To Get More Information on Quantum Dot Display Market - Request Sample Report

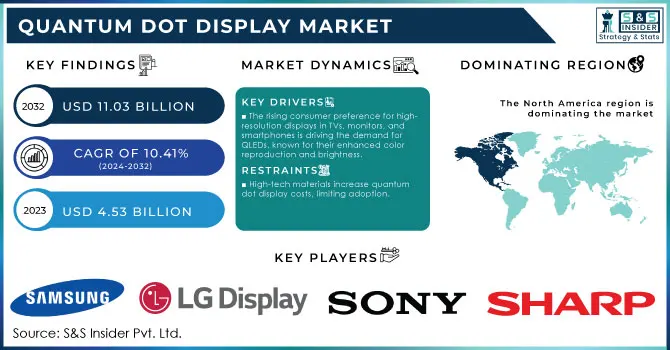

The Quantum Dot Display Market size was estimated at USD 4.53 billion in 2023 and is expected to reach USD 11.03 billion by 2032 at a CAGR of 10.41% during the forecast period of 2024-2032.

The Quantum Dot Display market is witnessing significant advancements and growth due to its ability to enhance display quality and energy efficiency. Quantum dot technology utilizes semiconductor nanocrystals to produce pure colors, resulting in vibrant and accurate displays that outperform traditional LED and OLED screens. This technology is increasingly being adopted in various applications, notably in televisions, monitors, smartphones, and wearable devices, leading to a notable increase in consumer demand. A significant driver for the market is the growing demand for high-resolution displays, particularly in the entertainment and gaming sectors. As consumers seek immersive viewing experiences, manufacturers are focusing on incorporating quantum dot technology into their products. The major players like Samsung have heavily invested in quantum dot technology, launching a range of QLED televisions that have gained popularity for their superior color accuracy and brightness levels.

Additionally, the rising trend of 8K and higher resolution displays has further propelled the market, as quantum dots enable manufacturers to meet the high standards required for such advanced visual experiences. According to research, over 25% of premium television sales in 2023 were attributed to quantum dot displays, reflecting their growing significance in the display market. Moreover, advancements in manufacturing processes are expected to reduce production costs, making quantum dot displays more accessible to a broader consumer base. The introduction of new materials, such as cadmium-free quantum dots, is also addressing environmental concerns, aligning with the global push for sustainable technology.

|

Type of Quantum Dot Display |

Description |

Commercial Products |

|---|---|---|

|

Quantum Dot LED (QLED) Displays |

Displays that use quantum dots combined with LED backlighting to produce high brightness and vibrant colors. |

Samsung QLED TVs, Hisense ULED |

|

Electroluminescent Quantum Dot Displays (QDEL) |

Quantum dots are used as the primary light source, potentially eliminating the need for backlighting. Offers better energy efficiency and flexibility in display design. |

Nanosys QDEL, Samsung prototypes |

|

Quantum Dot OLED (QD-OLED) Displays |

Combines quantum dots with OLED technology, enhancing color accuracy and contrast ratios. |

Sony Bravia XR A95K, Samsung QD-OLED TVs |

|

Mini-LED with Quantum Dots |

Utilizes mini-LED backlighting with quantum dots for improved brightness and contrast compared to traditional LED displays. |

TCL 8-Series, Samsung Neo QLED |

|

Micro-LED with Quantum Dots |

Micro-LED displays enhanced with quantum dots for superior color performance and low power consumption. |

Samsung MicroLED Wall, Sony Crystal LED with Quantum Dots |

|

Quantum Dot Enhancement Film (QDEF) |

Uses a film layer with quantum dots to enhance the color performance of LCD displays. Often used in consumer electronics like monitors and tablets. |

Acer Predator X27, ASUS ProArt Display |

|

Transparent Quantum Dot Displays |

Displays that maintain transparency while using quantum dots to create vibrant colors, ideal for commercial and automotive applications. |

