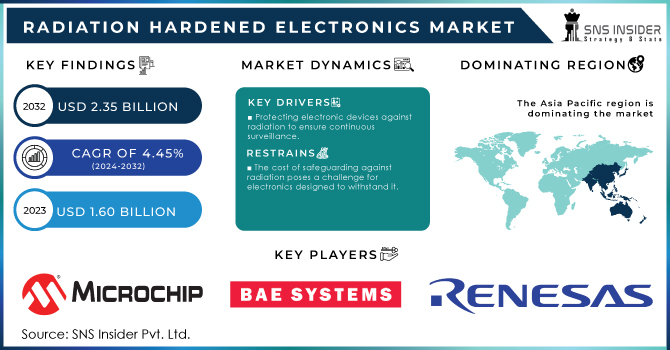

The Radiation Hardened Electronics Market Size was valued at USD 1.60 billion in 2023 and is expected to reach USD 2.35 billion by 2032, growing at a CAGR of 4.45% over the forecast period 2024-2032.

Increasing need for reliable technology in challenging environments like space is fueling growth in Radiation Hardened Electronics Market. These specialized parts guarantee flawless performance in high radiation environments, playing a crucial role in security applications (such as ISR systems) and space exploration. The remarkable expansion of the space industry, which has grown to a $384 billion global economy in 2022 and tripled its active satellites in only five years, continues to drive demand for these components. Spacecrafts are always being bombarded by energetic particles and radiation, making radiation-resistant electronics crucial for their ongoing functioning.

Get More Information on Radiation Hardened Electronics Market - Request Sample Report

For Instance, NASA's innovative Habitable Worlds Observatory (HWO) mission idea, aims to find evidence of life outside our solar system, needs a cutting-edge telescope with unmatched stability. Additionally, BAE Systems is spearheading a group to create the highly stable optical systems crucial for HWO's accomplishment. These systems are designed to achieve stability at the picometer scale, which is much smaller than what current technology can achieve. This high level of stability is necessary for directly capturing images of exoplanets and potentially finding indications of life. HWO's main difficulty lies in suppressing starlight. Exoplanets are significantly dimmer compared to their host stars, requiring a remarkable 10 billion to 1 contrast ratio for successful imaging by the High Contrast Imaging techniques.

Nuclear power plants, impressive feats of modern technology, utilize atomic energy but are at risk from radiation which can damage their electronics and lead to potential malfunctions or safety risks. Radiation-tolerant electronics are becoming essential safeguards, enhancing signal quality, enhancing reactor safety and efficiency, and minimizing radiation-induced damage. The demand for these specific parts is increasing due to a rise in the worldwide count of functioning nuclear reactors from 411 units in 2022 to 436 units by May 2023, boosted by investments in emerging areas. These electronics play a crucial role in tasks such as nuclear detection and measurement, ultimately leading to safer and more efficient energy generation. They allow for wireless monitoring in nuclear facilities, which is especially important in emergencies or high-radiation zones where conventional communication systems may not work.

Drivers

Protecting electronic devices against radiation to ensure continuous surveillance.

The constant requirement for strong security systems drives the market for radiation-resistant electronics. These specific parts are crucial in Intelligence, Surveillance, and Reconnaissance (ISR) systems, which are essential for border control and data gathering.

ISR systems work in various settings, some of which could present radiation dangers. From guarding border security outposts in isolated deserts to supervising sensitive facilities, these systems need constant functionality. Conventional electronics may be vulnerable to the negative impacts of radiation, which can jeopardize mission reliability and present safety hazards. This is when radiation-resistant electronics come into play as the quiet protectors. Designed to endure extreme conditions with radiation exposure, they guarantee flawless operation of ISR systems. Their steady performance offers security personnel the dependable information and thorough understanding required to make crucial decisions. Essentially, durable electronics resistant to radiation are crucial for reliable surveillance, protecting security initiatives worldwide.

Innovation Introduces a New Age for Electronics that are Resistant to Radiation

The world of electronics that can withstand radiation is changing due to constant technological progress. These advancements cover three main areas materials science, design techniques, and testing methodologies. The collaboration among these sectors is fueling a transformation - better efficiency, increased dependability, and a more appealing cost for electronics that can withstand radiation. Materials science is leading the way in developing novel materials that have inherent radiation resistance. For example, Gallium Nitride (GaN) has outstanding radiation resistance, which makes it perfect for use in nuclear power plants. This enhances the safety and durability of crucial systems while also creating opportunities for smaller, more efficient electronics in challenging conditions. Design strategies are also changing. Experts are using new tactics to reduce the impact of radiation on electronic parts. This could include using specific designs, integrating protection measures, or even embracing fresh circuit structures. These design improvements not only enhance the durability of electronics but also facilitate the development of completely new features suited for environments with high levels of radiation.

