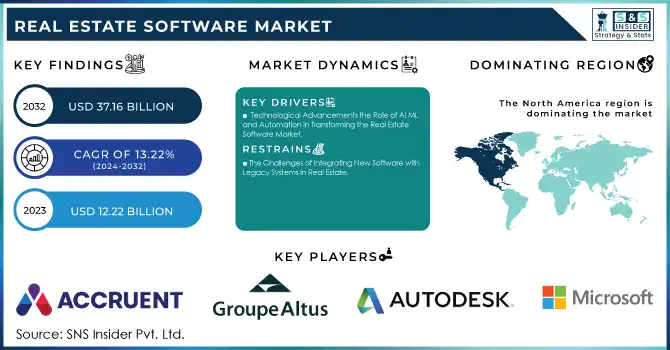

The Real Estate Software Market was valued at USD 12.22 billion in 2023 and is expected to reach USD 37.16 billion by 2032, growing at a CAGR of 13.22% from 2024-2032.

Get More Information on Real Estate Software Market - Request Sample Report

The real estate software industry is witnessing considerable expansion fueled by the rising use of digital tools in managing properties, conducting real estate deals, and development activities. With the increasing need for automation, efficiency, and decisions based on data, software solutions that combine property listing management, virtual tours, client relationship management, and financial analysis are becoming more popular. For example, in September 2024, Planon introduced Real Estate Management for SAP S/4HANA®, improving the integration of real estate and facilities management with ERP systems. This expansion illustrates the overall digital change in industries, as the real estate field utilizes software to optimize processes and improve customer satisfaction.

The need for real estate software is anticipated to increase as urbanization progresses worldwide, fueling the demand for advanced property management and investment solutions. Market participants are progressively concentrating on AI, machine learning, and blockchain integration to deliver advanced solutions that facilitate predictive analytics, fraud prevention, and improved transparency. Moreover, the expansion of smart home technologies and the growth of eco-friendly building initiatives are encouraging software developers to integrate features that support energy efficiency and real-time oversight of building systems.

Looking forward, there are numerous opportunities for real estate software ahead. With the rise of remote work and flexible lifestyles, there is increasing potential for software solutions designed for emerging property types, including co-living arrangements and short-term rental services. Moreover, as environmental, social, and governance issues become more significant, software that aids in managing sustainability, regulatory adherence, and energy efficiency will see increased demand. Emphasizing the speed of innovation, MRI Software's introduction of the advanced CTM eContracts in January 2024 demonstrates how improved tools and intuitive interfaces can simplify real estate transactions. This corresponds with changing customer demands and the industry's drive for flexibility and efficiency. Through ongoing innovation, the real estate software sector is poised for steady expansion and change in the years ahead.

Drivers

Technological Advancements the Role of AI ML and Automation in Transforming the Real Estate Software Market

The integration of artificial intelligence AI machine learning ML and automation into real estate software is transforming the industry. These technologies enable predictive analytics, allowing real estate professionals to forecast market trends, identify investment opportunities, and optimize pricing strategies with greater accuracy. AI-powered tools enhance property management by automating routine tasks such as tenant communication, maintenance requests, and lease management, significantly improving operational efficiency. Additionally, machine learning algorithms refine customer relationship management CRM systems by providing personalized recommendations and insights, fostering better client relationships. The ability to automate tasks, analyze vast amounts of data, and predict market shifts is propelling the demand for advanced real estate software solutions, driving substantial growth within the industry.

The Rise of Virtual and Remote Tools Driving Innovation in the Real Estate Software Market

Virtual tours, augmented reality AR, and remote property management tools have gained significant traction due to shifts in consumer behavior, particularly after the pandemic. These tools allow potential buyers and renters to experience properties remotely, saving time and providing convenience. Virtual tours offer an immersive, interactive experience, enabling users to explore properties without visiting in person. Augmented reality AR enhances these tours by adding digital overlays, helping clients visualize customized designs or furnishings. Remote property management tools further support landlords and property managers by enabling them to handle tasks like maintenance, rent collection, and tenant communication from any location. The increasing preference for online and contactless interactions has made these technologies essential, fueling the demand for advanced real estate software solutions.

