Get More Information on Railway Telematics Market - Request Sample Report

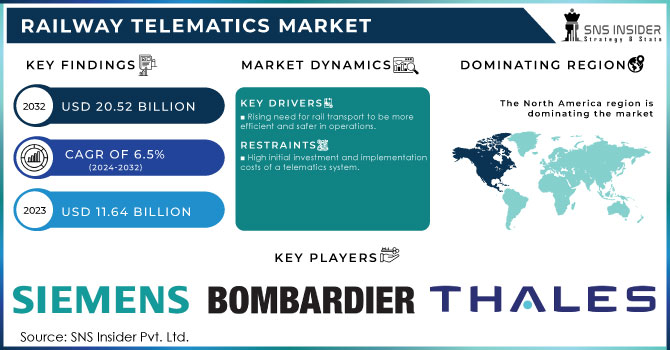

The Railway Telematics Market Size is projected to reach USD 20.52 billion by 2032 and will be growing at a CAGR of 6.5% over 2024-2032. The market was valued at USD 11.64 billion in 2023.

Improvements in efficiency and safety are supposed to be the key drivers for the demand in the Railway Telematics Market. As the need to track train operations in real time is increasing, the real-time tracking of data has become very crucial as nearly 70% of railway operators are reportedly improving their operational performance with increased visibility. There has been a sharp increase in the adoption of IoT in the railway sector; 45% of the companies are utilizing IoT-enabled solutions to optimize maintenance and reduce downtimes. This integration is critical for predictive maintenance, avoiding delays brought about by equipment failures. Other drivers will include rigid regulatory compliance in safety and efficiency standards, forcing rail operators to invest in sophisticated telematics systems. An above 60 % of rail operators attribute regulatory compliance as a major drive for adopting new technologies.

That is why this demand is further encouraged by the growing importance of sustainability and the aim to decrease carbon emissions; after all, data shows telematics systems on rails can decrease fuel consumption up to 15%. Lastly, freight and passenger traffic continue to increase and this will be about 25% within the next ten years, so it requires more efficient management systems. Such factors are driving the railway telematics market as stakeholders have become aware of the fact that application of more advanced technologies is necessary to enhance efficiency, safety, and sustainability in their operations. Some of the significant trends include increased demand for real-time monitoring and data analytics that enable rail operators to optimize performance and reduce downtime.

Railway companies are investing in advanced telematics solutions to help improve predictive maintenance by reducing unexpected failures by as much as 40%. Another added motivation for telematics systems is the increasing concern over safety regulations and compliance; about 60% of rail operators point to better safety management as their reason for investing in telematics. Another crucial trend is the integration of IoT technology and is anticipated to reach 35 % of the telematics systems concerning more connectivity and better data exchange between the vehicles and the central systems. Also, sustainability in the Public Transportation sector is now becoming a very crucial factor by forcing railway operators for telematics concerning fuel efficiency and emission monitoring, as around 50 % are giving much importance to these factors within the telematics strategies.

Drivers:

Rising need for rail transport to be more efficient and safer in operations.

With an expanding rail system around the globe, companies operating trains are under pressure to streamline services, ensure minimal delays, and at the same time, make improvements to safety measures. Telematics can, therefore, be applied in the management of a train to track performance in real-time. Applications may range from speed and location tracking to checking on performance indicators. Industry statistics have it that with the use of telematics, operational efficiency could be boosted by as much as 20% following its deployment, much maintenance cost and downtime reduced or completely eliminated. This also impacts positively upon decision-making processes since data analytics lets one realize problem events beforehand or at the onset, hence enabling proactive maintenance and response to potential issues in good time. Increasing freight transport in North America and Europe only calls for more reliable and efficient rail systems. Freight transport by rail has grown by about 10% in the last five years alone, and increased volumes require more advanced technology to control them. However, growing concerns towards sustainability have, on the other hand, brought focus and demand for using rail transport reasons that relate to being energy-friendly, thus investment in telematics solutions supporting energy efficiency in operations. Hence, the significance of telematics systems adoption was especially felt by the rail operators when they had to align the structure with regulatory standards and customer expectations in regard to reliability and sustainability in the services.

Restrains:

High initial investment and implementation costs of a telematics system.

