Get more information on QR Code Payments Market - Request Free Sample Report

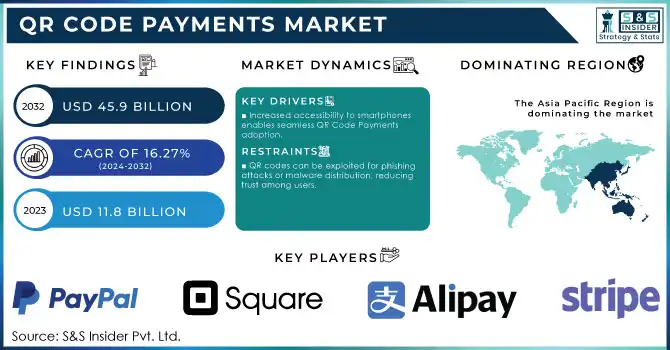

The QR Code Payments Market was valued at USD 11.8 billion in 2023 and is expected to reach USD 45.9 billion by 2032, growing at a CAGR of 16.27% over 2024-2032.

The QR Code Payments Market is rapidly expanding, driven by technological advancements and evolving consumer preferences. QR payments enable users to scan a code with their smartphone to complete secure and fast transactions. Due to its convenience and cost-effectiveness, this technology has seen widespread adoption across industries, including retail, dining, e-commerce, and transportation. the increasing adoption of digital wallets and smartphones as primary drivers for QR Code Payments growth. In 2023, approximately 30% of global in-store transactions utilized mobile payment methods, including QR codes, with projections indicating this figure could reach 42% by 2025. Additionally, over 85% of consumers in China already use QR codes for payments, primarily through platforms like WeChat Pay and Alipay, setting a benchmark for global adoption trends. Smartphone penetration has also facilitated QR code usage, with nearly 80% of digital wallet users in the U.S. preferring mobile payments due to their speed and convenience. Globally, mobile wallets accounted for 50% of online purchases in 2023, and this preference has spilled into physical retail, where businesses are integrating QR codes to reduce transaction friction and enhance customer experience.

A significant factor in the market's growth is the rising adoption of digital wallets and smartphones, which provide a seamless platform for QR code integration. Businesses benefit from reduced transaction costs and the ability to offer customers a convenient payment experience. For example, restaurants use QR codes for digital menus and payment options, streamlining operations and reducing the need for physical interaction. Similarly, retailers and e-commerce platforms employ QR codes for both in-store and remote purchases, enhancing customer engagement and satisfaction. The COVID-19 pandemic played a pivotal role in accelerating the demand for contactless payment solutions, making QR codes a preferred choice for businesses and consumers. Static QR codes, which are easy to generate and implement, are popular among small businesses, while dynamic QR codes offer enhanced security and customization, making them suitable for larger enterprises. These codes are also being used in innovative ways, such as loyalty programs, subscription services, and identity verification processes. Push payments, where consumers initiate the transaction by scanning the code, are particularly favored for their fraud-resistant nature and enhanced security. Pull payments, initiated by merchants for recurring transactions, are also gaining popularity for their seamless user experience.

The continued innovation in QR code technology, such as the development of dynamic devices that integrate with payment systems, is further driving adoption. By offering a simple, secure, and scalable solution, QR codes are transforming the payment landscape, allowing businesses to cater to a tech-savvy, cashless consumer base. This ongoing evolution signals strong future growth potential for the QR Code Payments Market.

Additionally, alternatives to QR codes for payment and data transfer include technologies like Near Field Communication (NFC), Bluetooth Low Energy (BLE), and RFID. NFC enables secure, contactless communication between devices, allowing for mobile payments and data exchange without needing to scan a code. BLE is used for proximity-based applications, providing short-range communication between devices with minimal energy consumption, making it ideal for customer engagement in retail. RFID, often used in inventory and payment systems, operates with tags that can be read without physical contact, offering efficiency in managing assets. These alternatives provide more flexibility and security compared to QR codes, enhancing user experiences in various industries, from finance to retail and logistics.

Drivers

Increased accessibility to smartphones enables seamless QR Code Payments adoption.

Widespread use of apps like Google Pay and PayPal supports QR integration for faster transactions.

Online shopping drives QR code usage for secure and convenient remote payments.

As e-commerce has grown in popularity, there is also a larger demand for payment methods that are secure, efficient, and easy to use. This is where QR codes play a significant role as they allow fast and easy transactions with a simple scan, eliminating entering your complex card details or lengthy procedures. Payment security is still the biggest concern for online shoppers. QR codes resolve these issues; from encrypting transaction data to preventing fraud and unauthorized access. If users can authorize transactions via a scanned code, it helps to ensure that the person transacting has privacy and security, as well as control and knowledge during remote transactions.

Another reason QR Codes are so popular in e-commerce is the convenience factor. QR codes unlike other payment methods do not need some dedicated hardware with them. Instead, they are seamlessly integrated through mobile wallets and apps which allow payments from anywhere through smartphones. This ends up, naturally, reducing the operational costs for businesses while increasing the user experience during checkout, which leads to increased customer satisfaction and retention.

With a tech-savvy consumer base on the rise, global e-commerce giants including Amazon, Alibaba, and Shopify have introduced QR code payments. Apart from promotions, QR codes are extensively used to provide discounts and other incentives for customer adoption at work and also during the purchase. The growth in QR code use for e-commerce and online shopping goes hand in hand with the penetration of smartphones and better internet connectivity, along with rising digital literacy. While businesses are continuously innovating with QR codes to provide more secure and speedy payment solutions, it has become a consistent characteristic found in e-commerce platforms, thus making QR codes relevant to the market and providing solutions to the ever-changing digital economy.

| Year | Increase in QR Code Usage (%) | Key Drivers |

|---|---|---|

| 2019 | 15% | Early adoption in major markets |

| 2020 | 30% | Surge in contactless payments during COVID-19 |

| 2021 | 40% | Expansion of e-commerce and mobile wallet adoption |

| 2022 | 50% | Integration with loyalty programs and promotions |

| 2023 | 60% | Enhanced security features and dynamic QR codes |

| 2024 | 70% | Continued innovation and consumer trust |

Restraints

QR codes can be exploited for phishing attacks or malware distribution, reducing trust among users.

Reliable internet connectivity is essential, limiting adoption in areas with poor infrastructure.

Excessive use of QR codes in marketing and payments can lead to consumer fatigue and decreased engagement.

The growing prevalence of QR codes in marketing and payment systems could lead to consumer burnout, diminishing their engagement and ultimately resulting in reduced adoption rates. Since many businesses have now brought QR codes into their promotions, loyalty programs, and payment methods, customers can easily get overloaded with constant interactions. Too much saturation of this technology can lead to the user being a bit tired of QR codes or even getting bored of scanning them. It is counterintuitive, as consumers may get tired of seeing QR codes in ads, on product packaging, or other types of marketing materials, and as a result, they begin to think that QR code is just another tool to promote something instead of a useful convenience. This over-exposure often causes what is referred to as "QR code fatigue," and the excitement rapidly dissipates, leaving users feeling like they're not useful anymore or desirable.

Futher, businesses that rely too much on QR codes can under-deliver on incentives or in as much that QR code scanning is not an experience in itself, but a means to an end. If these codes do not immediately offer something tangible—for example, special promotions, interactive content, or a customized experience—there may be little motivation for consumers to scan them, and scan rates could plummet, resulting in further dampened interest in QR payment systems.

This increasingly common trend spells trouble for QR code payments, which thrive only when consumers maintain high engagement levels. Also, businesses have to deploy QR codes judiciously for people to continue using them, and not enough for them to be oversaturated. Adding value in terms of rewards, promotions or smoother payment processes will keep consumers engaged ahead of fatigue and drive repeat usage without exhausting consumers.

By offerings

In 2023, the solution segment dominated the market and represented revenue with more than 69.75% share in the market, dominating the larger market. QR Code Payments systems can often also be customized to fit specific requirements, such as integration with the current POS systems or online stores. The high level of flexibility and customizability has made solution-based offers highly attractive to small and mid-size enterprises who are looking for a payment solution that would follow them in their development. Additionally, they enable businesses to offer a payment experience customers desire helping businesses to drive sales & revenues.

The services segment is expected to register the highest CAGR during the forecast period. Professional and managed services fall under the services segment. The complexity of a QR Code Payments system requires specialized knowledge and expertise that is not available within most businesses. This compels them to outsource their QR Code Payments systems designing, implementation, and management to professional and managed service providers. Such services can include consulting, design, implementation, and customization, integration with other larger enterprise systems, testing, maintenance, and support. Further, an uptick in consumer and business adoption of QR Code Payments is creating demand for professional and managed services.

By Solution

In 2022, the dynamic QR code segment held the largest market share, over 66.00% in revenue generation. As Dynamic QR codes are generated at the moment the QR code can have variable data depending on the transaction. This flexibility enables companies to personalize payment experiences like providing discounts or promotional offers based on purchase history, or customer data of any form and dimension. Moreover, dynamic QR codes are more secure than static QR codes, as they may be protected with distinct transactional data and also prevent any type of deceitful activity from taking place. Security therefore has popularised the use of dynamic QR codes in business, especially in high-risk markets like e-commerce and finance.

Among QR code types, the static QR code segment is anticipated to grow at the highest CAGR over the forecast period. This segment has grown due to its simplicity, low cost, and ease of implementation. Since static QR codes can be created in seconds without the need for additional hardware or software, they represent a low-cost solution for small and medium-sized businesses.

In addition, static QR codes have simple implementations, as they may fulfil a wide range of purposes, such as being printed on receipts, displayed on different screens, etc. Static QR codes can be used for transactions from small retail purchases to bill payments, etc., which is why it is widely accepted in the diverse nature of businesses.

Payment Type

The push payment segment held the largest share of over 59.60% in revenue in 2023. In the case of push payments, it is the customer who initiates the transaction by scanning the QR code and approving the payment that gets pushed from his account to the merchant account.

As a result, the customer has total control over each transaction; and must approve each payment explicitly, limiting the possibility of fraudulent transactions or non-authorized charges at all. Moreover, push payments are frequently employed in one-off purchases like in-store retail purchases or online shopping, making this segment even less vulnerable to fraud and bolstering its growth prospects.

Pull payments are expected to grow significantly during the forecast period. With pull payments, merchants generate a QR code and show it to the customer who scans and approves the payment, pulling it from his account to the merchant account. This means the customer does not have to initiate every transaction and thus pull payments tend to be a popular significant solution for recurring payments, such as subscriptions or bill payments. In addition, pull payments allow customers a more native payment solution – faster transactions. In addition, pull payments can also help companies save money, especially those that process many repeat payments.

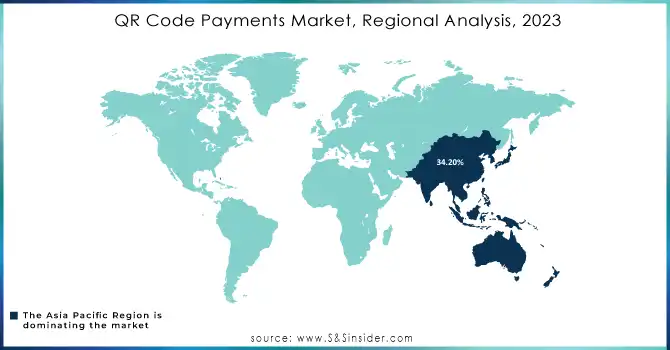

The QR code payments market had the largest share for Asia Pacific in 2023 with a revenue share of more than 34.20%. This growth in the region can be due to multiple reasons—a rising and huge population, smartphone penetration, and a large unbanked population. The region encompasses a range of economies, with developed nations like Japan, Singapore, and South Korea, as well as emerging markets including India, Indonesia, and Vietnam. In several such markets, QR code payments turned out to be widely embraced as a convenient and common payment method among the youth and tech-friendly customers who prefer speed, convenience, and security when carrying out any payment transaction.

The North American regional market is estimated to register the highest growth rate over the forecast period. Key factors behind the growth of the region include high penetration of smartphones, increasing acceptance of digital payments, and well-organized financial infrastructure. North America, having a more developed and mature economy and a huge wealthy, convenience-oriented consumer class is most profitable for expedient payment. In response, the rising popularity of mobile payments and digital wallets in the region has also accelerated QR Code Payments use, with prominent players—including PayPal, Square, and Venmo—driving QR Code Payments offerings. In addition, the region has a competitive retail sector that has adopted QR code payments to provide customers with a quick and convenient payment experience.

Need any customization research on QR Code Payments Market - Enquiry Now

The major key players along with one product are

PayPal - PayPal QR Code Payments Service

Square (Block Inc.) - Square Point of Sale (POS)

Alipay - Alipay QR Code Payments System

WeChat Pay - WeChat Pay QR Codes

Stripe - Stripe Terminal with QR Code Payments

Google Pay - Google Pay QR Code Payments Feature

Samsung Pay - Samsung Pay with QR Code Support

Venmo - Venmo QR Code Payment

MasterCard - MasterCard QR Code Payments Solutions

Visa - Visa QR Code Payments Acceptance

Shopify - Shopify Payments with QR Code Integration

Amazon Pay - Amazon Pay QR Code Payments

Zell - Zell QR Code Payments System

FIS Global - FIS QR Code Payments

Ayden - Ayden QR Code Payments Solutions

Karma - Karma QR Code Payments Integration

Pat - Pat QR Code Payments Service

Razor pay - Razor pay QR Code Payments Gateway

World pay - World pay QR Code Payments

Pine Labs - Pine Labs QR Code Payments Solution

PayPal is pushing forward with QR code enhancements in its mobile payment system. In March 2024, PayPal unveiled updates to its QR code technology, offering new functionalities for businesses to accept payments directly via QR codes, while also integrating loyalty programs and exclusive offers for customers who pay using this method.

In April 2024, Alipay expanded its smart payment services, introducing a unique QR code feature designed for international tourists. The new service offers easy, real-time currency conversion and discounted rates when tourists pay using QR codes at partner businesses globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.8 Bn |

| Market Size by 2032 | US$ 45.9 Bn |

| CAGR | CAGR of 16.27% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings (Solution, Services) • By Solution (Static QR code, Dynamic QR code) • By Payment Type (Push Payment, Pull Payment) • By Transaction Channel (Face-to-Face, Remote) • By End-user (Restaurant, Retail & E-commerce, E-ticket Booking, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Square (Block Inc.), Alipay, WeChat Pay, Stripe, Google Pay, Samsung Pay, Venmo, MasterCard, Visa, Shopify, Amazon Pay, Zell |

| Key Drivers | • Increased accessibility to smartphones enables seamless QR Code Payments adoption. • Widespread use of apps like Google Pay and PayPal supports QR integration for faster transactions. • Online shopping drives QR code usage for secure and convenient remote payments. |

| Market Restraints | • QR codes can be exploited for phishing attacks or malware distribution, reducing trust among users. • Reliable internet connectivity is essential, limiting adoption in areas with poor infrastructure. • Excessive use of QR codes in marketing and payments can lead to consumer fatigue and decreased engagement. |

Ans- The QR Code Payments Market was valued at USD 11.8 billion in 2023 and is expected to reach USD 45.9 billion by 2032.

Ans- The QR Code Payments Market is expected to grow at a CAGR of 16.27% during the forecast period of 2024-2032.

Ans- Asia-Pacific dominated the QR Code Payments Market.

Ans- The QR Code Payments Market is driven by factors such as:

Increased accessibility to smartphones enables seamless QR Code Payments adoption.

Widespread use of apps like Google Pay and PayPal supports QR integration for faster transactions.

Ans- The QR Code Payments Market faces challenges such as:

QR codes can be exploited for phishing attacks or malware distribution, reducing trust among users.

Reliable internet connectivity is essential, limiting adoption in areas with poor infrastructure.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. QR Code Payments Market Segmentation, by Offerings

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. QR Code Payments Market Segmentation, By Solution

8.1 Chapter Overview

8.2 Static QR code

8.2.1 Static QR code Market Trends Analysis (2020-2032)

8.2.2 Static QR code Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Dynamic QR code

8.3.1 Dynamic QR code Market Trends Analysis (2020-2032)

8.3.2 Dynamic QR code Market Size Estimates And Forecasts To 2032 (USD Billion)

9. QR Code Payments Market Segmentation, By Payment Type

9.1 Chapter Overview

9.2 Push Payment

9.2.1 Push Payment Market Trends Analysis (2020-2032)

9.2.2 Push Payment Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Pull Payment

9.3.1 Pull Payment Market Trends Analysis (2020-2032)

9.3.2 Pull Payment Market Size Estimates And Forecasts To 2032 (USD Billion)

10. QR Code Payments Market Segmentation, By Transaction Channel

10.1 Chapter Overview

10.2 Face-to-Face

10.2.1 Face-to-Face Market Trends Analysis (2020-2032)

10.2.2 Face-to-Face Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Remote

10.3.1 Remote Market Trends Analysis (2020-2032)

10.3.2 Remote Market Size Estimates And Forecasts To 2032 (USD Billion)

11. QR Code Payments Market Segmentation, By End-user

11.1 Chapter Overview

11.2 Restaurant

11.2.1 Restaurant Market Trends Analysis (2020-2032)

11.2.2 Restaurant Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Retail & E-commerce

11.3.1 Retail & E-commerce Market Trends Analysis (2020-2032)

11.3.2 Retail & E-commerce Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 E-ticket Booking

11.4.1 E-ticket Booking Market Trends Analysis (2020-2032)

11.4.2 E-ticket Booking Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Others

11.5.1 Others Market Trends Analysis (2020-2032)

11.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.4 North America QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.2.5 North America QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.2.6 North America QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.2.7 North America QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.8.2 USA QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.2.8.3 USA QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.2.8.4 USA QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.2.8.5 USA QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.9.2 Canada QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.2.9.3 Canada QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.2.9.4 Canada QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.2.9.5 Canada QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.10.2 Mexico QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.2.10.3 Mexico QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.2.10.4 Mexico QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.2.10.5 Mexico QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.8.2 Poland QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.8.3 Poland QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.8.4 Poland QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.8.5 Poland QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.9.2 Romania QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.9.3 Romania QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.9.4 Romania QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.9.5 Romania QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.10.2 Hungary QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.10.3 Hungary QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.10.4 Hungary QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.10.5 Hungary QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.11.2 Turkey QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.11.3 Turkey QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.11.4 Turkey QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.11.5 Turkey QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.4 Western Europe QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.5 Western Europe QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.6 Western Europe QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.7 Western Europe QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.8.2 Germany QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.8.3 Germany QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.8.5 Germany QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.9.2 France QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.9.3 France QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.9.4 France QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.9.5 France QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.10.2 UK QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.10.3 UK QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.10.4 UK QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.10.5 UK QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.11.2 Italy QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.11.3 Italy QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.11.4 Italy QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.11.5 Italy QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.12.2 Spain QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.12.3 Spain QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.12.4 Spain QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.12.5 Spain QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.15.2 Austria QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.15.3 Austria QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.15.4 Austria QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.15.5 Austria QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.4 Asia Pacific QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.5 Asia Pacific QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.6 Asia Pacific QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.7 Asia Pacific QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.8.2 China QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.8.3 China QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.8.4 China QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.8.5 China QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.9.2 India QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.9.3 India QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.9.4 India QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.9.5 India QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.10.2 Japan QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.10.3 Japan QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.10.4 Japan QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.10.5 Japan QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.11.2 South Korea QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.11.3 South Korea QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.11.4 South Korea QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.11.5 South Korea QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.12.2 Vietnam QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.12.3 Vietnam QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.12.4 Vietnam QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.12.5 Vietnam QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.13.2 Singapore QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.13.3 Singapore QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.13.4 Singapore QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.13.5 Singapore QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.14.2 Australia QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.14.3 Australia QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.14.4 Australia QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.14.5 Australia QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.4 Middle East QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.5 Middle East QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.6 Middle East QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.7 Middle East QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.8.2 UAE QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.8.3 UAE QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.8.4 UAE QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.8.5 UAE QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.9.2 Egypt QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.9.3 Egypt QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.9.4 Egypt QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.9.5 Egypt QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.11.2 Qatar QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.11.3 Qatar QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.11.4 Qatar QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.11.5 Qatar QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.4 Africa QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.2.5 Africa QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.2.6 Africa QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.2.7 Africa QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.8.2 South Africa QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.2.8.3 South Africa QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.2.8.4 South Africa QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.2.8.5 South Africa QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America QR Code Payments Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.4 Latin America QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.6.5 Latin America QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.6.6 Latin America QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.6.7 Latin America QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.8.2 Brazil QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.6.8.3 Brazil QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.6.8.4 Brazil QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.6.8.5 Brazil QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.9.2 Argentina QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.6.9.3 Argentina QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.6.9.4 Argentina QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.6.9.5 Argentina QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.10.2 Colombia QR Code Payments Market Estimates And Forecasts, By Solution (2020-2032) (USD Billion)

12.6.10.3 Colombia QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.6.10.4 Colombia QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.6.10.5 Colombia QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America QR Code Payments Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America QR Code Payments Market Estimates And Forecasts, Solution (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America QR Code Payments Market Estimates And Forecasts, By Payment Type (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America QR Code Payments Market Estimates And Forecasts, By Transaction Channel (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America QR Code Payments Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

13. Company Profiles

13.1 PayPal

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Square (Block Inc.)

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Alipay

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 WeChat Pay

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Stripe

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Google Pay

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Samsung Pay

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Venmo

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 MasterCard

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Visa

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Offerings

Solution

Services

By Solution

Static QR code

Dynamic QR code

By Payment Type

Push Payment

Pull Payment

By Transaction Channel

Face-to-Face

Remote

By End-user

Restaurant

Retail & E-commerce

E-ticket Booking

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Edge-to-Cloud Architectures Market was valued at XX Bn in 2023 and will reach XX Bn with the CAGR at xx % cagr, over the forecast period by 2032.

Content Moderation Services Market was valued at USD 10.01 billion in 2023 and is expected to reach USD 30.75 billion by 2032, growing at a CAGR of 13.33% from 2024-2032.

The Business Software and Services Market Size was valued at USD 529.39 Billion in 2023 and will reach USD 1343.11 Billion and CAGR of 11.02% by 2032.

The Reverse Factoring Market Size was valued at USD 586.11 Billion in 2023 and will reach USD 1369.59 Billion by 2032 and grow at a CAGR of 10.01% by 2032.

The MEP Software Market was valued at USD 3.80 billion in 2023 and is expected to reach USD 9.20 Billion by 2032, growing at a CAGR of 10.34% by 2032.

The Carbon Accounting Software Market was valued at USD 16.1 billion in 2023 and will reach USD 102.9 billion by 2032, growing at a CAGR of 22.9% by 2032.

Hi! Click one of our member below to chat on Phone