payments on mobile devices have become the new normal. With increasing smartphone penetration worldwide, mobile payment adoption is likely to continue leveraging RTP growth potential as more markets digitalize their payment infrastructures.

Real-Time Payment Market Restraints:

Payment fraud and cybersecurity risks are among the major restraints for the Real-Time Payment (RTP) market. With faster transactions comes the potential for more fraud. The instant nature of RTP systems also makes them very vulnerable to cyberattacks like phishing, identity theft, and hacking. The issue is balancing sound security practices with the high level of convenience afforded by RTP. Fraudulent transactions can damage trust in the digital payments ecosystem while also costing banks and payment service providers a lot of money and reputational damage as well. Moreover, since RTP systems are commonly unidirectional, they also cross borders, making it even more difficult to combat fraud with the differing regulatory and security standards between nations. Ensuring robust encryption, real-time fraud detection systems and industry-wide cybersecurity protocols is crucial to mitigate these risks.

Real-Time Payment Market Segment Analysis:

By Payment Type

The Person-to-Business (P2B) payment segment dominated the Real-Time Payment market in 2024, with a 63% share of the global revenue. This growth is due to the increased demand for quicker and more hassle-free transactions between consumers and businesses. P2B payments in business are especially important in different fields, including retail, e-commerce, and service, where purchases for customers can be made instantly, improve customer experience, and allow businesses to function smoothly. Another factor that has helped the sector is government initiatives. Numerous countries have released digital payment regulatory frameworks to aid businesses. Take, for instance, the U.S. Federal Reserve, which has had considerable success in advancing its “Faster Payments Strategy” by facilitating real-time payment systems available to businesses, creating much-needed immediacy in B2B transactions and enabling better cash-flow management for smaller firms.

Moreover, lots of organizations are utilizing Real-Time Payment to lessen the payment lag, making payments more visible and the management of working capital more efficient. The use of Real-Time Payment in 2023 improved the efficiency of payment processing for U.S. businesses by 27% on average, according to government data. Additionally, sectors like retail and e-commerce have grown their adoption of Real-Time Payment to enable high-volume transactions, particularly during peak shopping periods like Black Friday and Cyber Monday, where quick completion of payment is necessary to secure sales. Businesses are sweeping further towards Real-Time Payment as companies continuously look for new methods to keep up with consumer demands as efficiently and time-saving as possible while also ensuring security through verified identity affordances.

By Component

The solutions segment held the largest market share, contributing more than 75% revenue share in the Real-Time Payment market in 2024. The increase in this phenomenon has been mainly due to the increasing adoption of end-to-end solutions that offer seamless transaction processing, fraud prevention, and compliance with legal requirements. This has led governments around the world to fuel investments in such solutions as, for the safe and smooth running of economic activity, we need payment systems to accommodate large-scale and secure transactions. The European Central Bank has recently released its annual e-Euro report, stating that the usage of integrated payment solutions increased by 22% compared to previous years, while transactions were directed towards the standardization of payment systems with regulatory oversight at the prompting of governments to ensure interoperability. They provide companies and financial institutions with everything they need to seamlessly handle real-time transactions from start to finish, including things like blockchain technology and artificial intelligence to prevent fraud.

A few programs are encouraging companies to embrace these solutions by providing governments with incentives, like in the U.S. which offers grants for implementing digital payment systems in small businesses. In addition, public payment infrastructures embraced real-time payment solutions as governments partnered with fintech firms to make such access available for businesses and consumers. The continued and viable dominance of the solutions segment in the Real-Time Payment market is complemented by the success of these initiatives that have government regulations and incentives on their side.

By End Use

In 2024, the Real-Time Payment market was led by the retail and e-commerce segment, which accounted for about 34% of the global revenue. Surging demand for immediate payment solutions in e-commerce and traditional retail settings fuels this dominance. As the world moves towards digital commerce, lots of businesses are transitioning to real-time payment to improve consumer experience, reduce online shopping basket abandonment rates, and make more favorable transactions. U.S. government statistics show a 19% increase in retail e-commerce sales from 2022 to 2023, with many consumers demanding faster, more convenient ways to complete purchases. The rapid adoption of Real-Time Payment is particularly notable during high-demand periods such as holiday sales, where quick and reliable transactions are crucial.

Moreover, initiatives supported by the government e.g., the U.S. Digital Dollar Project have set the stage for digital currency to take a role in retail, which would shave the number of years it might take for Real-Time Payment to take root. Governments are also focused on fostering cashless and contactless cross-border payment systems and enabling a seamless flow of instant payment globally to accommodate global e-commerce and eliminate foreign remittances. This will be especially advantageous for small and medium-sized businesses (SMBs) that often find it tedious to process international trades. Real-Time Payment support global commerce, with the U.S. Commerce Department reporting in 2023 that businesses using Real-Time Payment experienced a 15% rise in international sales. The ongoing growth in the retail and e-commerce segment in 2023 will likely result in further innovation and adoption of real-time payment systems across the globe over the next few years.

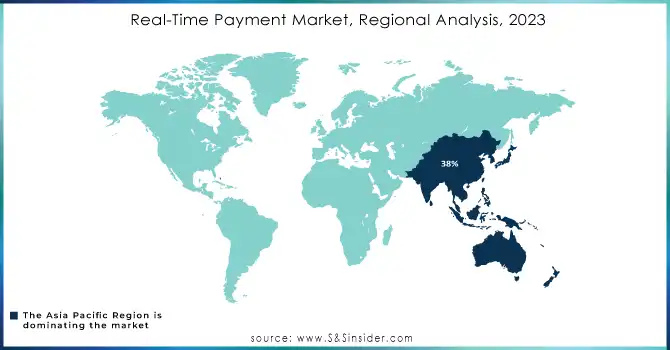

Real-Time Payment Market Regional Analysis:

Asia Pacific Real-Time Payment Market Insights

The Asia Pacific region dominated the market and accounted for 38% of the global real-time payment market share in 2024. That dominance is being fueled by the fast-track digital transformation in large economies including China, India, and Japan, where governments are proactively supporting both digital and real-time payment systems. India's Unified Payments Interface (UPI) is an example that leads to one of the top real-time payment systems processing 85 billion transactions in 2023 alone. Policies implemented by the government of India, like the Digital India initiative, have added significantly to financial inclusion and seamlessly real-time transaction capacity in India. Along the same line, digital payment platforms such as Alipay and WeChat Pay, supported by the government, have changed the face of payments in China, resulting in a major share of the Asia Pacific market.

North America Real-Time Payment Market Insights

The North American region is forecasted to experience significant growth due to its already advanced payment infrastructure and a high adoption rate among businesses and consumers. The largest contribution came from the U.S. due to the adoption of trending real-time payment systems supported by the Federal Reserve's Faster Payments Initiative and the increasing demand for seamless digital payment solutions in all sectors of the economy. Substantial growth also was experienced within the European market as governments around the region encouraged the adoption of Real-Time Payment with new regulatory frameworks and partnerships with fintech companies. The European Central Bank states that Real-Time Payment were up 25% in 2023 across the region, making it one of the fastest-growing markets in the world.

Europe Real-Time Payment Market Insights

The Europe Real-Time Payment market is advancing rapidly, driven by regulatory support such as PSD2, the growth of open banking, and strong digital adoption among consumers and businesses. Increasing cross-border payment needs, combined with fintech collaborations, are further boosting the ecosystem, positioning Europe as a mature and innovation-led real-time payment hub.

Latin America (LATAM) and Middle East & Africa (MEA) Real-Time Payment Market Insights

The LATAM and MEA Real-Time Payment markets are growing significantly, fueled by digital financial inclusion, mobile-first adoption, and supportive government initiatives. In LATAM, platforms like Pix in Brazil are reshaping payments, while MEA sees rising adoption through mobile wallets and banking partnerships, fostering accessibility, convenience, and growth in real-time transaction ecosystems.

Need any customization research on Real-Time Payment Market - Enquiry Now

Competitive Landscape for Real-Time Payment Market:

Bitpanda is a European fintech specializing in digital asset trading and financial services, actively expanding into the Real-Time Payment market. Through solutions like Bitpanda Pay and Bitpanda Pro, it enables instant, secure, and borderless transactions. Its focus on speed, transparency, and digital integration strengthens adoption of real-time payment ecosystems globally.

-

June 2024: Bitpanda partnered with Deutsche Bank to provide users with a real-time payment option for their transactions in Germany. Integration of German International Bank Account Numbers (IBAN) in this collaboration speeds up transaction times, thus enhancing user experience overall.

MasterCard plays a pivotal role in the Real-Time Payment market through solutions like MasterCard Send and MasterCard RTP, enabling secure, instant money movement across borders. By supporting consumers, businesses, and financial institutions with advanced payment infrastructure, MasterCard drives faster settlements, financial inclusion, and innovation in the evolving real-time digital payment ecosystem.

-

January 2024: MasterCard worked with The Clearing House (TCH) to extend real-time payment functionality to businesses, consumers and governments. Based on TCH’s RTP network, this partnership will now develop next generation account-to-account payment technologies for financial institutions.

Real-Time Payment Market Key Players:

Service Providers / Manufacturers:

-

Visa (Visa Direct, Visa B2B Connect)

-

MasterCard (MasterCard Send, MasterCard RTP)

-

The Clearing House (RTP Network, Payment Solutions)

-

PayPal (Xoom, PayPal Instant Transfer)

-

Bitpanda (Bitpanda Pay, Bitpanda Pro)

-

Deutsche Bank (RTP Payments Solution, Cash Management)

-

Ripple Labs (RippleNet, On-Demand Liquidity)

-

FIS (RealNet, PayNet)

-

ACI Worldwide (ACI Real-Time Payment, ACI Payments Hub)

-

Worldpay (Worldpay Instant Payments, Worldpay B2B Payments)

| Report Attributes | Details |

| Market Size in 2024 | USD 159.30 Billion |

| Market Size by 2032 | USD 1541.05 Billion |

| CAGR | CAGR of 32.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payment Type (P2B, B2B, P2P, Others) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Component (Solutions, Services) • By Deployment (Cloud, On-premise) • By End-use Industry (Retail & E-commerce, BFSI, IT & Telecom, Travel & Tourism, Government, Healthcare, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Visa, MasterCard, The Clearing House, PayPal, Bitpanda, Deutsche Bank, Ripple Labs, FIS, ACI Worldwide, Worldpay |