The advantages include higher operational efficiency and safety, but these up-front installation and maintenance costs can be prohibitive for many small rail operators. According to SNS Insider study, the development of high-end telematics systems would require an investment from 5% to 10% of annual budgets for railway operators, which might be a very high investment for organizations that have already been facing tight financial constraints. Introducing the telematics solution into the existing legacy system at the railway operator would also not be easy and timely and would require considerable investment in infrastructure and training. This is complicated by inconsistencies in standards and interoperability among various rail networks, which could prevent the use of new solutions or raise the risk factors associated with operations.

Recent studies indicate that some 30% of rail operators still fear that new telematics solutions developed might not be compatible with their current systems, making them hesitant towards the adoption of such technologies. The actual financial burden in relation to the expected benefits is what can make the process of innovation and transformation in the railway industry take a noticeably long time, resulting in restrained growth within the market in deciding whether the costs outweigh the benefits.

By Solution:

Revenue share by the largest group is fleet management which held 35% market share in 2023 in which companies look at optimal scheduling and resource allocation with enhanced operational efficiencies through real-time data and analytics. Automatic Stock Control, which has a 25% market share, also makes its way up as it significantly reduces the stock discrepancy and has improved inventory management, growing at 20% per annum. About 15% is covered by Remote Data Access, which is derived from the need for real-time visibility and operation flexibility, with a projected CAGR of 18%. Railcar Tracking and Tracing accounts for around 20% and is considered to be a critical feature for enhancing asset visibility. The increasing GPS and IoT technologies propel these capabilities. "Others" is the smallest category at 5%, yet it is comprised of niche solutions designed to meet special operational requirements.

Railcar Type

Hoppers held the largest share of revenue in the total railcar market, with around 30%. Hoppers are being feted because their rising demand is linked to the transport of bulk commodities like grains, coal, and minerals, which come first in optimizing logistics. Tank Cars accounted for about 25% of revenue and form the basic framework used for liquids or gaseous products, which may be hazardous. Growing governmental regulation on safety and surveillance is driving this segment into embracing telematics in order to ensure compliance and enhance operational safety. Well Cars, used basically to shift intermodal containers, account for around 15% market share and represent growing international trade and e-commerce volumes. Boxcars continue to remain the best in the rail freight business, carrying all commodities with a 20% market share. Refrigerated Boxcars continue to stand at 5% and are essentially used for perishable products only.

Component Type

Major contributions in the segment involve Telematics Control Units, which account for about 60% of the total revenues. These units form the backbone of the telematics systems because they collect and transmit data captured by sensors and onboard systems to implement real-time monitoring and analysis. Major factor driving TCUs are the increasing complexity in rail operations and the demand for integrated data solutions. Sensors, at about 40% in terms of component type revenue, are equally critical as they capture key operational data, such as temperature, speed, and location. The ability of advanced sensor integration, including those with installed IoT devices, to be placed and positioned results in more accurate and reliable data collection, thus supporting more informed decisions about maintenance and operational efficiency.

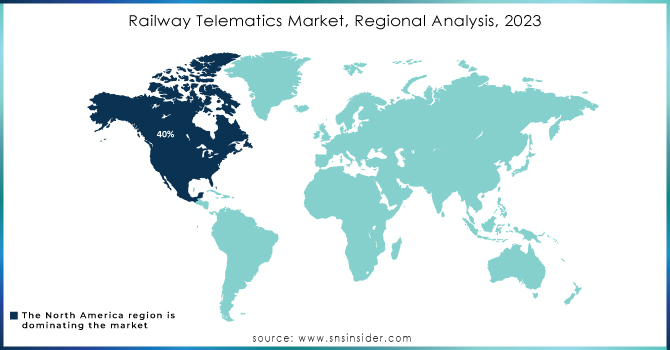

North America accounted for the largest market share, amounting to about 40% of overall revenue, primarily due to the sheer size of the U.S. rail network and substantial investments in smart technologies that continue to be made there. The emphasis on safety and corresponding regulatory requirements supports advanced telematics solutions in this region, enhancing operational efficiency as well as asset tracking capabilities. Europe is another region and lags close to that figure with a share of about 30%, where the high quest for smart transportation solutions and increasing volumes of rail freight are pushing up demand for telematics. The European Union's tough policies on emissions and safety stimulate further adoption of innovative solutions for rail operators in the region.

The Asia-Pacific region, holding some 20%, shows rapid growth based on urbanization, increased expansion of rail infrastructure, and the growing need to realize efficient solutions in logistics. High investment into rail modernization in emerging economies, such as India and China, is substantially driving market prospects. Middle East and Africa, with an estimated 10%, are only beginning to adapt to telematics due to regional governments emphasizing improving their rail infrastructure and efficiency of operations. This regional heterogeneity brings varied opportunities for growth and innovation in the landscape of railway telematics.

Need Any Customization Research On Railway Telematics Market - Inquiry Now

The major railway telematics market key players are:

Siemens AG: (Siemens Mobility Telematics Solutions, Railway Control Systems)

Bombardier Inc.: (Advanced Train Control Systems (ATCS), Train Communication Network (TCN))

Thales Group: (On-board Telematics Systems, Railway Signaling Solutions)

Alstom SA: (Smart Mobility Solutions, Train Control & Monitoring Systems)

General Electric (GE): (GE Transportation’s RailConnect 360, Predix Platform for Rail Analytics)

IBM Corporation: (IBM Watson IoT for Rail, Rail Operations Management Solutions)

Trimble Inc.: (Rail Asset Management Solutions, Telematics for Fleet Management)

Mitsubishi Electric Corporation: (Train Control Systems, Railway Telematics Solutions)

Nokia Corporation: (Railway Communication Solutions, IoT Connectivity for Rail Operations)

Hitachi Rail: (Smart Railway Systems, Traffic Management Solutions)

SAP SE: (SAP Transportation Management, SAP Asset Intelligence Network)

Toshiba Corporation: (Railway Automation Systems, Telematics and Monitoring Solutions)

Kapsch TrafficCom AG: (Vehicle and Fleet Management Systems, Telematics for Freight and Logistics)

Cleveland Track Material: (Track Monitoring Solutions, Railway Infrastructure Management Tools)

Cisco Systems, Inc.: (Railway Network Infrastructure Solutions, IoT Solutions for Rail Operations)

Bae Systems: (Cybersecurity for Railway Operations, Railway Command and Control Systems)

Oracle Corporation: (Oracle Transportation Management Cloud, Data Analytics for Rail Performance)

Zebra Technologies Corporation: (Asset Tracking and Management Solutions, RFID Solutions for Rail Logistics)

Railinc Corporation: (Interline Settlement Services, Railcar Tracking and Monitoring Services)

Wabtec Corporation: (Positive Train Control Systems, Railway Condition Monitoring Systems)

Recent developments:

• Siemens AG - March 2024 They introduced analytics using AI into its railway business for predictive maintenance.

• Alstom SA - January 2024 Launched smart mobility platform that promises to improve sharing of real-time data and operational efficiency.

• Bombardier Inc. - February 2024: Introduced high-tech digital signalling systems to improve the safety and the performance of the trains.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.64 Billion |

| Market Size by 2032 | USD 20.52 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type: (Telematics Control Unit, Sensors) • By Solution Type: (Fleet Management, Automatic Stock Control, Remote Data Access, Railcar Tracking And Tracing, Others) • By Railcar Type: (Hoppers, Tank Cars, Well Cars, Boxcars, Refrigerated Boxcars, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alstom SA, General Electric, IBM Corporation, Trimble Inc, Mitsubishi Electric Corporation, SAP SE, Nokia Corp, Hitachi Rail, Bae Systems, Zebra Tech |

| Key Drivers | Rising need for rail transport to be more efficient and safer in operations. |

| Restraints | High initial investment and implementation costs of a telematics system. |

Ans: The Railway Telematics Market is expected to reach USD 20.52 billion by 2032, driven by increased efficiency needs and smart technology adoption.

Ans: Key drivers include improved operational efficiency, enhanced safety, asset tracking, and government initiatives for smart infrastructure.

Ans: Hoppers led with 30% revenue share, followed by tank cars at 25%, driven by the need for safe and efficient logistics solutions.

Ans: TCUs account for 60% of the market, while sensors contribute 40%, both essential for data collection and real-time monitoring.

Ans: North America leads with 40% of the market share, followed by Europe at 30%, due to investments in safety and regulatory compliance.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Component Type Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Railway Telematics Market Segmentation, By Component Type

7.1 Chapter Overview

7.2 Telematics Control Unit

7.2.1 Telematics Control Unit Market Trends Analysis (2020-2032)

7.2.2 Telematics Control Unit Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Sensors

7.2.3.1 Sensors Market Trends Analysis (2020-2032)

7.2.3.2 Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Railway Telematics Market Segmentation, by Railcar Type

8.1 Chapter Overview

8.2 Fleet Management

8.2.1 Fleet Management Market Trends Analysis (2020-2032)

8.2.2 Fleet Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Automatic Stock Control

8.3.1 Automatic Stock Control Market Trends Analysis (2020-2032)

8.3.2 Automatic Stock Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Remote Data Access

8.4.1 Remote Data Access Market Trends Analysis (2020-2032)

8.4.2 Remote Data Access Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Railcar Tracking And Tracing

8.5.1 Railcar Tracking And Tracing Market Trends Analysis (2020-2032)

8.5.2 Railcar Tracking And Tracing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Railway Telematics Market Segmentation, by Solution Type

9.1 Chapter Overview

9.2 Hoppers

9.2.1 Hoppers Market Trends Analysis (2020-2032)

9.2.2 Hoppers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Tank Cars

9.3.1 Tank Cars Market Trends Analysis (2020-2032)

9.3.2 Tank Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Well Cars

9.4.1 Well Cars Market Trends Analysis (2020-2032)

9.4.2 Well Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 BoxCars

9.5.1 BoxCars Market Trends Analysis (2020-2032)

9.5.2 BoxCars Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Refrigerated Boxcars

9.6.1 Refrigerated Boxcars Market Trends Analysis (2020-2032)

9.6.2 Refrigerated Boxcars Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.2.4 North America Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.2.5 North America Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.2.6.2 USA Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.2.6.3 USA Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.2.7.2 Canada Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.2.7.3 Canada Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.7.2 France Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.7.3 France Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.6.2 China Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.6.3 China Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.7.2 India Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.7.3 India Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.8.2 Japan Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.8.3 Japan Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.12.2 Australia Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.12.3 Australia Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.2.4 Africa Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.2.5 Africa Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Railway Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.6.4 Latin America Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.6.5 Latin America Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Railway Telematics Market Estimates and Forecasts, By Solution Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Railway Telematics Market Estimates and Forecasts, by Railcar Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Railway Telematics Market Estimates and Forecasts, by Component Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 Amara Raja Batteries Ltd,

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

111.1.4 SWOT Analysis

11.2 Aulton New Energy

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 ECHARGEUP

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Esmito Solutions

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Gogoro

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 KYMCO

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Lithion Power

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 NIO

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Oyika Ltd

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Others

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component Type

Telematics Control Unit

Sensors

By Solution Type

Fleet Management

Automatic Stock Control

Remote Data Access

Railcar Tracking And Tracing

Others

By Railcar Type

Hoppers

Tank Cars

Well Cars

Boxcars

Refrigerated Boxcars

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Luxury Car Market Size was valued at USD 658.43 billion in 2023, and will reach to USD 1210.49 billion by 2032, and grow at a CAGR of 7% by 2024-2032.

The Automotive Bumpers Market size was valued at USD 19.8 Billion in 2023, the market is expected to reach USD 27.18 Billion by 2031. And grow at a CAGR of 4% over the forecasted period of 2024-2031.

All-Terrain Vehicle (ATV) Engines Market Size was valued at USD 4.46 billion in 2023 and is expected to reach USD 5.87 billion by 2032 and grow at a CAGR of 3.1% over the forecast period 2024-2032.

The Electric Vehicle Thermal Management System Market Size was valued at USD 3 billion in 2023 and is expected to reach USD 9.15 billion by 2031 and grow at a CAGR of 14.5% over the forecast period 2024-2031.

The Automotive HUD Market size was valued at USD 1.25 billion in 2023 and will reach USD 5.88 billion by 2032, the estimated CAGR by 2024-2032 is 16.72%

The Automotive Actuators Market Size was USD 20.3 Billion in 2023 and is expected to reach USD 32.4 Bn by 2032, growing at a CAGR of 5.34% by 2024-2032.

Hi! Click one of our member below to chat on Phone