Samsung Transparent QD Display, LG Transparent OLED with Quantum Dots |

|

Flexible Quantum Dot Displays |

Quantum dot displays that are flexible, allowing for use in curved or foldable devices. |

BOE Flexible Quantum Dot Display, Samsung Galaxy Z Fold prototypes |

|

Wearable Quantum Dot Displays |

Quantum dot technology applied to wearables for vivid color and lower power consumption. |

Fitbit Quantum Dot Display, TCL Wearable Display |

|

High Dynamic Range (HDR) Quantum Dot Displays |

Quantum dot displays designed for HDR content, offering enhanced brightness and contrast ratios. |

Vizio Quantum HDR, LG NanoCell with Quantum Dot |

DRIVERS

The growing demand for high-quality displays is significantly reshaping the electronics landscape, particularly in televisions, monitors, and smartphones. As consumers become more discerning about their viewing experiences, the shift towards high-resolution displays has become evident. This preference is driven by the desire for superior image quality, with Quantum Dot Light Emitting Diodes (QLEDs) emerging as a favored choice due to their exceptional color reproduction and brightness. QLED technology utilizes quantum dots to enhance color accuracy and brightness levels, resulting in vibrant images that are appealing to viewers.

According to recent research, QLED displays can achieve brightness levels of up to 2,000 nits, allowing for impressive performance even in brightly lit environments. Additionally, the color gamut of QLEDs often exceeds 90% of the DCI-P3 standard, offering a broader range of colors compared to traditional LCD or LED displays. This technological advancement not only enhances the viewing experience for consumers but also positions QLEDs as an attractive option for manufacturers aiming to meet the growing expectations of quality. The rise of 4K and 8K content further propels this demand, as consumers seek displays that can fully exploit the potential of high-definition content.

Technological advancements in quantum dot technology have significantly transformed display applications across various sectors, enhancing visual experiences in televisions, monitors, and mobile devices. Quantum dots are semiconductor nanocrystals that emit light when stimulated, and recent innovations have focused on improving their light-emitting efficiency and color accuracy. These enhancements enable displays to achieve vibrant, true-to-life colors and higher brightness levels, surpassing traditional display technologies. The advancements in manufacturing techniques have led to the development of quantum dots that exhibit improved photostability and durability, making them more reliable for prolonged use. Moreover, the integration of quantum dots into OLED (Organic Light Emitting Diode) displays has resulted in screens with better color reproduction and wider viewing angles, catering to consumer demands for high-quality visuals.

The growing impact of these technologies: displays utilizing quantum dot technology can cover up to 90% of the DCI-P3 color gamut, which is essential for high-definition content production. Furthermore, advancements in quantum dot film technology have increased energy efficiency, allowing displays to consume less power while maintaining superior brightness and clarity. As manufacturers continue to innovate, the incorporation of quantum dot technology is expected to expand beyond traditional displays, potentially influencing sectors like automotive displays and virtual reality systems, ultimately shaping the future of visual technology. This evolution underscores the vital role of ongoing research and development in enhancing the capabilities of quantum dot displays.

RESTRAIN

Quantum dot displays represent a significant advancement in display technology, offering enhanced color accuracy, brightness, and energy efficiency. However, their production entails high manufacturing costs primarily due to the sophisticated technology and specialized materials required. The process begins with the synthesis of quantum dots, which are nanometer-sized semiconductor particles that emit specific colors when illuminated. This synthesis involves complex chemical processes that require precision and control, driving up costs. In addition to the quantum dots themselves, the manufacturing process necessitates advanced fabrication techniques, including precision layer deposition and encapsulation methods to ensure stability and longevity. These processes are not only labor-intensive but also demand high-quality raw materials, further inflating production expenses.

As a result of these factors, the retail price of quantum dot displays remains significantly higher than that of traditional LCD or OLED displays. According to the research 70% of manufacturers cited high production costs as a barrier to scaling up quantum dot technology. Consequently, while the performance benefits of quantum dot displays are compelling, the elevated costs pose challenges for widespread adoption in consumer electronics and other industries, limiting their penetration in the market despite their technological advantages.

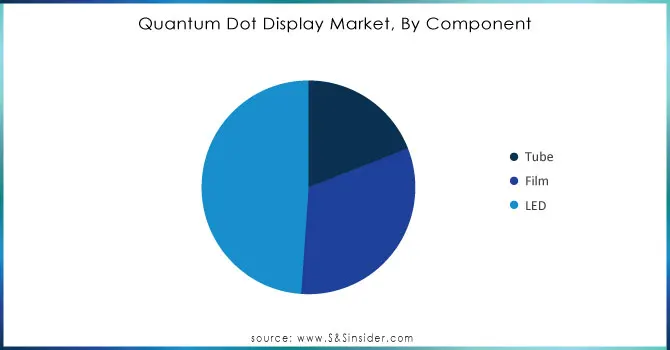

By Component

In 2023, the LED segment dominated the market, contributing 48.9% of total revenue. LEDs are essential in quantum dot display technologies, serving as the primary light source. The integration of quantum dots enhances the color performance of LEDs, allowing for richer and more vibrant visuals. This synergy between LEDs and quantum dots results in displays with improved color accuracy and brightness. Furthermore, LEDs offer significant design flexibility, enabling innovative display configurations that are not possible with traditional lighting solutions. Their compatibility with quantum dot films allows for efficient manufacturing processes, leading to compact display designs that can be produced at a lower cost than older technologies, such as bulky glass tubes.

Do You Need any Customization Research on Quantum Dot Display Market - Inquire Now

By Material

In 2023, cadmium-containing quantum dot (QD) displays captured a significant market share of 53.08%, primarily due to their outstanding ability to reproduce a wide color gamut. This capability enables the production of displays with vibrant and highly accurate colors, which is particularly important for manufacturers of high-definition televisions and other premium display technologies. Additionally, cadmium-based quantum dots boast superior light-emitting efficiency, allowing for higher brightness levels without the need for increased power consumption. This energy efficiency not only enhances the viewing experience for consumers but also reduces operating costs for manufacturers. As a result, the demand for cadmium-containing QD displays continues to grow, as they meet the expectations for quality and performance in today’s competitive market.

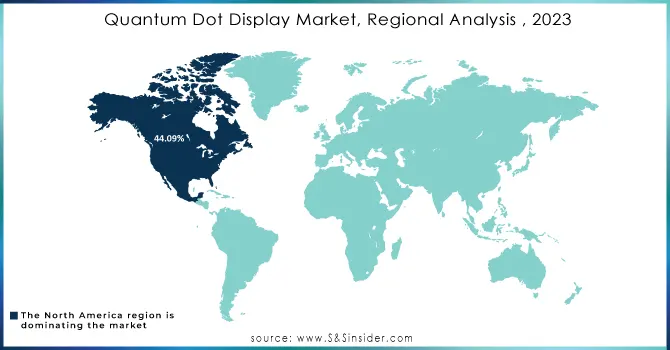

In 2023, North America dominated the market with a notable share of 44.09%, driven by its concentration of leading technology firms specializing in advanced display solutions. The consumer shift towards premium display options, including 4K, UHD, QLED, and 8K screens, further propels market growth. According to research, approximately 70% of consumers in North America prioritize high-resolution displays for enhanced viewing experiences, reflecting a strong demand for cutting-edge visual technologies. Additionally, the adoption of quantum dot displays, known for their superior color accuracy and energy efficiency, is gaining traction, further supporting the region's leadership in the display technology market.

The Asia Pacific region is poised for rapid growth in the adoption of quantum dot display technology, driven by rising disposable incomes among the working population. As consumers gain more purchasing power, there is an increased demand for advanced consumer electronics, notably smartphones, televisions, and tablets, which benefit significantly from quantum dot technology. This technology enhances picture quality, offering vibrant colors and improved energy efficiency compared to traditional displays. Additionally, governments in the Asia Pacific are actively encouraging the use of energy-efficient technologies through subsidies and regulations, further supporting the transition to quantum dot displays. As a result, the region is expected to lead in the implementation of this cutting-edge display technology, aligning consumer preferences with sustainability initiatives.

Some of the major key players of Quantum Dot Display Market

Samsung Electronics Co., Ltd. (QD-OLED Displays, QLED TVs)

LG Display Co., Ltd. (QD-OLED Panels, Quantum Dot TV)

Sony Corporation (Triluminos Displays)

Sharp Corporation (4K Quantum Dot TVs)

The Dow Chemical Company (Quantum Dot Materials)

3M Company (Quantum Dot Enhancement Film)

Nanosys, Inc. (Quantum Dot Enhancement Film (QDEF))

TCL Corporation (QD TVs)

BOE Technology Group Co., Ltd. (Quantum Dot Display Panels)

Innolux Corporation (Quantum Dot Displays)

AU Optronics Corp. (Quantum Dot LCD Panels)

Nanoco Group plc (Cadmium-Free Quantum Dots)

InVisage Technologies (Apple) (Quantum Film for Imaging Sensors)

Shoei Electronic Materials, Inc. (Quantum Dot Solutions)

NN-Labs (NNCrystal US Corporation) (Quantum Dot Materials)

Ocean NanoTech (High-Purity Quantum Dots)

QD Laser (Quantum Dot Lasers)

QLight Nanotech (Quantum Dot Films)

Quantum Materials Corporation (Cadmium-Free Quantum Dot Materials)

CSOT (China Star Optoelectronics Technology Co., Ltd.) (QD Display Technology)

Suppliers for Innovator in QNED technology, combining quantum dots with Mini LED backlighting for enhanced color and contrast of Quantum Dot Display Market:

Samsung Electronics Co., Ltd.

LG Display Co., Ltd.

3M Company

Nanosys, Inc.

Sony Corporation

QD Vision, Inc.

Sharp Corporation

BOE Technology Group Co., Ltd.

TCL Corporation

AU Optronics Corp.

In October 2024: Samsung Display has developed a quantum dot ink recycling technology that enhances the efficiency of its QD-OLED manufacturing process. This innovation enables the recovery and reprocessing of up to 80% of unused QD ink, significantly reducing waste. By adopting this technology, the company anticipates annual cost savings exceeding KRW 10 billion approximately USD 7.2 million.

In September 2023: Shoei Chemical, Inc. and its North America-based subsidiary, Shoei Electronic Materials, Inc., revealed their acquisition of Nanosys, Inc., a leader in quantum dot technology. This strategic move is anticipated to enhance Shoei's position within the advanced materials sector.

In May 2023: Nanoco Technologies entered into a licensing and collaboration agreement with Guangdong Poly Optoelectronics Co., Ltd. Under this agreement, the two companies will work together to develop cadmium-free quantum dot solutions for various applications, including advanced displays and lighting films. Additionally, this partnership will enable Nanoco to promote its eco-friendly CFQD quantum dots in China.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.53 Billion |

| Market Size by 2032 | USD 11.03 Billion |

| CAGR | CAGR of 10.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Tube, Film, LED) • By Material (Cadmium Containing, Cadmium-free) • By Application (Consumer Electronics, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co., Ltd., LG Display Co., Ltd., Sony Corporation, Sharp Corporation, The Dow Chemical Company, 3M Company, Nanosys, Inc., TCL Corporation, BOE Technology Group Co., Ltd., Innolux Corporation, AU Optronics Corp., Nanoco Group plc, InVisage Technologies (Apple), Shoei Electronic Materials, Inc., NN-Labs (NNCrystal US Corporation), Ocean NanoTech, QD Laser, QLight Nanotech, Quantum Materials Corporation, CSOT (China Star Optoelectronics Technology Co., Ltd.) |

| Key Drivers | • The rising consumer preference for high-resolution displays in TVs, monitors, and smartphones is driving the demand for QLEDs, known for their enhanced color reproduction and brightness. • Ongoing innovations in quantum dot technology, including enhanced light-emitting efficiency and color accuracy, are advancing display applications and improving overall performance. |

| RESTRAINTS | • The advanced technology and specialized materials required to produce quantum dot displays result in higher manufacturing costs than traditional display technologies, limiting their widespread adoption. |

Ans: The Quantum Dot Display Market is expected to grow at a CAGR of 10.41% during 2024-2032.

Ans: The Quantum Dot Display Market was USD 4.53 Billion in 2023 and is expected to Reach USD 11.03 Billion by 2032.

Ans: The rising consumer preference for high-resolution displays in TVs, monitors, and smartphones is driving the demand for QLEDs, known for their enhanced color reproduction and brightness.

Ans: The “LED segment” segment dominated the Quantum Dot Display Market.

Ans: North America dominated the Quantum Dot Display Market in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Quantum Dot Display Market Segmentation, By Component

7.1 Chapter Overview

7.2 Tube

7.2.1 Tube Market Trends Analysis (2020-2032)

7.2.2 Tube Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Film

7.3.1 Film Market Trends Analysis (2020-2032)

7.3.2 Film Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 LED

7.4.1 LED Market Trends Analysis (2020-2032)

7.4.2 LED Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Quantum Dot Display Market Segmentation, By Material

8.1 Chapter Overview

8.2 Cadmium Containing

8.2.1 Cadmium Containing Market Trends Analysis (2020-2032)

8.2.2 Cadmium Containing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cadmium-free

8.3.1 Cadmium-free Market Trends Analysis (2020-2032)

8.3.2 Cadmium-free Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Quantum Dot Display Market Segmentation, By Application

9.1 Chapter Overview

9.2 Consumer Electronics

9.2.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.2.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Healthcare

9.3.1 Healthcare Market Trends Analysis (2020-2032)

9.3.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.5 North America Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.6.3 USA Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.7.3 Canada Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.8.3 Mexico Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.6.3 Poland Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.7.3 Romania Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.5 Western Europe Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.6.3 Germany Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.7.3 France Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.8.3 UK Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.9.3 Italy Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.10.3 Spain Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.13.3 Austria Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.6.3 China Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.7.3 India Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.8.3 Japan Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.9.3 South Korea Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.10.3 Vietnam Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.11.3 Singapore Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.12.3 Australia Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.5 Middle East Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.6.3 UAE Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.5 Africa Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Quantum Dot Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.5 Latin America Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.6.3 Brazil Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.7.3 Argentina Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.8.3 Colombia Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Quantum Dot Display Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Quantum Dot Display Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Quantum Dot Display Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Ocean NanoTech

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 The Dow Chemical Company

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Quantum Materials Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 QLight Nanotech

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 SAMSUNG

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Shoei Electronic Materials, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 NN-Labs (NNCrystal US Corporation)

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 InVisage Technologies (Apple)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Nanoco Group plc

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 QD Laser

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Component

Tube

Film

LED

By Material

Cadmium Containing

Cadmium-free

By Application

Consumer Electronics

Healthcare

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Neural Processor Market was valued at USD 231.8 million in 2023 and is expected to reach USD 1085.1 million by 2032, growing at a CAGR of 18.73% from 2024-2032.

The Optical Modulators Market size was valued at USD 5.12 Bn in 2023 and is expected to reach USD 21.13 Bn by 2032 and grow at a CAGR of 17.07% by 2024-2032

The Automotive Rain Sensor Market was valued at USD 4.38 billion in 2023 and is expected to reach USD 7.81 billion by 2032, growing at a CAGR of 6.67% over the forecast period 2024-2032.

The Automated Optical Inspection Market Size was valued at USD 942.3 million in 2023 and is expected to reach USD 5085.28 million by 2032 and grow at a CAGR of 20.6% over the forecast period 2024-2032.

The Immersive Display in Entertainment Market Size was valued at USD 2.73 Billion in 2023 and is expected to grow at a CAGR of 24.1% From 2025-2032.

The Airborne Radars Market Size was valued at USD 9.81 Billion in 2023 and is expected to reach USD 18.94 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone