Radiopharmaceutical Injectors Market Report Scope & Overview:

Get More Information on Radiopharmaceutical Injectors Market - Request Sample Report

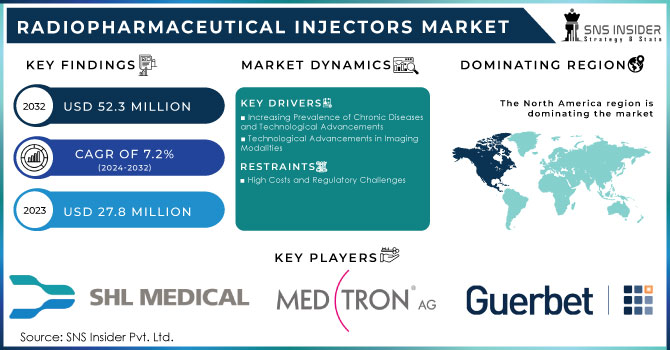

The Radiopharmaceutical Injectors Market was valued at USD 27.8 million in 2023 and will reach USD 52.3 million by 2032, with a growing CAGR of 7.2% during the forecast period of 2024-2032.

Radiopharmaceutical Injectors Market: Rapid Growth Driven by Advancements in Nuclear Medicine

The demand for precise and efficient radiopharmaceutical delivery systems is surging.

The Radiopharmaceutical Injectors Market is rapidly expanding as the use of radiopharmaceuticals in diagnostic imaging and treatments continues to grow, particularly in oncology, cardiology, and neurology. Radiopharmaceutical injectors, designed to safely and accurately administer radioactive compounds, are playing a critical role in improving the safety and efficacy of nuclear medicine.

Growing Prevalence of Chronic Diseases Boosting Market Demand

The rising prevalence of cancer and cardiovascular diseases has significantly increased the utilization of radiopharmaceuticals for both diagnostic and therapeutic purposes. The need for precise drug administration has led to an increased demand for reliable injector systems. Additionally, advancements in nuclear medicine, particularly in PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography) imaging, are further driving the adoption of radiopharmaceutical injectors.

The growing focus on personalized medicine, which tailors treatments to individual patients, has also amplified the demand for accurate delivery systems that optimize therapeutic outcomes. Furthermore, the increasing preference for non-invasive diagnostic methods like PET and SPECT scans is propelling the market growth.

On the supply side, technological innovations are enhancing injector systems with features like automation, dose control, and integration with medical imaging equipment. Key players such as Medtron AG, Guerbet Group, and Bayer AG are expanding their product offerings to meet the rising demand. Additionally, stringent regulatory requirements for radiopharmaceutical safety are encouraging manufacturers to innovate with features like automated shielding and contamination control.

The market is particularly strong due to the growing number of diagnostic procedures and the increasing use of radiopharmaceuticals in therapeutic settings. Emerging markets in Asia-Pacific and Latin America are experiencing significant growth, driven by expanding healthcare infrastructure.

Market Dynamics

Drivers

-

Increasing Prevalence of Chronic Diseases and Technological Advancements

The rising prevalence of chronic diseases, particularly cancer and cardiovascular conditions, is a significant driver for the growth of the Radiopharmaceutical Injectors Market. As the global burden of these diseases continues to escalate, there is an increasing demand for advanced diagnostic and therapeutic tools that offer precision and effectiveness in disease management. Radiopharmaceutical injectors play a crucial role in the administration of radiopharmaceuticals, which are widely used in nuclear medicine for diagnostic imaging and targeted treatments. These injectors ensure accurate dosage delivery, enhancing the effectiveness of procedures like positron emission tomography (PET) scans and single-photon emission computed tomography (SPECT). Globally, chronic diseases, also referred to as noncommunicable diseases (NCDs), are responsible for approximately 41 million deaths annually, accounting for 74% of all deaths worldwide, according to the World Health Organization (WHO).

In addition to disease prevalence, the aging population is another key factor driving market growth. With aging comes a higher susceptibility to chronic illnesses, making timely diagnosis critical for effective treatment. Radiopharmaceutical injectors facilitate early disease detection by supporting sophisticated imaging techniques, which can identify conditions such as cancer or heart disease in their early stages.

Moreover, growing awareness of the importance of early diagnosis, fueled by public health campaigns and improved healthcare accessibility, has led to a rise in diagnostic procedures. This surge in diagnostic imaging procedures is directly boosting the demand for radiopharmaceutical injectors, as healthcare providers increasingly rely on nuclear medicine for accurate and non-invasive diagnostics. Consequently, the Radiopharmaceutical Injectors Market is expected to see sustained growth in response to these trends.

-

Technological Advancements in Imaging Modalities

The development of advanced imaging technologies such as PET and SPECT have enhanced the accuracy of nuclear medicine, prompting healthcare providers to adopt more advanced injectors.

Restraints

-

High Costs and Regulatory Challenges:

The high costs associated with radiopharmaceutical injectors and the complex regulatory framework governing radioactive substances pose significant challenges to market growth. Additionally, supply chain disruptions due to the limited shelf life of radioisotopes further complicate the market expansion.

Key Segmentation

By Type

The PET Radioactive Drugs Injector segment dominated the Radiopharmaceutical Injectors Market in 2023, accounting for a 65.9% share. This dominance is due to the widespread use of PET imaging in oncology, cardiology, and neurology. PET scans provide high sensitivity and specificity, making them crucial for early detection and treatment planning. The increasing prevalence of cancer and cardiovascular diseases, along with the growing focus on personalized medicine, is driving demand for PET radioactive drug injectors.

The PET and SPECT Radioactive Drugs Injector segment is experiencing rapid growth due to the rising demand for hybrid imaging systems that combine PET and SPECT technologies. These hybrid systems provide comprehensive diagnostic data, enhancing the accuracy of disease diagnosis and treatment planning.

By Application

The Hospitals and Clinics segment held the largest market share, 72.6% in 2023, driven by the increasing number of diagnostic imaging procedures. The growing use of radiopharmaceuticals in therapeutic applications such as targeted cancer treatments is also contributing to the demand for radiopharmaceutical injectors in hospitals and clinics.

The R&D Institutions segment is the fastest-growing application in the market, fueled by increasing investment in nuclear medicine research. The development of new radiopharmaceutical compounds and rising investment in oncology and neurology research are driving the demand for advanced injector systems in research environments.

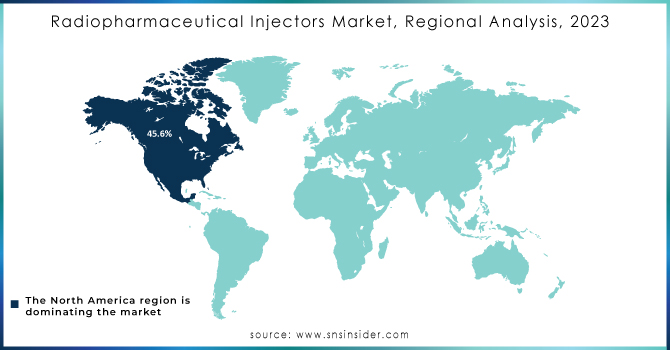

Regional Analysis

In 2023, North America emerged as the dominant region in the Radiopharmaceutical Injectors Market, holding a 45.6% market share. This leadership is primarily attributed to proactive government initiatives aimed at promoting advanced medical technologies and the region’s well-established healthcare infrastructure. Government efforts to enhance nuclear medicine applications, combined with strong research and development capabilities, have significantly contributed to the region's prominence in this market. Additionally, the increasing prevalence of chronic diseases like cancer has further bolstered the demand for radiopharmaceuticals, driving market growth.

Meanwhile, Europe is also witnessing steady growth in the market. This can be attributed to heightened awareness of advanced healthcare technologies, particularly in diagnostic imaging and treatment methods, as well as growing investment in healthcare infrastructure. The region’s regulatory framework supporting the adoption of new medical technologies also contributes to its positive market trajectory.

In the Asia-Pacific region, led by China, the market is experiencing rapid growth. This surge is driven by increasing healthcare expenditure and favorable government policies that encourage the adoption of nuclear medicine technologies. China’s expanding manufacturing base for radiopharmaceuticals, coupled with advancements in nuclear medicine research, is helping to position the Asia-Pacific region as a key player in the global radiopharmaceutical injectors market. This region is expected to witness continued strong growth in the coming years, as healthcare systems expand and demand for advanced diagnostic and therapeutic tools increases.

Need any customization research on Radiopharmaceutical Injectors Market - Enquiry Now

Key Players

The Major Players are Comecer, Trasis, Tema Sinergie, Eckert & Ziegler AG, Siemens Healthineers, Cardinal Health, Inc., Bayer Healthcare, Lemer Pax, and other players. These companies are focusing on expanding their product portfolios to meet the growing demand for radiopharmaceutical injectors.

Recent Developments

In August 2022, Comecer introduced a new radiopharmaceutical injector, IRIS, designed for delivering precise and calibrated injections from a multi-dose solution of FDG or other radiopharmaceuticals. The compact, user-friendly injector features autonomous battery power for enhanced portability.

Conclusion

The Radiopharmaceutical Injectors Market is set for continued growth, driven by advancements in nuclear medicine, the increasing prevalence of chronic diseases, and the rising demand for personalized medicine. With significant technological innovations and expanding healthcare infrastructure in emerging regions, the market outlook remains highly promising.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 27.8 million |

| Market Size by 2032 | US$ 52.3 million |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PET Radioactive Drugs Injector, PET and SPECT Radioactive Drugs Injector) • By Application (Hospitals and Clinics, R&D Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SHL Medical, Medtron AG, Guerbet Group, Bayer AG, Bracco Imaging S.p.A., Comecer, Mallinckrodt Pharmaceuticals, Cardinal Health, Inc.,GE Healthcare, Siemens Healthineers, Draximage, Atomomed, Lantheus Medical Imaging, Eckert & Ziegler AG and others. |

| Key Drivers | • Increasing Prevalence of Chronic Diseases and Technological Advancements • Technological Advancements in Imaging Modalities |

| Restraints | • High Costs and Regulatory Challenges |