Restraints

The cost of safeguarding against radiation poses a challenge for electronics designed to withstand it.

Specialized materials, as opposed to easily accessible ones, are required to endure the severe effects of radiation. Moreover, it is essential to employ meticulous design methods and thorough testing protocols to guarantee seamless functionality in such challenging settings. Regrettably, this results in a high cost, acting as a major obstacle for potential users. This cost factor is particularly detrimental for emerging markets and applications with constrained budgets, impeding broader utilization of this essential technology.

The difficulty lies in developing a testing environment that replicates the diverse and high levels of radiation found in space.

Accurately simulating real-world environments is a critical challenge in the development of radiation-hardened electronics. Picture the electronics facing the brutal radiation in outer space, the powerful bursts of a nuclear explosion, or the tough environments on a military field. These settings subject electronics to a diverse mix of radiation - various kinds, different energy levels, and changing intensities. Creating a controlled testing lab environment to mimic this disorderly combination is a major obstacle.

Testing centers commonly use a mix of different radiation sources and methods to simulate a somewhat accurate setting. This could include the utilization of particle accelerators, gamma-ray sources, and neutron generators. Although these tools offer a solid foundation, replicating the real-world situation accurately is still difficult to achieve. The issue stems from the possibility of inconsistencies between the artificial setting in a lab and the real-life exposure of electronic parts to radiation. This unpredictability may lead to doubts regarding the actual durability of the electronics in practical scenarios.

by Product Type

Commercial-off-the-Shelf (COTS) components hold the majority of the market share in 2023 with 55% in the radiation-hardened electronics market. Several factors can be credited for this dominance. To start with, Commercial Off-The-Shelf (COTS) products provide a noticeable cost benefit in contrast to tailor-made options. Secondly, they cut down project timelines by getting rid of long design and development processes. Ultimately, current COTS components may be ideal for specific radiation conditions, offering a convenient and budget-friendly option for numerous uses.

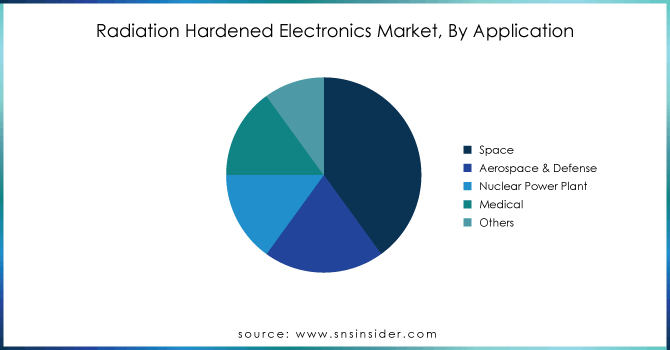

by Application

In the radiation-hardened electronics market, Space dominates with a 40% market share in 2023, based on application. Space exploration is expected to be the main application for electronics that can withstand radiation. Cosmic rays and solar radiation are always bombarding space vehicles, satellites, and planetary explorers. This is where radiation-resistant electronics come in as the protectors of the galaxies. These unique parts guarantee the ongoing functionality of these incredible spacecraft, protecting both data reliability and mission security. The growing investment by the government in space exploration, along with the emergence of commercial space companies, is also driving the need for radiation-resistant electronics. As space exploration goes further and requires extended durations, these durable electronics will be essential for unraveling the secrets of the universe.

Need any Customized Research Report on Flexible Display Market - Enquiry Now

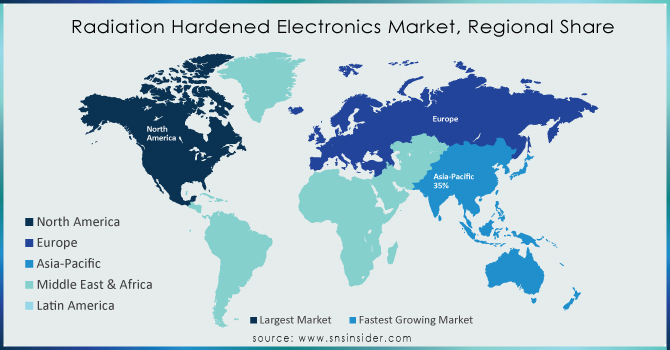

In 2023, the Asia Pacific region is rapidly advancing towards a dominant position in the radiation-hardened electronics market, commanding a solid 35% market share and expected to continue growing. This increase is driven by a combination of different elements. China's successful space programs, overseen by CASC, and India's space advancements under ISRO's leadership are expanding the horizons of space exploration, requiring dependable electronics for satellite launches and space missions.

The growing defense and aerospace sectors in the area, led by major companies such as Mitsubishi Heavy Industries (Japan) and Hindustan Aeronautics Limited (India), need radiation-resistant parts for advanced defense purposes and future aircraft. Moreover, government efforts such as China's National Integrated Circuit Industry Investment Fund and India's "Make in India" program are actively promoting local manufacturing and technological progress in this field. South Korea and Taiwan lead the way in the region's semiconductor industry, establishing a strong base for producing these specialized electronics. The combination of these elements establishes Asia Pacific as a potential center for radiation-resistant electronics, with advantages reaching beyond space and defense to support nuclear power plants, medical devices, and other industries in need of reliable electronics in challenging conditions.

North America, is a growing force in the market for radiation-hardened electronics, possessing a significant 30% market share in 2023. This expansion is a result of its extensive background in space research and military protection. Big companies such as Lockheed Martin and Raytheon Technologies heavily depend on these specialized components for their advanced spacecraft, missiles, and defense systems. Nuclear power, a well-established sector in North America, also drives the need for electronics that can withstand radiation to guarantee the safe functioning of nuclear facilities.

Westinghouse Electric and GE Hitachi Nuclear Energy are heavily engaged in the development of these essential components. North America's dedication to technological progress further enhances its strength. Universities and private institutions are always advancing radiation-resistant electronics, helping to keep regional companies at the forefront of this changing field. Prominent companies producing these unique electronics in North America are Texas Instruments, Analog Devices, and Airbus Defence and Space. They create circuits and components that are resistant to radiation, designed for use in space on satellites, spaceships, and other equipment. Airbus Defence and Space has a strong presence in North America, where they create and produce radiation-resistant electronics for satellites and space systems. North America's past in space discovery, defense technology, nuclear energy, and dedication to advancement solidify its role in the expanding market for radiation-resistant electronics.

Some of the major key players in the Radiation Hardened Electronics market with their respective products:

Microchip Technology Inc. (US) (Radiation-hardened microcontrollers and field-programmable gate arrays (FPGAs))

BAE Systems (UK) (Radiation-hardened power systems, sensors, and communication systems)

Renesas Electronics Corporation (Japan) (Radiation-hardened microcontrollers and semiconductors)

Infineon Technologies AG (Germany) (Radiation-hardened power semiconductors and ICs)

STMicroelectronics (Switzerland) (Radiation-hardened diodes, transistors, and memory components)

AMD (US) (Radiation-hardened processors and FPGAs)

Texas Instruments (US) (Radiation-hardened analog and mixed-signal ICs)

Honeywell International Inc. (US) (Radiation-hardened sensors and control systems)

Teledyne Technologies (US) (Radiation-hardened cameras and imaging sensors)

TTM Technologies, Inc. (US) (Radiation-hardened printed circuit boards (PCBs))

Cobham (UK) (Radiation-hardened communication systems and equipment)

Analog Devices, Inc. (US) (Radiation-hardened analog-to-digital converters (ADCs) and signal processors)

Data Device Corporation (DDC) (US) (Radiation-hardened power supplies and data buses)

3D Plus (France) (Radiation-hardened memory and storage devices)

Mercury Systems Inc. (US) (Radiation-hardened integrated circuits and systems)

PCB Piezotronics (US) (Radiation-hardened sensors for pressure and vibration measurements)

Vorago Technologies (US) (Radiation-hardened microcontrollers and ASICs)

Micropac Industries (US) (Radiation-hardened semiconductors and components)

GSI Technology (US) (Radiation-hardened memory devices)

Everspin Technologies (US) (Radiation-hardened magnetoresistive random-access memory (MRAM))

Semiconductor Components Industries (US) (Radiation-hardened transistors and diodes)

Aitech (US) (Radiation-hardened embedded systems and FPGAs)

Microelectronics Research Development Corporation (US) (Radiation-hardened semiconductor devices)

Space Micro (US) (Radiation-hardened communications and data processing systems)

Triad Semiconductor (US) (Radiation-hardened analog and digital ICs)

List of suppliers that provide raw materials and components for the radiation-hardened electronics market:

Materion Corporation (US)

L3Harris Technologies (US)

Ametek, Inc. (US)

Kryoflux (US)

Teledyne Microelectronics (US)

Advanced Cryogenics (US)

IMT (Integrated Microwave Technologies) (US)

Semiconductor Technologies and Instruments (STI) (US)

Global Semiconductor (US)

Planar Systems (US)

VPT, Inc. (US)

Tata Steel (India)

Mitsubishi Materials Corporation (Japan)

In January 2024, Infineon Technologies AG unveiled radiation-hardened asynchronous static random-access memory (SRAM) chips for space applications. Using RADSTOP technology, these chips are designed with proprietary methods for enhanced radiation hardness, ensuring high reliability and performance in harsh environments.

In October 2023, Teledyne e2v collaborated with Microchip Technology to develop a pioneering space computing reference design, featuring Microchip's Radiation-Tolerant Gigabit Ethernet PHYs. The innovative design focuses on high-speed data routing in space applications, presented at the EDHPC 2023.

In September 2023, Microchip Technology Inc. launched the MPLAB Machine Learning Development Suite, a comprehensive solution supporting 8-bit, 16-bit, and 32-bit MCUs, and 32-MPUs for efficient ML at the edge. The integrated workflow streamlines ML model development across Microchip's product portfolio.

In September 2023, Infineon Technologies collaborated with Chinese firm Infypower in the new energy vehicle charger market, providing industry-leading 1200 V CoolSiC MOSFET power semiconductors. This partnership aimed to enhance efficiency in electric vehicle charging stations, offering wide constant power range, high density, minimal interference, and high reliability for Infypower's 30 kW DC charging module.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.60 billion |

| Market Size by 2032 | USD 2.35 Billion |

| CAGR | CAGR of 4.45 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Commercial-off-the-Shelf (COTS), Custom Made) • By Component (Mixed Signal ICs, Processors & Controllers, Memory, Power Management) • By Manufacturing Technique (Radiation-Hardening by Design, Radiation-Hardening by Process) • By Application (Space, Aerospace & Defense, Nuclear Power Plant, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microchip Technology Inc.(US), BAE Systems (UK), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), Renesas Electronics Corporation (Japan), AMD (US), Texas Instruments (US), Honeywell International Inc. (US), TTM Technologies, Inc. (US), Cobham (UK), Analog Devices, Inc.(US), Teledyne Technologies (US), Data Device Corporation (DDC) (US), 3D Plus (France), Mercury Systems Inc (US), Vorago Technologies (US), Micropac Industries (US), GSI Technology (US), PCB Piezotronics (US), Everspin Technologies (US), Semiconductor Components Industries (US), Microelectronics Research Development Corporation (US), Aitech (US), Space Micro (US), Triad Semiconductor (US) |

| Key Drivers | • Protecting electronic devices against radiation to ensure continuous surveillance. • Innovation Introduces a New Age for Electronics that are Resistant to Radiation. |

| RESTRAINTS | • The cost of safeguarding against radiation poses a challenge for electronics designed to withstand it. • The difficulty lies in developing a testing environment that replicates the diverse and high levels of radiation found in space. |

Ans. Growing need in space exploration, defense, nuclear power, and security industries fuels the Radiation-Hardened Electronics market.

Ans. The Radiation Hardened Electronics Market size was $ 1.60 Billion in 2023 & expects a good growth by reaching USD 2.35 billion till end of year 2032 at CAGR about 4.45% during forecast period 2023-2032.

Ans. North America region is anticipated to record the Fastest Growing in the Radiation Hardened Electronics market.

Ans. The Commercial-off-the-Shelf (COTS) Segment is leading in the market revenue share in 2023.

Ans. Asia Pacific is to hold the largest market share in the Radiation Hardened Electronics market during the forecast period.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption Rates

5.2 Failure Mechanisms and Radiation Dosage

5.3 Energy Consumption Data

5.4 Demand and Supply by Region

5.5 Failure Rates and Reliability Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Radiation Hardened Electronics Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Commercial-off-the-Shelf (COTS)

7.2.1 Commercial-off-the-Shelf (COTS) Market Trends Analysis (2020-2032)

7.2.2 Commercial-off-the-Shelf (COTS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Custom Made

7.3.1 Custom Made Market Trends Analysis (2020-2032)

7.3.2 Custom Made Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Radiation Hardened Electronics Market Segmentation, by Component

8.1 Chapter Overview

8.2 Mixed Signal ICs

8.2.1 Mixed Signal ICs Market Trends Analysis (2020-2032)

8.2.2 Mixed Signal ICs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Processors & Controllers

8.3.1 Processors & Controllers Market Trends Analysis (2020-2032)

8.3.2 Processors & Controllers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Memory

8.4.1 Memory Market Trends Analysis (2020-2032)

8.4.2 Memory Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Power Management

8.5.1 Power Management Market Trends Analysis (2020-2032)

8.5.2 Power Management Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Radiation Hardened Electronics Market Segmentation, by Manufacturing Technique

9.1 Chapter Overview

9.2 Radiation-Hardening by Design (RHBD)

9.2.1 Radiation-Hardening by Design (RHBD) Market Trends Analysis (2020-2032)

9.2.2 Radiation-Hardening by Design (RHBD) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Radiation-Hardening by Process (RHBP)

9.3.1 Radiation-Hardening by Process (RHBP) Market Trends Analysis (2020-2032)

9.3.2 Radiation-Hardening by Process (RHBP) Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Radiation Hardened Electronics Market Segmentation, by Application

10.1 Chapter Overview

10.2 Space

10.2.1 Space Market Trends Analysis (2020-2032)

10.2.2 Space Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Aerospace & Defense

10.3.1 Aerospace & Defense Market Trends Analysis (2020-2032)

10.3.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Nuclear Power Plant

10.4.1 Nuclear Power Plant Market Trends Analysis (2020-2032)

10.4.2 Nuclear Power Plant Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Medical

10.5.1 Medical Market Trends Analysis (2020-2032)

10.5.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.4 North America Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.5 North America Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.2.6 North America Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.7.2 USA Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.7.3 USA Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.2.7.4 USA Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.8.2 Canada Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.8.3 Canada Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.2.8.4 Canada Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.9.3 Mexico Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.2.9.4 Mexico Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.7.3 Poland Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.7.4 Poland Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.8.3 Romania Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.8.4 Romania Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.5 Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.6 Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.7.3 Germany Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.7.4 Germany Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.8.2 France Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.8.3 France Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.8.4 France Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.9.3 UK Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.9.4 UK Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.10.3 Italy Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.10.4 Italy Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.11.3 Spain Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.11.4 Spain Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.14.3 Austria Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.14.4 Austria Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.4 Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.5 Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.6 Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.7.2 China Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.7.3 China Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.7.4 China Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.8.2 India Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.8.3 India Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.8.4 India Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.9.2 Japan Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.9.3 Japan Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.9.4 Japan Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.10.3 South Korea Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.10.4 South Korea Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.11.3 Vietnam Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.11.4 Vietnam Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.12.3 Singapore Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.12.4 Singapore Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.13.2 Australia Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.13.3 Australia Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.13.4 Australia Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.5 Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.6 Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.7.3 UAE Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.7.4 UAE Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.4 Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.5 Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.2.6 Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.4 Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.5 Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.6.6 Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.7.3 Brazil Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.6.7.4 Brazil Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.8.3 Argentina Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.6.8.4 Argentina Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.9.3 Colombia Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.6.9.4 Colombia Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Manufacturing Technique (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Radiation Hardened Electronics Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 Microchip Technology Inc

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 BAE Systems

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Renesas Electronics Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Infineon Technologies AG

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 STMicroelectronics

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 AMD

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Texas Instruments

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Honeywell International Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Teledyne Technologies

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 TTM Technologies, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product Type

Commercial-off-the-Shelf (COTS)

Custom Made

By Component

Mixed Signal ICs

Processors & Controllers

Memory

Power Management

By Manufacturing Technique

Radiation-Hardening by Design (RHBD)

Radiation-Hardening by Process (RHBP)

By Application

Space

Aerospace & Defense

Nuclear Power Plant

Medical

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The RF Interconnect Market Size was valued at USD 1.50 Billion in 2023 and will reach USD 2.35 Billion by 2032, growing at a CAGR of 5.15% by 2024-2032.

The Drone Camera Market Size was valued at USD 14.20 billion in 2023 and is expected to reach USD 145.45 billion by 2032 and grow at a CAGR of 29.5% over the forecast period 2024-2032.

The GPS Tracking Device Market was valued at USD 3.17 billion in 2023 and is expected to reach USD 10.03 billion by 2032, growing at a CAGR of 13.69% over the forecast period 2024-2032.

The Mobile TV Market Size was valued at USD 13.26 Billion in 2023 and is expected to grow at a CAGR of 8.53% to Reach USD 27.70 Billion by 2032.

The Outsourced Semiconductor Assembly and Test Services Market Size was valued at USD 40.10 Billion in 2023 and is expected to reach USD 77.90 Billion by 2032, growing at a CAGR of 7.67% over the forecast period 2024-2032

The Microcontroller Market Size was valued at USD 29.11 Billion in 2023 and is expected to reach USD 69.33 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone