Get E-PDF Sample Report on Pyridine Market - Request Sample Report

The Pyridine Market Size was valued at USD 726.0 million in 2023 and is expected to reach USD 1142.4 million by 2032, and grow at a CAGR of 5.2% over the forecast period 2024-2032.

The pyridine market represents the sphere of dynamic changes that happened within recent years under the impact of different factors, influencing the growth and development of the market. Pyridine is a heterocyclic organic compound, the field of application of which is very extensive. It is indispensable at the stages of agrochemicals, pharmaceuticals, and industrial chemicals synthesis. Its significance in manufacturing herbicides, fungicides, and various pharmaceuticals such as vitamins and anti-tuberculosis drugs, positions it in several key industries. The main driving force for market growth comes from the increasing demand originating within the agrochemical industry, basically a result of the growing global demand for efficient crop protection. These will be increasingly relied upon with the growing demand for high-yield and disease-resistant crops emanating from evolving agriculture, hence giving rise to increasing requirements for relevant pesticides and herbicides that incorporate pyridine as an active ingredient.

The other major reason for the changing landscape in the pyridine market involves pharmaceutical applications. Pyridine and its derivatives are used in the manufacture of drugs like anti-histaminic, anti-cholesterol, tuberculosis, and cancer. The factors have driven demand for pharmaceutical products, hence encouraging companies to invest in research and development by developing new pyridine-based pharmaceuticals that can effectively address the emerging healthcare needs. For instance, during the last two decades, pharmaceutical firms focused their effort on creating a new generation of pyridine-based compounds targeting specific therapies. This once again highlights the versatility and importance of this compound in contemporary medicine.

The industrial sector also forms a major part of the trends taking place within the pyridine market. Pyridine is used in the production of many types of industrial chemicals such as rubber additives and coatings. Large demand increases for pyridine applications owe a lot to the development of the automotive and construction industries, among others. All this is happening, especially with the discovery of new materials and technology. The range of companies engaged in the manufacture of chemicals has introduced innovations contributing to increasing the efficiency and functionality of products using pyridine. Recent breakthroughs in the development of more environmentally friendly and cost-effective methods of synthesis contribute not only to better market prospects for pyridine but also to in-general trends in the world concerning environmental friendliness and decreased environmental impacts.

Recent growth by major players in the pyridine market further depicts a changing landscape. The global chemical company Lonza, for example, has made great improvement in the production processes of pyridine. Their innovations are pegged on the improvement in the yield of the pyridine with limited waste products and little energy usage. In India, the largest chemical producer, Shreeji Chemicals, has scaled up their capacity in producing pyridines and its derivatives to meet growing demand from both local and global markets. This points to strategic efforts within the industry regarding rising demand and changes in market trends.

Furthermore, the growing attention being attached to sustainability issues has driven companies toward seeking alternative feedstocks and production methods. The development of greener, more sustainable production technologies is showing rapid growth. For example, testing of renewable feedstocks and waste materials as feedstocks in pyridine synthesis is being conducted; this would decrease the dependence on fossil fuels and generally lower the environmental impact. This will represent a shift towards sustainability in concert with global environmental objectives and one which will also create new market opportunities and drive innovation.

Market Dynamics:

Drivers:

Increasing demand for pyridine-based agrochemicals due to the need for effective crop protection solutions.

The rapidly growing demand for pyridine-based agrochemicals is one of the major drivers in the pyridine market, reflecting the enormous role played by these chemicals in modern agriculture. The creation of several herbicides, fungicides, and insecticides crucial in crop protection against pests, diseases, and weeds is impossible without pyridine derivatives. With agriculture being at the forefront of challenges such as climate change, soil degradation, and increased food demand, the need for healthy and productive means of crop protection is felt more intensely. For instance, pyridine is an important ingredient in the manufacture of herbicides, notably picloram, and triclopyr, used to prevent the infestation of jutting plant species that would eventually reduce crop production. The efficacy of such chemicals in enhancing yield encourages demand for such, and in turn propels the pyridine market. Besides, pyridine-based fungicides, such as pyrimethanil, are also deployed to combat fungal infestation that could wipe out crops and cause enormous economic loss. This growth in agriculture, through more intensified farming and genetically modified crops, increases the demand for more sophisticated and highly effective agrochemicals, thus setting up a bigger demand for pyridine. Accompanying this trend is the increase in its use in developing economies, where there is a gravitation toward increased agricultural productivity to meet food security concerns and adjoining economic growth.

Growing pharmaceutical applications for pyridine in the synthesis of treatments for chronic diseases and various health conditions.

The pharmaceutical applications for pyridine are growing, hence giving it a significant push within the market. The main fact is that pyridine is a versatile compound; its place in the development of a great range of therapeutic agents has targets for chronic diseases and health conditions. Because of certain specific chemical properties, pyridine acts as an important building block in the synthesis of several pharmaceuticals since it has the advantage of building complex molecules with high potency. For example, derivatives of pyridine are indispensable during the manufacturing of medications against diseases like hypertension, diabetes, and even cancer. An important application includes the synthesis of some anti-tuberculosis medicines such as isoniazid, which is one of the cornerstones during tuberculosis treatment for decades. Another major use of pyridine pertains to the synthesis of nicotinamide adenine dinucleotide analogs implicated in metabolic disorders and age-related diseases. This, in addition to increasing healthcare needs around the world, an ever-growing pharmaceutical industry, and rising incidence of chronic diseases, generates a demand for pyridines as building blocks in the development of drugs. About this, the rising interest in pharmaceutical research and innovation supplies clear and logical reasoning as to why, in consequence, the demand for pyridine will only continue to grow due to the newer and more effective treatments the compound helps develop. That this trend will go on is most evident due to investment in the development of novel pyridine-based molecules that address unmet medical needs, improve patient outcomes, and further give evidence to this compound's critical role in the advancement of modern medicine.

Restraint:

Environmental regulations and concerns over the sustainability of traditional pyridine production methods.

One of the major restraints in the pyridine market is environmental regulations and debate over the sustainability of conventional pyridine manufacturing processes. Most traditional methods of pyridine synthesis are hazardous by-product-emitting, besides being energy-intensive, and they lead to environmental pollution and depletion of natural resources. Conventional processes, for example, in the manufacture of pyridine, use either high-temperature processes or toxic chemicals. This contributes to environmental degradation and health risks to communities where production facilities may be located. These have thus spurred regulations from regulatory bodies in enforcing a tightening of regulations and standards to reduce emissions and ensure that the processes become more sustainable. There is also an influence on companies to employ greener technologies and develop greener production methods. This shift toward sustainability not only involves investment in new technologies that reduce waste and limit energy consumption but also the following of very strict environmental policies. As a result, the need to balance economic viability with environmental responsibility represents a significant challenge for the pyridine market, impacting production costs and operational practices.

Opportunity:

Development of green and sustainable pyridine production technologies to reduce environmental impact and meet regulatory requirements.

The development of green and sustainable technologies of pyridine production opens a very promising perspective on the pyridine market, since there is an improvement of ecological requirements and the fulfillment of legislative needs. In most of the classical syntheses of pyridine, work with hazardous chemicals is involved, accompanied by high energy consumption and resulting in environmental pollution and high production costs. Companies can drastically reduce their ecological footprint by investing in innovative and cleaner modes of production, such as renewable feedstocks or energy-efficient catalysts. For example, some researchers are looking at different synthesis routes, which involve minimized waste and less harm to substances; again, this would help fulfill the stern environmental regulations and reduce overall production costs. It will not only align with global sustainability goals but provide a competitive advantage to the firms that can adapt quickly to such newer technologies that would turn their operations efficient and more environmentally responsible. If implemented well, the deployment of such green technologies can further facilitate market growth by attracting environmentally-conscious investors and consumers who set new bars in industries regarding sustainability.

Challenge:

Volatility in raw material prices affecting the cost stability and profitability of pyridine production.

Volatility in the prices of raw materials constitutes one of the main deterring factors affecting the pyridine market, as it will directly influence the cost stability and profitability of producing pyridines. Pyridine is produced by complex chemical manufacturing processes typically, which are dependent on different types of raw materials-such as petrochemical by-products and other chemical feedstock. A combination of these raw materials into their final products may result in rather unpredictable production costs since commodity price fluctuations are driven by global market dynamics, geopolitical tension, or supply chain disruption. For instance, sharp rises in the cost of crude oil or other essential feedstocks increase production expenses that may not always be easily absorbed by manufacturers. This makes the profit margin and pricing strategy somewhat volatile; this could translate to higher consumer costs and less competitiveness in the marketplace. In addition, fluctuating prices create difficulties in long-term planning and investing in production facilities due to uncertainty over volatile raw material costs. This calls for diversification of raw material sources, optimization of production processes, and setting up of cost controls that can either minimize or reduce the impact of raw material price volatility in the pyridine market.

By Type

In 2023, Beta Picoline dominated and held the largest share in the pyridine market, at about 35%. Beta Picoline is an important segment because it finds very wide application in the manufacture of various key agrochemicals and pharmaceuticals for instance, Beta Picoline is a key feedstock in the synthesis of Vitamin B6, pyridoxine, which enjoys very high demand in nutritional supplements and the fortification of food. The principal application of the chemical is in the production of herbicides like Picloram, an agrochemical that plays a great role in crop protection and weed control. The massive area of application of Beta Picoline and the important role it plays in both the agro-based and pharmaceutical industries explain its leading market share. The demand for these products propels the huge market share of Beta Picoline, signifying its prominence within the pyridine segment.

By Application

In 2023, the pesticide segment is leading in the pyridine market and accounts for approximately 40% of the market. Pyridine is a raw material for the manufacture of certain key pesticides, including herbicides, fungicides, and insecticides. The demand for these forms of pesticides treads on grounds of driving this dominance. As a specific example, pyridine is used as a building block for major herbicides such as Picloram and Triclopyr, which form a fundamental backbone for the effective control of weeds and pests in agriculture. The growth in demand for high-end crop protection chemicals to enhance agricultural yields and for better management of pests has, therefore, greatly enhanced the demand for pyridine in this segment. Hence, due to these factors, the massive application of pyridine-based chemicals in agriculture contributes to the high market share of the pesticide segment, which indicates that the pesticide segment is critical in the pyridine market.

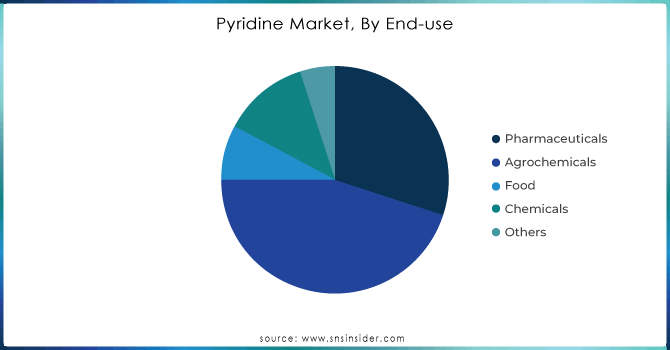

By End-use

The Agrochemicals segment dominated and accounted for about 45% of the largest share of the pyridine market in 2023. The applications of pyridine and its derivatives to different formulation products, such as herbicides, fungicides, and insecticides, can be quite huge. Pyridine is classified as an important starting material in the manufacture of many herbicides, including Picloram and Triclopyr. These are very commonly used in the field with the view of boosting agricultural productivity by controlling weeds and pests. Another major consumer is the agrochemical industry, mainly because of the high demand for effective and efficient methods of crop protection against pests, diseases, and soil degradation. Hence, the agrochemical industry uses a wide range of pyridine-based products in carrying out protection on crops; therefore, it accounts for the leading position.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

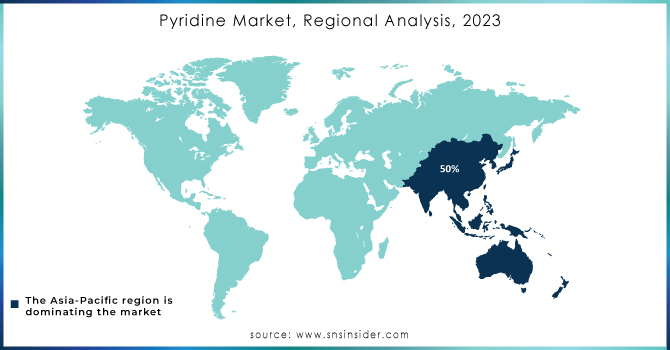

Regional Analysis

The Asia-Pacific region dominated the pyridine market in 2023, with an approximate share of 50% in the market. The leadership of this region may be said to be due to its huge industrial base and high agricultural activity, increasing the demand for pyridine-based products within the region. Countries like China and India are among the major contributors because pyridine is used in significant amounts during the manufacture of agrochemicals, such as herbicides and pesticides, to aid large farming sectors. For instance, rapid agriculture development in China and leading positions of the region among pyridine derivatives manufacturers point to the leading role of the region in the market. Besides, very rapidly developing pharmaceutical industry in the Asia-Pacific region increases the demand for pyridine due to the synthesis of different drugs and health supplements on its basis. Such strong industrial potential along with increasing agriculture and pharmaceutical demand cements the leading position of the Asia-Pacific in the pyridine market.

KEY PLAYERS

Trineso, Lonza Group Ltd, Resonance Specialties Ltd, Shandong Luba Chemical Co Ltd, Weifang Sunwin Chemicals Co Ltd, Jubilant Life Sciences Ltd, Vertellus Specialties Inc, Red Sun Group, Koei Chemical Co Ltd, Bayer AG and other key players are mentioned in the final report.

Recent Developments

March 2023: Vertellus Holdings LLC completed the acquisition of CENTAURI Technologies and was rebranded as Aurorium. This reflects not only the growth of the company but its evolution into a global materials innovation partner with a diversified portfolio of specialty ingredients and performance-enhancing materials.

February 2022: Sino-Agri Leading entered into a strategic cooperation pact with Red Sun in pursuit of extending the supply of products such as diquat and glufosinate. The said investment represented the exploration and embodiment of the status enjoyed by Sino-Agri Leading at the national level as an enterprise in pesticide distribution and plant protection services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 726.0 Million |

| Market Size by 2032 | US$ 1142.4 Million |

| CAGR | CAGR of 5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Alpha Picoline, Gamma Picoline, 2-Methyl-5-Ethylpyridine, Beta Picoline, Pyridine N-Oxide) •By Application (Medicines, Rubber, Paints and Dyes, Pesticides, Solvent, Food Flavouring, Others) •By End-use (Pharmaceuticals, Agrochemicals, Food, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trineso, Lonza Group Ltd, Resonance Specialties Ltd, Shandong Luba Chemical Co Ltd, Weifang Sunwin Chemicals Co Ltd, Jubilant Life Sciences Ltd, Vertellus Specialties Inc, Red Sun Group, Koei Chemical Co Ltd, Bayer AG and other key players |

| Key Drivers | • Increasing demand for pyridine-based agrochemicals due to the need for effective crop protection solutions • Growing pharmaceutical applications for pyridine in the synthesis of treatments for chronic diseases and various health conditions |

| RESTRAINTS | • Environmental regulations and concerns over the sustainability of traditional pyridine production methods |

Ans. The Asia Pacific region dominated the Pyridine market holding the largest market share of about 50% during the forecast period.

Ans. Volatility in raw material prices affecting the cost stability and profitability of pyridine production is one of the challenges faced in the Pyridine Market

Ans. The development of green and sustainable pyridine production technologies to reduce environmental impact and meet regulatory requirements is one of the opportunities in the Pyridine Market

Ans. The Pyridine Market Size was valued at USD 726.0 million in 2023 and is expected to reach USD 1142.4 million by 2032

Ans. The Pyridine Market is expected to grow at a CAGR of 5.2%.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Pyridine Market Segmentation, by Type

7.1 Chapter Overview

7.2 Alpha Picoline

7.2.1 Alpha Picoline Market Trends Analysis (2020-2032)

7.2.2 Alpha Picoline Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Gamma Picoline

7.3.1 Gamma Picoline Market Trends Analysis (2020-2032)

7.3.2 Gamma Picoline Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 2-Methyl-5-Ethylpyridine

7.4.1 2-Methyl-5-Ethylpyridine Market Trends Analysis (2020-2032)

7.4.2 2-Methyl-5-Ethylpyridine Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Beta Picoline

7.5.1 Beta Picoline Market Trends Analysis (2020-2032)

7.5.2 Beta Picoline Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Pyridine N-Oxide

7.6.1 Pyridine N-Oxide Market Trends Analysis (2020-2032)

7.6.2 Pyridine N-Oxide Market Size Estimates and Forecasts to 2032 (USD Million)

8. Pyridine Market Segmentation, by Application

8.1 Chapter Overview

8.2 Medicines

8.2.1 Medicines Market Trends Analysis (2020-2032)

8.2.2 Medicines Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Rubber

8.3.1 Rubber Market Trends Analysis (2020-2032)

8.3.2 Rubber Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Paints and Dyes

8.4.1 Paints and Dyes Market Trends Analysis (2020-2032)

8.4.2 Paints and Dyes Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Pesticides

8.5.1 Pesticides Market Trends Analysis (2020-2032)

8.5.2 Pesticides Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Solvent

8.6.1 Solvent Market Trends Analysis (2020-2032)

8.6.2 Solvent Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Food Flavouring

8.7.1 Food Flavouring Market Trends Analysis (2020-2032)

8.7.2 Food Flavouring Market Size Estimates and Forecasts to 2032 (USD Million)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Pyridine Market Segmentation, by End-use

9.1 Chapter Overview

9.2 Pharmaceuticals

9.2.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.2.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Agrochemicals

9.3.1 Agrochemicals Market Trends Analysis (2020-2032)

9.3.2 Agrochemicals Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Food

9.4.1 Food Market Trends Analysis (2020-2032)

9.4.2 Food Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Chemicals

9.5.1 Chemicals Market Trends Analysis (2020-2032)

9.5.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Pyridine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Pyridine Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Pyridine Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Pyridine Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11. Company Profiles

11.1 Trineso

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Lonza Group Ltd

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Resonance Specialties Ltd

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Shandong Luba Chemical Co Ltd

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Weifang Sunwin Chemicals Co Ltd

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Jubilant Life Sciences Ltd

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Vertellus Specialties Inc

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Red Sun Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Koei Chemical Co Ltd

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Bayer AG

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Alpha Picoline

Gamma Picoline

2-Methyl-5-Ethylpyridine

Beta Picoline

Pyridine N-Oxide

By Application

Medicines

Rubber

Paints and Dyes

Pesticides

Solvent

Food Flavouring

Others

By End-use

Pharmaceuticals

Agrochemicals

Food

Chemicals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Hollow Fiber Membranes Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 8.52 billion by 2032, at a CAGR of 14.85% from 2024-2032.

The Cryogenic Fuels Market Size was valued at USD 112.57 billion in 2023 and is expected to reach USD 195.08 billion by 2032 and grow at a CAGR of 6.30% over the forecast period 2024-2032.

Medical Refrigerators Market was estimated at USD 3.99 billion in 2023 and is expected to reach USD 6.83 billion by 2032 at a CAGR of 6.16% from 2024-2032.

The Process Oil Market Size was valued at USD 4.9 billion in 2023 and is expected to reach USD 5.98 billion by 2032 and grow at a CAGR of 2.25% over the forecast period 2024-2032.

The Long-chain Polyamide Market size was USD 2.1 billion in 2023 and is expected to reach USD 3.2 billion by 2032 and grow at a CAGR of 5.0% over the forecast period of 2024-2032.

Explore the Castor Oil & Derivatives Market, covering applications in cosmetics, pharmaceuticals, and industrial sectors. Learn about trends in bio-based chemicals, sustainable sourcing, and the rising demand for castor oil in diverse industries.

Hi! Click one of our member below to chat on Phone