Restraints

High Initial Costs Limiting the Adoption of Real Estate Software Market

The development and implementation of advanced real estate software often require substantial investments in technology, training, and infrastructure, posing a significant barrier, especially for small and medium-sized businesses. The high costs associated with purchasing, customizing, and maintaining software solutions can be prohibitive for firms with limited budgets. Additionally, the need for specialized staff to manage and operate these tools adds to the overall financial burden. For many businesses, these expenses may not be justified by the immediate returns, leading to reluctance in adopting new technologies. This financial barrier can prevent smaller real estate companies from leveraging advanced software, ultimately slowing the overall growth of the market. As a result, the high initial costs of real estate software remain a key challenge in expanding its adoption.

The Challenges of Integrating New Software with Legacy Systems in Real Estate

Integrating new software with existing legacy systems often presents significant challenges. Compatibility issues frequently arise as modern software may not align seamlessly with older systems, causing disruptions in data flow and operational processes. The time-consuming nature of data migration from legacy systems to newer platforms can lead to data inconsistencies, errors, and potential loss of valuable information. Additionally, the complexity of mapping and updating old workflows to fit the new system can create delays and confusion. Employees, accustomed to traditional methods, may resist adopting new technologies, which can hinder smooth implementation. The time, effort, and potential disruption involved in integration often lead to reluctance from real estate businesses, making it a considerable barrier to widespread adoption of advanced software solutions.

By Deployment

In 2023, the Cloud segment dominated the real estate software market, capturing the highest revenue share of approximately 57%. This dominance is driven by the increasing demand for scalable, flexible, and cost-effective solutions. Cloud-based software allows businesses to easily access, store, and analyze data from anywhere, improving operational efficiency. Additionally, its ability to offer real-time updates and seamless integration with various platforms further enhances its appeal, making it the preferred choice for many real estate companies.

The On-premise segment is expected to grow at the fastest CAGR of about 14.17% from 2024 to 2032. This growth is primarily attributed to the rising concerns over data privacy and security, which drive businesses to prefer on-premise solutions that provide full control over their data infrastructure. Furthermore, industries in regulated sectors or with legacy systems favor on-premise deployment for its customization flexibility, which contributes to its rapidly expanding market share in the coming years.

By Application

In 2023, the Residential segment dominated the real estate software market, accounting for approximately 54% of the revenue share. This dominance is driven by the increasing demand for property management solutions, especially with the rapid growth of residential real estate transactions. The shift toward digital tools for managing listings, virtual tours, and customer interactions has significantly streamlined processes for real estate agents and property owners, making the residential sector a key driver of market revenue.

The Commercial segment is projected to grow at the fastest CAGR of about 14.33% from 2024 to 2032. This growth can be attributed to the rising need for advanced software solutions in managing large-scale commercial properties and complex lease agreements. The increasing adoption of technology to streamline operations such as tenant management, leasing, and space utilization, combined with the expansion of global business hubs, positions the commercial real estate sector for rapid growth in the coming years.

By Type

In 2023, the Customer Relationship Management Software segment led the real estate software market, capturing the highest revenue share of approximately 32%. This dominance is attributed to the growing need for real estate companies to manage client relationships effectively and enhance customer satisfaction. CRM software offers a unified platform for tracking leads, managing communication, and automating marketing efforts, all of which are essential for boosting sales and improving client retention in a highly competitive market.

The Contract Software segment is expected to grow at the fastest CAGR of about 17.40% from 2024 to 2032. This growth is driven by the increasing complexity of real estate contracts and the rising demand for automated, streamlined contract management solutions. Real estate businesses are increasingly adopting contract software to improve efficiency, reduce errors, and ensure compliance with regulatory requirements, positioning this segment for rapid expansion in the coming years.

By End-use

In 2023, the Architects & Engineers segment dominated the real estate software market, securing the highest revenue share of approximately 40%. This dominance stems from the increasing reliance on advanced software for design, project management, and building information modeling (BIM). Architects and engineers are adopting sophisticated tools to streamline the design process, optimize construction workflows, and ensure regulatory compliance, making this segment a major contributor to market revenue.

The Real Estate Agents segment is expected to grow at the fastest CAGR of about 14.62% from 2024 to 2032. This growth is driven by the increasing demand for digital tools that help agents manage property listings, engage with clients, and streamline transactions. As real estate agents continue to embrace technology for virtual tours, customer relationship management, and market analysis, the segment is poised for rapid expansion in response to evolving consumer expectations and the shift toward online property buying and selling.

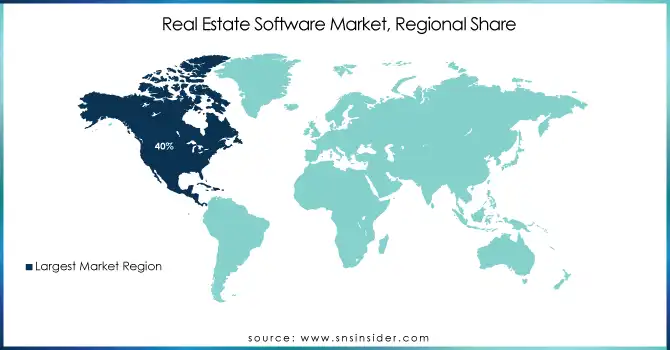

In 2023, North America dominated the real estate software market, accounting for approximately 40% of the revenue share. This dominance is driven by the region's early adoption of advanced technologies, robust infrastructure, and the presence of numerous key players in the real estate sector. The growing demand for efficient property management, customer relationship management, and data-driven decision-making has led to widespread implementation of software solutions, solidifying North America's position as the market leader.

The Asia Pacific region is expected to grow at the fastest CAGR of about 14.79% from 2024 to 2032. This rapid growth can be attributed to the region's expanding real estate markets, urbanization, and increasing technological adoption. As developing economies invest in infrastructure and digital transformation, the demand for real estate software to streamline operations, manage large-scale developments, and improve customer experiences is expected to rise significantly, driving market expansion in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Accruent (Maintenance Connection, Angus Anywhere)

Altus Group Ltd. (Argus Enterprise, Altus Analytics)

Autodesk Inc. (AutoCAD, Revit)

CoStar Realty Information Inc. (CoStar, LoopNet)

Microsoft Corporation (Azure, Dynamics 365)

MRI Software LLC (MRI Real Estate Manager, MRI Property Management)

Oracle Corporation (Oracle Primavera, Oracle Cloud Infrastructure)

RealPage Inc. (RealPage Property Management, RealPage Marketing)

SAP SE (SAP S/4HANA, SAP Cloud Platform)

SMR Group (SMR Management Software, SMR Cloud)

Trimble Inc. (Trimble Real Estate, Tekla Structures)

Yardi Systems Inc. (Yardi Voyager, Yardi Matrix)

Fiserv Inc. (Fiserv Payments, Fiserv LoanServ)

Procore Technologies, Inc. (Procore Construction Management, Procore Project Management)

AppFolio, Inc. (AppFolio Property Manager, AppFolio Investment Management)

Zillow Group, Inc. (Zillow Premier Agent, Zillow Rentals)

Rentlytics (Rentlytics Analytics, Rentlytics Insights)

Cresa (Cresa Workplace Solutions, Cresa Lease Advisory)

ResMan (ResMan Property Management, ResMan Leasing)

Brokermint (Brokermint Transaction Management, Brokermint Commission Management)

RealEstateMall (RealEstateMall CRM, RealEstateMall Marketing)

VTS (VTS Rise, VTS Market)

TenantCloud (TenantCloud Property Management, TenantCloud Accounting)

SpaceIQ (SpaceIQ Workspace Management, SpaceIQ Workplace Solutions)

In June 2024, House730, a Hong Kong-based property search platform, became the first to integrate Microsoft Azure OpenAI Service's natural language processing, significantly improving search accuracy and user experience. This innovation caters to more complex property queries, enhancing results by 4%.

In September 2024, Hyatt selected Oracle OPERA Cloud as its global property management system, aiming to centralize data and improve operational efficiency across its portfolio of over 1,000 hotels. This shift enhances guest experience by offering personalized insights and streamlining property management.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 12.22 Billion |

|

Market Size by 2032 |

USD 37.16 Billion |

|

CAGR |

CAGR of 13.22% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Customer Relationship Management Software, Enterprise Resource Planning Software, Property Management Software, Contract Software, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Accruent, Altus Group Ltd., Autodesk Inc., CoStar Realty Information Inc., Microsoft Corporation, MRI Software LLC, Oracle Corporation, RealPage Inc., SAP SE, SMR Group, Trimble Inc., Yardi Systems Inc., Fiserv Inc., Procore Technologies Inc., AppFolio Inc., Zillow Group Inc., Rentlytics, Cresa, ResMan, Brokermint, RealEstateMall, VTS, TenantCloud, SpaceIQ |

|

Key Drivers |

• Technological Advancements the Role of AI ML and Automation in Transforming the Real Estate Software Market |

|

RESTRAINTS |

• High Initial Costs Limiting the Adoption of Real Estate Software Market |

Ans: The Architects & Engineers segment captured 40% of the revenue share.

Ans: Contract management software, with a projected CAGR of 17.40% from 2024 to 2032.

Ans: The Commercial segment is expected to grow at the highest CAGR of 14.33% by 2032.

Ans: Cloud-based solutions led the market with a 57% revenue share in 2023.

Ans: Real Estate Software Market was valued at USD 12.22 billion in 2023 and is expected to reach USD 37.16 billion by 2032, growing at a CAGR of 13.22% from 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Real Estate Software Market Segmentation, By Type

7.1 Chapter Overview

7.2 Customer Relationship Management Software

7.2.1 Customer Relationship Management Software Market Trends Analysis (2020-2032)

7.2.2 Customer Relationship Management Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Enterprise Resource Planning Software

7.3.1 Enterprise Resource Planning Software Market Trends Analysis (2020-2032)

7.3.2 Enterprise Resource Planning Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Property Management Software

7.4.1 Property Management Software Market Trends Analysis (2020-2032)

7.4.2 Property Management Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Contract Software

7.5.1 Contract Software Market Trends Analysis (2020-2032)

7.5.2 Contract Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Real Estate Software Market Segmentation, by Application

8.1 Chapter Overview

8.2 Commercial

8.2.1 Commercial Market Trends Analysis (2020-2032)

8.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Residential

8.3.1 Residential Market Trends Analysis (2020-2032)

8.3.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Real Estate Software Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Architects & Engineers

9.2.1 Architects & Engineers Market Trends Analysis (2020-2032)

9.2.2 Architects & Engineers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Project Managers

9.3.1 Project Managers Market Trends Analysis (2020-2032)

9.3.2 Project Managers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Real Estate Agents

9.4.1 Real Estate Agents Market Trends Analysis (2020-2032)

9.4.2 Real Estate Agents Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Real Estate Software Market Segmentation, By Deployment

10.1 Chapter Overview

10.2 Cloud

10.2.1 Cloud Market Trends Analysis (2020-2032)

10.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 On-premise

10.3.1 On-premise Market Trends Analysis (2020-2032)

10.3.2 On-premise Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.4 North America Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.6 North America Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.2 USA Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.7.4 USA Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.2 Canada Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.8.4 Canada Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.9.4 Mexico Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.7.4 Poland Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.8.4 Romania Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.6 Western Europe Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.7.4 Germany Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.2 France Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.8.4 France Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.9.4 UK Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.10.4 Italy Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.11.4 Spain Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.14.4 Austria Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.6 Asia Pacific Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.2 China Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.7.4 China Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.2 India Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.8.4 India Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.2 Japan Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.9.4 Japan Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.10.4 South Korea Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.11.4 Vietnam Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.12.4 Singapore Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.2 Australia Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.13.4 Australia Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.6 Middle East Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.7.4 UAE Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.4 Africa Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.6 Africa Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Real Estate Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.4 Latin America Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.6 Latin America Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.7.4 Brazil Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.8.4 Argentina Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.9.4 Colombia Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Real Estate Software Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Real Estate Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Real Estate Software Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Real Estate Software Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12. Company Profiles

12.1 Accruent

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Altus Group Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Autodesk Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 CoStar Realty Information Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Microsoft Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 MRI Software LLC

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Oracle Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 RealPage Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 SAP SE

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 SMR Group

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Customer Relationship Management Software

Enterprise Resource Planning Software

Property Management Software

Contract Software

Others

By Deployment

Cloud

On-premise

By End-use

Architects & Engineers

Project Managers

Real Estate Agents

Others

By Application

Commercial

Residential

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Managed Network Services Market Size was valued at USD 66.22 Billion in 2023 and will reach USD 122.77 Billion by 2032 and grow at a CAGR of 7.1% by 2032.

The 5G Enterprise Market was valued at USD 4.0 billion in 2023 and is expected to reach USD 43.8 billion by 2032, growing at a CAGR of 30.58% from 2024-2032.

The Cyber Insurance Market size was valued at USD 15.3 Billion in 2023. It is expected to grow to USD 97.3 Billion by 2032 and grow at a CAGR of 22.8% over the forecast period of 2024-2032.

The Email Marketing Software Market was valued at USD 1.4 Billion in 2023 and will reach USD 3.8 Billion by 2032, growing at a CAGR of 11.39% by 2032.

The AI In Fintech Market was valued at USD 12.2 Billion in 2023 and is expected to reach USD 61.6 Billion by 2032, growing at a CAGR of 19.72% by 2032.

The Dealer Management System Market Size was valued at USD 9.24 Billion in 2023 and is expected to reach USD 15.09 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone